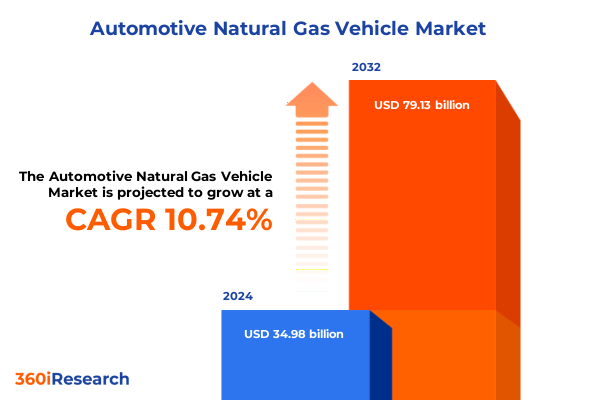

The Automotive Natural Gas Vehicle Market size was estimated at USD 37.98 billion in 2025 and expected to reach USD 41.24 billion in 2026, at a CAGR of 11.05% to reach USD 79.13 billion by 2032.

Understanding the strategic significance of natural gas vehicles in driving sustainable mobility amid evolving energy dynamics and regulatory imperatives

Natural gas vehicles (NGVs) have emerged as a pivotal component in the global effort to reduce carbon emissions and improve air quality. Life cycle analyses by the U.S. Department of Energy’s Argonne National Laboratory indicate that heavy-duty NGVs can achieve moderate greenhouse gas reductions compared to conventional diesel counterparts, with ultra-low NOₓ engines producing near-zero nitrogen oxide emissions that comply with California’s stringent standards (turn1search0; turn1search1). In addition, renewable natural gas (RNG) blends can further enhance environmental performance by capturing methane from organic waste streams and reducing overall greenhouse gas intensity (turn1search2). This combination of lower tailpipe emissions and life cycle benefits underpins the growing strategic importance of NGVs in sustainable transportation planning.

Moreover, the abundance of domestic natural gas supplies has bolstered the economic appeal of NGVs, offering operators predictable fuel costs and reduced exposure to crude oil price volatility. The International Energy Agency projects that supportive policies and low wholesale gas prices in North America could incentivize broader NGV adoption, particularly within commercial and public fleet segments where centralized refueling infrastructures enhance operational efficiency (turn1search4). As energy security considerations gain prominence, NGVs are positioned to complement electrification and hydrogen initiatives by providing a mature, low-carbon alternative that leverages existing distribution networks and scales rapidly to meet diverse mobility requirements.

Examining regulatory reforms and advanced technologies that are propelling natural gas vehicles to the forefront of low-carbon transportation innovation

The NGV landscape has undergone transformative shifts driven by evolving regulations, technological innovation, and competitive pressures from electrification. Recent proposals by the U.S. Environmental Protection Agency to rollback greenhouse gas endangerment findings could reshape emissions strategies and alter the competitive balance among alternative fuel technologies (turn1news12). Conversely, state and local incentives-including California’s optional near-zero NOₓ standards and emerging low-carbon fuel regulations-are catalyzing investments in advanced dual-fuel engines and aftertreatment systems that blend CNG and liquid natural gas (LNG) for enhanced range and performance (turn1search0; turn1search1).

On the technological front, breakthroughs in high-pressure Type IV composite tanks and lightweight materials have reduced vehicle weight and improved fuel storage capacity, while vehicle manufacturers are introducing dedicated and bi-fuel platforms that address diverse duty cycles. These innovations are occurring in parallel with the expansion of refueling infrastructure; recent data shows that North American CNG station networks have grown by over 10% in the past two years, and LNG corridor projects are gaining momentum to support long-haul freight applications (turn1search4; turn1search2). Collectively, these regulatory and technological shifts are redefining the economics of NGVs and accelerating their competitiveness against both traditional internal combustion engines and emerging electric powertrains.

Analyzing the cascading effects of 2025 import and component tariffs on the cost structure and supply chain resilience of natural gas vehicle production

The implementation of sweeping U.S. import tariffs in 2025 has introduced significant cost pressures across the NGV supply chain. Under a presidential proclamation effective April 2, all imported passenger vehicles and light trucks, including NGV models, are subject to a 25% duty, followed by a 25% tariff on key auto components such as engines, powertrain modules, and high-pressure storage tanks beginning May 3 (turn0search2). These measures, layered on existing USMCA reciprocal duties and potential retaliatory tariffs, have raised landed costs for conversion kits and aftermarket components sourced from major suppliers in China and India, where a substantial share of CNG injection systems and composite tank assemblies are produced.

Automakers and fleet operators have reported cumulative impacts that underscore the policy’s reach. General Motors disclosed a $1.1 billion hit to second-quarter operating income attributable to Trump-era tariffs, reflecting the broader industry strain (turn0news12; turn0news13). Similarly, Stellantis has warned of over $350 million in anticipated tariff costs, prompting strategic shifts in production and sourcing to mitigate financial exposure. These headwinds have prompted manufacturers and converters to reassess global supply chains, accelerate domestic content verification under USMCA, and pursue localized manufacturing investments to buffer future tariff cycles (turn0news13; turn0news14).

In the aftermarket segment, suppliers of conversion kits and retrofit systems face eroded margins as tariffs lift component prices. BusinessResearchCompany has noted a revision in growth projections for NGV-related components, with anticipated tariff burdens tempering demand for cost-sensitive aftermarket conversions and OEM-fitted solutions alike (turn0search4). This environment underscores the need for industry stakeholders to navigate complex trade policy landscapes while sustaining momentum toward decarbonization targets through strategic sourcing and policy advocacy.

Uncovering how fuel form, propulsion architecture, storage technologies, vehicle classifications, and conversion pathways shape the natural gas vehicle ecosystem

Considering market segmentation by fuel type, compressed natural gas (CNG) continues to dominate owing to established infrastructure and lower compression energy requirements, while liquefied natural gas (LNG) is gaining traction in heavy-duty applications for its superior energy density and suitability for long-haul transport. Within propulsion categories, bi-fuel systems offer operational flexibility by seamlessly switching between natural gas and conventional fuels, whereas dedicated NGV platforms maximize engine optimization and emissions performance through purpose-built designs (turn1search0; turn1search1).

Storage technology segmentation reveals that Type IV composite tanks, which combine plastic liners with carbon fiber reinforcements, are becoming the preferred choice for their reduced weight and corrosion resistance, although Type I steel tanks remain in use for lower-cost fleet conversions. In terms of vehicle classification, commercial applications are spearheading NGV deployment, with heavy commercial vehicles such as refuse trucks and buses leading market uptake, alongside light commercial vans that benefit from centralized refueling. Passenger vehicle adoption remains modest but is supported by OEM-fitted models and growing consumer awareness of environmental incentives (turn0search3; turn1search3).

Beyond vehicle design, application segmentation underscores that on-road fleets-including public transit and last-mile delivery-have leveraged NGVs to meet clean-air mandates, while off-road opportunities in agriculture and mining are emerging through specialized conversions that enhance engine durability under demanding conditions. Finally, conversion type analysis highlights a bifurcation between aftermarket conversions, which provide retrofit pathways for legacy fleets, and OEM-fitted NGVs, which integrate factory-validated systems that ensure warranty coverage and regulatory compliance (turn1search2; turn0search4).

This comprehensive research report categorizes the Automotive Natural Gas Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Propulsion

- Tank Type

- Vehicle Type

- Application

- Conversion Type

Exploring how distinctive regional policies, infrastructure investments, and market dynamics are shaping natural gas vehicle adoption across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States remains the largest NGV market, driven by abundant domestic gas production, federal tax credits for alternative fuel vehicles, and state-level incentives that offset infrastructure and vehicle acquisition costs. Canada’s market is smaller but benefits from cross-border NGV refueling corridors, while Mexico’s fleet conversions are supported by its significant CNG distribution network and government subsidies for public transit modernization. These regional dynamics foster a diverse ecosystem where legacy fleets and new investments coexist, leveraging North America’s mature fuel infrastructure and policy support for low-carbon mobility (turn1search4; turn1search0).

Europe, Middle East & Africa (EMEA) has seen robust NGV growth in Europe, where the EU’s Clean Vehicles Directive mandates public authorities to procure low-emission buses and trucks, and tax incentives in countries like Germany and France have accelerated commercial fleet adoption. The Middle East is exploring LNG applications for long-haul freight along key trade corridors, buoyed by government funding for station networks, while North African retrofit programs are extending the life of existing vehicles through cost-effective CNG conversions. Together, these regional initiatives emphasize policy-driven demand and infrastructure expansion as catalysts for NGV deployment (turn0search3; turn0search5).

In the Asia-Pacific region, China and India lead global NGV adoption, accounting for over a third of the global fleet. Both countries have integrated CNG fleets within urban bus and taxi services to combat severe air pollution, and government mandates ensure steady growth in station networks. Southeast Asia is witnessing rapid LNG uptake for intercity logistics, while Australia explores NGV technology for mining and remote applications. This diverse regional mosaic underscores the importance of aligning technology strategies with local fuel economics, environmental goals, and infrastructure readiness (turn0search3; turn1search4).

This comprehensive research report examines key regions that drive the evolution of the Automotive Natural Gas Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the collaborations and technological strengths of leading stations, engine suppliers, and OEMs driving natural gas vehicle innovation and market growth

Market leaders are leveraging core competencies in fuel supply, engine technology, and vehicle integration to capture value within the NGV ecosystem. Clean Energy Fuels has established the largest CNG station network in North America, pairing refueling infrastructure investments with fuel supply contracts to secure recurring revenue streams. Cummins and Westport Fuel Systems drive innovation in natural gas engine platforms and fuel delivery systems, enabling OEMs to achieve performance parity with diesel counterparts while meeting stringent emission regulations (turn0search0; turn0search1).

Vehicle manufacturers and component suppliers are forming strategic partnerships to expand product portfolios. PACCAR and Navistar provide dedicated NGV options for their heavy-duty truck lines, while Volvo leverages dual-fuel technologies to optimize operational efficiency. Meanwhile, CNH Industrial addresses off-road applications by integrating CNG powertrains into agricultural and construction equipment. These collaborative models underscore a shift from isolated product offerings toward integrated solutions that streamline fleet conversion processes and reinforce commercial value propositions (turn0search0; turn1search4).

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Natural Gas Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Iveco Group N.V.

- Nissan Motor Co., Ltd.

- Scania AB

- Stellantis N.V.

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

Strategic guidance for optimizing local production, policymaker engagement, and infrastructure interoperability to fortify natural gas vehicle market resilience

To navigate tariff challenges and sustain momentum, industry leaders should prioritize localized manufacturing and supply chain diversification. Establishing modular assembly lines for tank systems and fuel injection components within tariff-protected regions can mitigate duty impacts and enhance responsiveness to policy shifts. Concurrently, engaging proactively with policymakers to shape regulatory frameworks-such as advocating for low-carbon fuel standards that recognize RNG-will support competitive parity and encourage infrastructure investments (turn0search2; turn1search2).

Investment in interoperable refueling solutions and digital platforms can also strengthen customer value and operational visibility. Deploying fast-fill and time-fill CNG stations with telematics integration enables fleet managers to optimize fueling schedules, track emissions performance, and leverage volume price agreements. Finally, fostering public-private partnerships to expand LNG corridors will unlock new heavy-duty use cases and amplify the role of NGVs in meeting net-zero freight targets. This holistic approach aligns technology deployment with economic incentives and environmental imperatives, ensuring sustainable growth across the NGV value chain (turn1search4; turn1search0).

Detailing the integrated primary and secondary research framework underpinned by expert interviews, industry data, and lifecycle analyses for credible market insights

This analysis leverages a blend of primary and secondary research methodologies to ensure robust, actionable insights. Primary research included structured interviews with OEM technical leads, fleet operators, and infrastructure developers, as well as surveys of station network utilization and conversion service providers. These firsthand inputs provided granular visibility into operational challenges, technology adoption barriers, and emerging market priorities (turn2search3; turn2search0).

Secondary research encompassed a comprehensive review of government publications, industry reports, trade association data, and peer-reviewed studies. Data sources included regulatory filings from the U.S. Environmental Protection Agency, market forecasts from leading industry analysts, and academic lifecycle assessments. Triangulation of these data points with proprietary survey findings enabled the validation of trends and the synthesis of coherent strategic recommendations. This dual-method approach ensures that conclusions reflect both empirical evidence and real-world perspectives, supporting decision-makers in navigating a complex and dynamic NGV landscape (turn2search1; turn2search6).

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Natural Gas Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Natural Gas Vehicle Market, by Fuel Type

- Automotive Natural Gas Vehicle Market, by Propulsion

- Automotive Natural Gas Vehicle Market, by Tank Type

- Automotive Natural Gas Vehicle Market, by Vehicle Type

- Automotive Natural Gas Vehicle Market, by Application

- Automotive Natural Gas Vehicle Market, by Conversion Type

- Automotive Natural Gas Vehicle Market, by Region

- Automotive Natural Gas Vehicle Market, by Group

- Automotive Natural Gas Vehicle Market, by Country

- United States Automotive Natural Gas Vehicle Market

- China Automotive Natural Gas Vehicle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing the convergence of technology, policy, and supply chain strategies that will determine the future trajectory of the natural gas vehicle sector

The natural gas vehicle segment stands at a critical juncture, balancing the promise of lower emissions and energy security against the realities of tariff obstacles and competitive pressures from electrification. While policy shifts-such as evolving EPA emission standards-introduce uncertainty, the fundamental advantages of natural gas fuels, including domestic availability and established distribution networks, continue to drive value for commercial and off-road applications (turn1search2; turn1search4). Economic feasibility for fleet operators is strengthened by RNG integration, infrastructure co-investment models, and bi-fuel capabilities that reduce operational risk.

Looking ahead, the interplay between technological advancements in storage systems, regulatory developments, and global supply chain strategies will dictate the pace of NGV adoption. Stakeholders who align their investments with flexible sourcing models, infrastructure interoperability, and proactive policy engagement will be best positioned to harness the environmental and economic benefits of natural gas as part of a diversified low-carbon mobility mix. Ultimately, NGVs will remain an essential complement to electrified and hydrogen modalities, offering a bridge to sustainable transportation while meeting immediate decarbonization imperatives.

Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock strategic insights and purchase the definitive automotive natural gas vehicle market report

To secure comprehensive insights and strategic guidance tailored to your organization’s needs, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in automotive industry analysis and can provide personalized support to help you leverage the full value of this market research report and inform critical decisions for natural gas vehicle adoption and infrastructure development.

- How big is the Automotive Natural Gas Vehicle Market?

- What is the Automotive Natural Gas Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?