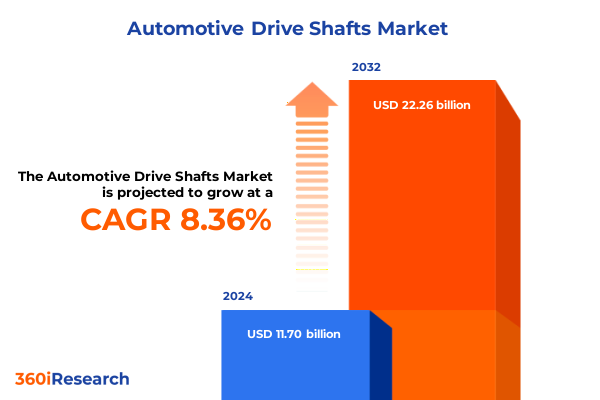

The Automotive Drive Shafts Market size was estimated at USD 12.67 billion in 2025 and expected to reach USD 13.71 billion in 2026, at a CAGR of 8.38% to reach USD 22.26 billion by 2032.

Comprehensive Introduction to Automotive Drive Shafts Highlighting Their Functional Importance, Technological Evolution, and Emerging Market Dynamics in Modern Vehicle Powertrains

Modern automotive powertrains rely on the drive shaft as an essential component for transmitting mechanical power and torque from the gearbox to the wheels. As automotive architectures have evolved-with front-wheel, rear-wheel, and all-wheel drive configurations-the design and material requirements of drive shafts have diversified accordingly. Beyond merely transferring rotational force, contemporary drive shafts must endure torsional stress, accommodate suspension movements via universal or constant velocity joints, and balance rigidity with weight efficiency to optimize vehicle performance.

In recent years, the role of the drive shaft has expanded in importance due to technological shifts across passenger cars, light commercial vehicles, and heavy commercial vehicles. Software-driven powertrain management systems increasingly demand precision-engineered shafts to minimize vibration and support advanced safety features such as electronic stability control. Moreover, the transition toward electrified drivetrains-whether hybrid electric or fully electric-has placed new demands on drive shaft specifications, particularly in multi-motor electric vehicles where efficiency and lightweight construction directly influence range and power delivery.

Stakeholders across OEMs and aftermarket channels recognize that drive shaft innovation now intersects with broader mobility trends, including emissions regulation, fuel economy standards, and consumer expectations for cabin quietness. These factors underscore the criticality of materials research, manufacturing process optimization, and adaptive design as the automotive drive shaft market continues to evolve in response to dynamic industry forces.

Exploring Transformative Shifts in the Automotive Drive Shaft Industry Driven by Electrification, Lightweight Materials, Additive Manufacturing, and Digitalization

The automotive drive shaft industry is undergoing transformative shifts driven by multiple converging technological and manufacturing trends. First, electrification has redefined powertrain architectures; modern multi-motor electric vehicles still require drive shafts but at optimized specifications that accommodate high torque outputs and variable speed regimes. These applications, seen in industry-leading EVs, mandate lighter, stronger materials such as carbon fiber composites and advanced aluminum alloys to enhance range and performance.

In parallel, advances in additive manufacturing and automated fiber placement are enabling rapid prototyping and production of complex drive shaft geometries. These techniques allow for integration of internal damping structures and optimized wall thicknesses that were previously infeasible with traditional tube fabrication. At the same time, digitalization of design workflows-leveraging finite element analysis and digital twins-accelerates development cycles and supports in-line quality monitoring, ensuring consistency across high-volume outputs.

Simultaneously, regulatory imperatives around emissions and fuel efficiency continue to drive weight reduction initiatives. The need to comply with stringent global standards has pushed manufacturers to explore hybrid material combinations that balance cost and performance. Supply chain strategies are adapting accordingly, with a growing emphasis on sourcing raw composite feedstocks from secure, compliant suppliers to mitigate raw material volatility and maintain production continuity.

In-Depth Analysis of the Cumulative Implications of the 2025 United States Steel and Aluminum Tariffs on Automotive Drive Shaft Supply Chains and Production

In June 2025, the United States government enacted a significant escalation in import duties on steel and aluminum, raising rates from 25 percent to 50 percent ad valorem under Section 232 national security proclamations. This policy adjustment reshaped cost structures for automotive component suppliers, particularly those reliant on imported metal content for drive shaft production. By tightening the exclusion process and terminating general approved exclusions, the measure removed key safeguards that had previously buffered suppliers from extreme price volatility.

The immediate effect was a surge in domestic steel and aluminum demand, pressuring downstream manufacturers to secure alternative material sources or invest in tariff mitigation strategies. While some OEMs absorbed initial cost impacts to preserve consumer price stability, second-quarter financial reports revealed multi-hundred-million-dollar tariff charges for leading integrators, reflecting the magnitude of the excess duties. Underlying supply chains were forced to reorient toward domestic mills or pursue nearshoring options, triggering capital investment in North American forging and extrusion facilities.

Over time, these duties prompted design teams to accelerate material diversification, with a notable uptick in composite and aluminum-alloy drive shaft adoption as a hedge against steel price escalations. Manufacturers also engaged in proactive negotiations with integrated steel producers for locked-price contracts and initiated advocacy efforts to renew or extend product-specific exclusions. The cumulative impact of the 2025 tariffs thus represents a transformative moment in supply chain resilience, cost management, and material strategy for automotive drive shaft stakeholders.

Insightful Assessment of Market Segmentation Based on Vehicle Class, Material Composition, Application Type, and End User for Drive Shaft Solutions

An effective understanding of the automotive drive shaft market arises from examining several key segmentation dimensions. When viewed through the lens of vehicle class, drive shafts for heavy commercial vehicles-including both bus and truck applications-prioritize durability and high-torque capacity, often leveraging specialized steel alloys for resilience under sustained load. In contrast, light commercial vehicles such as pickups and vans require a balance of strength and weight efficiency to support payload performance while meeting fuel economy regulations. Passenger cars are further differentiated into hatchbacks, sedans, and SUVs, each segment driving unique demand for torsional stiffness, NVH (noise, vibration, and harshness) characteristics, and shared component commonality across model families.

Material composition is equally pivotal: traditional steel assemblies remain prevalent in segments demanding cost optimization and proven performance, while aluminum alloys deliver meaningful weight reductions for efficiency-focused models. Composite shafts, though still limited by higher production costs, are gaining traction in premium and performance-oriented applications due to their superior strength-to-weight ratios. The dichotomy between propeller drive shafts-tasked with transmitting power across varying angle offsets-and steering shafts, which serve precise steering column alignment and safety functions, underscores the specialized engineering approaches required for each application type.

Finally, end-user segmentation between OEM platforms and aftermarket replacement cycles shapes product requirements and distribution strategies. OEM partnerships demand tight integration with vehicle development cycles and stringent qualification protocols, whereas the aftermarket sector emphasizes standardized component families, ease of installation, and broad distributor networks. Together, these segmentation insights inform targeted innovation roadmaps and commercial strategies for drive shaft suppliers.

This comprehensive research report categorizes the Automotive Drive Shafts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Class

- Material

- Application

- End User

Key Regional Insights on Automotive Drive Shaft Trends and Strategic Dynamics across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on the automotive drive shaft landscape, reflecting local regulations, manufacturing ecosystems, and mobility trends. In the Americas, nearshoring initiatives and trade agreements have spurred investment in Mexican and U.S. forging facilities, enhancing supply chain agility in response to evolving tariff regimes and logistical challenges. OEMs in North America leverage these capabilities to align production footprints with consumer demand while mitigating currency fluctuations and cross-border compliance risks.

Meanwhile, Europe, the Middle East, and Africa (EMEA) navigate an intricate regulatory environment characterized by the European Union’s Circular Material Use Rate mandates and evolving emissions thresholds. These policies drive local drive shaft producers to adopt recyclable aluminum and thermoplastic composite solutions, coupling sustainability targets with material performance. In regions such as the Gulf Cooperation Council, infrastructure expansion and heavy-duty commercial vehicle adoption further underscore the demand for robust drive shafts engineered to endure extreme environmental conditions.

Across Asia-Pacific, a robust manufacturing base and aggressive electric vehicle rollout are reshaping drive shaft requirements. Markets such as South Korea and China lead in composite shaft production, leveraging advanced material capabilities and supportive industrial policies to scale lightweight solutions for high-volume EV and hybrid platforms. The convergence of cost-effective labor, vertically integrated supply chains, and government incentives has cemented Asia-Pacific as a critical hub for both OEM sourcing and aftermarket distribution networks.

This comprehensive research report examines key regions that drive the evolution of the Automotive Drive Shafts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Evaluation of Leading Automotive Drive Shaft Manufacturers Focusing on Strategic Positioning, Product Innovation, and Global Footprint

A critical evaluation of market-leading drive shaft manufacturers reveals diverse strategic approaches centered on innovation, geographic reach, and customer engagement. GKN Automotive, the world’s largest producer of constant-velocity joints and driveline components, maintains a global footprint with 47 manufacturing facilities and six technology centers, leveraging advanced composite and ePowertrain divisions to support both ICE and electrified platforms.

Dana Incorporated distinguishes itself through precision engineering and a robust portfolio of drive shaft solutions spanning passenger cars to heavy-duty commercial vehicles. The company’s investments in advanced materials and additive manufacturing partnerships bolster its capacity to deliver lightweight, high-performance shafts tailored for next-generation EVs. American Axle & Manufacturing (AAM) remains a key player in North America, integrating forging, machining, and heat-treat processes to optimize cost structure and support OEM powertrain architectures across global assembly plants. Meanwhile, Neapco Holdings leverages decades of driveline expertise to supply high-torque shafts for off-highway and racing applications, co-innovating with OEMs on torque vectoring and noise mitigation technologies.

Other notable participants such as JTEKT Corporation and NTN Corporation focus on steering and joint integration, tapping into their bearing and transmission system strengths to diversify into propeller and half-shaft markets. Each of these companies drives competitive advantage through targeted R&D, strategic alliances, and modularity in design to meet the evolving needs of automotive OEMs and aftermarket channels worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Drive Shafts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Axle & Manufacturing, Inc.

- Cummins Inc.

- Dana Incorporated

- Danchuan Automotive Parts Co., Ltd.

- Dorman Products, Inc.

- GKN Automotive Limited

- Guansheng Automotive Driveline Systems Co., Ltd.

- Hyundai WIA Corporation

- IFA Holding GmbH

- JTEKT Corporation

- Kalyani Group

- KWS Manufacturing Company Ltd.

- Lingyun Parts Manufacturing Co., Ltd.

- Meritor, Inc.

- Neapco Holdings LLC

- Nexteer Automotive Group Limited

- NTN Corporation

- SDS (Drive Shaft) Co., Ltd.

- Showa Corporation

- The Timken Company

- Trelleborg AB

- Wanxiang Qianchao Co., Ltd.

- Wilson Drive Shafts LLC

- Yamada Manufacturing Co., Ltd.

- Yuandong (Automotive Driveshafts) Co., Ltd.

Actionable Strategic and Operational Recommendations for Industry Leaders Navigating Competitive, Technological, and Regulatory Challenges in Drive Shaft Markets

Industry leaders must adopt a proactive stance to navigate the convergence of competitive pressures, material cost volatility, and regulatory demands. First, investing in advanced composite R&D and scalable production methods will be essential to balance weight reduction objectives with cost constraints. Partnerships with material science firms and university consortia can accelerate breakthroughs in high-strength, low-cost hybrid composites suitable for mass adoption.

Second, supply chain resilience strategies-such as dual-sourcing agreements, nearshore manufacturing facilities, and locked-price raw material contracts-will mitigate exposure to sudden tariff escalations and geopolitical shifts. Engaging in multilateral advocacy for product-specific exclusions can further soften the impact of metal duties, preserving margins and production continuity.

Third, integrating digital twins and real-time quality analytics into production lines will enhance process transparency, reduce scrap rates, and optimize throughput. Coupled with predictive maintenance platforms for aftermarket safety, this digital transformation will support premium service offerings and strengthen customer loyalty. Finally, establishing cross-functional centers of excellence for powertrain integration, NVH testing, and lifecycle analysis will provide comprehensive support to OEM programs and differentiate suppliers as strategic innovation partners.

Rigorous Research Methodology Detailing Multi-Source Data Collection, Expert Consultations, and Analytical Frameworks Underpinning the Drive Shaft Market Analysis

This analysis draws on a structured, multi-step research methodology combining both secondary and primary data sources. Secondary research encompassed industry reports, government publications, regulatory filings, and trade association releases to map tariff regimes, regional regulatory frameworks, and material innovation trends. Complementary data were sourced from company annual reports, investor presentations, and technology white papers to identify leading product portfolios and strategic priorities.

Primary research included in-depth interviews with automotive powertrain engineers, supply chain executives, and materials specialists across OEMs, Tier-1 suppliers, and aftermarket distributors. These consultations provided firsthand insights into design criteria, sourcing challenges, and performance validation protocols. Additionally, a Delphi panel of subject matter experts helped refine scenario analyses around tariff impacts and material substitution risks.

Quantitative frameworks such as Porter’s Five Forces and SWOT analyses were employed to assess competitive intensity and organizational strengths. Segmentation matrix models were constructed to correlate vehicle class, material, application, and end user dynamics with strategic imperatives. Throughout, data triangulation and cross-validation ensured robustness, minimizing bias and reinforcing the credibility of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Drive Shafts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Drive Shafts Market, by Vehicle Class

- Automotive Drive Shafts Market, by Material

- Automotive Drive Shafts Market, by Application

- Automotive Drive Shafts Market, by End User

- Automotive Drive Shafts Market, by Region

- Automotive Drive Shafts Market, by Group

- Automotive Drive Shafts Market, by Country

- United States Automotive Drive Shafts Market

- China Automotive Drive Shafts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Synthesis Highlighting Pivotal Insights, Industry Impacts, and Strategic Implications for Stakeholders in the Automotive Drive Shaft Ecosystem

The automotive drive shaft ecosystem stands at a pivotal inflection point, shaped by electrification, materials innovation, and shifting trade policies. As EV platforms proliferate, the quest for lightweight, high-strength drive shafts will intensify, challenging suppliers to expand composite competencies while managing cost structures. Concurrently, the escalation of U.S. steel and aluminum tariffs underscores the imperative for supply chain agility and proactive advocacy.

Segmentation insights reveal that differentiated strategies tailored to heavy commercial, light commercial, and passenger vehicle classes will remain critical, alongside bespoke solutions for propeller and steering shaft applications. Moreover, the interplay between OEM and aftermarket channels highlights the need for integrated product roadmaps and digital service models that maximize lifecycle value.

Regional analysis confirms that geographic diversification-leveraging manufacturing hubs in the Americas, EMEA, and Asia-Pacific-will underpin competitive advantage. Leading companies that align innovation pipelines with local regulatory landscapes and customer demand signals will be best positioned to capture emergent opportunities. Collectively, these insights form a strategic compass for stakeholders seeking to navigate disruption and drive sustained growth in the dynamic automotive drive shaft market.

Direct Call to Action Encouraging Stakeholders to Connect with the Associate Director for Tailored Market Intelligence and Accelerate Decision Making

To gain comprehensive, data-driven perspectives and strategic guidance tailored to the unique challenges of the automotive drive shaft market, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will enable your organization to access customized insights, deep-dive analyses, and interactive discussions designed to support informed decision-making. Whether you seek detailed examination of supply chain resilience strategies, innovative material evaluations, or competitive benchmarking, our experts are prepared to collaborate on shaping solutions that align with your priorities. Let us partner with you to unlock growth opportunities and navigate the evolving landscape with confidence. Contact Ketan Rohom today to purchase the full market research report and empower your strategic roadmap.

- How big is the Automotive Drive Shafts Market?

- What is the Automotive Drive Shafts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?