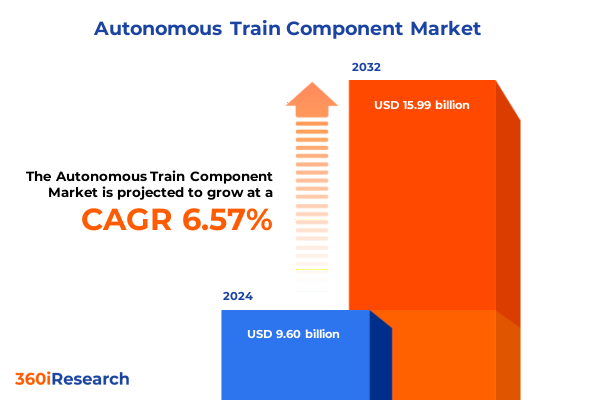

The Autonomous Train Component Market size was estimated at USD 10.13 billion in 2025 and expected to reach USD 10.69 billion in 2026, at a CAGR of 6.72% to reach USD 15.99 billion by 2032.

Exploring the Evolutionary Journey and Strategic Significance of Autonomous Train Components Within the Digitally Transformed Modern Rail Ecosystem

The autonomous train component landscape has experienced a profound transformation over the past decade, driven by advances in digital technologies, connectivity, and software-defined systems. An increasing number of rail operators and infrastructure providers are looking beyond conventional signaling and mechanical subsystems toward integrated solutions that prioritize safety, efficiency, and passenger experience. Underpinning this transition is a convergence of sensor systems, control architectures, and communication networks working in harmony to enable trains to operate with minimal human intervention. As a result, stakeholders from engineering teams to regulatory bodies are reevaluating traditional roles and responsibilities to align with the promise of autonomous rail.

Moreover, market participants are focusing on interoperability standards and open interfaces to accelerate deployment cycles and reduce vendor lock-in. In parallel, emerging technologies such as edge computing and digital twins are reshaping how component health is monitored, diagnosed, and maintained in real time. This shift away from reactive maintenance toward proactive diagnostics not only enhances reliability but also provides operators with granular insights into lifecycle costs and performance trends.

Consequently, understanding the current state of autonomous train components is vital for decision-makers aiming to capitalize on the next wave of rail innovation. This executive summary provides a concise yet comprehensive overview of transformative trends, regulatory dynamics, segmentation insights, regional nuances, and strategic recommendations that will inform your organization’s path toward a more autonomous, resilient, and efficient rail network.

How Artificial Intelligence Integration, 5G Connectivity Deployment, and Electrification Trends Are Reshaping Future Autonomous Rail Component Innovation

In recent years, artificial intelligence and machine learning algorithms have become integral to the development of autonomous rail systems, enabling real-time decision-making and adaptive control capabilities that were once beyond reach. By leveraging predictive analytics, operators can now forecast component failures before they occur, thus reducing downtime and optimizing maintenance schedules. Furthermore, the rollout of 5G networks has unlocked ultra-low latency communication, facilitating precise train-to-ground coordination and high-bandwidth data exchanges for advanced sensor modalities such as lidar and radar.

Additionally, electrification trends have reshaped propulsion system design, with a growing emphasis on energy recuperation and hybrid powertrains. These propulsion advancements align with broader decarbonization goals, fostering the adoption of electric motors that feature both AC and DC configurations to meet diverse operational needs. At the same time, modular control architectures are streamlining system integration, allowing on-board real-time processors and software platforms to interface seamlessly with wayside control elements such as signal interlocks and switch control.

As a result of these converging shifts, the autonomous train component market is undergoing a fundamental realignment. Companies that integrate digital twins with robust cybersecurity frameworks and scalable communication systems will be best positioned to lead the next generation of rail automation. Consequently, stakeholders must remain vigilant of both technological breakthroughs and evolving regulatory requirements to fully harness the potential of autonomous rail innovation.

Evaluating the Cumulative Effects of 2025 United States Tariff Policies on International Supply Chains for Autonomous Train Component Manufacturing

The imposition of new tariff measures by the United States in early 2025 has introduced increased complexity across global supply chains for autonomous train components. These policy adjustments, targeting a range of imported subassemblies and raw materials, have led to higher input costs and extended lead times for manufacturers operating in cross-border environments. Consequently, many OEMs are reevaluating their sourcing strategies, considering nearshoring options and diversifying supplier portfolios to mitigate exposure to potential tariff fluctuations.

In parallel, breaching compliance thresholds has become more cumbersome, with advanced documentation requirements and stricter customs inspections prolonging transit times. As a result, transportation providers are incorporating buffer inventories and reorder point adjustments into their logistics planning. Additionally, component producers are accelerating in-country production capabilities to qualify for tariff exemptions under regional trade agreements, thereby reducing duties and preserving competitiveness. This localized production approach also enhances agility in responding to regulatory changes and geopolitical tensions.

Moreover, tariff-induced cost pressures have spurred innovation in design optimization and material substitution. Companies are investing in research to identify alternative alloys and polymers that maintain performance standards while lowering import duties. This dual focus on strategic supply chain management and product engineering underscores the broader imperative for manufacturers to remain resilient amid an evolving trade landscape. Ultimately, understanding the cumulative effects of 2025 tariff policies is critical for market participants aiming to sustain growth and operational stability.

Unlocking Insights from Component Type, Train Type, and Deployment Strategies Driving Segmentation Dynamics in Autonomous Rail Component Markets

Market segmentation in the autonomous train component arena is multifaceted, reflecting the intricate architectures that underpin modern rail systems. Based on component type, the landscape spans communication systems such as LTE and 5G technologies-including 4G fallback options-alongside radio modules offered in analog and digital formats. Wi-Fi connectivity strategies range from Wifi 5 deployments to emerging Wifi 6 implementations. Equally critical are control systems, which encompass onboard solutions powered by real-time processors and modular software platforms, as well as wayside equipment like signal interlocks and switch control units. Propulsion systems further extend across diesel engines-available in both four-stroke and two-stroke variants-electric motors in AC and DC configurations, and hybrid architectures employing parallel and series topologies. Safety systems feature collision avoidance technologies based on lidar and radar sensors, door control mechanisms in electronic and mechanical designs, and fire detection solutions utilizing heat and smoke detection. Lastly, sensor systems integrate cameras with infrared and optical capabilities, lidar units employing phase-shift and time-of-flight methods, and radar sensors utilizing FMCW and pulse techniques.

When considering train type segmentation, the market divides into freight and passenger applications; freight rail is further distinguished by bulk transport for heavy and light cargo, container operations spanning standard and tank units, and refrigerated services delivered via chilled and frozen configurations. Passenger services encompass commuter networks in suburban and urban settings, high-speed corridors deploying electric and maglev technologies, and intercity routes differentiated by day and night schedules.

Deployment type analysis reveals a bifurcation between new builds and retrofit projects. Stakeholders embarking on greenfield developments prioritize fully integrated solutions, whereas retrofit programs concentrate on upgrading legacy fleets with add-on sensors, enhanced communication modules, and control system overhauls. This layered segmentation underscores the nuanced demand drivers shaping component strategies across the autonomous rail ecosystem.

This comprehensive research report categorizes the Autonomous Train Component market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Train Type

- Deployment Type

Examining Regional Dynamics and Growth Patterns Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific Autonomous Train Component Sectors

Regional distinctions play a pivotal role in shaping autonomous train component trends, with the Americas leading initial adoption through substantial investments in modernizing freight corridors and commuter rail networks. Within North America, focus areas include integrating advanced sensor arrays and control platforms to enhance safety and reliability, while Latin American rail administrations concentrate on cost-effective retrofit programs to extend the lifespan of existing assets. These divergent priorities reflect investment capacities and network maturity levels that vary significantly across the region.

In Europe, the Middle East & Africa corridor, unified regulatory frameworks such as the EU’s Digital Rail for Greener Mobility initiative have accelerated the rollout of interoperable communication and control solutions. Meanwhile, Middle Eastern markets are channeling capital toward high-speed passenger lines, often leveraging public-private partnerships, and African rail authorities are embarking on pilot deployments that emphasize scalability and resilience in challenging operating environments. Each subregion’s unique regulatory context and funding mechanisms inform the selection of communication standards, propulsion technologies, and maintenance strategies.

The Asia-Pacific region exhibits vibrant growth and innovation, led by major rail economies including China, Japan, and India, where nationwide digital signaling projects and electrification mandates are creating demand for cutting-edge components. Additional markets such as Australia are prioritizing sustainability, integrating energy-efficient propulsion systems and advanced fire detection measures into both urban transit and long-haul freight lines. Consequently, the interplay of policy objectives, infrastructure investment levels, and technology partnerships across these regions delineates a complex mosaic of opportunities and challenges for manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Train Component market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Technological Innovations from Leading Suppliers in the Autonomous Train Component Industry Landscape

Key industry players have been strategically aligning their product roadmaps to address the evolving requirements of autonomous rail. Leading conglomerates have accelerated R&D investments in modular communication platforms that support seamless handoffs between LTE, 5G, and Wi-Fi networks, while concurrently developing next-generation real-time processors optimized for on-board control and safety critical applications. Collaborative ventures between established rolling stock manufacturers and specialized sensor system providers have also gained momentum, fostering end-to-end solutions that streamline integration and simplify certification pathways.

Prominent suppliers have expanded their footprints into emerging markets through joint ventures and localized production facilities, ensuring compliance with regional content rules and tariff mitigation strategies. At the same time, they have bolstered cybersecurity offerings, recognizing the acute threat of ransomware and network intrusion in highly automated rail environments. By embedding security features directly into hardware and firmware layers, these companies aim to deliver holistic risk management frameworks that resonate with both operators and regulators.

Moreover, startup ecosystems are producing niche innovations in areas such as phase-shift lidar modules and software-defined signaling controllers. These agile entrants often become acquisition targets for established manufacturers seeking to augment their portfolios with specialized technologies. As competitive dynamics continue to intensify, the ability of companies to demonstrate coherent system interoperability, robust after-sales support, and proactive lifecycle management will be central to securing long-term leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Train Component market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz Group

- Alstom SA

- Alstom Transport India Limited

- Bharat Heavy Electricals Limited

- Bombardier Transportation

- CRRC Corporation Limited

- Green Automated Solutions, Inc.

- Hitachi Rail Ltd.

- Hyundai Rotem Company

- Indra Sistemas, S.A.

- Ingeteam Corporation SA

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Pintsch GmbH

- Siemens AG

- Stadler Rail AG

- Stadler, Inc.

- Thales Group

- Toshiba Corporation

- Wabtec Corporation

Implementing Strategic Recommendations to Navigate Technological Shifts and Regulatory Challenges in the Autonomous Rail Components Sector

To capitalize on the momentum of autonomous rail adoption, industry leaders must prioritize modular product architectures that enable incremental upgrades and minimize system downtime. By designing communication and control platforms with open APIs and standardized data models, firms can facilitate integration with third-party analytics engines and digital twin frameworks. This approach not only accelerates time-to-market but also reduces the total cost of ownership by promoting reusable component libraries and adaptable software overlays.

Furthermore, diversification of supply chains is essential to mitigate the risks associated with tariff volatility and geopolitical uncertainty. Organizations should map their global supplier ecosystems, identify critical single-source dependencies, and establish nearshore manufacturing partnerships to ensure continuity. In parallel, engaging proactively with regulatory bodies to align emerging standards for safety systems and cybersecurity will help streamline certification processes and reduce compliance burdens.

Additionally, investing in workforce upskilling is crucial for maintaining operational excellence. Companies should implement training programs focused on data analytics, software development, and systems engineering to equip technicians and engineers with the capabilities needed for autonomous maintenance routines and remote diagnostics. Lastly, fostering cross-industry collaborations with telecom operators and cloud service providers will accelerate the deployment of edge computing infrastructures, laying the foundation for intelligent, responsive rail networks.

Outlining a Comprehensive Research Methodology Integrating Primary Interviews and Secondary Data Validation for Autonomous Train Components Analysis

This analysis draws on a rigorous methodological framework combining in-depth primary research with comprehensive secondary data validation. Primary insights were gathered through structured interviews with senior executives, system integrators, and railway operators, alongside focused workshops to capture end-user requirements and performance benchmarks. These engagements provided firsthand perspectives on operational pain points, technology adoption timelines, and regional regulatory constraints.

Secondary research encompassed an exhaustive review of technical white papers, academic journals, patent filings, and industry standards documentation. Publicly available corporate disclosures, annual reports, and regulatory filings were systematically analyzed to corroborate technology roadmaps and investment patterns. Data triangulation was performed by cross-referencing quantitative findings from multiple credible sources, ensuring both accuracy and consistency in reporting key trends and strategic imperatives.

Quality assurance protocols included peer reviews by subject matter experts in rail signaling, propulsion engineering, and telecommunications. All data points were subjected to validation checks, ensuring alignment with the latest industry announcements and regulatory updates. This multi-layered approach provides a robust foundation for informed decision-making and strategic planning in the autonomous train component space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Train Component market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Train Component Market, by Component Type

- Autonomous Train Component Market, by Train Type

- Autonomous Train Component Market, by Deployment Type

- Autonomous Train Component Market, by Region

- Autonomous Train Component Market, by Group

- Autonomous Train Component Market, by Country

- United States Autonomous Train Component Market

- China Autonomous Train Component Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 4929 ]

Drawing Concluding Insights on Market Evolution and the Critical Need for Adaptive Leadership in the Autonomous Train Component Domain

In summary, the advent of autonomous train components represents a pivotal moment for the rail industry, promising heightened safety, operational efficiency, and enhanced passenger experiences. As AI, advanced connectivity, and electrification converge, the potential to transform legacy networks into intelligent, self-optimizing systems becomes increasingly tangible. Nevertheless, stakeholders must remain vigilant of evolving tariff regimes, supply chain disruptions, and regulatory complexities that could impede progress.

Looking ahead, companies that invest in modular architectures, robust cybersecurity measures, and agile supply chain strategies will be best positioned to capture emerging opportunities. Regional dynamics underscore the need for localized approaches, from the extensive retrofit programs in Latin America to the high-speed corridor deployments across Europe and Asia-Pacific. By aligning product roadmaps with diverse market requirements, organizations can navigate the intricate segmentation landscape and drive sustainable growth.

Ultimately, sustained leadership in autonomous rail hinges on a balanced focus across technological innovation, regulatory collaboration, and workforce development. This comprehensive overview equips decision-makers with the insights needed to chart a resilient path forward, ensuring that autonomous train components fulfill their transformative promise across the global rail ecosystem.

Partner with Ketan Rohom to Access In-Depth Autonomous Train Component Analysis and Accelerate Your Strategic Decision-Making

Embark on a transformative journey by partnering with Ketan Rohom, an industry expert whose insights will equip your leadership team with the clarity and confidence needed to thrive in the evolving world of autonomous rail innovation. By engaging directly, you will gain tailored guidance on integrating advanced component strategies into your operational roadmap, leveraging cutting-edge analysis to pinpoint growth opportunities and circumvent emerging risks. This personalized collaboration ensures that your organization is armed with actionable intelligence, from navigating complex tariff regulations to optimizing supply chain resilience. Reach out today to unlock a comprehensive market research report that will elevate your strategic decision-making and place your enterprise at the forefront of autonomous train component development

- How big is the Autonomous Train Component Market?

- What is the Autonomous Train Component Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?