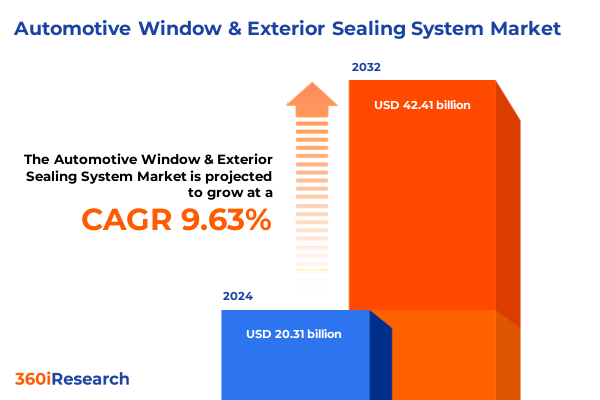

The Automotive Window & Exterior Sealing System Market size was estimated at USD 21.57 billion in 2025 and expected to reach USD 22.91 billion in 2026, at a CAGR of 10.13% to reach USD 42.41 billion by 2032.

Pioneering Advances in Automotive Window and Exterior Sealing Solutions Shaping the Future of Vehicle Performance and Durability

The world of automotive window and exterior sealing systems has evolved dramatically over recent decades, reflecting broader shifts in vehicle design, consumer expectations, and regulatory imperatives. As automobiles have become more sophisticated and modular, sealing systems that ensure weatherproofing, noise reduction, and structural integrity have moved from mere functional components to critical enablers of performance and passenger comfort. Beyond preventing water ingress, modern seals help optimize cabin acoustics, improve aerodynamic efficiency, and contribute to weight reduction targets. Innovations in materials, extrusion processes, and bonding technologies have expanded the boundaries of what these systems can achieve, laying the groundwork for a new generation of high-performance sealing solutions.

Against this backdrop, stakeholders across the automotive value chain-from original equipment manufacturers and tier suppliers to aftermarket distributors-are compelled to reassess seals not just as cost centers but as strategic assets. Demand for electric and autonomous vehicles is pressuring traditional suppliers to develop seals optimized for quieter cabins and reduced maintenance. At the same time, environmental regulations are driving interest in recyclable elastomers and manufacturing processes with lower carbon footprints. Coupled with global supply chain disruptions and evolving distribution models, these factors are reshaping priorities for innovation, procurement, and go-to-market strategies. This report offers a foundational perspective on the forces at play, setting the stage for an in-depth exploration of transformative trends, policy impacts, and granular market segmentation that inform decision-making at every level.

Driving Transformation Through Electrification Sustainability and Next Generation Technologies in Automotive Sealing Systems Across Global Markets

The automotive landscape is undergoing a profound metamorphosis as electrification, connectivity, and sustainability converge to redefine vehicle architectures and component requirements. Electrified powertrains eliminate traditional engine noise, making cabin solidness and acoustic management paramount; sealing system developers are responding with advanced elastomer blends that offer superior sound insulation and minimal compression set. Meanwhile, increased use of lightweight composites and aluminum structures demands seals with enhanced adaptability and bonding performance. In parallel, digital innovations such as in-line sensor-driven quality control and 3D printing of complex profiles are reducing defects and accelerating time to market, opening avenues for bespoke sealing geometries that were previously unattainable.

Regulatory dynamics further amplify these shifts, as global emissions targets and stricter fuel economy standards incentivize designs that reduce drag and weight. Consequently, sealing system research has broadened to include aerodynamic modeling and multi-material laminate constructions that integrate foam cores, films, and metal inserts. At the same time, consumer preferences for panoramic roofs and frameless door assemblies are elevating design complexity, challenging suppliers to develop solutions that seamlessly blend form and function. Taken together, these transformative shifts are reshaping competitive imperatives and forcing a reimagining of sealing systems from passive barriers to active contributors to vehicle efficiency and user experience.

Navigating the Ripple Effects of 2025 United States Tariffs on Automotive Sealing Material Costs Supply Chains and Strategic Sourcing

In 2025, a series of cumulative tariff measures enacted by United States trade authorities imposed additional duties on key automotive sealing materials and finished components imported from various jurisdictions. These levies, designed to protect domestic manufacturing and address trade imbalances, have amplified cost pressures across the supply chain, compelling both original equipment manufacturers and high-volume tier suppliers to reassess sourcing strategies. As a result, regional integration has accelerated, with multiple suppliers expanding North American production footprints to mitigate punitive import charges and secure long-term contract awards with leading OEMs.

Consequently, price escalation for raw materials such as EPDM rubber, neoprene, and high-grade thermoplastic elastomers has translated into increased expenditure on sealing system procurement. Suppliers have responded by streamlining extrusion lines, negotiating multi-year volume commitments, and exploring nearshoring partnerships with smaller specialty rubber producers. At the same time, OEMs are incentivizing innovation that reduces material usage through thinner cross-sections and hybrid constructions combining metal inserts with adhesive bonding, thereby offsetting the impact of tariffs through lightweighting gains. Although these measures help contain total landed costs, they also demand significant capital investment and extended validation cycles, reinforcing the urgency of strategic tariff mitigation planning within procurement functions.

Uncovering Strategic Priorities Through In-Depth Analysis of Product Material Application End User Distribution and Technology Segments

Deep analysis of market segments reveals nuanced performance and growth trajectories shaped by product type distinctions. Door seals remain the largest category, owing to their critical role in passenger compartment insulation, while evolving sunroof seal designs address the dual challenge of panoramic visibility and leak prevention. Hood and tailgate seals have benefited from advancements in adhesive-bonded integration techniques that streamline assembly and improve long-term adhesion under temperature cycling. Trunk seals, traditionally overlooked, are gaining attention as liftgate dynamics become more sophisticated in electric vehicle designs. Window seals themselves continue to evolve through no-metal-insert profiles that facilitate full-glass applications and frameless doors without compromising structural stability.

Material choice underpins these product innovations, with EPDM rubber maintaining dominance due to its balanced performance in temperature extremes and chemical resistance. However, increased emphasis on sustainability has spurred trials of thermoplastic elastomers, offering recyclability advantages without sacrificing resiliency. Silicone seals are selectively deployed in high-temperature zones around engine compartments or LED lighting housings, while PVC blends address cost-sensitive aftermarket requirements. In tandem, OEM and aftermarket channels diverge sharply: original equipment manufacturers prioritize bespoke profile development and validated supplier partnerships, whereas aftermarket players focus on inventory depth and ease of installation to meet service bay turnaround targets.

End-user segmentation further underscores demand variations between commercial and passenger vehicles. Heavy commercial vehicles require robust sealing solutions that can withstand harsh off-road conditions and extended maintenance intervals, whereas light commercial segments favor modular designs that simplify part replacement. In passenger cars, hatchbacks and sedans gravitate toward streamlined profiles that support acoustic insulation, while SUV applications demand larger cross-sectional seals to accommodate heavier door assemblies. Distribution channel dynamics mirror these distinctions: direct sales relationships between tier-one suppliers and OEM program managers drive long-cycle development, distributors facilitate regional coverage for fleet maintenance, and digital platforms are emerging as a growth avenue for aftermarket orders.

Technology adoption also differentiates supplier strategies. Adhesive-bonded seals are increasingly integrated into automated assembly lines, reducing manual labor costs and enhancing repeatability. Metal-insert profiles sustain mechanical fastening requirements, particularly in high-load applications, while no-metal-insert solutions gain traction in lightweight vehicle architectures. Collectively, these segmentation insights illuminate where investments and innovation priorities align across diverse market pockets, informing targeted strategies for product development, channel management, and end-use customization.

This comprehensive research report categorizes the Automotive Window & Exterior Sealing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Technology

- Application

- End-User

- Distribution Channel

Examining Diverse Opportunities and Regional Dynamics Shaping Automotive Sealing Systems in Americas EMEA and Asia Pacific Markets

Regional dynamics in the Americas are shaped by the proximity to key OEM assembly plants in North America and major commercial vehicle hubs in South America. In response, sealing system suppliers have concentrated manufacturing investments in the United States, Mexico, and Brazil to harness free trade agreements and manage logistical costs. North American markets emphasize stringent sealing performance for electric pick-up trucks and luxury passenger segments, whereas Latin American demand is driven by cost-effective solutions for light commercial fleets operating in diverse climate conditions.

Across Europe, Middle East, and Africa, regulatory standards around emissions and material recyclability have prompted suppliers to develop seals with integrated vapor barriers and eco-friendly formulations. Central European vehicle makers leading in premium segments necessitate precision-engineered seals for high-end sedans and SUVs, while Middle Eastern markets prioritize durability under extreme heat. In Africa, aftermarket distribution networks are expanding, presenting opportunities for modular sealing products suited to local service ecosystems.

In the Asia-Pacific region, robust growth of passenger vehicles in China and India has triggered widespread capacity expansions for EPDM extrusion and sealing system assembly. Japanese and Korean OEMs are pioneering adhesive bonding and laser welding integration to enhance leakproof validation rates, supporting vehicle designs that feature frameless doors and panoramic glass. Southeast Asian markets, characterized by rapid urbanization and emerging electric two- and three-wheeler segments, are catalyzing demand for compact and versatile sealing solutions compatible with agile manufacturing practices.

This comprehensive research report examines key regions that drive the evolution of the Automotive Window & Exterior Sealing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovation Alliances Defining Leadership in Automotive Sealing Supply Chains

Leading suppliers in window and exterior sealing systems are consolidating their positions through strategic partnerships and targeted investments. Companies with deep expertise in rubber compounding have bolstered their R&D pipelines to address evolving electrification requirements, while metalforming specialists have diversified into hybrid sealing assemblies. Collaborative ventures between extrusion process innovators and adhesive technology firms are accelerating the commercialization of next-generation bonding methods that reduce cycle times and enhance seal longevity.

Several players have pursued vertical integration, acquiring resin manufacturers to secure supply of specialty elastomer blends and mitigate raw material volatility. Others have formed alliances with automotive glass producers to co-develop integrated seal-and-glazing modules, simplifying line-side handling for OEMs. In the aftermarket arena, distributors are leveraging digital catalogues and just-in-time fulfillment models to meet the service needs of aging vehicle populations, forging exclusive agreements with tier-one suppliers to establish branded replacement programs. Across all channels, intellectual property around low-permeation profiles and noise-dampening geometries is becoming a key competitive moat, with patent filings rising sharply over the past two years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Window & Exterior Sealing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- Cooper-Standard Automotive Inc.

- Dana Incorporated

- Freudenberg SE

- Henniges Automotive Holdings, Inc.

- Hutchinson SA

- Magna International Inc.

- Parker-Hannifin Corporation

- SaarGummi Group

- Sumitomo Riko Co., Ltd.

- The Marmon Group, Inc.

- Toyoda Gosei Co., Ltd.

- Trelleborg AB

Enabling Future Growth Through Innovation Investments Supply Chain Resilience Digitalization and Collaborative Ecosystem Development

Industry leaders should prioritize investment in advanced materials research to develop sealing compounds that balance recyclability, temperature resilience, and acoustic performance. By establishing cross-functional innovation centers that bring together materials scientists, process engineers, and vehicle architects, companies can accelerate the validation of next-generation profiles under real-world conditions. Simultaneously, strengthening nearshoring initiatives with flexible contract manufacturers will provide a buffer against evolving tariff landscapes and supply chain disruptions, ensuring uninterrupted component flow to assembly lines.

Digital transformation is equally critical; deploying sensor-based monitoring on extrusion lines and integrating real-time quality analytics will reduce scrap rates and enable predictive maintenance. For original equipment manufacturers, co-creating modular seal-and-glazing systems with suppliers can streamline assembly processes and reduce complexity in platform consolidation. Aftermarket channels can capitalize on e-commerce ecosystems by offering subscription-based replenishment services that leverage telematics data to predict seal lifecycle and preempt maintenance interventions. Furthermore, forging partnerships with emerging electric vehicle startups and two-wheeler manufacturers in high-growth markets can unlock new revenue streams and diversify customer portfolios.

Employing a Rigorous Mixed Methodology Comprising Primary Interviews Secondary Research Data Triangulation and Expert Validation

This report draws on a rigorous mixed-method research design, integrating qualitative and quantitative approaches to ensure comprehensive market understanding. Primary research comprised in-depth interviews with product managers, procurement executives, and engineering leaders across the value chain, providing firsthand insights into decision criteria, development roadmaps, and regulatory considerations. Secondary research leveraged authoritative industry publications, patent databases, and trade association reports to contextualize emerging technologies and benchmark competitive landscapes.

Quantitative analysis involved data triangulation from global trade statistics, regional production figures, and aftermarket sales records. Segmentation modeling was validated through sample audits of supplier shipments and OEM program announcements, ensuring alignment between theoretical estimates and ground-level realities. An expert panel of industry consultants and academic researchers conducted peer reviews of draft findings, further enhancing the report’s reliability and minimizing bias. Overall, this methodology ensures a balanced view of market drivers, technological developments, and policy impacts that underlie the automotive window and exterior sealing systems sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Window & Exterior Sealing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Window & Exterior Sealing System Market, by Product Type

- Automotive Window & Exterior Sealing System Market, by Material

- Automotive Window & Exterior Sealing System Market, by Technology

- Automotive Window & Exterior Sealing System Market, by Application

- Automotive Window & Exterior Sealing System Market, by End-User

- Automotive Window & Exterior Sealing System Market, by Distribution Channel

- Automotive Window & Exterior Sealing System Market, by Region

- Automotive Window & Exterior Sealing System Market, by Group

- Automotive Window & Exterior Sealing System Market, by Country

- United States Automotive Window & Exterior Sealing System Market

- China Automotive Window & Exterior Sealing System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing the Evolution of Sealing Solutions as Critical Enablers of Vehicle Efficiency Comfort and Compliance in a Changing Industry

Automotive window and exterior sealing systems occupy a pivotal role in contemporary vehicle design, balancing the dual imperatives of functional reliability and aesthetic integration. As the automotive industry accelerates toward electrification, autonomous capabilities, and more stringent sustainability targets, sealing solutions are emerging as strategic differentiators that contribute to efficiency, comfort, and regulatory compliance. Shifts in global trade policies and regional manufacturing expansions are redefining cost structures and supplier networks, underscoring the need for agile sourcing and tariff mitigation strategies.

The interplay of advanced materials research, digital manufacturing processes, and collaborative development models is catalyzing a transformation of sealing systems from passive components to integrated performance enablers. Suppliers and OEMs that embrace holistic innovation frameworks-blending material science expertise with automated quality control and strategic partnerships-will be best positioned to meet the evolving demands of commercial and passenger vehicle segments. Ultimately, the dynamic convergence of technological, regulatory, and consumer trends will continue to shape the direction of sealing system development, making proactive adaptation essential for long-term competitiveness.

Secure Strategic Growth by Connecting with Ketan Rohom to Acquire Exclusive Market Intelligence on Sealing Systems and Drive Competitive Advantage

To take advantage of comprehensive intelligence on automotive window and exterior sealing systems, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He can provide personalized guidance on how this research supports your strategic goals and share exclusive insights tailored to your organization’s needs. Engage now to secure early access to in-depth analyses and differentiated recommendations that will empower your teams to navigate market shifts with confidence. Contact Ketan Rohom today and ensure your company remains at the forefront of innovation and competitiveness in sealing system solutions.

- How big is the Automotive Window & Exterior Sealing System Market?

- What is the Automotive Window & Exterior Sealing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?