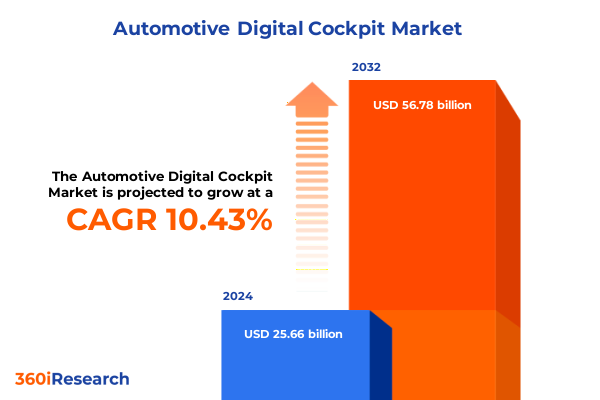

The Automotive Digital Cockpit Market size was estimated at USD 27.77 billion in 2025 and expected to reach USD 30.06 billion in 2026, at a CAGR of 10.75% to reach USD 56.78 billion by 2032.

Unveiling the Next Era of In-Vehicle Interaction: How Digital Cockpits Are Redefining Driver Engagement and Automotive Innovation

The automotive industry is experiencing a paradigm shift as the traditional instrument cluster gives way to immersive digital cockpits, where advanced displays, intuitive controls, and seamless connectivity redefine the driver experience. This introduction outlines the key motivations behind this comprehensive analysis, which aims to equip stakeholders with the critical insights necessary for navigating a rapidly evolving landscape. It establishes the conceptual framework for understanding how digital cockpit technologies serve as the nexus of innovation, safety enhancement, and user personalization.

Emerging vehicle architectures are increasingly software-defined, enabling over-the-air updates, customizable interfaces, and scalable hardware platforms. These capabilities not only enhance vehicle functionality but also extend product lifecycles by allowing modular upgrades. Concurrently, escalating consumer expectations around in-car entertainment, driver assistance features, and holistic wellness monitoring are propelling demand for sophisticated human–machine interfaces that transcend mere information display.

By examining converging trends such as artificial intelligence–powered personalization, augmented reality head-up displays, haptic feedback mechanisms, and next-generation connectivity protocols, this report sets the stage for a deep dive into market drivers, competitive dynamics, and actionable recommendations. Subsequent sections explore the transformative forces reshaping cockpit ecosystems, the impact of U.S. tariffs on supply chains, and granular segmentation insights to guide investment and development strategies.

Navigating Disruption: How Advances in Connectivity, Artificial Intelligence, and Augmented Reality Are Reshaping Automotive Cockpit Landscapes

The automotive cockpit landscape is undergoing profound transformation driven by digitalization and a shift towards software-centric architectures. What were once isolated control units are now converging into centralized computing platforms that integrate infotainment, driver assistance, and vehicle management functions. This shift is underpinned by rising adoption of artificial intelligence, which enables real-time personalization, predictive maintenance alerts, and context-aware user interfaces that adapt to driving conditions and occupant preferences.

Meanwhile, augmented reality head-up displays are moving from concept to commercialization, overlaying navigation cues, hazard warnings, and performance metrics directly onto the windshield. Early prototypes showcased at global events like CES 2025 illustrate how AR can improve situational awareness without requiring drivers to avert their gaze from the road. In parallel, multi-screen and integrated panel designs are redefining interior aesthetics and ergonomics by merging instrument clusters, central displays, and passenger screens into seamless surfaces that cater to diverse functional requirements.

Despite the emphasis on digital interfaces, recent industry research underscores a resurgence of physical controls-particularly tactile buttons and rotary knobs-in response to safety concerns and user fatigue associated with extensive touchscreen use. These hybrid HMI designs strike a balance between digital flexibility and the tactile reassurance that drivers value. Collectively, these developments mark a decisive move towards a new cockpit paradigm characterized by convergence, customization, and enhanced driver–vehicle interaction.

Assessing the Multifaceted Impact of 2025 United States Auto Import Tariffs on Automotive Digital Cockpit Supply Chains and Profitability

In April 2025, the United States implemented a 25% tariff on all imported light-duty vehicles, with automotive parts tariffs following in May, fundamentally altering the economics of the digital cockpit supply chain. As digital cockpits rely heavily on components sourced from global suppliers-ranging from high-resolution displays and microprocessors to specialized sensors-the increased duties have escalated production costs and prompted a reevaluation of sourcing strategies.

Major automakers have already reported substantial financial impacts. Volkswagen disclosed a €1.3 billion hit to operating profits attributable to tariff rates in the high teens and beyond, leading to revised guidance and discussions around shifting production footprints. Concurrently, studies by independent research centers estimate that U.S. automotive manufacturers may incur upwards of $41.7 billion in added costs through 2025 if tariff levels persist.

This tariff environment has accelerated conversations around regionalization of supply chains and nearshoring of critical manufacturing capabilities for semiconductors, display modules, and HMI assemblies. While policy incentives for domestic production offer some relief, the substantial capital investment required and the long lead times for establishing advanced fabrication capacities present significant challenges. As a result, stakeholders across OEMs, Tier 1 suppliers, and technology partners are deploying a combination of contract renegotiations, dual-sourcing arrangements, and strategic inventory buffers to mitigate ongoing uncertainty.

Decoding the Layered Structure of Automotive Digital Cockpit Markets Through Product Technology Interaction Connectivity Vehicle Application and End-User Perspectives

The automotive digital cockpit sector exhibits a multi-dimensional structure that spans diverse product types, technologies, user-interaction modalities, connectivity options, vehicle segments, applications, and end-user channels. On the product side, offerings encompass both sophisticated control systems-such as multi-function controllers and steering-wheel inputs-and advanced display solutions, ranging from center-stack AMOLED and OLED panels to instrument clusters and head-up display variants that project information via windshield or combiner units.

Technological segmentation further illuminates the landscape through the lenses of artificial intelligence frameworks-comprising machine learning algorithms and natural language processing modules-augmented reality capabilities like gesture recognition and visual overlays, and tactile innovations in haptic feedback, including force and tactile haptics. Each of these domains contributes to the overarching goal of delivering intuitive, responsive, and context-aware interfaces.

User interaction pathways reveal a triad of gesture-based controls, capacitive or resistive touch surfaces, and robust voice-recognition platforms that support hands-free command inputs and speech-to-text functions. In addition, evolving connectivity architectures integrate 5G bandwidth, dual-mode Bluetooth/Wi-Fi, and emerging V2X protocols-spanning vehicle-to-infrastructure and vehicle-to-pedestrian communication-to sustain real-time data exchange.

From a market perspective, digital cockpits are deployed across commercial and passenger vehicles, with the former subdividing into heavy-duty and light commercial platforms, and the latter embracing hatchbacks, sedans, and SUVs. Applications bifurcate into infotainment ecosystems-enabling streaming, gaming integration, and immersive media-and navigation systems that leverage real-time traffic monitoring and advanced route-optimization engines. Across these segments, both OEMs and the aftermarket channel serve distinct end-user needs, shaping innovation roadmaps and distribution strategies.

This comprehensive research report categorizes the Automotive Digital Cockpit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- User Interaction

- Connectivity Type

- Vehicle Type

- Application

- End-User

Diverse Global Dynamics: Key Automotive Digital Cockpit Developments and Regional Differentiators Across Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping automotive digital cockpit adoption, influenced by disparate regulatory regimes, consumer preferences, and technology infrastructure. In the Americas, emphasis rests on connectivity robustness and integration with mobile ecosystems. Automakers prioritize over-the-air software updates and cloud-native services, while suppliers focus on scalable semiconductor solutions that support advanced driver-monitoring features tailored to North American safety standards.

Across Europe, the Middle East, and Africa, stringent safety mandates and emissions regulations drive investment in heads-up displays and integrated driver-assistance systems. Manufacturers collaborate with local technology hubs to co-develop AR-enhanced user interfaces and ensure compliance with cybersecurity and data-privacy requirements. Regional partnerships between OEMs and telecommunications providers are also expanding the deployment of 5G-based V2X networks, enabling city-wide intelligent-traffic frameworks.

In the Asia-Pacific, rapid growth in electric vehicle platforms and a burgeoning consumer appetite for digital entertainment converge to accelerate multi-screen cockpit designs and AI-driven personalization. Governments in key markets are incentivizing domestic production of high-performance computing units, while industry consortiums in China and South Korea prioritize standardization of gesture recognition and voice-control protocols. As these regions pursue differentiated strategies, they collectively underscore the necessity for adaptable cockpit architectures that can be tailored to local market exigencies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Digital Cockpit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves and Collaborative Innovations: How Leading Tier 1 Suppliers and OEM Partnerships Are Driving the Future of Digital Cockpit Solutions

Leading suppliers and OEM partnerships are charting the course for digital cockpit innovation through strategic alliances, R&D consolidation, and targeted investments. Bosch, for instance, has earned its first Chinese order for an AI-enabled cockpit computer, leveraging high-performance central computing platforms to unify infotainment and driver-assistance domains on a single SoC. The company’s collaborations with major automakers in China and North America highlight its commitment to scalable, software-defined vehicle architectures.

Qualcomm’s chipset roadmap remains central to next-generation HMI platforms, with its Snapdragon Ride™ Flex series powering domain controllers and enabling flexible allocation of processing resources for balanced cockpit-ADAS integration. Partnerships such as the recent alliance between Spark Minda and Qualcomm underscore the global nature of innovation, extending advanced cockpit solutions to emerging markets with localized engineering teams.

Meanwhile, OEMs like Volkswagen are reconfiguring production strategies to offset tariff pressures, exploring domestic assembly of premium brands in the United States to align costs and safeguard profit margins. China’s Geely Group has taken a different tack by streamlining its internal R&D, combining teams from Zeekr, Lynk & Co, and Geely into a unified digital cockpit development hub to drive efficiency and accelerate time to market.

Other notable participants, including Continental, Aptiv, and Denso, are intensifying their focus on integrated HMI platforms, leveraging AI-driven analytics, AR overlays, and cybersecurity frameworks to differentiate their offerings. Collectively, these strategic moves illustrate a concerted effort to consolidate core competencies and establish long-term partnerships that can withstand geopolitical volatility and evolving regulatory mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Digital Cockpit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alps Alpine Co., Ltd.

- Altia, Inc.

- Aptiv PLC

- BlackBerry Limited

- Continental AG

- Denso Corporation

- DXC Technology Company

- FORVIA Group

- Garmin Ltd.

- Infineon Technologies AG

- Intellias Global Limited

- JVCKENWOOD Corporation

- KPIT Technologies Limited

- LG Electronics Inc.

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Nippon Seiki Co., Ltd.

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- Pioneer Corporation

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Stellantis N.V.

- Tata Elxsi Limited

- Texas Instruments Incorporated

- Tietoevry Oyj

- TomTom N.V.

- Valeo

- Visteon Corporation

- Volkswagen Group

- YAZAKI Corporation

- ZF Friedrichshafen AG

Strategic Imperatives for Automotive Leaders to Capitalize on Digital Cockpit Innovations Mitigate Tariff Risks and Enhance Competitive Positioning

Industry leaders must adopt a proactive stance to capitalize on digital cockpit advancements while managing regulatory and supply-chain uncertainties. First, organizations should invest in modular architecture frameworks that support multi-modal human–machine interfaces, allowing for seamless integration of gesture, touch, and voice inputs without compromising safety or usability. By standardizing these platforms across vehicle lines, manufacturers can achieve economies of scale and streamline software updates.

Second, stakeholders should establish dual-sourcing strategies for critical components such as display panels, processors, and sensors. Engaging with regional suppliers and exploring nearshore manufacturing options can mitigate the impact of fluctuating tariff regimes. Concurrently, contract structures should incorporate flexible pricing mechanisms that adjust to evolving duty rates and material costs, preserving margin stability.

Third, collaboration between OEMs, Tier 1 suppliers, and technology providers must extend beyond point solutions to encompass joint innovation ecosystems. Formalizing co-development agreements and shared IP frameworks can accelerate the deployment of AI-driven personalization, augmented-reality HUDs, and advanced driver-monitoring systems. Such alliances will be essential for addressing emerging requirements around cybersecurity, functional safety, and data privacy.

Finally, leadership teams should cultivate a data-driven decision-making culture that leverages predictive analytics and real-world usage data to refine feature roadmaps. Establishing clear KPIs focused on customer satisfaction, operational uptime, and development velocity will guide resource allocation and ensure that digital cockpit initiatives deliver tangible ROI.

Comprehensive Approach to Automotive Digital Cockpit Analysis Integrating Primary Interviews Secondary Data Synthesis and Advanced Analytical Techniques

This report synthesizes insights derived from a rigorous methodology combining primary interviews with senior executives across OEMs, Tier 1 suppliers, and technology firms, alongside extensive secondary research from reputable industry publications, government databases, and regulatory filings. Expert perspectives were solicited to validate market trends, emerging technologies, and the practical implications of U.S. tariffs.

Data from industry seminars, trade events such as CES, Auto Shanghai, and sector-specific webinars provided real-time visibility into technological demonstrations and product roadmaps. Quantitative analyses were conducted using advanced analytics tools, enabling cross-segmentation assessments of adoption rates, cost-impact scenarios, and regional growth differentials. Triangulation techniques ensured that findings were corroborated across multiple sources.

To enhance transparency and reproducibility, research logs detailing data origin, interview transcripts, and analytical models are maintained under strict confidentiality protocols. This approach ensures that stakeholders can confidently leverage the report’s conclusions to inform strategic planning, product development, and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Digital Cockpit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Digital Cockpit Market, by Product Type

- Automotive Digital Cockpit Market, by Technology

- Automotive Digital Cockpit Market, by User Interaction

- Automotive Digital Cockpit Market, by Connectivity Type

- Automotive Digital Cockpit Market, by Vehicle Type

- Automotive Digital Cockpit Market, by Application

- Automotive Digital Cockpit Market, by End-User

- Automotive Digital Cockpit Market, by Region

- Automotive Digital Cockpit Market, by Group

- Automotive Digital Cockpit Market, by Country

- United States Automotive Digital Cockpit Market

- China Automotive Digital Cockpit Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3657 ]

Converging Insights and Forward-Looking Perspectives on the Evolution of Automotive Digital Cockpits and Industry Trajectories

The automotive digital cockpit arena stands at the confluence of consumer expectations, regulatory imperatives, and rapid technological evolution. Through examining transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and corporate strategies, this report illuminates the key drivers shaping future mobility experiences. The convergence of AI, AR, and multi-modal HMI underlines the industry’s commitment to delivering safer, more engaging, and highly personalized in-vehicle environments.

US tariff policies have undeniably introduced cost pressures and supply-chain complexities. Nevertheless, these challenges have catalyzed strategic adaptations, including regional manufacturing initiatives and dual-sourcing frameworks. As digital cockpit deployments become increasingly ubiquitous, stakeholders equipped with granular market intelligence and robust collaborative networks will maintain a competitive edge.

Looking ahead, the integration of health and wellness monitoring, enhanced connectivity via 5G and V2X, and sustainable hardware materials will further differentiate cockpit offerings. For decision-makers, staying attuned to evolving regulatory landscapes and forging interoperable technology alliances will be paramount. This report’s insights provide a strategic foundation for navigating the complex terrain of automotive digital cockpits and capitalizing on the opportunities they present.

Unlock Exclusive Digital Cockpit Market Intelligence by Engaging Directly with Associate Director of Sales & Marketing Ketan Rohom to Acquire the Complete Research Report

We invite industry leaders and decision-makers to engage directly with Ketan Rohom, our Associate Director of Sales & Marketing, to explore how this comprehensive research can be tailored to address specific strategic needs and operational challenges. By partnering with Ketan, you will gain privileged access to deeper insights, bespoke data analysis, and expert guidance to support your digital cockpit initiatives. His expertise in aligning market intelligence with corporate objectives will ensure you receive actionable solutions that drive innovation and competitive advantage. Reach out today to schedule a personalized consultation and secure your organization’s future success through the full market research report.

- How big is the Automotive Digital Cockpit Market?

- What is the Automotive Digital Cockpit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?