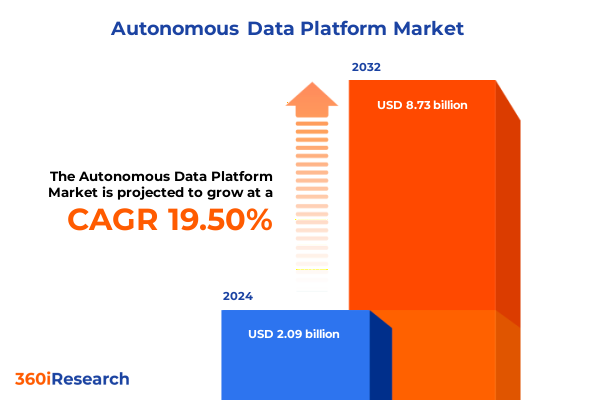

The Autonomous Data Platform Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.96 billion in 2026, at a CAGR of 19.52% to reach USD 8.73 billion by 2032.

Building the Foundation of Autonomous Data Platforms to Empower Intelligent Decision-Making Across Dynamic Enterprise Environments

Enterprises are navigating an era where data volumes and complexity continue to escalate, driving the need for self-managing data infrastructures that reduce manual oversight and accelerate decision-making. An autonomous data platform represents a paradigm shift beyond traditional data management systems by combining intelligent automation, adaptive algorithms, and continuous learning mechanisms. These capabilities empower organizations to unify disparate data sources, automate routine tasks such as tuning and scaling, and deliver real-time insights without constant human intervention.

By harnessing machine learning models and closed-loop feedback systems, autonomous platforms can dynamically adapt to changing workloads, detect anomalies, and optimize resource allocation. This evolution not only streamlines operations but also enhances resilience, security, and compliance maturity. As digital transformation mandates intensify, enterprises that embrace autonomous data platforms are better positioned to innovate rapidly, reduce total cost of ownership, and build a robust foundation for emerging applications in analytics, artificial intelligence, and data-driven product development.

Navigating Fundamental Technological and Operational Shifts Driving the Next Generation of Data Management and Analytics

The landscape of data management is undergoing fundamental shifts driven by the convergence of cloud-native architectures, pervasive AI integration, and evolving data governance requirements. In recent years, organizations have transitioned from monolithic on-premises systems to distributed, containerized environments deployed across hybrid and public clouds. This evolution has unlocked unprecedented scalability and agility, enabling continuous delivery of data services while demanding new paradigms for orchestration, interoperability, and security.

Moreover, the infusion of embedded AI and machine learning capabilities into core data platform components is redefining how metadata is processed, models are trained, and insights are delivered. Synchronous with these innovations, regulatory frameworks and privacy mandates are raising the bar for data provenance, lineage tracking, and policy enforcement. As a result, autonomous platforms must integrate advanced governance engines and automated compliance checks, ensuring that data assets are managed responsibly and transparently. Together, these transformative shifts are converging to shape next-generation solutions that deliver a seamless, intelligent data experience across heterogeneous IT landscapes.

Evaluating the Cascading Effects of United States Tariff Policies in 2025 on Global Data Infrastructure and Technology Ecosystems

The United States’ tariff policies enacted throughout 2025 have introduced a complex set of dynamics affecting the global technology supply chain and, by extension, the deployment of autonomous data platforms. Elevated duties on imported hardware components, including high-performance processors and specialized storage arrays, have increased acquisition costs and extended lead times for critical infrastructure elements. Consequently, enterprises are exploring alternative sourcing strategies and renegotiating vendor agreements to mitigate financial pressures while preserving project timelines.

At the software level, tariff-driven supply chain interruptions have influenced vendor roadmaps and licensing models, prompting providers to reevaluate distribution channels and support frameworks. In response, software producers are intensifying partnerships with domestic integrators and local service bureaus to ensure continuity of delivery and to address cost fluctuations. These strategic adjustments are essential for maintaining platform availability and for safeguarding expected service levels. In parallel, organizations are reallocating resources toward comprehensive risk assessments and contingency planning, ensuring that autonomous systems remain robust against geopolitical and economic volatility.

Unlocking Strategic Insights Through Comprehensive Component, Organizational, Deployment, and Vertical Segment Analysis for Informed Investment

Insightful analysis of component segmentation reveals that service offerings and software modules play complementary roles in enabling autonomy. Managed services provide turnkey administration and proactive monitoring, while professional services deliver bespoke implementations and strategy alignments. Software solutions span critical capabilities such as analytics engines that surface real-time trends, governance modules that enforce policies, integration layers that streamline data flow, management suites that orchestrate resources, and orchestration frameworks that automate complex workflows.

Considering organizational size, large enterprises emphasize scalability, multi-region deployment, and the consolidation of extensive data estates, whereas small and medium-sized entities prioritize rapid time-to-value, cost-effectiveness, and out-of-the-box configurations. Deployment models further diversify the landscape: cloud-native architectures accelerate innovation cycles and scalability, hybrid models balance legacy investments with modern capabilities, and on-premises deployments address stringent data sovereignty and performance requirements.

Industry verticals impose specialized demands on autonomous data platforms. Financial services and banking require high-throughput transaction processing and rigorous compliance controls. Healthcare organizations focus on patient privacy and interoperability across electronic health record systems. Manufacturing and energy sectors demand real-time operational intelligence for predictive maintenance. Government and defense agencies insist on multi-level security and classification handling. Telecom and IT enterprises drive network analytics at scale, while media and entertainment companies leverage data orchestration to personalize user experiences. Transportation networks integrate geospatial streaming data for dynamic route optimization.

This comprehensive research report categorizes the Autonomous Data Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Model

- Industry Vertical

Revealing Distinct Regional Dynamics in the Americas, Europe Middle East And Africa, And Asia Pacific for Tailored Growth Strategies

In the Americas, enterprises are accelerating cloud-first initiatives and embracing advanced analytics to drive digital transformation agendas. Market maturity is evidenced by a balanced mix of greenfield digital pioneers and established organizations modernizing legacy systems. Meanwhile, provider ecosystems in North and South America are expanding managed service portfolios and embedding AI capabilities into core offerings to meet growing demand for intelligent, automated data operations.

Europe, the Middle East, and Africa present a tapestry of regulatory landscapes and digital readiness levels. The European Union’s stringent data protection framework compels vendors to develop robust compliance functionalities. In the Middle East, public sector digitization is catalyzing large-scale autonomous platform deployments, while Africa’s burgeoning technology hubs are exploring innovative use cases in telecommunications and financial inclusion. This region’s diversity necessitates adaptable solutions that can accommodate variable connectivity, multilingual support, and modular service delivery.

Asia-Pacific is at the forefront of high-volume data innovation. Advanced markets such as Japan and South Korea are integrating edge computing into autonomous platforms for low-latency analytics, and Southeast Asia’s rapid adoption of cloud services is driving demand for cost-effective, scalable deployments. Collaborative partnerships between local systems integrators and global technology providers are creating new go-to-market models that align with regional data sovereignty requirements and varying infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Data Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Collaborators Shaping the Autonomous Data Platform Landscape With Breakthrough Capabilities

Leading vendors in the autonomous data platform arena are differentiating through strategic partnerships, modular architectures, and cross-functional AI integrations. Major cloud providers have evolved their native data services to incorporate self-healing capabilities and predictive optimizations, while specialized platform innovators are delivering turnkey solutions that address industry-specific challenges with preconfigured algorithms and templates. Collaboration between these vendor categories is fostering interoperability and driving a surge in open standards adoption.

Service integrators and technology consultancies are equally pivotal. By blending deep domain expertise with advanced automation tools, they accelerate deployments and ensure that governance, security, and performance objectives are met. Collaborative go-to-market initiatives between platform providers and system integrators are shaping a thriving ecosystem focused on delivering comprehensive service level agreements, continuous innovation, and outcome-based contracting. This concerted effort is instrumental in boosting customer confidence and in paving the way for widespread autonomous adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Data Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx Inc.

- Amazon Web Services Inc.

- AtScale Inc.

- Cloudera Inc.

- Databricks Inc.

- Denodo Technologies Inc.

- Domo Inc.

- Exasol AG

- Google LLC

- IBM Corporation

- Incorta Inc.

- Informatica LLC

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Snowflake Inc.

- Stardog Union Inc.

- Talend SA

- Teradata Corporation

- ThoughtSpot Inc.

- TIBCO Software Inc.

Actionable Strategic Imperatives to Drive Adoption and Competitive Advantage in the Autonomous Data Platform Market

Industry leaders should prioritize the adoption of modular, API-driven architectures that facilitate rapid integration with existing systems and third-party services. By standardizing interfaces and leveraging container orchestration frameworks, organizations can scale compute and storage resources elastically while minimizing friction during upgrades and migrations. Establishing a center of excellence for autonomous operations will also accelerate learning curves and promote best practices for model retraining, anomaly detection, and incident resolution.

It is essential to cultivate a partner ecosystem encompassing technology vendors, system integrators, and specialized consultancies. Collaborative engagements can expedite time-to-value, mitigate implementation risks, and unlock advanced use cases such as adaptive security analytics and autonomous data governance. Finally, investing in upskilling and cross-functional teams will cultivate the internal expertise needed to manage automated workflows, interpret AI-driven insights, and continuously refine platform performance in line with evolving business objectives.

Employing a Rigorous Multi-Source Research Framework Integrating Primary Interviews And Data-Driven Secondary Analysis

This research leverages a multi-tiered approach integrating both primary and secondary data sources. Secondary research encompassed the systematic review of industry white papers, regulatory guidelines, vendor documentation, and peer-reviewed publications. Complementing this desk-based effort, primary insights were obtained through structured interviews with C-suite executives, data architects, technology officers, and solution providers actively engaged in autonomous platform initiatives.

All collected data underwent rigorous validation and triangulation. Findings were cross-referenced with real-world deployment case studies, pilot project results, and public financial disclosures to ensure accuracy and reliability. Analytical frameworks addressing market segmentation, competitive positioning, technological differentiation, and regional dynamics were applied uniformly. Continuous quality checks and internal peer reviews guaranteed that the final report provides an authoritative, unbiased perspective on the autonomous data platform domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Data Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Data Platform Market, by Component

- Autonomous Data Platform Market, by Organization Size

- Autonomous Data Platform Market, by Deployment Model

- Autonomous Data Platform Market, by Industry Vertical

- Autonomous Data Platform Market, by Region

- Autonomous Data Platform Market, by Group

- Autonomous Data Platform Market, by Country

- United States Autonomous Data Platform Market

- China Autonomous Data Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Bringing Together Key Observations to Chart a Path Forward for Autonomous Data Platforms in Complex Enterprise Environments

As organizations navigate the complexities of modern data ecosystems, autonomous platforms emerge as a critical enabler for achieving resilient, intelligent operations at scale. By automating routine tasks, embedding advanced analytics, and enforcing governance policies, these platforms lay the groundwork for continuous innovation and strategic agility. The interplay of technological advancements, regulatory drivers, and supply chain considerations underscores the need for a holistic, data-centric approach.

Looking ahead, enterprises that embrace autonomous data management will be better positioned to harness AI-driven insights, streamline operational workflows, and adapt swiftly to market disruptions. With the right strategic focus on modular architectures, partner ecosystems, and talent development, organizations can unlock the full promise of autonomous platforms and maintain a sustainable competitive edge in an increasingly data-driven world.

Connect With Associate Director Of Sales And Marketing To Secure Comprehensive Autonomous Data Platform Intelligence And Insights

For organizations poised to harness the full potential of autonomous data platforms, personalized guidance and in-depth intelligence are essential. Ketan Rohom, Associate Director of Sales & Marketing, is ready to collaborate on tailoring our comprehensive research report to your organization’s strategic imperatives. Engaging with Ketan will provide you with a clear roadmap for adopting advanced data workflows, optimizing infrastructure investments, and aligning technology deployments with your most critical business outcomes.

Don’t miss the opportunity to elevate your data-driven initiatives with expert insights and actionable intelligence. Reach out today to discuss purchasing options, request a demonstration, or explore custom consulting engagements. Connect with Ketan Rohom to secure your leadership position in the evolving autonomous data platform landscape.

- How big is the Autonomous Data Platform Market?

- What is the Autonomous Data Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?