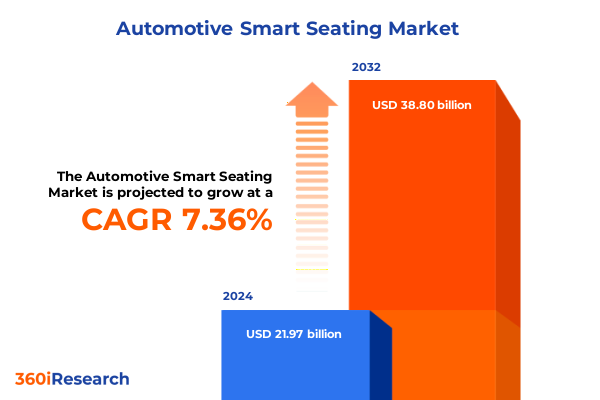

The Automotive Smart Seating Market size was estimated at USD 23.50 billion in 2025 and expected to reach USD 25.15 billion in 2026, at a CAGR of 7.42% to reach USD 38.80 billion by 2032.

Revolutionizing Vehicle Comfort with Next-Generation Smart Seating Solutions that Enhance Safety Personalization and Passenger Well-Being

The automotive landscape is undergoing a profound transformation driven by the convergence of electrification, connectivity, and human-centric design. Among these innovations, smart seating stands out as a pivotal technology that enhances safety, comfort, and user experience. As vehicles evolve into integrated digital platforms, the role of seating extends far beyond passive support to active sensing, predictive adaptation, and personalized interaction.

In recent years, consumer expectations have shifted dramatically. Drivers and passengers demand seating solutions that intuitively respond to their physical and cognitive needs, from fatigue detection to gesture-based adjustments. At the same time, regulatory pressures around occupant safety and health monitoring are intensifying, compelling automakers and suppliers to integrate advanced sensors, artificial intelligence, and seamless connectivity into seating systems. Consequently, the smart seating market has emerged as a strategic battleground where technology leaders and tier-one suppliers compete to deliver the most innovative, reliable, and cost-effective solutions.

This executive summary provides a comprehensive overview of the key trends, market dynamics, and actionable strategies shaping the automotive smart seating sector. Through in-depth analysis of transformative shifts, trade policy impacts, segmentation insights, and regional variances, this report equips stakeholders with the knowledge necessary to capitalize on emerging opportunities and mitigate potential challenges. Ultimately, this introduction sets the stage for a data-driven exploration of smart seating technologies that are redefining the future of mobility.

Unveiling the Breakthrough Shifts Driving Smart Seating Evolution through Connectivity Automation and Human-Centric Design in Modern Vehicle Interiors

The smart seating landscape is being reshaped by a series of technological and market-driven breakthroughs that are fundamentally redefining the in-cabin experience. Notably, the integration of high-fidelity haptics and advanced actuators, enabled by quieter electric powertrains, allows seats to continuously adjust posture and distribute pressure for optimal ergonomics, representing a departure from reactive designs toward proactive comfort management.

Furthermore, connectivity advancements such as 5G are enabling real-time communication between seating modules and centralized vehicle processors. This low-latency data exchange supports predictive safety interventions and adaptive climate control, allowing seats to modulate heating, cooling, and ventilation parameters based on live biometric feedback. In parallel, the rollout of Bluetooth and Wi-Fi protocols ensures seamless smartphone and cloud integration, empowering users to preconfigure seating preferences remotely and receive over-the-air updates.

In addition, a wave of human-machine interface innovations-spanning gesture recognition, voice control, and sensor-based monitoring-is creating more intuitive and distraction-minimized interactions. Voice-activated seat adjustments and hand-gesture driven memory presets are becoming mainstream features, enhancing usability and reducing driver cognitive load. Meanwhile, sensor arrays embedded within cushions and bolsters are tracking vital signs, posture, and fatigue indicators to deliver real-time driver assistance alerts and early warnings against drowsiness.

This confluence of connectivity, sensor intelligence, and AI-driven personalization underscores a shift toward modular, software-defined seating platforms. These platforms not only elevate occupant well-being and safety but also drive competitive differentiation for automakers seeking to deliver a compelling value proposition in an increasingly crowded market.

Exploring the 2025 Cumulative Impact of New U.S. Automotive Tariffs on Supply Chains Production Costs and Strategic Reshoring Efforts Across the Industry

In 2025, the U.S. government enacted sweeping tariffs that have significantly altered the economics of importing vehicles and components, including critical smart seating systems. On April 3, a 25 percent tariff took effect on all light-duty vehicles imported into the United States, followed by an identical levy on automotive parts beginning May 3. These measures, layered on existing duties, represent the most stringent trade policy adjustments the industry has faced in decades.

The introduction of these tariffs has put enormous pressure on global supply chains. Many Tier 1 seat suppliers report that they are absorbing incremental costs and working to recover unmitigated tariffs through contract renegotiations with OEMs. At the same time, components cross multiple jurisdictional borders during assembly, complicating compliance with tariff-exemption clauses linked to free-trade agreements such as USMCA. While parts compliant with USMCA rules are temporarily exempt, noncompliant items continue to incur full duties, driving localized production shifts and supplier diversification strategies.

As a result, automakers are reassessing global sourcing and reshoring critical seating component production to mitigate tariff exposure and maintain margin targets. Furthermore, rising input costs are increasing consumer vehicle prices and exerting downward pressure on sales volumes. Strategic responses have included expanding North American manufacturing footprints, qualifying new suppliers in low-tariff jurisdictions, and investing in automation to streamline assembly processes.

Ultimately, the cumulative impact of these 2025 tariffs extends far beyond immediate cost increases. The confluence of trade policy, supply chain reconfiguration, and regulatory complexity is reshaping how smart seating systems are engineered, sourced, and delivered, compelling industry participants to adopt agile strategies for sustained competitiveness.

Unlocking Critical Segmentation Insights for Automotive Smart Seating by Component Connectivity Technology Application and End User Perspectives

An in-depth segmentation lens reveals nuanced opportunities and challenges across the smart seating ecosystem. At the component level, cushions remain the primary interface with occupants, driving innovations in materials science and smart textiles for enhanced comfort and health monitoring, while electronic control units orchestrate data processing for adaptive features and seating systems integrate these elements into cohesive modules.

Connectivity segmentation underscores distinct requirements for 5G-enabled low-latency applications, Bluetooth-based device pairing, and Wi-Fi-enabled over-the-air updates. Each protocol addresses specific use cases-ranging from real-time biometric transmission to remote configuration-highlighting the need for versatile communication architectures.

Seating position further differentiates system design, as front seat solutions prioritize integrated safety functions and driver monitoring, whereas rear seat platforms focus on passenger comfort, entertainment integration, and flexible modularity. Technology segmentation illuminates how connected seating platforms leverage constant connectivity, gesture and voice control offer intuitive command interfaces, and sensor-based seating delivers proactive health and fatigue monitoring.

Application insights reveal that active monitoring encompasses both driver assistance alerts and continuous sensor-based surveillance, while impact protection leverages rapid-response bolstering mechanisms to mitigate crash forces. User interaction-focused applications emphasize haptic feedback and user-centric presets. Meanwhile, commercial and passenger vehicle types demand tailored solutions-from durability and maintenance considerations in fleet environments to luxury and personalization features in consumer automobiles.

End users span automotive OEMs driving platform integration, fleet operators prioritizing cost efficiency and compliance, individual consumers seeking personalized comfort and health features, and ride-sharing services focused on occupant safety and hygiene. Finally, distribution channels bifurcate into aftermarket solutions enabling retrofits and OEM channels delivering seamless factory integration, each with unique certification and support requirements.

This comprehensive research report categorizes the Automotive Smart Seating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Seating Position

- Technology

- Application

- Vehicle Type

- End User

- Distribution Channel

Illuminating Regional Variations Driving Adoption and Innovation in Automotive Smart Seating Across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics play a defining role in the adoption and innovation of smart seating technologies. In the Americas, North American stakeholders have accelerated investments in domestic production to navigate trade policy volatility, while U.S. and Canadian OEMs emphasize integration of wellness features and driver monitoring systems to meet stringent safety and health regulations.

In Europe, Middle East, and Africa, regulatory frameworks such as the EU’s General Safety Regulation are driving extensive deployment of occupant sensing and fatigue detection technologies. Manufacturers in Germany and France are pioneering integration of sustainable materials in smart seating, while Middle Eastern markets are focusing on luxury seating modules with advanced climate control suited to high-temperature environments.

Asia-Pacific continues to serve as both a production powerhouse and a high-growth consumer market. China’s leading automakers are embedding AI-driven personalization algorithms and in-seat biometric sensors to appeal to tech-savvy consumers, while Japanese suppliers are refining gesture and voice interfaces for mass-market applications. Emerging markets within Southeast Asia and India are gradually adopting smart seating features, driven by partnerships between local OEMs and global Tier 1 suppliers.

These regional variations underscore the importance of tailoring product roadmaps, certification strategies, and partnerships to local regulations, consumer expectations, and supply chain efficiencies. By aligning development priorities with regional imperatives, industry participants can unlock new growth corridors and ensure resilient market positioning.

This comprehensive research report examines key regions that drive the evolution of the Automotive Smart Seating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Strategic Landscape of Leading Smart Seating Innovators and Tier One Suppliers Shaping the Future of Connected Vehicle Interiors

The competitive landscape of automotive smart seating is shaped by a mix of legacy Tier 1 suppliers and emerging technology innovators. Adient and Lear Corporation remain at the forefront of seating architecture and modular systems, leveraging decades of OEM relationships and scale economies to integrate smart features seamlessly into production lines.

European leaders such as Faurecia and Continental AG are pioneering sensor fusion and haptic feedback solutions, backed by substantial R&D investments and partnerships with technology firms to accelerate AI-driven personalization. Likewise, Johnson Controls has introduced wellness-centric seating platforms that incorporate posture correction and stress-relief functionalities through closely monitored biometric data.

Emerging players, including Grammer and Brose, are capitalizing on niche expertise in lightweight structural components and advanced materials to offer differentiated seating solutions that cater to electric and autonomous vehicle architectures. Concurrently, Toyota Boshoku and Denso are strengthening their portfolios through strategic joint ventures and acquisitions, targeting deeper integration of smart seating within broader connected cabin ecosystems.

Across this diverse supplier ecosystem, key differentiators include the ability to deliver scalable software-defined platforms, robust cybersecurity measures, and responsive manufacturing footprints that can adapt to shifting trade policies. As competition intensifies, collaboration between OEMs, tech partners, and seat suppliers will become increasingly critical to drive innovation and maintain a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Smart Seating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient PLC

- Aisin Seiki Co., Ltd.

- Bostik SA

- Brose Fahrzeugteile GmbH & Co. KG

- Continental AG

- ESI Group

- Faurecia SE

- Gentherm Inc.

- Gentherm Incorporated

- GRAMMER AG

- Hyundai Motor Group

- Johnson Controls International PLC

- Lear Corporation

- Magna International Inc.

- Mitsubishi Electric Corporation

- Recaro Automotive GmbH

- TACHI-S Co.,Ltd.

- Tata Elxsi Ltd.

- Toyota Boshoku Corporation

- TS TECH Co., Ltd.

- Yanfeng International Automotive Technology Co., Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Smart Seating Innovations Enhance Competitiveness and Mitigate Supply Chain Disruptions

To capitalize on the smart seating revolution, industry leaders must prioritize flexible supply chain strategies that mitigate trade policy risks and ensure seamless access to critical components. This begins with diversifying supplier bases across low-tariff jurisdictions and strengthening localized manufacturing capabilities to reduce exposure to sudden tariff impositions.

Equally important is the acceleration of modular, software-driven seating platforms that can be updated over the air, enabling feature upgrades and safety enhancements post-deployment. By adopting agile software development practices and partnering with cloud service providers, automakers can deliver continuous improvements and maintain long-term customer engagement.

Moreover, investing in advanced data analytics and AI competencies will empower organizations to derive actionable insights from in-seat sensor data, driving personalized user experiences and predictive maintenance models. Cross-functional integration with vehicle cybersecurity frameworks is essential to safeguard sensitive biometric and connectivity data against evolving threats.

Finally, forming strategic alliances with HMI specialists, materials innovators, and regional certification bodies will streamline time-to-market and enhance compliance with diverse regulatory standards. By aligning R&D roadmaps with emerging regional requirements and consumer expectations, industry leaders can secure their position at the forefront of the automotive smart seating market.

Comprehensive Multi-Methodology Approach Highlighting Research Framework Data Sources and Analytical Techniques for Automotive Smart Seating Insights

This research leverages a comprehensive multi-methodology approach to ensure robust and reliable insights. Secondary data was collected from public filings, industry reports, and regulatory databases to establish foundational market intelligence. Primary research involved in-depth interviews with OEM executives, Tier 1 supplier R&D leads, and policy experts to capture forward-looking perspectives on technology adoption and trade policy impacts.

Data triangulation techniques were applied to validate findings, reconciled through comparative analysis of multiple data sources, and stress-tested against published case studies on tariff implementations and supply chain realignments. Qualitative insights from expert panels were quantified through scenario modeling and sensitivity analyses to assess the resilience of smart seating value chains under varying regulatory and economic conditions.

Analytical frameworks, including SWOT and Porter’s Five Forces, were adapted to the smart seating context, enabling a structured examination of competitive dynamics, technological enablers, and strategic imperatives. Finally, the research findings were peer-reviewed by independent industry advisors to ensure accuracy, objectivity, and practical relevance for decision-makers across the automotive value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Smart Seating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Smart Seating Market, by Component

- Automotive Smart Seating Market, by Connectivity

- Automotive Smart Seating Market, by Seating Position

- Automotive Smart Seating Market, by Technology

- Automotive Smart Seating Market, by Application

- Automotive Smart Seating Market, by Vehicle Type

- Automotive Smart Seating Market, by End User

- Automotive Smart Seating Market, by Distribution Channel

- Automotive Smart Seating Market, by Region

- Automotive Smart Seating Market, by Group

- Automotive Smart Seating Market, by Country

- United States Automotive Smart Seating Market

- China Automotive Smart Seating Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Concluding Insights on the Transformative Impact and Future Trajectory of Smart Seating Technologies Within the Evolving Automotive Ecosystem

Through this executive summary, we have explored the transformative shifts, regulatory headwinds, segmentation nuances, and regional distinctions that define the automotive smart seating landscape. From pioneering sensor-based health monitoring to the integration of AI-driven personalization, smart seating stands as a core differentiator in next-generation vehicle cabins. Furthermore, the cumulative impact of 2025 U.S. tariffs underscores the need for agile supply chain strategies and localized manufacturing investments.

Key takeaways emphasize the importance of modular architectures that support over-the-air feature enhancements, robust cybersecurity measures for in-seat connectivity, and strategic partnerships that align with regional market imperatives. As technology continues to evolve, stakeholders who invest in scalable software platforms and leverage advanced analytics will be best positioned to deliver compelling value propositions and secure long-term growth.

In conclusion, the automotive smart seating domain offers rich opportunities for innovation and market disruption. By adhering to data-driven strategies, fostering cross-industry collaborations, and proactively addressing trade policy challenges, industry participants can unlock new pathways to competitive advantage and shape the future of mobility.

Secure Your Competitive Edge Today by Accessing the In-Depth Automotive Smart Seating Report with Ketan Rohom to Drive Strategic Decision Making

Are you ready to stay ahead in the rapidly evolving world of automotive smart seating? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive report that delivers deep insights and strategic intelligence across components, connectivity, technology, and regional dynamics.

Connect with Ketan to discuss how this research can empower your organization to make data-driven decisions, optimize product roadmaps, and navigate trade and regulatory challenges with confidence. Secure exclusive access to expert analysis, actionable recommendations, and market segmentation insights tailored to your strategic objectives.

- How big is the Automotive Smart Seating Market?

- What is the Automotive Smart Seating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?