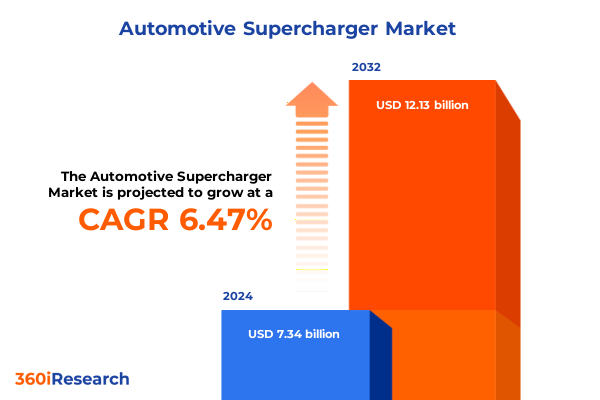

The Automotive Supercharger Market size was estimated at USD 7.69 billion in 2025 and expected to reach USD 8.06 billion in 2026, at a CAGR of 6.71% to reach USD 12.13 billion by 2032.

Unlocking the Potential of Forced Induction: How Superchargers Are Defining the Next Era of Automotive Power, Efficiency, and Innovation

The automotive supercharger has emerged as a cornerstone of modern engine enhancement, offering a unique blend of instantaneous throttle response and sustained power delivery. By mechanically forcing additional air into the combustion chamber, superchargers bypass the lag associated with turbochargers and drive performance gains across a broad RPM range. This immediate boost not only caters to enthusiast driving demands but also aligns with OEM objectives of engine downsizing without sacrificing output, making superchargers an integral component of next-generation powertrains.

Beyond pure performance, superchargers contribute to efficiency improvements by enabling smaller displacement engines to match the torque characteristics of larger units. As regulatory bodies worldwide enforce stricter emissions and fuel economy mandates, forced induction technologies like superchargers are gaining prominence as a compliance enabler. Automakers are leveraging advanced designs, such as variable-geometry and electrically assisted superchargers, to achieve precise boost control and minimal parasitic losses even under rigorous driving cycles.

The engineering ecosystem surrounding superchargers spans design validation, material science, and system integration. Manufacturers collaborate with specialist suppliers to optimize compressor housing geometry, rotor coatings, and thermal management systems. Concurrently, software firms develop digital interfaces for real-time boost calibration and predictive maintenance, further solidifying the supercharger’s role as both a hardware and software innovation platform within automotive powertrain strategies.

Redefining Performance Dynamics: Transformative Technological Shifts Catalyzing the Evolution of Automotive Supercharging Solutions for Modern Vehicles

The landscape of automotive supercharging is undergoing a transformative shift driven by evolving powertrain architectures. Electrification has introduced electric superchargers-systems that utilize dedicated electric motors to drive compression independently of engine speed. These e-boosters eliminate traditional lag, delivering instantaneous torque for hybrid and mild-hybrid applications. As automakers intensify their electrification roadmaps, electric superchargers are being positioned as complementary components to turbochargers, enhancing low-end performance while optimizing overall system efficiency.

In parallel, digital integration is reshaping how superchargers are engineered and controlled. Advanced engine management software now orchestrates variable boost pressure in real time, ensuring dynamic response to driver input and operating conditions. Virtual calibration tools, including online configurators and predictive analytics, enable engineers to fine-tune compressor maps long before the first prototype is built. These digital ecosystems not only accelerate development cycles but also empower aftermarket tuners to offer tailored performance packages via subscription-based calibration services.

Material innovations are also catalyzing the next generation of superchargers. Manufacturers are adopting high-strength aluminum alloys and carbon fiber composites to reduce weight and improve heat resistance. These lightweight materials lower the parasitic drag on the engine and support higher rotational speeds without sacrificing durability. Furthermore, collaborative R&D partnerships between automakers and technology firms are fostering integrated cooling solutions that maintain thermal stability during extended high-load operation, ensuring reliability in both performance and commercial vehicle segments.

Assessing the Comprehensive Ripple Effects of 2025 U.S. Tariffs on Imported Vehicles and Components in the Automotive Supercharger Ecosystem

The imposition of 25% tariffs on imported passenger vehicles and light trucks, followed by identical levies on engines, transmissions, and powertrain components, has introduced a new cost layer for supercharger systems and their integration. Effective April 2, 2025, the blanket tariff on finished vehicles was supplemented by a May 3, 2025 implementation on key components-a staged rollout that has disrupted procurement strategies across OEMs and tier-one suppliers. The United States-Mexico-Canada Agreement (USMCA) offers limited respite for parts with verified domestic content, but non-US-sourced components now face significant added duties.

Original equipment manufacturers are absorbing a substantial portion of these incremental costs. General Motors disclosed a $1.1 billion operating income hit in Q2 2025 directly attributable to tariffs on imported vehicles and parts. Mitigation efforts, including relocating production and requalifying supply chains, are underway but remain in nascent stages. The shift toward near-shore sourcing aims to restore margins over the medium term, yet it requires capital investment and operational realignment that compound short-term financial pressures.

Beyond OEM balance sheets, the tariffs have reverberated through the aftermarket and service sectors. Consumers experienced immediate price increases as dealership inventories thinned and repair shops faced 25% higher import costs for collision repair and performance parts. Prolonged lead times for critical components have amplified downtime concerns, driving a recalibration of inventory strategies and prompting service providers to negotiate alternative domestic suppliers. The cumulative impact across the supercharger ecosystem underscores the tariff policy’s far-reaching implications on cost structures, supply resilience, and end-user pricing.

Dissecting Market Segmentation: Deep Insights into Technology, Application, Engine, and Vehicle Type Trends Shaping Global Supercharger Adoption Patterns

A nuanced segmentation analysis reveals that technology type continues to shape the competitive dynamics. Centrifugal superchargers dominate in performance passenger cars due to their lightweight architecture and high efficiency at elevated RPMs, making them a preferred choice for OEMs focused on power-density and ease of installation; twin-screw systems, prized for their superior low-end torque and smoother boost curve, are increasingly targeted at luxury and sports models seeking seamless drivability, while roots superchargers maintain niche applications in muscle and commercial vehicles where instantaneous torque delivery at low engine speeds is paramount.

Applications bifurcate between original equipment and aftermarket channels. Within OEM integration, supercharger packages are co-developed to meet stringent emissions and NVH (noise, vibration, harshness) requirements, leveraging modular platforms to expedite launch. Conversely, the aftermarket segment benefits from offline retail dominance fueled by performance enthusiast communities, although online retail is rapidly gaining traction by offering direct-to-consumer kits and digital tuning services that democratize access to advanced forced induction solutions.

Engine type further delineates market behavior: gasoline applications account for the bulk of supercharger adoption in passenger vehicles, driven by the widespread use of turbocharged four-cylinder engines that benefit from additional boost; diesel powertrains, prevalent in heavy-duty commercial vehicles, utilize superchargers to offset turbo lag under high load conditions, reinforcing reliability in long-haul and vocational use cases. Vehicle type segmentation underscores divergent growth patterns: passenger cars underscore brand prestige and performance, while commercial vehicles demand durability and torque consistency, reflecting the distinct operational priorities across fleets and individual owners.

This comprehensive research report categorizes the Automotive Supercharger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Engine Type

- Vehicle Type

- Application

Regional Dynamics Revealed: A Strategic Deep Dive into Americas, EMEA, and Asia-Pacific Market Drivers Shaping the Future of Automotive Superchargers

The Americas region features a dynamic landscape where engine downsizing initiatives coexist with a thriving aftermarket culture. North America has emerged as a hub for performance tuning, spurred by strong consumer interest in personalization and high-performance SUVs and trucks. Government incentives for domestic manufacturing, coupled with robust OEM investments in R&D facilities, underpin a favorable environment for both OEM supercharger partnerships and aftermarket kit suppliers. Rapid adoption in motorsport applications further cements the region’s role as an innovation testbed.

In Europe, the Middle East & Africa, stringent CO₂ and NOₓ emissions regulations have accelerated the integration of forced induction across mainstream vehicle lineups to enable engine downsizing without compromising performance. Premium automakers have led this charge, incorporating electric superchargers in hybrid models to comply with revised European Commission targets. Established motorsport heritage and advanced engineering clusters in Germany, Italy, and the UK continue to drive collaborative R&D, positioning the region as a leader in thermal management and digital control solutions for superchargers.

Asia-Pacific presents the fastest-growing market, propelled by rising disposable incomes, emerging middle-class demand for performance and luxury vehicles, and rapid industrialization. China dominates production volumes, investing heavily in advanced manufacturing capabilities for twin-screw and electric superchargers. Japan’s legacy in precision engineering enhances quality benchmarks, while India’s aftermarket scene is gaining momentum as enthusiasts embrace customization. The cumulative effect of these factors establishes the region as a critical growth frontier with significant aftermarket and OEM opportunities.

This comprehensive research report examines key regions that drive the evolution of the Automotive Supercharger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Uncovered: Profiling Leading Innovators and Strategic Players Driving Innovation in the Automotive Supercharger Sector

Industry leaders are driving continuous innovation through differentiated product portfolios and strategic alliances. Eaton remains at the forefront with its robust roots and twin-screw supercharger offerings, leveraging decades of expertise in rotor design and material sciences. BorgWarner’s eBooster® electric supercharger has set a new benchmark for hybrid boost systems, illustrating the company’s pivot toward electrified forced induction solutions. Mitsuba and IHI have strengthened their competitive positions by focusing on compact, high-efficiency centrifugal units optimized for emerging global engine platforms. Friedrichshafen-based Federal-Mogul and embedded systems specialist Honeywell have formed joint ventures to integrate advanced thermal management and digital control modules, underscoring the growing intersection of mechanics and software in supercharger design.

Furthermore, aftermarket specialists such as Vortech and ProCharger continue to expand their reach through performance-tuning partnerships and global distribution networks. They are capitalizing on the expanding online retail channel to deliver turnkey boost solutions tailored to a wide spectrum of vehicles. Simultaneously, start-ups and tier-two suppliers are emerging with novel composite materials and patented rotor geometries, intensifying competition and accelerating cycle times for new product introductions.

Strategic collaborations between OEMs and pure-play technology providers are also becoming more prevalent. These alliances focus on co-development of modular supercharger platforms that can be seamlessly integrated across multiple engine families, reducing engineering complexity and driving economies of scale. As competition intensifies, leading players are differentiating through after-sales service, digital calibration ecosystems, and subscription-based performance updates, transforming the supercharger from a standalone hardware component into a holistic performance solution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Supercharger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accessible Technologies, Inc.

- Aeristech Ltd

- BORGWARNER INC.

- EATON CORPORATION PLC

- Edelbrock Group

- EDELBROCK LLC

- HARROP ENGINEERING PTY LTD

- INDUCTION SOLUTIONS, INC.

- Magnuson Products LLC

- PAXTON AUTOMOTIVE LIMITED

- PRECISION TURBO & ENGINE, LLC

- ROTREX GMBH

- SSR PERFORMANCE, LLC

- WHIPPLE SUPERCHARGERS, INC.

Strategic Imperatives for Industry Leaders: Actionable Recommendations to Navigate Opportunities and Challenges in the Supercharger Market

To navigate the evolving supercharger market, industry leaders should prioritize diversification of their supply chain to mitigate the financial impact of tariffs and trade policy shifts. Establishing dual-sourcing strategies and bolstering near-shore manufacturing capabilities will reinforce supply resilience while enabling competitive cost structures. Concurrently, firms must accelerate integration of electric superchargers and hybrid-specific boost systems to align with broader electrification mandates and unlock new hybrid performance segments.

Investing in advanced materials research and digital calibration platforms can yield significant differentiation. By leveraging lightweight composite housings, low-friction coatings, and integrated intercooling underpinnings, manufacturers can push the boundaries of compressor speed and efficiency without compromising durability. Complementary software tools that enable real-time boost optimization and predictive maintenance will enhance customer loyalty and open recurring revenue channels through subscription-based service offerings.

Collaboration remains a vital lever for innovation and market expansion. Forming cross-industry partnerships with software providers, academic institutions, and component specialists can accelerate R&D timelines and share the risk of new technology adoption. Targeted engagement with regulatory bodies will also ensure that emerging forced induction solutions remain compliant with evolving emissions and noise standards across key regions.

Finally, a calibrated go-to-market approach that addresses both OEM and aftermarket channels is essential. Tailoring product development roadmaps to the specific needs of performance brands, commercial fleets, and enthusiast tuners-while harnessing digital marketing and virtual configurators-will enable precise value communication and maximize market penetration.

Ensuring Rigor and Credibility: A Transparent Overview of the Research Methodology Underpinning Our Automotive Supercharger Analysis

This research combines primary and secondary methodologies to deliver a comprehensive analysis of the automotive supercharger landscape. In the primary phase, in-depth interviews were conducted with senior executives, powertrain engineers, and aftermarket experts to capture firsthand insights on technology roadmaps, supply chain challenges, and regulatory compliance strategies. These qualitative perspectives were supplemented by a structured survey targeting global OEMs, tier-one suppliers, and specialist supercharger manufacturers to quantify adoption trends and investment priorities.

Secondary research encompassed an exhaustive review of company books, patent filings, technical white papers, industry conferences, and public policy documents. Data from trade associations, customs agencies, and regulatory bodies informed the tariff impact assessment, while digital platform analytics provided visibility into online aftermarket demand patterns. Rigorous data triangulation ensured that divergent viewpoints were reconciled, leading to validated projections and actionable insights.

Market segmentation was developed using a multi-layered approach, analyzing technology type, application channel, engine architecture, and vehicle category. Regional analysis was structured to reflect demand-side drivers, regulatory frameworks, and competitive density across the Americas, EMEA, and Asia-Pacific. Competitive benchmarking evaluated over 50 companies based on product portfolio, innovation pipeline, strategic partnerships, and go-to-market proficiency.

Quality control measures included peer reviews by senior analysts, cross-validation of interview findings, and consistency checks between quantitative data and qualitative narratives. This methodology ensures that decision-makers have access to reliable, up-to-date intelligence on the global automotive supercharger market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Supercharger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Supercharger Market, by Type

- Automotive Supercharger Market, by Engine Type

- Automotive Supercharger Market, by Vehicle Type

- Automotive Supercharger Market, by Application

- Automotive Supercharger Market, by Region

- Automotive Supercharger Market, by Group

- Automotive Supercharger Market, by Country

- United States Automotive Supercharger Market

- China Automotive Supercharger Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Market Insights: Concluding Reflections on the Future Trajectory of Automotive Supercharger Technologies and Strategies

The automotive supercharger market stands at the intersection of performance demand and regulatory imperatives, poised for both opportunity and disruption. While traditional mechanical designs continue to serve high-performance and commercial applications, emerging electric supercharger technologies signal a paradigm shift that marries instantaneous boost with electrified powertrains. As manufacturers navigate the complexities of materials innovation, digital control, and supply chain realignment, the ability to adapt will distinguish leaders from laggards.

Trade policies and tariffs have injected short-term cost volatility, compelling stakeholders to reevaluate sourcing strategies and diversify production footprints. Simultaneously, evolving emissions standards and consumer expectations for efficiency necessitate ongoing R&D investment in thermal management and variable boost architectures. Regional dynamics underscore the importance of localized strategies, as opportunities in mature markets differ markedly from the rapid growth potential in Asia-Pacific.

Ultimately, success in this market will hinge on strategic agility, technological foresight, and collaborative execution. Companies that embrace modular product platforms, digital calibration ecosystems, and resilient supply networks are best positioned to capture value across OEM and aftermarket channels. The ongoing fusion of mechanical expertise and software intelligence will redefine what supercharging means for the next generation of vehicles, cementing its role as a critical enabler of automotive performance and efficiency.

Engage with Ketan Rohom to Elevate Your Competitive Edge: Secure the Definitive Automotive Supercharger Market Research Report for Strategic Advantage Today

To delve deeper into the automotive supercharger market and secure the insights you need to stay ahead of the competition, reach out today. Ketan Rohom, Associate Director, Sales & Marketing, is ready to guide you through the extensive research findings, answer your questions, and tailor the report to your strategic priorities. Don’t miss this opportunity to gain unparalleled intelligence on technology adoption, tariff impacts, segmentation dynamics, regional opportunities, and leading players. Contact Ketan to discuss pricing, licensing options, or custom add-ons and ensure your organization is equipped with the definitive resource on automotive superchargers. Take the first step toward data-driven decision-making and sustained market leadership by securing your copy now.

- How big is the Automotive Supercharger Market?

- What is the Automotive Supercharger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?