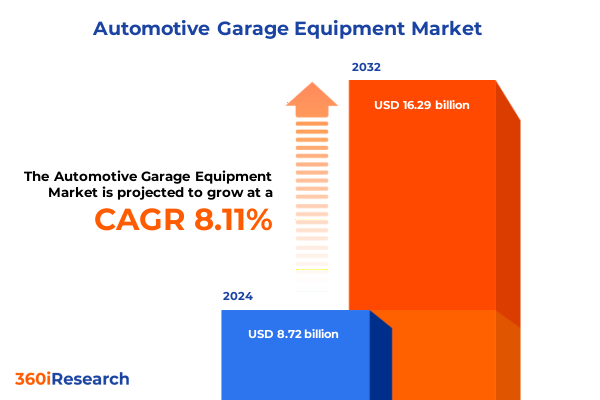

The Automotive Garage Equipment Market size was estimated at USD 9.41 billion in 2025 and expected to reach USD 10.16 billion in 2026, at a CAGR of 8.14% to reach USD 16.29 billion by 2032.

Navigating the Rapid Evolution of the Automotive Garage Equipment Market Amidst Technological Innovation and Regulatory Dynamics

The automotive garage equipment market stands at a pivotal crossroads, driven by a convergence of advanced technologies, shifting regulatory requirements, and evolving service models. As workshop operators and equipment manufacturers navigate a landscape shaped by digital transformation and an accelerating transition toward electrical propulsion, a clear understanding of the underlying forces is essential. This introduction frames the ensuing analysis by outlining the major catalysts reshaping the sector, from the growing complexity of modern vehicles to the regulatory imperatives tied to environmental sustainability and safety.

Capitalizing on opportunities in this dynamic environment requires stakeholders to recognize not only the immediate drivers but also the emerging currents that will define future competitiveness. In particular, the rise of data-driven maintenance, remote diagnostics, and integrated service management platforms is creating new benchmarks for operational efficiency and customer satisfaction. Meanwhile, the proliferation of electric and hybrid vehicles is generating demand for specialized high-voltage equipment and safety protocols. Together, these trends underscore the importance of a strategic, forward-looking approach to product development, service delivery, and market positioning.

This section sets the stage for a detailed exploration of transformative shifts, trade policy impacts, and actionable recommendations. It emphasizes the necessity for industry leaders to align technological innovation with regulatory compliance and to anticipate the evolving needs of diverse end users. By grounding our analysis in these foundational themes, the report equips decision-makers with a roadmap to not only respond to present challenges but also proactively shape the future of automotive garage equipment.

Emergence of Intelligent Diagnostic Solutions and Automated Systems Redefining Garage Equipment Operations

In recent years, the automotive service sector has undergone a profound transformation catalyzed by intelligent diagnostics and automation. Traditional brake lathes and tire changers have been enhanced with machine-learning algorithms capable of predicting wear patterns, while fully automatic wheel alignment systems integrate real-time camera calibration to achieve unprecedented precision. This shift toward smart equipment has redefined workshop operations; service bays now act as data hubs, enabling technicians to transition from reactive repairs to proactive maintenance guided by predictive analytics.

Simultaneously, the proliferation of electric vehicles has prompted the development of fluid management systems specifically engineered for battery cooling and insulation testing. Four-post and scissor lifts have been redesigned with integrated electrical isolation features, ensuring technician safety during high-voltage operations. Moreover, off-board and on-board diagnostic tools now support standardized communication with advanced driver assistance systems, facilitating faster identification of sensor faults and software anomalies. The growing interoperability of equipment underscores a broader trend toward modular, multifunctional platforms that can adapt to a widening array of vehicle architectures.

Environmental regulations have also acted as a catalyst for innovation, pushing manufacturers to develop water-based paint booths and energy-efficient motors that reduce carbon footprints. In parallel, the adoption of cloud-based service management solutions has accelerated workshop digitization, enabling real-time inventory tracking and seamless integration with online sales channels. Taken together, these advancements signal a fundamental reimagining of garage equipment, positioning the industry to meet the demands of a new era characterized by connected, electrified, and data-centric vehicle ecosystems.

Assessing the Comprehensive Consequences of Newly Enacted 25 Percent Tariffs on Automotive Imports and Parts

In March 2025, a presidential proclamation under Section 232 imposed a 25 percent ad valorem tariff on passenger vehicles and light trucks entering the United States, while extending the same rate to select automobile parts in a phased manner by May 3, 2025. The measure aims to protect domestic production by addressing national security concerns related to excessive imports of vehicles and key components such as engines, transmissions, and powertrain parts. Importers under the United States-Mexico-Canada Agreement may certify U.S. content to mitigate duties on non-U.S. value, though the broader tariff applies uniformly to goods from countries without preferential treatment.

Unveiling Nuanced Market Dynamics Across Diverse Equipment Types, Applications, and User Segments

A detailed examination of market segmentation reveals nuanced growth opportunities and operational requirements across equipment categories, end users, mobility types, applications, technology preferences, and distribution channels. The sector’s diversity spans from diagnostic equipment-encompassing both off-board and on-board solutions-to lifting equipment, where four-post, mobile column, scissor, and two-post configurations address varying workshop footprints and lifting capacities. Tire changers and wheel alignment systems exhibit a spectrum of automation levels, while wheel balancers range from static units to sophisticated on-car and dynamic platforms.

This comprehensive research report categorizes the Automotive Garage Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Mobility Type

- Technology

- Application

- End User

- Sales Channel

Regional Market Nuances Highlight Distinct Growth Drivers and Challenges Across Americas, EMEA, and Asia-Pacific

Geographic factors play a critical role in shaping demand patterns and competitive dynamics across the Americas, EMEA, and Asia-Pacific. In the Americas, a mature aftermarket landscape driven by high vehicle ownership and strong dealership networks underpins demand for advanced brake lathes, fluid management systems, and semi-automatic tire changers. Regulatory incentives promoting localized assembly and aftermarket compliance foster a robust environment for technology upgrades.

This comprehensive research report examines key regions that drive the evolution of the Automotive Garage Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Characterized by Strategic Collaborations, Technology Integration, and Market Consolidation Trends

The competitive environment is characterized by established equipment manufacturers forging strategic alliances with technology innovators to deliver integrated solutions. Through partnerships with OEMs, several companies have developed branded service platforms capable of supporting advanced driver assistance systems calibration and EV-specific maintenance. Concurrently, regional and niche players are differentiating through specialized offerings such as mobile diagnostic vans and compact alignment systems optimized for urban workshops.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Garage Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arex Test Systems B.V.

- Aro Equipments (India) Pvt Ltd.

- Atlas Automotive Equipment LLC

- Beissbarth GmbH

- BendPak Inc.

- Boston Garage Equipment Ltd.

- Challenger Lifts Inc.

- Continental AG

- Dover Corporation

- Forward Lift LLC

- Gray Manufacturing Company Inc.

- Hunter Engineering Company

- Istobal S.A.

- Launch Technology Co., Ltd.

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

- Manatec Electronics Private Limited

- Nussbaum Automotive Solutions LP

- Oil Lube Systems Pvt Ltd.

- Ravaglioli S.p.A.

- Robert Bosch GmbH

- Sarveshwari Engineers

- SICE S.r.l.

- Snap‑on Incorporated

- Stertil‑Koni USA, Inc.

- Vehicle Service Group LLC

Strategic Imperatives for Stakeholders to Capitalize on Emerging Trends and Mitigate Tariff-Driven Risks

To navigate the evolving market landscape and mitigate tariff-induced uncertainties, industry leaders should prioritize the localization of critical component manufacturing, thereby reducing exposure to import duties and supply chain disruptions. Investing in scalable diagnostic platforms that accommodate both legacy internal combustion engine vehicles and emerging electric powertrains will ensure relevance across mixed fleets. Further, forging partnerships with software providers to enhance predictive maintenance capabilities can unlock new service revenue streams.

Robust Multisource Research Framework Combining Primary Interviews, Secondary Data, and Rigorous Validation

This research harnesses a hybrid methodology combining primary interviews, field surveys, and expert consultations with secondary data analysis of publicly available government records, industry publications, and technical white papers. Primary interactions with workshop owners, fleet operators, and dealership managers have provided qualitative perspectives on equipment adoption and service workflows. Concurrently, secondary sources including trade policy announcements, regulatory filings, and patent registries were systematically reviewed to validate technology deployment trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Garage Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Garage Equipment Market, by Equipment Type

- Automotive Garage Equipment Market, by Mobility Type

- Automotive Garage Equipment Market, by Technology

- Automotive Garage Equipment Market, by Application

- Automotive Garage Equipment Market, by End User

- Automotive Garage Equipment Market, by Sales Channel

- Automotive Garage Equipment Market, by Region

- Automotive Garage Equipment Market, by Group

- Automotive Garage Equipment Market, by Country

- United States Automotive Garage Equipment Market

- China Automotive Garage Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Synthesizing Market Intelligence to Inform Strategic Decisions in Automotive Garage Equipment Sector

By synthesizing insights on technological disruption, tariff impacts, segmentation nuances, and regional dynamics, this report offers a holistic view of the automotive garage equipment sector’s current state and trajectory. The analysis equips stakeholders with the strategic context to prioritize investments, optimize product portfolios, and refine service models in alignment with evolving market demands and regulatory landscapes. Ultimately, the findings underscore the critical interplay between innovation and policy in shaping the future of vehicle maintenance and repair infrastructure.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Strategic Insights and Drive High-Impact Decisions in the Automotive Garage Equipment Market

For a comprehensive deep dive into transformative market dynamics, in-depth competitive intelligence, and actionable strategic frameworks tailored to the automotive garage equipment sector, partner with Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to unlock expert insights, receive customized presentations, and explore flexible licensing options that align with your organization’s objectives. Elevate your decision-making with the full market research report and seize emerging opportunities with confidence.

- How big is the Automotive Garage Equipment Market?

- What is the Automotive Garage Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?