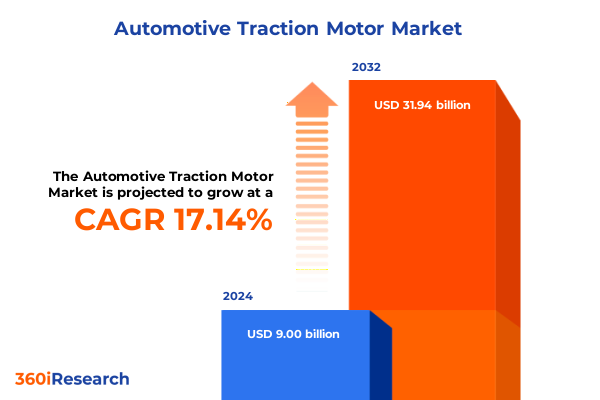

The Automotive Traction Motor Market size was estimated at USD 10.54 billion in 2025 and expected to reach USD 12.33 billion in 2026, at a CAGR of 17.16% to reach USD 31.94 billion by 2032.

Pioneering the Dawn of Electrified Propulsion: An Overview of the Advancements and Market Dynamics Shaping Automotive Traction Motors

Electrification has ushered in a profound transformation across the automotive sector, elevating the importance of traction motors as the cornerstone of next-generation propulsion systems. These electric drive units, which convert electrical energy into mechanical torque to propel vehicles, are now at the center of intense innovation driven by demands for higher efficiency, lighter weight, and greater power density. Against a backdrop of stringent global emissions regulations and evolving consumer preferences for cleaner mobility, traction motors have become indispensable technology components that determine an electric vehicle’s (EV’s) performance, range, and overall cost competitiveness.

The interplay of advanced materials research, digital control strategies, and manufacturing process optimization continues to push the boundaries of traction motor capabilities. Recent breakthroughs in permanent magnet materials and novel cooling solutions have enabled higher torque outputs while minimizing thermal losses, paving the way for more compact motor designs that support diverse vehicle segments, from urban passenger cars to heavy-duty commercial trucks. As such, market stakeholders must track both incremental enhancements and disruptive innovations that redefine how traction motors are engineered, produced, and integrated into vehicle architectures.

This executive summary sets the stage for a comprehensive exploration of the automotive traction motor landscape. It outlines transformative industry shifts, examines the cumulative impact of evolving tariff policies, and provides strategic insights into market segmentation, regional dynamics, and competitive positioning. Together, these chapters offer a clear lens into the forces shaping traction motor development and adoption, equipping decision-makers with the context needed to navigate this period of rapid technology evolution and shifting market demands.

Unveiling the Disruptive Shifts Driving Automotive Traction Motor Evolution Through Materials Innovation, Digital Integration, and Manufacturing Breakthroughs

The adoption of automotive traction motors has advanced beyond mere electrification, emerging as a catalyst for broader shifts in mobility paradigms. Materials innovation, such as the development of higher-performance rare earth permanent magnets and low-loss electrical steels, has elevated motor efficiency benchmarks, enabling lighter and more compact designs that extend vehicle range and responsiveness. Concurrently, digital integration through model-predictive control algorithms and real-time thermal management has allowed manufacturers to fine-tune torque delivery and cooling strategies, thereby enhancing performance while mitigating energy losses.

In parallel, manufacturing processes have undergone a revolution driven by automation, additive manufacturing, and Industry 4.0 connectivity. Robotic winding and modular assembly lines now facilitate rapid scaling of motor production with consistent quality, reducing time-to-market and enabling manufacturers to adapt quickly to changing power rating and cooling method requirements. The shift toward localized production hubs, paired with advanced analytics to optimize supply chain resilience, marks a departure from the traditional centralized, high-volume production model.

Together, these developments are redefining the competitive dynamics within the traction motor ecosystem. Legacy suppliers are forging partnerships with semiconductor and software specialists, while new entrants leverage nimble, data-driven approaches to introduce differentiated motor topologies at competitive cost structures. This convergence of materials science, digital intelligence, and agile manufacturing underscores the transformative shifts that are accelerating the evolution of automotive traction motors across the global mobility landscape.

Assessing the Total Cumulative Effects of United States 2025 Tariff Measures on Automotive Traction Motor Supply Chains Costs and Competitive Position

Since the imposition of new tariff measures by the United States in early 2025, automotive traction motor supply chains have faced a complex array of cost pressures and sourcing challenges. These cumulative duties, levied on imported electric drivetrain components from certain regions, have increased landed costs and compelled original equipment manufacturers and tier-one suppliers to reassess their procurement strategies. Components such as high-grade magnetic materials, power electronics modules, and motor housings have been subject to additional duties, heightening the financial burden on manufacturers reliant on cross-border trade flows.

This tariff environment has prompted several strategic responses across the industry. Some manufacturers have accelerated the establishment of domestic production facilities for critical motor components, investing in localized magnet production and coil winding operations to mitigate import levies. Others have diversified their sourcing footprints by forging partnerships in tariff-exempt markets, thereby balancing cost and regulatory compliance. In parallel, supply chain executives are negotiating long-term contracts with material suppliers to lock in favorable pricing ahead of potential tariff escalations, while also exploring alternative material formulations that circumvent impacted product classifications.

The net effect of these cumulative tariff measures extends beyond immediate cost increases. Manufacturers are recalibrating their total cost of ownership models, leading to adjustments in vehicle price points and, in some cases, the strategic reprioritization of power rating segments that deliver optimal margin performance under the new duty regime. As the regulatory landscape continues to evolve, industry players must remain agile, leveraging scenario analysis and proactive supply chain redesign to sustain competitiveness in an increasingly protectionist trade environment.

Deep Dive into Automotive Traction Motor Market Stratification: Insights into Motor Types Power Ratings Vehicle Types Speed Ranges Cooling Methods and Applications

Analyzing the automotive traction motor landscape through multiple segmentation lenses reveals nuanced performance and adoption patterns. Motor topologies range from conventional induction motors to more advanced synchronous machines, especially permanent magnet synchronous motors, which are further divided into interior permanent magnet and surface mount permanent magnet variants. Each configuration presents distinct tradeoffs in torque density, efficiency, and material costs, influencing manufacturer preferences and application suitability.

Power rating segmentation further clarifies market dynamics, with sub-50 kilowatt units typically deployed in smaller passenger cars and urban mobility platforms, mid-range motors spanning 51 to 100 kilowatts serving crossover and compact SUV segments, and high-power systems exceeding 100 kilowatts reserved for performance vehicles and heavy-duty commercial applications. Within vehicle type categories, battery electric vehicles lead demand for high-efficiency motor designs, while fuel cell electric vehicles, hybrid electric drivetrains, and plug-in hybrids each necessitate tailored motor control architectures to address distinct operational profiles and energy management requirements.

Speed range also influences motor design choices, as low-speed systems optimized for stop-and-go urban transit contrast with high-speed motors engineered for sustained highway performance. Cooling methods further stratify the market, as air-cooled designs offer simplicity and cost advantages, whereas liquid-cooled systems deliver superior thermal management crucial for high-power and heavy-duty applications. Finally, vehicle application segmentation distinguishes between passenger cars and commercial vehicles, the latter of which splits into heavy and light commercial categories with specific duty cycle, durability, and integration demands. Taken together, these segmentation insights form the foundation for strategic positioning and product portfolio optimization in the evolving traction motor ecosystem.

This comprehensive research report categorizes the Automotive Traction Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Power Rating

- Vehicle Type

- Speed Range

- Cooling Method

- Vehicle Application

Decoding Regional Dynamics in Automotive Traction Motor Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional market dynamics in automotive traction motors reflect diverse policy environments, infrastructure readiness, and industry capabilities across major geographies. In the Americas, policy incentives and infrastructure investments have galvanized battery electric vehicle adoption, driving demand for high-efficiency motor topologies. Domestic manufacturers are scaling production through partnerships and greenfield facilities to capitalize on reshoring trends and leverage local supply chains, especially in states with robust EV incentive frameworks.

In Europe, Middle East, and Africa, regulatory mandates on emissions and ambitious decarbonization targets have spurred innovation in traction motor designs. Premium automotive brands and commercial vehicle producers alike focus on permanent magnet synchronous motors with cutting-edge cooling methods to meet stringent performance criteria. Regional collaborative initiatives are also advancing joint research on next-generation magnetic materials, while North African and Middle Eastern markets emerge as growing hubs for component assembly and distribution serving Europe’s electrification drive.

Across Asia-Pacific, the traction motor landscape is characterized by rapid industrial scaling, particularly in China, Japan, and South Korea. OEMs and suppliers leverage deep expertise in rare earth magnet production and high-volume motor assembly, driving down unit costs and accelerating technology deployment. Southeast Asian economies are establishing new manufacturing corridors to support export-oriented EV production, whereas India’s market is poised for growth through localized motor manufacturing supported by government “Make in India” initiatives. This regional diversity underscores the importance of tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Traction Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Stakeholders in the Automotive Traction Motor Space: Competitive Strategies Collaborative Partnerships and Technology Differentiators

The competitive landscape of automotive traction motors is shaped by established powertrain incumbents, specialized motor manufacturers, and ambitious new entrants aiming to disrupt traditional value chains. Legacy automotive suppliers leverage decades of electric drivetrain experience to integrate traction motors with inverters and control electronics, emphasizing system-level efficiency and reliability. Meanwhile, pure-play motor companies focus on innovations in magnetic material formulations and advanced winding techniques to achieve incremental performance gains that resonate with OEM requirements.

A number of leading firms are investing heavily in research collaborations with universities and technology partners to pioneer next-generation motor topologies, including switched reluctance machines that promise lower rare earth dependencies and reduced cost structures. Strategic alliances between motor suppliers and semiconductor designers have also emerged, driven by the critical role of power electronics in optimizing motor control. These partnerships aim to co-develop integrated motor-inverter units that simplify assembly, improve thermal performance, and enhance vehicle energy efficiency.

New market entrants, benefiting from lean startup methodologies and digital native capabilities, are targeting disruptive cooling technologies and data-driven predictive maintenance services to differentiate their offerings. Through direct-to-automaker engagements and selective pilot programs, they are showcasing modular motor designs that can be rapidly customized across power rating and vehicle application requirements. This blend of legacy expertise, material science innovation, and agile market entry strategies defines the current competitive dynamics within the traction motor ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Traction Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Tesla, Inc.

- Valeo SA

- ZF Friedrichshafen AG

Strategic Imperatives for Industry Leaders to Navigate Market Disruption Capitalize on Emerging Technologies and Secure Sustainable Competitive Advantage

Industry leaders must adopt a multifaceted approach to maintain momentum in the rapidly evolving traction motor market. First, cultivating strategic partnerships across the value chain, from magnetic material suppliers to power electronics firms, will accelerate integrated solution development and yield efficiency gains. By co-investing in joint R&D initiatives and pilot programs, organizations can reduce time-to-market for next-gen motor architectures and secure proprietary technology advantages.

Second, companies should prioritize supply chain resilience by expanding localized manufacturing capabilities and diversifying sourcing networks. Securing alternative material formulas and establishing contingency agreements with multiple suppliers will mitigate risks associated with tariff fluctuations and geopolitical tensions. A proactive stance on regulatory engagement and scenario planning will further enable swift adaptation to evolving trade policies and ensure consistent component availability.

Finally, embedding digital intelligence throughout the motor lifecycle-from design simulations to real-time performance analytics-will unlock new operational efficiencies and service revenue streams. Leveraging predictive maintenance platforms, remote diagnostics, and data-driven optimization can extend motor lifespan, reduce warranty costs, and create differentiated value propositions. By executing these strategic imperatives, industry leaders can navigate market disruptions, harness emerging technologies, and secure sustainable competitive advantage in the global traction motor arena.

Robust Methodological Blueprint Underpinning the Automotive Traction Motor Market Study Through Comprehensive Primary and Secondary Data Triangulation

This study employed a rigorous research framework combining comprehensive secondary research, primary interviews, and data triangulation to ensure the validity and reliability of findings. The initial phase involved extensive review of academic journals, patent filings, regulatory filings, and public company disclosures to establish an evidence-based understanding of technological advancements and policy developments influencing traction motor markets.

In the primary research phase, in-depth interviews were conducted with sector specialists, including powertrain engineers, supply chain executives, and policy analysts. These discussions provided qualitative insights into manufacturing challenges, segment-specific performance requirements, and regional market entry considerations. Insights gleaned from these expert interactions were cross-validated against quantitative data collected from proprietary industry databases and publicly available trade statistics.

A structured data triangulation process was then applied, aligning qualitative insights with numerical trends to identify consistent patterns and anomalies. This approach facilitated the refinement of segmentation frameworks and the development of scenario-based analyses for tariff impacts and regional adoption trajectories. Throughout the methodology, strict adherence to data integrity protocols and peer-review processes ensured that the study’s conclusions reflect a balanced, objective perspective on the automotive traction motor landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Traction Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Traction Motor Market, by Motor Type

- Automotive Traction Motor Market, by Power Rating

- Automotive Traction Motor Market, by Vehicle Type

- Automotive Traction Motor Market, by Speed Range

- Automotive Traction Motor Market, by Cooling Method

- Automotive Traction Motor Market, by Vehicle Application

- Automotive Traction Motor Market, by Region

- Automotive Traction Motor Market, by Group

- Automotive Traction Motor Market, by Country

- United States Automotive Traction Motor Market

- China Automotive Traction Motor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Future Trajectories in Automotive Traction Motor Innovation Adoption and Market Maturation for Informed Decision Making

Drawing together the core insights from this study, it is evident that automotive traction motors stand at the intersection of material science breakthroughs, digital control advancements, and evolving trade landscapes. The diversity of motor topologies-from induction to switched reluctance-combined with power rating, vehicle application, speed, and cooling method considerations underscores the complexity of supplier and OEM decision-making.

Regional variations in policy drivers and manufacturing capabilities highlight the necessity for adaptive, region-specific strategies, while the cumulative impact of 2025 tariff measures emphasizes the urgency of supply chain resilience and localization. Competitive dynamics are shaped by legacy incumbents, specialist motor firms, and agile new entrants, each contributing to a vibrant ecosystem of technological experimentation and strategic collaboration.

Looking ahead, stakeholders that effectively integrate cross-functional partnerships, diversify sourcing, and embed digital intelligence throughout the motor lifecycle will be best positioned to capitalize on ongoing shifts in consumer demand and regulatory landscapes. By leveraging the analytical frameworks and industry narratives presented in this study, decision-makers can chart informed paths forward, aligning product development, supply chain design, and commercial strategies to the emerging contours of electrified mobility.

Engage with Associate Director Ketan Rohom for Exclusive Insights and Customized Automotive Traction Motor Research Solutions Tailored to Your Strategic Objectives

Discover how partnering with Ketan Rohom can transform your organization’s approach to electrified propulsion studies by offering tailored research solutions that address the nuanced demands of today’s rapidly evolving automotive landscape. Ketan Rohom, Associate Director of Sales & Marketing, specializes in translating complex traction motor market dynamics into clear strategic guidance. He will work closely with your team to deliver custom insights on segment performance, regional trends, tariff impacts, and competitive benchmarking, ensuring your investment yields maximum actionable intelligence.

By engaging directly with Ketan, you gain access to a wealth of industry expertise, proprietary data collection methodologies, and strategic foresight that can inform product development roadmaps, partnership models, and go-to-market approaches. His consultative engagement style ensures that each research deliverable is aligned with your organization’s priorities, whether that involves deep dives into induction versus permanent magnet synchronous motor performance metrics, granular power rating demand shifts, or advanced cooling method implementation across vehicle applications.

Secure your market-leading advantage and unlock a comprehensive understanding of the automotive traction motor ecosystem by contacting Ketan Rohom today. Elevate your strategic decision-making with bespoke reports that distill key segmentation insights, regional opportunities, tariff strategy implications, and competitive landscapes into an integrated, actionable framework. Reach out now to acquire the definitive market research on automotive traction motors that your stakeholders demand.

- How big is the Automotive Traction Motor Market?

- What is the Automotive Traction Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?