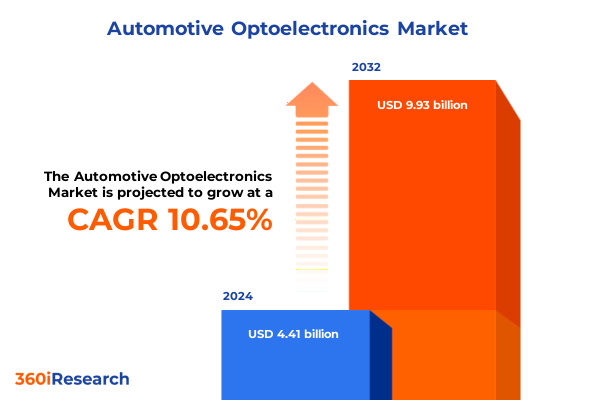

The Automotive Optoelectronics Market size was estimated at USD 4.82 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 10.86% to reach USD 9.93 billion by 2032.

Setting the Stage for the Future of Automotive Optoelectronics by Exploring Market Dynamics and Technological Innovations that Drive Strategic Growth

The emergence of automotive optoelectronics as a pivotal enabler of next-generation mobility solutions underscores its transformative potential across multiple vehicle subsystems. In recent years, advancements in materials science, semiconductor fabrication, and illumination technologies have converged to redefine the automotive user experience. From safety-critical sensing modules to immersive display architectures and dynamic ambient lighting, optoelectronic components now serve as the connective tissue between driver, passenger, and machine. As vehicles evolve toward higher degrees of autonomy and electrification, the integration of sophisticated photonic systems will only deepen, placing optoelectronics at the heart of innovation in mobility.

As the marketplace becomes more competitive, stakeholders must navigate a complex web of regulatory mandates, shifting consumer preferences, and disruptive technological breakthroughs. Automotive OEMs and their supply chains are tasked with balancing stringent safety and emissions requirements against the demand for unparalleled visual performance and seamless digital interaction. Consequently, strategic decisions concerning component selection, supplier partnerships, and system integration have far-reaching implications for vehicle differentiation, production cost, and long-term resilience.

Identifying the Pivotal Technological and Regulatory Shifts Redefining Automotive Lighting Displays Sensors and Connectivity Architectures

A confluence of advances is reshaping the automotive optoelectronics arena, heralding a new epoch of connectivity, autonomy, and immersive user experiences. The rapid proliferation of light-based communication protocols and sensor arrays has catalyzed a migration from analog assemblies to software-defined photonic ecosystems. This transition is further accelerated by breakthroughs in miniaturized LiDAR modules, microLED displays, and adaptive exterior lighting solutions that adapt in real time to environmental stimuli and traffic conditions.

On the regulatory front, stricter nighttime visibility standards and stringent pedestrian-detection requirements are prompting automakers to adopt high-resolution imaging and illumination subsystems. Simultaneously, the rise of electric propulsion architectures is unlocking new opportunities for power-efficient OLED panels and infrared-based thermal management strategies. These dual forces of technology and policy are propelling vehicle manufacturers to forge deeper alliances with semiconductor foundries and specialized optics providers, fostering co-innovation ecosystems that can respond with agility to emerging challenges and customer expectations.

Evaluating the Combined Effects of 2025 United States Import Tariffs on Supply Chain Resilience Component Costs and Market Adoption Rates in Automotive Optoelectronics

Since the implementation of new import tariffs in early 2025, automotive OEMs and tier-one suppliers have grappled with elevated component costs and heightened supply chain complexity. These levies, introduced in response to global trade imbalances, have disproportionately affected critical modules sourced from established manufacturers in the Asia-Pacific corridor. As a result, procurement teams are reevaluating sourcing strategies, securing longer-term supply agreements, and exploring nearshore manufacturing partnerships to mitigate tariff exposures and preserve margin profiles.

The cumulative impact extends beyond cost inflation, precipitating a reevaluation of inventory management and lead-time buffers. In parallel, the propagation of tariffs has incentivized the geographic diversification of printed circuit board assembly sites and the localization of sensor fabrication capabilities. While some stakeholders have absorbed short-term price increases, others are transitioning to alternative photonic materials and reconfigurable system architectures to sustain competitiveness. Overall, the tariff landscape of 2025 has acted as a catalyst for supply chain reconfiguration and intensified the pursuit of end-to-end operational resilience.

Uncovering Essential Segmentation Perspectives That Illuminate Diverse Product Types Vehicle Classes Technologies Channels and Applications in Optoelectronics

Segmenting the automotive optoelectronics domain by product type reveals distinct trajectories in adoption and innovation. Display panels, encompassing both head-up and human-machine interfaces, are advancing rapidly as manufacturers seek to deliver richer visual experiences while minimizing power consumption. Exterior lighting technologies have transitioned from traditional halogen to LED and laser-based headlights, elevating safety outcomes and aesthetic appeal. Meanwhile, interior lighting innovations are increasingly focused on creating customizable ambient and mood lighting environments that enhance occupant well-being and brand differentiation. Sensing systems, spanning infrared and LiDAR sensors, are central to automated driving initiatives and occupant monitoring functions.

Analyzing vehicle types underscores a broad spectrum of application requirements and growth vectors. Passenger cars remain the largest adopters of sophisticated display and lighting systems, yet commercial vehicles are integrating ruggedized sensors to bolster fleet management and safety. The ascent of electric and hybrid vehicles has introduced new thermal and electromagnetic compatibility considerations, prompting the development of specialized optoelectronic modules optimized for reduced power draw and enhanced heat dissipation.

A technology-centric segmentation highlights the prominence of LED in lighting and display contexts, with infrared sensors expanding into cabin monitoring and gesture recognition. Laser illumination, once niche, is now scaling into mainstream headlight assemblies, delivering unparalleled range and beam control. OLED panels are emerging within premium cabins for ultra-high contrast digital instrument clusters.

Investigating sales channels surfaces divergent strategies between aftermarket vendors, who emphasize modular plug-and-play retrofits, and original equipment manufacturers, which pursue vertically integrated design-to-production roadmaps. Finally, mapping applications across illumination, information display, sensing, and signaling demonstrates the expansive role of optoelectronics in fulfilling diverse functional mandates, from enhancing driver awareness to enabling advanced human-machine collaboration.

This comprehensive research report categorizes the Automotive Optoelectronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Technology

- Sales Channel

- Application

Comparing Regional Evolution Patterns Across Americas Europe Middle East Africa and AsiaPacific to Highlight Geostrategic Opportunities and Challenges

In the Americas, strong consumer appetite for advanced infotainment and driver assistance systems coexists with regulatory frameworks that incentivize pedestrian detection and adaptive lighting. The United States leads in the rapid adoption of head-up displays and LiDAR-enabled safety suites, while Canada and Mexico bolster regional supply networks through cross-border manufacturing alliances.

Europe, Middle East, and Africa collectively present a mosaic of market dynamics. Western Europe’s luxury automotive hubs in Germany, France, and the United Kingdom spearhead investments in microLED and infrared sensing innovations. Simultaneously, Middle Eastern markets are investing in smart mobility projects and infrastructure to support high-performance lighting trials, while African markets offer nascent opportunities for cost-effective retrofit solutions in commercial fleets.

Asia-Pacific remains the epicenter of optoelectronics manufacturing and rapid deployment. China’s vertically integrated value chains drive scale in LED and laser headlight production, complemented by aggressive R&D in sensor miniaturization. Japan and South Korea continue to lead in OLED display development, while India’s fast-growing vehicle parc is prompting tier-two suppliers to introduce localized lighting and sensing variants suited to diverse operating environments. These regional patterns underscore the necessity for tailored strategies that align technological capabilities with localized regulatory and consumer contexts.

This comprehensive research report examines key regions that drive the evolution of the Automotive Optoelectronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Their Strategic Alliances Innovation Portfolios and Competitive Postures within Automotive Optoelectronics

The competitive landscape of automotive optoelectronics is shaped by a blend of established automotive suppliers and agile photonics specialists. Legacy Tier-one players have bolstered their portfolios through targeted acquisitions of sensor startups and partnerships with semiconductor foundries, allowing them to offer integrated system solutions that span optics, electronics, and software. Emerging challengers, often originating from consumer electronics or aerospace sectors, are entering the market with disruptive microLED display modules and compact LiDAR engines designed for mass-market scalability.

Strategic alliances have become a cornerstone of competitive differentiation. Cross-industry collaborations between automotive OEMs and technology firms are accelerating the co-development of real-time adaptive lighting controls and machine-vision-enabled safety functions. Furthermore, several leading players are investing in open-architecture platforms that enable software-defined lighting and sensing updates post-deployment, fostering extended product lifecycles and recurring revenue streams.

Innovation pipelines are increasingly characterized by in-house R&D complemented by university partnerships and consortium-driven standardization efforts. This hybrid model accelerates time-to-market for advanced optoelectronic modules while ensuring compliance with evolving safety and electromagnetic compatibility regulations. As a result, companies that effectively integrate multidisciplinary capabilities and maintain agile production footprints are best positioned to capture emerging opportunities across the global automotive value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Optoelectronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams OSRAM AG

- Cree, Inc.

- Hella GmbH & Co. KGaA

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co., Ltd.

- Koito Manufacturing Co., Ltd.

- LG Innotek Co., Ltd.

- LITE-ON Technology Corporation

- Lumileds Holding B.V.

- Luminar Technologies, Inc.

- Nichia Corporation

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Signify N.V.

- Sony Group Corporation

- Stanley Electric Co., Ltd.

- Stanley Electric Co., Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

- Valeo SA

- Velodyne Lidar, Inc.

- Vishay Intertechnology, Inc.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Foster Collaborative Innovation in Automotive Optoelectronics

Industry leaders seeking to capitalize on the momentum within automotive optoelectronics should prioritize the development of modular, scalable architectures that can be seamlessly integrated across diverse vehicle platforms. By adopting sensor fusion approaches and leveraging machine learning for real-time beam control, automotive manufacturers can deliver differentiated safety and user-experience enhancements beyond traditional hardware upgrades.

Supply chain diversification remains paramount in mitigating the effects of trade policy volatility and component shortages. Engaging with multiple qualified suppliers across different geographies and investing in nearshore or onshore manufacturing capabilities will foster resilience and reduce lead-time risk. Concurrently, partnerships with specialized semiconductor and optics providers can expedite the adoption of emerging materials such as gallium nitride for high-performance LED systems.

To unlock new revenue streams, companies must embrace software-defined optoelectronic platforms that support over-the-air updates and feature monetization models. Collaboration with operating system providers and mobility service integrators will enable dynamic content delivery and personalized lighting experiences, enhancing both safety and customer satisfaction. Ultimately, a balanced investment in hardware innovation, digital services, and ecosystem partnerships will drive sustainable growth in the optoelectronics domain.

Detangling the Rigorous Research Methodology Employed to Ensure Credibility Reproducibility and Robustness of Automotive Optoelectronics Market Analysis

This analysis is underpinned by a structured research methodology designed to ensure thoroughness, credibility, and repeatability. Primary research involved in-depth interviews with key stakeholders across the automotive value chain, including OEM design engineers, tier-one module integrators, and component fabricators. These conversations provided nuanced perspectives on technology adoption cycles, procurement strategies, and regulatory compliance challenges.

Secondary research comprised a comprehensive review of technical journals, patent filings, regulatory publications, and publicly available corporate filings. This phase enabled the validation of primary findings and the cross-verification of emerging technology trajectories. Triangulation of multiple data sources ensured that insights were grounded in both quantitative evidence and qualitative expert opinion.

Data synthesis employed thematic analysis to identify recurring trends and stress test assumptions through scenario planning. Findings were further reviewed in expert workshops to refine conclusions and validate strategic recommendations. Rigorous attention to data integrity and methodological transparency underlies the robustness of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Optoelectronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Optoelectronics Market, by Product Type

- Automotive Optoelectronics Market, by Vehicle Type

- Automotive Optoelectronics Market, by Technology

- Automotive Optoelectronics Market, by Sales Channel

- Automotive Optoelectronics Market, by Application

- Automotive Optoelectronics Market, by Region

- Automotive Optoelectronics Market, by Group

- Automotive Optoelectronics Market, by Country

- United States Automotive Optoelectronics Market

- China Automotive Optoelectronics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Outline the Transformational Landscape and Chart Strategic Directions for Stakeholders in Automotive Optoelectronics

The automotive optoelectronics sector stands at a pivotal crossroads, shaped by rapid technological advancements, evolving regulatory landscapes, and dynamic global trade policies. The interplay of display innovations, high-performance lighting, and advanced sensing systems is redefining vehicle architectures and unlocking new opportunities for enhanced safety, comfort, and connectivity. Regional variations in market maturity and regulatory frameworks underscore the necessity for tailored go-to-market strategies, while tariff-driven supply chain realignments are accelerating the pursuit of resilience and localized production.

Leading corporations are responding through strategic alliances, targeted R&D investments, and the rollout of modular, software-enabled platforms that can adapt to shifting requirements over the vehicle lifecycle. As the industry accelerates toward electrification and autonomy, the ability to integrate photonic and electronic disciplines will become an increasingly critical differentiator. Stakeholders that embrace open innovation models and maintain flexible supply networks will be best positioned to thrive in this environment of perpetual change.

In sum, the confluence of technological maturity, policy imperatives, and competitive dynamics calls for a holistic, forward-looking approach to automotive optoelectronics. By synthesizing these insights, decision-makers can chart a course that leverages core strengths, mitigates emerging risks, and drives sustainable value creation in the mobility landscape.

Engage Directly with Ketan Rohom to Unlock Comprehensive Market Insights and Secure Tailored Research Support for Informed DecisionMaking and Growth Strategies

If you are poised to leverage the critical insights uncovered in this comprehensive analysis, Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the next steps. With an in-depth understanding of the automotive optoelectronics landscape, he can offer personalized support to align the findings with your strategic objectives. Engaging with Ketan ensures you receive bespoke recommendations tailored to your organization’s unique needs and market positioning.

To access the full market research report and unlock the detailed data that underpins these insights, reach out to Ketan Rohom. He will provide you with a seamless experience in procuring the report and can arrange a consultation to discuss how your team can translate the research into actionable growth strategies. Connect now to secure your copy and drive forward with confidence.

- How big is the Automotive Optoelectronics Market?

- What is the Automotive Optoelectronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?