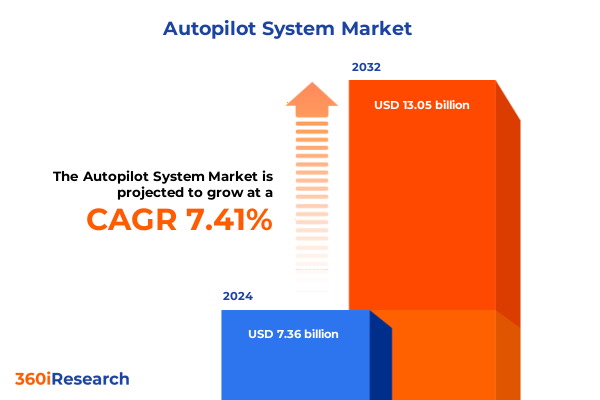

The Autopilot System Market size was estimated at USD 7.87 billion in 2025 and expected to reach USD 8.43 billion in 2026, at a CAGR of 7.49% to reach USD 13.05 billion by 2032.

Understanding the Evolution and Strategic Importance of Autopilot Systems Across Industries in a Rapidly Advancing Technological Era

Autopilot systems have transcended their origins in aerospace to become pivotal technologies driving innovation across multiple sectors, including automotive, maritime, and rail. This section introduces the multifaceted nature of these systems, outlining their core components, operational principles, and the technological breakthroughs that have accelerated their adoption. By framing the discussion around recent advancements in artificial intelligence, sensor fusion, and software integration, this introduction establishes a foundation for understanding the current market dynamics and strategic relevance of autopilot solutions.

As organizations increasingly prioritize safety, efficiency, and cost-effectiveness, autopilot systems have emerged as enablers of transformative change. Their ability to process vast volumes of real-time data, make split-second decisions, and reduce human error is driving unparalleled growth and investment. Moreover, regulatory developments and evolving consumer expectations are reshaping market priorities, compelling stakeholders to recalibrate their operational and investment strategies. Through this introduction, readers gain a clear perspective on why autopilot systems represent not only a technological innovation but also a strategic imperative for industry leaders seeking to maintain a competitive edge in a rapidly evolving landscape.

Exploring Key Technological, Regulatory, and Market Dynamics Redefining the Autopilot System Landscape Across Multiple Sectors

Over the past decade, transformative shifts have redefined the autopilot system landscape, propelled by exponential advances in machine learning algorithms and sensor technologies. Cutting-edge neural network models now underpin perception modules, enabling unparalleled accuracy in object identification and predictive path planning. Concurrently, quantum leaps in sensor resolution-encompassing high-definition cameras, LiDAR arrays, and RADAR units-have facilitated richer environmental mapping and more robust situational awareness.

Regulatory environments have also experienced a paradigm shift, with governments worldwide formulating comprehensive frameworks to govern autonomous operations. These policies have stimulated industry collaboration on standardized testing protocols and certification processes, fostering interoperability and accelerating commercialization. Meanwhile, the convergence of telecommunications infrastructure and cloud computing has catalyzed the development of vehicle-to-everything communication, reinforcing safety and reliability.

As a result of these combined forces, market participants are reimagining the role of autopilot systems from isolated subsystems to integrated platforms that deliver seamless, end-to-end automation. This evolution underscores the growing convergence of hardware, software, and connectivity, which collectively drive the industry toward fully autonomous operations.

Assessing How United States Tariff Policies Implemented in 2025 Are Reshaping Supply Chains, Costs, and Competitive Strategies in Autopilot Markets

In 2025, the United States implemented targeted tariffs on critical electronic components, semiconductors, and sensor elements used in autopilot systems, prompting a cascade of adjustments across the supply chain. Manufacturers faced immediate cost pressures as major suppliers in Asia responded with price increases or capacity realignments. Consequently, many original equipment manufacturers (OEMs) reevaluated their sourcing strategies, forging partnerships with alternative vendors in Europe and North America to mitigate exposure to volatile tariff structures.

Beyond direct cost implications, the tariff environment spurred accelerated investments in domestic semiconductor fabrication and advanced sensor production. This shift encouraged collaborations between technology startups and established automotive and aerospace firms to co-develop resilient supply networks and shared manufacturing capabilities. Such alliances not only diffused the risk associated with trade policy fluctuations but also fostered innovation through localized research and development clusters.

Furthermore, procurement teams adopted predictive analytics to model tariff trajectories and optimize inventory levels, thereby maintaining operational continuity. Although the initial imposition of tariffs introduced uncertainty and disrupted established workflows, the industry’s adaptive measures have laid the groundwork for a more diversified and agile supply ecosystem that enhances long-term resilience.

Deep Dive into Autopilot System Segmentation Revealing Insights Across Component Types, Automation Levels, Applications, and End-Use Channels

When viewed through component type segmentation, the market divides into control systems comprising actuators, electronic control units, and powertrain systems; sensor arrays including cameras, GPS, IMU, LiDAR, RADAR, and ultrasonic sensors; and increasingly sophisticated software platforms that integrate these elements. Control system providers are concentrating on modular architectures that deliver scalable performance and seamless integration, while sensor developers are racing to enhance range, accuracy, and cost efficiency. Software innovators are concurrently advancing perception algorithms and decision-making engines to accommodate the expanding diversity of hardware inputs.

Applying autonomous level segmentation, the sector encompasses technologies ranging from Level 1 basic driver assistance to Level 5 fully autonomous operations. At lower levels, system enhancements focus on augmenting human performance through lane-keeping and adaptive cruise control. Mid-level automation solutions refine situational analysis and conditional autonomy, whereas high and full automation segments demand comprehensive failsafe mechanisms, sophisticated redundancy architectures, and validated machine-learning models capable of managing complex, real-world scenarios.

Examining application segmentation reveals distinct innovation trajectories across automotive, aviation, marine, and railroad domains. Automotive platforms address both commercial and passenger vehicle needs by emphasizing safety standards and user-experience enhancements. Aviation implementations span commercial aircraft, general aviation, and military contexts, each with unique certification requirements. Marine deployments include autonomous surface vehicles, larger ships, and specialized submarines that benefit from long-range navigation capabilities. Adding end-use segmentation of aftermarket services versus OEM partnerships highlights how channel strategies shape product lifecycle management and customer engagement models.

This comprehensive research report categorizes the Autopilot System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Autonomous Level

- Technology

- Application

- End-use

Analyzing Regional Variations in Autopilot System Adoption and Innovation Trends Across Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the development and uptake of autopilot systems. In the Americas, strategic investments in advanced manufacturing and a robust startup ecosystem are driving breakthroughs in sensor miniaturization and AI-driven control modules. North American regulatory agencies are collaborating closely with industry consortia to expedite certifications, while Latin American markets are exploring selective applications in agriculture and mining automation, leveraging remote-navigation solutions to overcome challenging terrains.

Within Europe, Middle East & Africa, diverse regulatory landscapes and varied infrastructure readiness levels present both opportunities and complexities. The European Union’s unified approach to autonomous vehicle legislation has galvanized cross-border pilot programs, whereas Gulf cooperation states are investing heavily in smart port and autonomous shipping initiatives. African markets, meanwhile, are focusing on cost-effective adaptations of autopilot systems for rail and road safety improvements, often integrating renewable energy sources to power connected infrastructure.

Asia-Pacific continues to serve as a leading hub for procurement and manufacturing, with major clusters in East Asia leveraging high-volume production and rapid prototyping capabilities. Governments across the region are championing national autonomy roadmaps that align with broader smart city and digital economy agendas. Collaborative testbeds in countries such as Japan, South Korea, and Australia facilitate rigorous validation under diverse environmental conditions, reinforcing the region’s strategic importance.

This comprehensive research report examines key regions that drive the evolution of the Autopilot System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Organizations Driving Innovation, Partnerships, and Competitive Positioning in the Global Autopilot Systems Market

Market leadership in autopilot systems is driven by companies that excel at integrating cross-disciplinary expertise in hardware engineering, AI algorithm development, and systems integration. Industry frontrunners have established dedicated research centers to pioneer breakthroughs in edge computing, sensor fusion, and fail-safe control protocols. These organizations often engage in strategic alliances with technology startups to access cutting-edge innovations, rapidly transitioning prototypes into commercial solutions.

Collaborative consortiums are another hallmark of leading companies, enabling shared investment in open architecture standards and interoperability frameworks. By contributing to industry-wide safety benchmarks and participating in government-sponsored pilot programs, these companies reinforce their competitive positioning and accelerate market readiness of next-generation autopilot functionalities. Simultaneously, forward-thinking manufacturers are pursuing vertical integration strategies that encompass in-house semiconductor production, proprietary sensor fabrication, and bespoke software platforms.

Despite these strengths, established players must navigate challenges related to escalating R&D costs, evolving regulatory demands, and intensifying competition from nimble new entrants. As a result, successful organizations are those that balance robust internal innovation pipelines with external partnerships to distribute risk and capitalize on emerging technological niches.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autopilot System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Anschütz GmbH

- Aurora Innovation Inc.

- Avidyne Corporation

- BAE Systems PLC

- Collins Aerospace by RTX Corporation

- ComNav Technology Ltd.

- DJI Technology Co., Ltd.

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- Honeywell International, Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- MicroPilot Inc.

- Moog Inc.

- Nvidia Corporation

- Raymarine by Teledyne Technologies Incorporated

- Robert Bosch GmbH

- Saab AB

- Safran S.A.

- Tesla Inc.

- Thales Group

- The Boeing Company

- TMQ International Pty Ltd

- UAV Navigation S.L. by Oesia Group

- Waymo LLC by Alphabet Inc.

- ZF Friedrichshafen AG

Strategic Recommendations for Industry Leaders to Navigate Market Complexities, Enhance Innovation, and Maximize Competitive Advantage in Autopilot Systems

Industry stakeholders seeking to maintain leadership in autopilot systems should prioritize investment in modular architectures that enable rapid component upgrades and customization. By designing systems around plug-and-play modules, companies can streamline integration across diverse vehicle platforms and reduce time to market. Additionally, embracing open interface standards will facilitate ecosystem interoperability, allowing third-party developers to contribute specialized capabilities without compromising system integrity.

Moreover, firms should cultivate partnerships with regional manufacturing hubs to establish resilient supply chains that can adapt swiftly to geopolitical shifts and trade policy changes. Joint ventures with contract manufacturers in key markets can optimize production costs and localize value-added activities, thereby securing preferential access to government incentives. Concurrently, embedding advanced analytics within procurement workflows will enhance visibility into cost drivers and support strategic sourcing decisions.

Finally, prioritizing human-machine interaction design and robust cybersecurity protocols will be essential as autonomy deepens. Engaging end users through iterative demo programs and soliciting real-time operational feedback will refine system usability, while comprehensive cybersecurity frameworks will safeguard against emerging digital threats, preserving system reliability and user trust.

Outlining the Comprehensive Research Approach Including Primary and Secondary Data Collection Techniques for Authoritative Market Insights

The research methodology underpinning this analysis integrates both primary and secondary data collection techniques to ensure comprehensive coverage and accuracy. Primary research encompassed in-depth interviews with key executives, engineers, and regulatory experts from leading OEMs, technology providers, and standardization bodies. These conversations yielded firsthand insights into emerging technical challenges, procurement strategies, and policy developments.

Complementing these interviews, the study leveraged a broad spectrum of secondary sources, including industry white papers, peer-reviewed journals, and government publications. Data triangulation was employed to validate findings across multiple channels, while thematic analysis techniques identified recurring patterns and critical inflection points. Advanced data synthesis tools processed quantitative inputs related to component shipments, patent filings, and pilot program outcomes, enabling the extraction of nuanced trends.

To enhance the report’s reliability, the methodology also incorporated scenario planning exercises that simulated market responses to potential regulatory shifts and technological breakthroughs. Sensitivity analyses further assessed the robustness of strategic recommendations under varying economic conditions and tariff environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autopilot System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autopilot System Market, by Component Type

- Autopilot System Market, by Autonomous Level

- Autopilot System Market, by Technology

- Autopilot System Market, by Application

- Autopilot System Market, by End-use

- Autopilot System Market, by Region

- Autopilot System Market, by Group

- Autopilot System Market, by Country

- United States Autopilot System Market

- China Autopilot System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Critical Conclusions on Autopilot System Evolution, Market Dynamics, and Strategic Imperatives for Sustained Industry Leadership

This analysis underscores the transformative potential of autopilot systems as they redefine operational paradigms across industries. From the integration of advanced sensor arrays and AI-driven control architectures to the adaptive responses prompted by changing tariff policies, the landscape is characterized by rapid evolution and strategic interdependence. Companies that align their innovation roadmaps with modular design principles, open standards, and resilient supply networks will be best positioned to capture emerging opportunities.

The segmentation insights reveal that success hinges on addressing the unique demands of each component type, automation level, application domain, and distribution channel. Meanwhile, regional perspectives highlight the importance of tailored strategies that reflect disparate regulatory frameworks and infrastructure maturities. Leading organizations demonstrate the power of cross-sector partnerships and proactive engagement with policy stakeholders while navigating complex market dynamics.

In conclusion, sustained industry leadership in autopilot systems demands a balanced focus on technological excellence, strategic alliances, and adaptive operational models. By synthesizing these imperatives, decision-makers can effectively chart a course toward fully autonomous solutions that deliver enhanced safety, efficiency, and customer value.

Encouraging Engagement with Associate Director to Secure Comprehensive Market Research Report and Unlock Actionable Insights on Autopilot Systems

For personalized guidance on leveraging these market insights and to secure the comprehensive report that will elevate your strategic planning efforts, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Connecting with him will grant you exclusive access to detailed data, actionable recommendations, and ongoing support as you navigate the evolving landscape of autopilot systems. Engage today to capitalize on emerging opportunities and stay ahead of the competition.

- How big is the Autopilot System Market?

- What is the Autopilot System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?