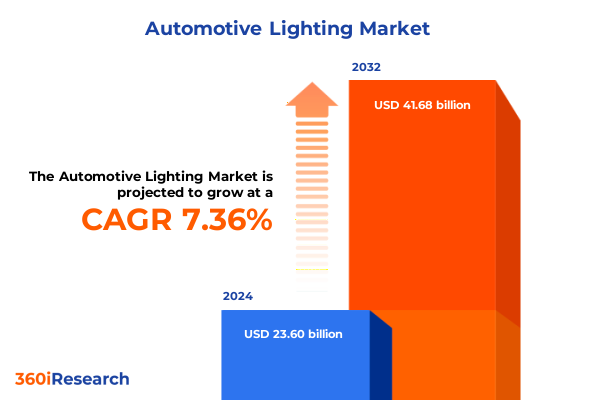

The Automotive Lighting Market size was estimated at USD 25.31 billion in 2025 and expected to reach USD 27.15 billion in 2026, at a CAGR of 7.38% to reach USD 41.68 billion by 2032.

Innovations Illuminating a New Era in Vehicle Lighting Systems with Advanced Functionality, Enhanced Efficiency, Seamless Integration, and Elevated Safety

The automotive lighting domain has undergone a remarkable evolution, bridging the gap between basic illumination and intelligent safety-critical systems. Originally conceived to simply provide nighttime visibility, lighting solutions have transformed into complex networks of LEDs, sensors, and software algorithms that optimize beam patterns in real time to respond to oncoming traffic and varying weather conditions. This shift reflects the broader trend toward vehicle electrification and autonomous driving, where adaptable lighting not only enhances aesthetic appeal but also serves as an active interface between vehicles and their surroundings.

As the industry advances, three key trends catalyze the next wave of innovation. First, integration with vehicle electronics and connectivity platforms has enabled adaptive front lighting systems to adjust intensity and direction instantaneously. Second, rising consumer demand for personalization drives the incorporation of color ambient lighting and customizable intensity control within the cabin environment. Third, regulatory frameworks continue to evolve, requiring higher photometric performance and stricter safety certification, which in turn spur technology developers to invest in high-efficiency semiconductor light sources and robust thermal management solutions. Consequently, lighting assemblies now represent a core functional pillar in vehicle design, shaping driver experience, bolstering brand identity, and contributing to overall safety architecture.

Moreover, the convergence of design excellence and functional performance in lighting systems underscores their central role in future mobility solutions, setting the stage for continued advancements in both hardware and software around light management and user interaction.

Transformative Shifts Defining the Future of Vehicle Illumination from Connectivity and Sustainability to Autonomous Adaptive Lighting Architectures

Automotive lighting is no longer confined to static high-beam and low-beam demarcations; it has evolved into a dynamic element that interacts with both driver and environment. Connectivity technologies now link lighting modules to onboard sensors, cameras, and cloud-based data platforms, allowing predictive beam adjustments that adapt to road geometry, pedestrian movement, and weather variations. At the same time, sustainability imperatives guide the transition to solid-state lighting solutions, with LEDs and laser diodes reducing energy consumption while enabling slimmer, more aerodynamically efficient headlamp designs.

In parallel, the advent of autonomous and semi-autonomous driving architectures elevates lighting from a purely passive component to a communication tool. Exterior lighting gestures can signal vehicle intentions to pedestrians and other road users, and interior ambient cues help passengers anticipate upcoming maneuvers. Simultaneously, digital control strategies harness microcontroller-driven dimming and color-temperature shifts to improve driver alertness and comfort on long journeys. These transformative shifts in technology, regulation, and user experience combine to redefine lighting as an intelligent, interactive, and sustainable pillar of modern vehicle ecosystems.

Cumulative Impact of 2025 US Tariff Adjustments on Automotive Lighting Supply Chains and Cost Structures Across the Industry Landscape

With the implementation of new United States tariffs on selected lighting components and raw materials in early 2025, the automotive lighting value chain faces a wave of cost realignments and sourcing adjustments. Manufacturers reliant on imported semiconductor chips and specialized glass substrates have encountered increased landed costs, prompting a reevaluation of global procurement strategies. In response, several suppliers have accelerated nearshore manufacturing initiatives in Mexico and South America, while diversifying supply agreements to include alternative Asia-Pacific vendors exempt from the revised tariff schedule.

These adjustments have yielded a cumulative impact on both original equipment manufacturers and aftermarket players. OEMs are negotiating long-term contracts to lock in favorable pricing and secure just-in-time deliveries, whereas aftermarket distributors are exploring hybrid supply models that blend domestic production of commodity components with imported high-value modules. At the same time, engineering teams are optimizing board layouts and thermal solutions to reduce material intensity in next-generation headlamp architectures. As a result, the tariff-induced cost pressures have not only reshaped sourcing footprints but also catalyzed incremental design innovations aimed at mitigating input price volatility and sustaining performance standards under evolving trade policies.

Uncovering Critical Segmentation Insights Across Distribution Channels Vehicle Types Applications Technologies and Product Categories for Distinct Value

Analyzing market segmentation through the lens of distribution channel reveals two primary pathways: the aftermarket channel, which addresses vehicle maintenance and customization, and the OEM channel, which integrates lighting solutions directly into new vehicle architectures. Aftermarket stakeholders concentrate on modular upgrades and retrofit kits, leveraging standardized plug-and-play interfaces, while OEM alliances work on deep integration of systems within the vehicle’s central electronic control unit.

Delving into vehicle type segmentation uncovers a layered structure. Commercial vehicles encompass heavy commercial platforms designed for long-haul logistics and light commercial platforms, which further divide into pickups and vans for urban distribution networks. Passenger cars bifurcate into hatchbacks, sedans, and SUVs; sedans then break down into compact and mid-size variants, and SUVs split into compact and luxury classes. This granularity highlights distinct application requirements, as heavy vehicles prioritize robust thermal management and durability, while luxury SUVs seek premium styling and adaptive functionality.

From an application standpoint, lighting modules fall into exterior and interior categories. Exterior assemblies include headlamps, fog lamps, daytime running lamps, and tail lamps, each engineered for specific photometric performance. Interior systems feature ambient lighting, dome lamps, and map lamps, with ambient applications offering advanced color customization and intensity control to enhance the in-cab experience.

Technology segmentation encompasses halogen, HID, laser, and LED platforms. HID systems subdivide into plasma and xenon variants, and LED solutions extend across traditional LED arrays, microLED chips, and OLED panels-further categorized into flexible and rigid form factors to suit curved instrument panels or frameless headlamp designs.

Product type segmentation captures the full spectrum of lighting use cases. Daytime running lamps utilize both fiber optic strands and LED sources, fog lamps deploy halogen or LED arrays, and headlamps integrate high-beam, low-beam, and advanced adaptive front lighting systems, including matrix LED and adaptive front lighting architecture. Interior lighting replicates the ambient system hierarchy, while tail lamps range between conventional incandescent and LED formats.

This comprehensive research report categorizes the Automotive Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Vehicle Type

- Application

- Distribution Channel

Key Regional Dynamics Shaping Automotive Lighting Adoption Trends and Strategic Opportunities across Americas Europe Middle East Africa and Asia Pacific Markets

The Americas region has emerged as a foundational market for automotive lighting, characterized by stringent safety regulations and a strong supplier base concentrated in North America. LED adoption rates have accelerated due to fuel efficiency mandates and consumer demand for premium features, prompting several OEMs and tier-one suppliers to localize production. At the same time, Brazilian and Mexican hubs have advanced their manufacturing capabilities to serve both domestic and export markets, while aftermarket networks in the United States and Canada emphasize retrofit packages to meet customization trends.

In Europe, Middle East & Africa, regulatory frameworks around photometric standards and pedestrian safety drive continuous refinement of lighting modules. European OEMs lead in design sophistication, leveraging laser and OLED technologies to achieve ultra-compact headlamp footprints. Concurrently, Middle Eastern markets prioritize ruggedized solutions for extreme temperature conditions, and African routes focus on cost-efficient legacy technologies to support expanding commercial fleets in developing economies.

Asia-Pacific blends high-volume production with rapid adoption of emerging technologies. Japanese and Korean OEMs remain global trendsetters in adaptive matrix lighting and OLED integration, while Chinese manufacturers scale LED and laser systems at competitive costs. India and Southeast Asia present strong growth potential for entry-level passenger vehicles, favoring halogen-to-LED retrofits as urbanization accelerates. This diverse regional landscape underscores the importance of tailored strategies for supply chain optimization and product portfolio alignment across geographies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading OEMs Tier One Suppliers and Emerging Players Advancing Technological Innovations Partnerships and Competitive Strategies in Automotive Lighting Segment

Several industry leaders shape the automotive lighting ecosystem through strategic innovation and collaborative partnerships. Traditional OEMs have forged alliances with semiconductor manufacturers to develop next-generation LED chips offering higher lumens per watt, while tier-one suppliers partner with software firms to embed intelligent control modules capable of over-the-air updates. Emerging players have entered the market with disruptive microLED prototypes and flexible OLED lighting panels that conform to complex surfaces, challenging established vendors to accelerate R&D cycles.

Beyond technology, competitive positioning hinges on global manufacturing footprints and supply chain resilience. Key suppliers have diversified their assembly plants across North America, Europe, and Asia to mitigate trade policy risks, while leveraging shared platforms and standardized interfaces to streamline production. Additionally, companies are investing in digital design tools and virtual testing environments to reduce time-to-market for bespoke lighting modules. As a result, the competitive landscape blends legacy expertise with nimble startups, creating a dynamic environment where collaboration and differentiation coalesce to drive long-term leadership in the automotive lighting domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams OSRAM AG

- HELLA GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- LG Innotek Co., Ltd.

- Lumileds LLC

- Magneti Marelli S.p.A.

- Min Hsiang Corporation

- Nichia Corporation

- Renesas Electronics Corporation

- Signify N.V.

- Stanley Electric Co., Ltd.

- Valeo S.A.

- Varroc Lighting Systems Pvt. Ltd.

- ZKW Group GmbH

Actionable Strategies to Optimize Supply Chains Enhance Product Development and Leverage Emerging Technologies for Sustained Leadership in Automotive Lighting

To maintain a competitive edge, industry leaders should fortify supply chain flexibility by qualifying alternate component sources outside tariff-sensitive regions and embracing nearshore partnerships that reduce lead times. Concurrently, embedding advanced analytics into procurement processes will enable real-time visibility of cost fluctuations, empowering organizations to secure favorable pricing commitments and optimize inventory levels.

On the innovation front, prioritizing investment in high-efficiency solid-state technologies such as microLED and flexible OLED can yield substantial differentiation in both premium and entry-level segments. At the same time, expanding cross-functional collaborations between lighting engineers, software developers, and UX designers will accelerate the deployment of interactive lighting features that enhance both safety and personalization.

Strategically, forging alliances with automotive OEMs and technology startups can unlock new use cases for lighting as a communication interface in autonomous driving environments. Implementing modular architectures and standardized control protocols facilitates rapid integration into next-generation vehicle platforms, while providing the agility to respond to evolving regulatory requirements and consumer preferences.

Comprehensive Research Methodology Integrating Qualitative and Quantitative Analyses Primary Interviews Secondary Data Validation and Rigorous Data Triangulation

This research employs a multifaceted methodology that integrates both qualitative and quantitative dimensions to ensure comprehensive coverage of the automotive lighting sector. Primary research included in-depth interviews with product engineers, procurement executives, and R&D leaders from OEMs and tier-one suppliers across North America, Europe, and Asia-Pacific. These discussions provided firsthand perspectives on emerging design priorities, cost drivers, and strategic partnerships shaping the market.

Secondary research entailed systematic review of industry publications, regulatory documents, and patent filings to map out technology trajectories and policy frameworks. This data was supplemented with trade and customs data analysis to quantify the impact of tariffs and supply chain realignments. To validate findings, a rigorous data triangulation approach cross-referenced insights from primary interviews with secondary sources and regional market intelligence, ensuring accuracy and consistency across different information streams.

Collectively, this structured research design delivers an authoritative market perspective, combining expert viewpoints with empirical data to support strategic decision-making and long-term investment planning in the automotive lighting landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Lighting Market, by Product Type

- Automotive Lighting Market, by Technology

- Automotive Lighting Market, by Vehicle Type

- Automotive Lighting Market, by Application

- Automotive Lighting Market, by Distribution Channel

- Automotive Lighting Market, by Region

- Automotive Lighting Market, by Group

- Automotive Lighting Market, by Country

- United States Automotive Lighting Market

- China Automotive Lighting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Highlighting the Strategic Imperatives and Future Pathways for Industry Stakeholders in the Automotive Lighting Landscape

In conclusion, the automotive lighting sector stands at an inflection point where technological innovation, regulatory evolution, and supply chain dynamics converge to redefine market priorities. Stakeholders who proactively address tariff implications through diversified sourcing strategies will mitigate cost pressures, while those that invest in adaptive, energy-efficient lighting platforms will capture both safety and personalization trends. Furthermore, leveraging segmentation insights across distribution channels, vehicle types, and regional markets will enable precise product alignments that resonate with end-user expectations.

Looking ahead, the integration of lighting as an interactive medium within autonomous and connected vehicle ecosystems will unlock new pathways for differentiation. Companies that harmonize hardware advances with software-driven user experiences will position themselves as frontrunners in a landscape where light serves not merely as illumination, but as an integral component of vehicle safety, communication, and brand identity. As such, strategic agility, collaborative partnerships, and a deep understanding of evolving regulations will be critical imperatives for sustained leadership in this rapidly evolving domain.

Secure Your Comprehensive Automotive Lighting Market Intelligence Today by Connecting with Ketan Rohom for Tailored Insights and Strategic Guidance

To secure unparalleled insights into the dynamic automotive lighting landscape and tailor strategies that align precisely with your organization’s objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to arrange a personalized briefing or demo of the full market intelligence report. Engaging with this comprehensive research will equip your team with the actionable intelligence needed to anticipate emerging opportunities, mitigate supply chain risks, and capitalize on technological breakthroughs such as adaptive front lighting systems and next-generation solid-state sources. Ketan will guide you through the report’s detailed analyses on segmentation, regional demand drivers, tariff implications, and competitive benchmarking, ensuring you derive maximum value from the findings. Don’t miss the opportunity to empower your strategic roadmap with data-driven recommendations crafted for the fast-evolving automotive lighting sector and position your organization for sustainable growth and innovation.

- How big is the Automotive Lighting Market?

- What is the Automotive Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?