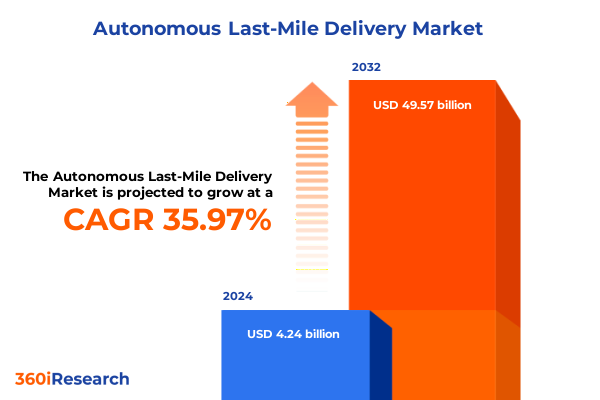

The Autonomous Last-Mile Delivery Market size was estimated at USD 5.75 billion in 2025 and expected to reach USD 7.81 billion in 2026, at a CAGR of 36.01% to reach USD 49.57 billion by 2032.

Unveiling the Strategic Foundations of Autonomous Last-Mile Delivery to Propel Next-Generation Logistics Efficiency and Customer Satisfaction

Autonomous last-mile delivery has emerged as a pivotal innovation reshaping the final link in supply chains by combining robotics, artificial intelligence, and advanced connectivity. As consumer expectations increasingly demand rapid, contactless delivery, logistics operators are under pressure to adopt solutions that reduce costs while enhancing speed and reliability. Transitioning from pilot programs to full-scale deployments, autonomous platforms are beginning to demonstrate their ability to streamline operations across diverse urban and rural environments, paving the way for a new era of logistics efficiency.

In recent years, breakthroughs in sensor fusion, machine learning algorithms, and battery technology have collectively driven down barriers to adoption. These technological strides are complemented by evolving regulatory frameworks that balance safety considerations with incentives for innovation. As a result, stakeholders across the ecosystem-from vehicle manufacturers and software developers to logistics providers and local authorities-are collaborating to refine operational protocols, standardize performance benchmarks, and accelerate market readiness.

This executive summary synthesizes the latest developments in autonomous last-mile delivery, presenting a clear overview of transformative trends, the implications of recent tariff policies, segmentation insights, and regional dynamics. The analysis culminates in actionable recommendations and a robust research methodology, equipping decision-makers with the strategic intelligence necessary to navigate the rapidly changing landscape and capitalize on emerging opportunities.

Charting the Deep Transformative Shifts Redefining Autonomous Last-Mile Delivery through Technological Innovation and Evolving Urban Mobility Patterns

The autonomous last-mile delivery sector is experiencing profound shifts driven by the convergence of emerging technologies and changing consumer behaviors. At the forefront, robotics and AI advancements are enabling vehicles to navigate complex urban terrains with unprecedented precision, while machine vision systems ensure real-time obstacle detection and adaptive route planning. Consequently, operators are witnessing improved safety records and reduced labor dependencies, setting new performance benchmarks for the industry.

Simultaneously, urban mobility patterns are evolving under the influence of smart city initiatives, where connected infrastructure and Internet of Things ecosystems facilitate seamless vehicle-to-grid communication. As a result, autonomous platforms are increasingly integrated with traffic management systems, enabling dynamic route optimization and real-time congestion avoidance. Moreover, the proliferation of micro-distribution hubs located within urban centers is redefining last-mile workflows, shortening delivery windows, and reducing carbon footprints.

Moreover, shifting consumer preferences toward eco-friendly and personalized delivery experiences are prompting service providers to prioritize both sustainability and flexibility. Whether through electric ground vehicles that minimize emissions or aerial platforms that bypass ground-level obstacles, companies are calibrating their solutions to align with evolving environmental goals and customer expectations. These transformative shifts collectively underscore an industry in transition, poised for accelerated adoption and long-term impact.

Assessing the Cumulative Impact of United States 2025 Tariff Policies on Autonomous Last-Mile Delivery Supply Chains and Operational Strategies

Recent tariff adjustments enacted by United States policymakers in early 2025 have introduced new variables into the cost structure of autonomous last-mile delivery operations. Tariffs targeting imported robotic components, such as high-precision sensors and specialized actuators, have incrementally increased procurement costs for hardware integrators. As a result, companies are reassessing supply chain architectures, seeking alternative sourcing strategies or negotiating long-term contracts to mitigate the immediate financial impact of these duties.

In parallel, software development workflows are indirectly affected by the reallocation of investment resources toward navigating the revised tariff landscape. With budgets concentrated on insulating hardware supply chains from sudden price spikes, some firms have temporarily deferred non-essential software feature rollouts in order to preserve overall project timelines. This strategic pivot highlights the interconnected nature of hardware and software in autonomous platforms and underscores the importance of a balanced investment approach.

Furthermore, the tariff environment has accelerated conversations around onshoring critical manufacturing processes for both hardware and vehicle assembly. By investing in domestic production facilities, stakeholders anticipate not only reduced exposure to international trade fluctuations but also enhanced control over quality assurance and delivery lead times. Nonetheless, this transition carries its own set of challenges, including workforce training and capital expenditure, indicating that a phased, hybrid sourcing model may emerge as the most resilient path forward.

Illuminating Key Segmentation Insights across Service Type Propulsion Components Delivery Range and End User Industries Driving Autonomous Last-Mile Delivery Adoption

Segmenting the autonomous last-mile delivery landscape according to service type reveals distinct performance profiles and use cases. Aerial platforms encompass both fixed wing designs optimized for extended range missions and rotary wing systems that offer vertical takeoff and landing capabilities, each suited to different operational topographies. On the ground, wheeled vehicles excel in urban environments with well-defined infrastructure, while multi-terrain robots are engineered to traverse rugged or uneven surfaces, expanding service coverage into previously inaccessible areas.

End user industries further delineate market needs, with food and beverage providers emphasizing speed and perishability control, healthcare and pharmaceutical firms prioritizing secure, temperature-regulated delivery, and retail e-commerce brands seeking seamless customer experiences and flexible delivery time slots. Propulsion type also shapes solution selection, as purely electric platforms align with carbon reduction agendas, while hybrid vehicles offer extended operational readiness through combined powertrain configurations. Delivery range segmentation-spanning micro runs in hyper-local neighborhoods, short-distance urban corridors, and medium-range suburban routes-illuminates the importance of battery management strategies and route density considerations.

Component analysis underscores the dual focus on hardware and software ecosystems. On the hardware side, battery systems drive endurance, chassis design dictates payload capacity and stability, and sensor suites ensure real-time environmental awareness. In the software realm, analytics platforms transform operational data into actionable insights, fleet management solutions orchestrate vehicle dispatching and maintenance scheduling, and navigation and mapping tools deliver precise route orchestration. By integrating these components, industry participants craft end-to-end solutions tailored to specific market demands.

This comprehensive research report categorizes the Autonomous Last-Mile Delivery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Propulsion Type

- Delivery Range

- Component

- End User Industry

Revealing Critical Regional Dynamics Shaping Autonomous Last-Mile Delivery in the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics in the Americas underscore a mature market environment shaped by advanced infrastructure and strong regulatory support for autonomous platforms. In North America, leading technology hubs have fostered pilot corridors in metropolitan areas, enabling proof-of-concept trials that pave the way for broader commercialization. Meanwhile, Latin American markets exhibit growing interest in cost-effective ground-based robots to address last-mile challenges in densely populated urban centers with limited logistics footprint.

Across Europe, the Middle East, and Africa, diverse regulatory regimes and infrastructure quality create a multifaceted operating environment. Western European nations benefit from harmonized safety standards and expansive testing grounds, whereas emerging markets in the Middle East are increasingly investing in drone corridors to service remote communities. In contrast, several African jurisdictions are exploring hybrid ground-aerial models to overcome challenging terrain and limited roadway networks, positioning the region as an incubator for novel delivery concepts.

In the Asia-Pacific region, rapid urbanization and high population densities are driving expansive trials and early deployments of autonomous solutions. Markets such as China, Japan, and South Korea are leveraging robust manufacturing ecosystems to accelerate production of both aerial and ground vehicles. At the same time, India and Southeast Asian nations are prioritizing cost-efficient ground robots to navigate bustling street markets and narrow alleys. Together, these developments reflect a region hungry for scalable, automated delivery frameworks that can accommodate fast-growing e-commerce demand.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Last-Mile Delivery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Companies and Strategic Collaborations Steering the Growth and Technology Leadership in Autonomous Last-Mile Delivery

Leading global logistics providers are increasingly incorporating autonomous technologies into their service portfolios through both in-house development and strategic partnerships. Technology giants have deployed aerial drone programs to complement existing fleets, while legacy players in parcel and freight distribution have collaborated with robotics startups to pilot ground-based delivery corridors. These alliances aim to accelerate technology transfer and operational learnings, ultimately reducing time-to-market for autonomous solutions.

Simultaneously, specialized robotics firms and software innovators are carving out distinct niches by offering modular vehicle platforms and SaaS-based command and control systems. Emerging companies are differentiating themselves through proprietary navigation algorithms and custom sensor integration services, catering to clients seeking turnkey delivery solutions. As a result, the competitive landscape is evolving from a dichotomy of incumbents versus disruptors toward a complex ecosystem of co-opetition and shared investment initiatives.

Industry consortia and standardization bodies are also playing a pivotal role in shaping technology roadmaps and safety protocols. By convening cross-functional stakeholders, these forums facilitate the harmonization of certification processes and the establishment of performance benchmarks. This collaborative approach not only de-risks early trials but also fosters an environment in which companies can scale deployments with greater confidence in regulatory compliance and public acceptance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Last-Mile Delivery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agility Robotics, LLC

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Autonomous Solutions, Inc.

- Cainiao Smart Logistics Network Limited

- FedEx Corporation

- Gatik AI, Inc.

- JD.com, Inc.

- Nuro, Inc.

- SF Holding Co., Ltd.

- Starship Technologies Ltd

- Wing Aviation LLC

- Zipline International Inc.

- Zoox, Inc.

Delivering Actionable Recommendations for Industry Leaders to Leverage Autonomous Last-Mile Delivery Innovations and Secure Sustainable Competitive Advantages

To capitalize on the transformative potential of autonomous last-mile delivery, industry leaders should prioritize the development of interoperable platforms that seamlessly integrate with existing logistics infrastructures. By investing in modular vehicle architectures and open API frameworks, organizations can reduce integration complexity and accelerate time-to-value for new deployments. This approach also enables rapid iteration of hardware and software components in response to evolving market requirements.

Engaging proactively with regulatory authorities and municipal planners is equally critical for securing operational corridors and refining safety standards. Companies that collaborate on pilot programs with local governments can shape policy frameworks that balance innovation incentives with risk mitigation. Such public-private partnerships not only facilitate early access to testing environments but also build stakeholder trust and community acceptance around autonomous delivery services.

Finally, a data-driven mindset should guide strategic decision-making, with advanced analytics applied to optimize fleet utilization, maintenance planning, and customer engagement. By harnessing insights from real-time operational metrics, organizations can identify efficiency bottlenecks and tailor service offerings to specific end-user preferences. Ultimately, combining technical agility with strategic foresight will empower industry leaders to secure sustainable competitive advantages in the rapidly evolving autonomous delivery landscape.

Outlining Rigorous Research Methodology Approaches and Analytical Frameworks Underpinning the Autonomous Last-Mile Delivery Market Study

This study employs a comprehensive research methodology that synthesizes insights from primary and secondary sources to ensure robust analysis. Primary research encompasses in-depth interviews with key stakeholders across the ecosystem, including vehicle manufacturers, software developers, logistics operators, and regulatory experts. These conversations provide nuanced perspectives on technology adoption challenges, operational constraints, and emerging use cases.

Secondary research involves a rigorous review of industry reports, patent filings, and publicly available databases to contextualize primary findings within broader market dynamics. Technical white papers and academic publications inform the assessment of sensor technologies and propulsion advancements, while press releases and pilot program disclosures offer real-world evidence of deployment efficacy. This multi-faceted approach ensures that the analysis remains both current and grounded in empirical data.

Analytical frameworks applied in this study include segmentation by service type, end user industry, propulsion type, delivery range, and component. Each segment is evaluated for technological maturity, operational viability, and strategic fit. The methodology also incorporates scenario planning to examine the potential impacts of regulatory shifts and tariff changes. Throughout the process, findings are validated through expert workshops and peer reviews to maintain objectivity and methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Last-Mile Delivery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Last-Mile Delivery Market, by Service Type

- Autonomous Last-Mile Delivery Market, by Propulsion Type

- Autonomous Last-Mile Delivery Market, by Delivery Range

- Autonomous Last-Mile Delivery Market, by Component

- Autonomous Last-Mile Delivery Market, by End User Industry

- Autonomous Last-Mile Delivery Market, by Region

- Autonomous Last-Mile Delivery Market, by Group

- Autonomous Last-Mile Delivery Market, by Country

- United States Autonomous Last-Mile Delivery Market

- China Autonomous Last-Mile Delivery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Compelling Conclusions on the Future of Autonomous Last-Mile Delivery and the Strategic Imperatives for Stakeholders across the Ecosystem

The convergence of advanced robotics, connectivity, and regulatory evolution positions autonomous last-mile delivery as a cornerstone of future logistics architectures. As organizations continue to navigate supply chain complexities and consumer expectations accelerate, the integration of autonomous platforms offers a pathway to both cost efficiencies and service enhancements. Stakeholders who adopt a holistic strategy-one that balances technology innovation with policy engagement and data-driven operations-will be best equipped to thrive in this competitive landscape.

Moreover, the interplay between hardware and software ecosystems underscores the need for cross-functional collaboration. By aligning teams across engineering, operations, and commercial functions, companies can expedite solution development and ensure seamless user experiences. Equally, partnerships with municipal authorities and industry consortia are essential for establishing the safety and performance benchmarks that will foster wider adoption.

Looking ahead, the ability to adapt to evolving tariff environments, regional regulatory shifts, and segmentation-specific requirements will determine market leaders. Those who embrace a modular, data-centric, and collaborative approach will not only mitigate risk but also unlock new avenues for scale and differentiation. Ultimately, autonomous last-mile delivery stands to redefine how goods move through complex networks, delivering tangible value to businesses and consumers alike.

Engage with Ketan Rohom to Transform Your Last-Mile Delivery Strategies with Comprehensive Autonomous Solutions Backed by Industry-Leading Market Insights

To explore tailored strategies and in-depth analyses that can revolutionize your last-mile delivery operations, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive report can empower your organization’s decision-making and strategic roadmap. Connect with Ketan to arrange a personalized briefing, gain exclusive insights into cutting-edge autonomous delivery innovations, and secure the competitive advantage offered by industry-leading findings and strategic guidance. Your next step toward pioneering logistics excellence begins with a conversation with Ketan Rohom.

- How big is the Autonomous Last-Mile Delivery Market?

- What is the Autonomous Last-Mile Delivery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?