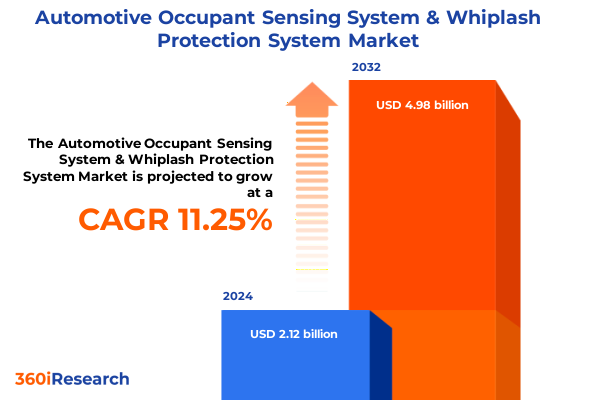

The Automotive Occupant Sensing System & Whiplash Protection System Market size was estimated at USD 2.34 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 11.36% to reach USD 4.98 billion by 2032.

Unveiling the Critical Role of Automotive Occupant Sensing and Whiplash Protection Systems in Shaping Next-Generation Vehicle Safety Standards

The automotive landscape is undergoing a profound transformation as occupant sensing and whiplash protection systems emerge as indispensable components of holistic vehicle safety architectures. No longer confined to isolated features, these technologies are now integral to the dynamic interplay between advanced driver-assistance systems and passive restraint mechanisms. With the National Highway Traffic Safety Administration mandating more stringent in-cab detection capabilities to optimize airbag deployment and seatbelt reminders, manufacturers are racing to integrate camera-based and sensor-fusion platforms that can accurately classify occupants by size, position, and posture for enhanced protection.

Simultaneously, consumer expectations are being reshaped by a wave of innovations in in-cabin sensing. The adoption of near-infrared and RGB camera combinations, driven by regulatory pushes and premium vehicle differentiation strategies, has made real-time monitoring of drowsiness, distraction, and vital signs mainstream. These shifts underscore a critical inflection point: occupant sensing technologies have evolved from optional comfort add-ons to foundational safety enablers that can prevent airbag-induced injuries, particularly for children and smaller adults. This report illuminates how the convergence of regulation, technology, and user demand is setting new benchmarks for occupant protection and whiplash mitigation in the modern automotive sector.

Exploring the Technological Convergence and Regulatory Evolution that are Redefining Automotive Occupant Sensing and Whiplash Protection Systems

In the past five years, automotive occupant sensing and whiplash protection have leaped forward via the fusion of traditional sensor modalities and artificial intelligence. Pressure sensors, radar modules, and ultrasonic arrays now operate in concert with deep-learning algorithms that predict occupant behavior and adapt restraint strategies in milliseconds. This sensor fusion paradigm not only refines occupant classification under complex seating scenarios but also elevates passive safety architectures with predictive whiplash mitigation responses.

At the same time, consumer electronics events like CES are spotlighting the blurring boundaries between in-vehicle comfort and security. Bosch’s interior sensing solutions demonstrate how a single wide-angle camera can monitor driver engagement, hands-near-wheel detection, and passenger motion, all while supporting compliance with anticipated U.S. and European regulations. Meanwhile, the shift toward centralized electrical and electronic architectures has enabled scalable radar and video sensor roadmaps that enhance system reliability, cost-efficiency, and integration across multiple trim levels and mobility applications.

Concurrently, the industry’s push towards higher levels of vehicle autonomy, electrification, and connected services is redefining safety priorities. As automated driving functions extend passenger time spent in reclined or non-standard seating positions, whiplash protection systems-once purely mechanical-are becoming active, adaptive sub-systems that respond to real-time crash dynamics and occupant kinematics. These transformative shifts are not incremental; they represent a fundamental reimagining of how vehicles perceive, classify, and protect their occupants.

Assessing How Recent 2025 United States Tariff Measures Have Altered Supply Chains Impacting Automotive Safety Sensor and Whiplash Mitigation Technologies

In early 2025, a series of U.S. tariff measures significantly altered the cost structure for manufacturers and suppliers of automotive safety sensors and whiplash protection components. The proposed 25% tariffs on imported auto parts, scheduled to take effect in May, prompted urgent consultations between automakers and government officials, with industry groups warning of elevated vehicle prices and supply-chain disruptions. This policy decision reverberated across tier-1 and tier-2 suppliers, many of which were already operating on tight margins amid escalating semiconductor and raw material costs.

Simultaneously, the imposition of a universal 10% “reciprocal” tariff on all imports and a 30% levy on Chinese goods introduced new complexities for global sourcing strategies. Suppliers of camera modules, radar chips, and ultrasonic transducers faced the choice of absorbing additional costs, which could compress R&D budgets, or passing them on through higher pricing, potentially affecting OEM adoption rates. In response, several leading safety system manufacturers began to diversify their production footprints, shifting select assembly and sub-module fabrication operations closer to end-market regions to mitigate tariff exposure.

The cumulative impact of these trade policies extends beyond immediate cost implications. By accelerating discussions around localized content thresholds, dual sourcing, and vertical integration of critical sensor technologies, the 2025 tariff landscape has reshaped supplier-OEM collaborations. Industry stakeholders are now grappling with the long-term task of balancing operational resilience with the imperative to remain at the forefront of rapid technological innovation.

Deriving Actionable Insights from Technology, Application, Vehicle Type, and Distribution Channel Segmentation to Inform Market Positioning Strategies

A nuanced understanding of market segmentation offers invaluable strategic direction for organizations aiming to lead in occupant sensing and whiplash protection. Looking through the lens of technology, the market spans camera-based systems-both 2D and 3D stereo cameras-inductive solutions differentiated by electromagnetic and magnetic principles, multiple pressure sensor variants including capacitive, piezoelectric, and resistive types, radar modalities from millimeter-wave to short-range applications, and high- and low-frequency ultrasonic platforms. Each technology brings distinct functional advantages and cost-positioning considerations, making the choice of sensor architecture pivotal for product differentiation and margin optimization.

From an application standpoint, system design diverges across active head restraints-with hydraulic or spring-loaded actuation-child seat occupant detection using optical, pressure-based, or weight-based methods, and sophisticated occupant classification platforms employing camera, capacitance, ultrasound, or weight data fusion. Additionally, passive head restraints range from adjustable designs to fixed configurations, while safety features such as seat belt reminders combine belt latch, buckle, and seat occupancy sensors, and whiplash mitigation seats integrate energy-absorbing backrests or multi-stage foam technologies to reduce injury severity.

Market dynamics also shift with vehicle type segmentation, where the commercial vehicle sector-divided into heavy and light commercial vehicles-presents a different set of regulatory requirements, durability standards, and purchase cycles compared to passenger cars. Lastly, distribution channels influence pricing structures and aftermarket penetration, differentiating OEM-embedded solutions from resources available through the aftermarket. Collectively, these segmentation insights enable stakeholders to tailor product roadmaps, pricing strategies, and go-to-market models to specific target niches.

This comprehensive research report categorizes the Automotive Occupant Sensing System & Whiplash Protection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Application

- Vehicle Type

- Distribution Channel

Analyzing Regional Dynamics and Emerging Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Automotive Occupant Sensing and Whiplash Protection

A regional perspective reveals pronounced distinctions in the adoption and evolution of occupant sensing and whiplash protection systems. In the Americas, regulatory mandates from NHTSA and growing consumer safety awareness have driven a rapid integration of rear seat reminder systems and multi-modal sensing platforms across new vehicle models. This market benefits from extensive OEM-supplier collaboration and a robust second-life aftermarket ecosystem that sustains innovation momentum.

Within Europe, the Middle East, and Africa, stringent Euro NCAP standards and forthcoming General Safety Regulation requirements are compelling automakers to accelerate deployment of advanced occupant classification systems and adaptive whiplash mitigation seats. Government incentives for vehicle safety ratings, coupled with high consumer sensitivity to in-cab safety features, have created fertile ground for European Tier-1 suppliers to pioneer biometric sensing displays and off-zone crash detection capabilities.

Meanwhile, in the Asia-Pacific region, a surge in passenger vehicle production and the rising prominence of emerging markets like India and Southeast Asia are expanding demand for cost-effective, scalable sensing solutions. Local manufacturers are swiftly adopting camera-radar fusion technologies to meet both domestic safety regulations and the needs of global OEM partners. Across all regions, the interplay between local regulatory landscapes and consumer expectations continues to shape the competitive environment and innovation pathways for occupant sensing and whiplash protection.

This comprehensive research report examines key regions that drive the evolution of the Automotive Occupant Sensing System & Whiplash Protection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Innovation Leadership Among Key OEMs and Tier 1 Suppliers in Occupant Sensing and Whiplash Protection Industries

Major corporations are defining the competitive contours of the occupant sensing and whiplash protection market through distinct innovation and partnership strategies. Autoliv, a recognized leader in safety systems, introduced its Omni Safety™ platform at the 2025 Shanghai Auto Show, showcasing an integrated seatbelt and airbag solution that mitigates submarining risks for reclined seating positions through advanced biomechanical designs and extensive simulation testing.

Bosch has responded to regulatory pressures and consumer expectations by advancing interior sensing solutions that merge high-resolution cameras with cabin radar to monitor both driver engagement and passenger motion. Its scalable radar and video sensor roadmap, complemented by AI-powered software stacks for ADAS functions up to SAE Level 4 autonomy, underscores a holistic approach to occupant and environmental sensing.

Continental has similarly expanded the boundaries of in-cab monitoring with its Invisible Biometrics Sensing Display, which integrates biometric detection behind an OLED dashboard screen to support airbag optimization and emergency health interventions through contactless vital sign monitoring. These leading players, alongside others such as Denso, Valeo, Aptiv, ZF, and Visteon, are forging collaborative ecosystems with semiconductor partners, university research centers, and OEMs to maintain rapid product cycles and regulatory compliance in a highly dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Occupant Sensing System & Whiplash Protection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- DENSO Corporation

- Forvia S.A.

- Infineon Technologies AG

- Joyson Safety Systems Co., Ltd.

- Lear Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Innovation, Regulatory Compliance, and Supply Chain Resilience in Automotive Safety Systems

Industry leaders seeking to capitalize on evolving occupant safety trends should pursue a multi-pronged strategic agenda. First, integrating AI-driven sensor fusion across camera, radar, and pressure modalities will unlock higher classification accuracy and predictive restraint capabilities, delivering quantifiable safety benefits and differentiation.

Second, establishing resilient supply chains through localized manufacturing partnerships and dual sourcing will alleviate exposure to trade policy risks such as the 2025 U.S. tariffs. Organizations should negotiate flexible contracts with semiconductor and sensor providers while exploring in-house assembly options to secure critical components.

Third, proactive engagement with regulatory bodies and participation in standards consortia will enable companies to anticipate safety mandates and shape emerging requirements for occupant sensing, whiplash protection, and related passive safety systems. Finally, fostering collaborative R&D ventures with technology firms and academic institutions will accelerate the development of next-generation materials and sensor architectures, ensuring a continuous pipeline of innovative safety solutions.

Detailed Overview of Research Methodology Employing Primary Interviews, Secondary Data Triangulation, and Expert Validation to Ensure Rigorous Market Insights

This market research report is underpinned by a rigorous methodology combining primary and secondary research to deliver reliable insights. Primary research included structured interviews with C-suite executives, product development leads, and procurement specialists from OEMs, tier-1 suppliers, and aftermarket distributors. These interviews provided first-hand perspectives on technology roadmaps, regulatory impacts, and adoption barriers.

Secondary research encompassed an exhaustive review of publicly available sources such as government regulations, industry consortium publications, technical white papers, and leading automotive and technology news outlets. Data triangulation techniques were applied by cross-validating qualitative findings with quantitative data points, ensuring consistency and accuracy.

Additionally, an expert advisory panel comprised of safety engineers, academic researchers, and trade association representatives reviewed preliminary findings, contributing domain-specific insights and validating assumptions. This multi-layered approach guarantees that the report’s conclusions are both evidence-based and reflective of current market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Occupant Sensing System & Whiplash Protection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Technology

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Application

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Vehicle Type

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Distribution Channel

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Region

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Group

- Automotive Occupant Sensing System & Whiplash Protection System Market, by Country

- United States Automotive Occupant Sensing System & Whiplash Protection System Market

- China Automotive Occupant Sensing System & Whiplash Protection System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Perspectives on the Future Trajectory of Automotive Occupant Sensing and Whiplash Protection Systems within an Evolving Mobility Landscape

The convergence of advanced sensing modalities, artificial intelligence, and adaptive restraint mechanisms is fundamentally redefining how vehicles protect occupants in crash events. As regulatory landscapes evolve to mandate more sophisticated in-cab detection and active whiplash mitigation, manufacturers and suppliers are accelerating technology development and strategic partnerships to meet new safety benchmarks.

Regional variations in regulatory stringency and consumer priorities continue to shape product roadmaps, driving a geography-specific approach to platform commonality and localization. Simultaneously, the industry’s response to trade policy shifts-particularly the 2025 U.S. tariffs-highlights the critical importance of resilient supply chains and agile manufacturing footprints.

Looking forward, the ability to seamlessly integrate occupant sensing data into predictive safety architectures and connected mobility ecosystems will be a cornerstone of future vehicle designs. Organizations that successfully align their innovation strategies with regulatory foresight and operational flexibility will be best positioned to lead in the next era of automotive occupant protection.

Engage Directly with Ketan Rohom for Customized Market Intelligence and Strategic Guidance to Elevate Your Automotive Safety Systems Portfolio Today

If you’re ready to translate these insights into decisive action and secure a competitive edge, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in automotive safety systems research will guide you through customized data, in-depth competitive analysis, and strategic frameworks tailored to your organization’s unique needs. Reach out today to schedule a consultation and discover how this comprehensive market research report can become the catalyst for your next growth initiative.

- How big is the Automotive Occupant Sensing System & Whiplash Protection System Market?

- What is the Automotive Occupant Sensing System & Whiplash Protection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?