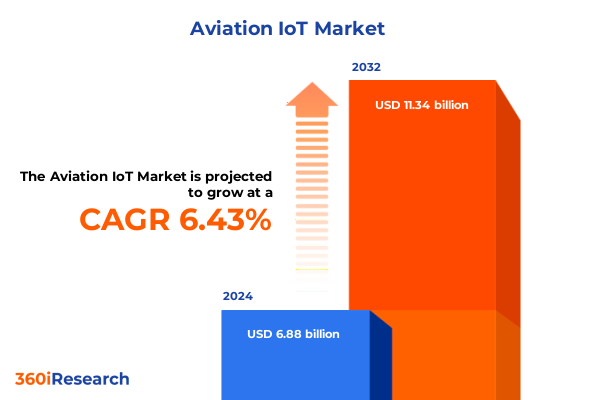

The Aviation IoT Market size was estimated at USD 7.25 billion in 2025 and expected to reach USD 7.64 billion in 2026, at a CAGR of 6.59% to reach USD 11.34 billion by 2032.

Unveiling the Role of Aviation IoT in Driving Next-Generation Efficiency Safety and Innovation Across the Global Aerospace Sector

The aerospace industry stands at an inflection point as the integration of Internet of Things technologies ushers in unprecedented capabilities that span from the ground to the stratosphere. Aviation IoT solutions are redefining aircraft operations by enabling seamless data exchange among sensors, ground stations, and cloud platforms, thereby transforming the way stakeholders manage fleets, maintain systems, and deliver passenger experiences. In this era of digital convergence, the ability to harness real-time data and predictive analytics has become a defining competitive edge for airlines, operators, and OEMs.

Moreover, the proliferation of high-bandwidth communication channels, including satellite links and next-generation cellular networks, has accelerated the adoption of connected aircraft architectures. These developments not only bolster safety and situational awareness but also empower in-flight entertainment and connectivity services, catering to evolving passenger expectations. As aviation ecosystems grow more complex, the intelligent orchestration of hardware, software, and services emerges as a critical success factor.

This executive summary provides a holistic overview of the transformative shifts, regulatory dynamics, segmentation nuances, regional trends, and key players shaping the Aviation IoT market. By exploring these dimensions, decision-makers will gain actionable insights to architect resilient technology roadmaps and optimize operational performance. The subsequent sections delve into each area in detail, illuminating the strategic imperatives and innovative opportunities that define the future of connected aviation.

Examining Disruptive Technological Paradigm Shifts Reshaping Aviation IoT Architecture From Edge Computing to AI-Driven Predictive Analytics

The Aviation IoT landscape has undergone a profound metamorphosis, driven by breakthroughs in edge computing, artificial intelligence, and advanced sensor integration. Edge devices installed across airframes and ground infrastructure now capture granular performance metrics and environmental parameters, enabling real-time anomaly detection and condition monitoring. This shift from centralized to decentralized data processing reduces latency and enhances the resiliency of critical systems, particularly in scenarios where immediate decision-making can avert operational disruptions or safety incidents.

Concurrently, AI-driven analytics platforms have matured to facilitate predictive maintenance workflows, leveraging machine learning models trained on historical and current flight data. By identifying early indicators of component fatigue and system degradation, operators can transition from reactive repair schedules to proactive service regimes, thereby extending asset lifecycles and improving uptime. In parallel, the convergence of LPWAN, 5G cellular, and satellite communication technologies has expanded coverage footprints, ensuring uninterrupted connectivity even in remote flight corridors.

Together, these disruptive paradigm shifts are redefining core aviation processes, from flight scheduling and crew management to in-flight entertainment and safety monitoring. As operators and OEMs recalibrate their technology strategies, the emphasis increasingly lies on modular, interoperable platforms that can evolve alongside regulatory standards and emerging cybersecurity requirements. The momentum generated by these transformative shifts sets the stage for a new era of resilient, data-driven aerospace operations.

Assessing the Ripple Effects of 2025 United States Import Tariffs on Aviation IoT Supply Chains Component Sourcing and Industry Dynamics

In 2025, the United States implemented targeted import tariffs on select IoT hardware components and satellite communication modules originating from key foreign suppliers. These measures aimed to bolster domestic manufacturing capabilities and safeguard critical supply chains, but they also introduced new cost considerations and sourcing complexities for aviation operators. In response, many companies have recalibrated their procurement strategies, seeking alternative suppliers, reshoring certain production segments, and negotiating volume-based pricing agreements to mitigate the impact of increased duties.

Despite the initial cost escalations, the tariff-driven realignment has stimulated investments in domestic technology partnerships and local ecosystem development. Component manufacturers and system integrators are forging alliances to co-develop next-generation sensors, gateways, and embedded systems, thereby reducing reliance on cross-border logistics and fostering greater control over quality assurance. However, this transition has not been seamless: lead times for critical edge devices have extended as new production lines scale, prompting some operators to revise maintenance schedules and inventory management protocols.

Looking ahead, aviation stakeholders are evaluating hybrid sourcing frameworks to balance cost efficiencies with supply chain resilience. By integrating nearshore suppliers and adopting digital twin simulations for inventory optimization, operators can adapt to evolving tariff regimes without compromising operational continuity. The cumulative effect of these regulatory shifts underscores the necessity for agile procurement models and close collaboration across the technology value chain.

Unraveling Strategic Insights from Multifaceted Aviation IoT Market Segmentation Across Applications Connectivity Platforms Components and User Verticals

A nuanced understanding of market segmentation is essential for tailoring IoT solutions to the diverse requirements of aviation stakeholders. When considering applications, asset tracking encompasses both fleet management and real-time tracking functionalities, enabling operators to maintain precise visibility over their assets while optimizing route planning. Flight operations management spans pre-flight crew assignments through dynamic flight scheduling, streamlining resource utilization and enhancing on-time performance. Predictive maintenance, through anomaly detection and condition monitoring, elevates safety and reliability, while in-flight entertainment and safety monitoring platforms enrich passenger experiences and regulatory compliance.

Connectivity technologies delineate another critical axis of segmentation. Cellular communication networks, ranging from 3G through 5G, offer varying trade-offs between bandwidth and coverage, whereas LPWAN solutions deliver low-power, long-range connectivity suited for sensor telemetry. Satellite communication, across GEO, LEO, and MEO constellations, bridges global coverage gaps, ensuring seamless data flows during oceanic and remote operations. Wi-Fi continues to serve short-range, high-bandwidth passenger services, reinforcing cabin connectivity and infotainment ecosystems.

Platform segmentation reflects the heterogeneity of the aviation fleet. Business jets, spanning very light to large-cabin variants, prioritize bespoke connectivity and personalized cabin management systems. Commercial aircraft, from narrow-body short-haul airliners to wide-body long-haul fleets, demand scalable IoT architectures capable of supporting hundreds of simultaneous data streams. Helicopters and unmanned aerial vehicles introduce unique payload constraints and mission profiles, necessitating lightweight, resilient sensor arrays and adaptive communication modules.

Component type and service-based segmentation further define the market landscape. Hardware categories, including edge devices, gateways, and sensors, serve as the physical interface for data capture and transmission. Services such as consulting, maintenance, and system integration foster end-to-end solution delivery, while software suites for analytics and fleet management translate raw data into actionable insights. Finally, end-user segmentation-ranging from cargo operators and commercial airlines to military, defense, and private operators-demonstrates the broad applicability and customization potential of IoT deployments across the aviation spectrum.

This comprehensive research report categorizes the Aviation IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connectivity Technology

- Platform

- Component Type

- Application

- End User

Highlighting Regional Dynamics and Growth Drivers in the Aviation IoT Ecosystem Across the Americas EMEA and Asia-Pacific Landscapes

Regional dynamics in Aviation IoT adoption reveal distinct growth drivers and regulatory landscapes. In the Americas, advanced infrastructure investments and a robust MRO ecosystem have accelerated the uptake of predictive maintenance solutions, while North American carriers lead the charge in integrating real-time tracking and in-flight connectivity platforms. Moreover, policy frameworks emphasizing domestic manufacturing have prompted collaborations between technology providers and local supply chains, fostering a vibrant innovation ecosystem focused on enhancing fleet reliability and operational efficiency.

Meanwhile, Europe, Middle East & Africa present a mosaic of regulatory harmonization efforts and connectivity initiatives. European aviation authorities have prioritized cybersecurity mandates and data privacy regulations, compelling operators to adopt comprehensive security architectures. In the Gulf region, ambitious airport expansion programs and emerging national carriers have catalyzed demand for advanced IoT-based passenger experience platforms, including biometric boarding and personalized cabin services. Across Africa, the emphasis on affordable, low-power communication technologies has bolstered LPWAN and satellite connectivity projects to address infrastructure challenges.

Asia-Pacific markets exhibit some of the most dynamic growth trajectories, driven by rapid fleet modernization and expanding intra-regional travel. Airlines and general aviation operators in major economies are investing heavily in 5G-enabled edge computing solutions and AI analytics platforms to manage dense air traffic corridors. Additionally, partnerships between regional satellite operators and aviation technology firms have unlocked novel service offerings, from real-time weather monitoring to remote operations management, suited to the region’s diverse geographical and meteorological conditions.

This comprehensive research report examines key regions that drive the evolution of the Aviation IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers in Aviation IoT Featuring Strategies Partnerships and Technological Breakthroughs

Key market participants have distinguished themselves through strategic partnerships, product innovation, and integrated service offerings. Leading aerospace OEMs have embedded IoT platforms within airframe systems, delivering native connectivity solutions that streamline data capture and transmission. Simultaneously, specialized software vendors have developed advanced analytics engines capable of processing terabytes of flight data to generate maintenance advisories and performance benchmarks.

Connectivity providers have expanded their footprints by launching dedicated aviation-grade networks, offering hybrid communication models that blend terrestrial and satellite coverage. These initiatives have strengthened network resilience and reduced latency, catering to both flight-critical applications and passenger services. On the hardware front, sensor manufacturers and gateway vendors continue to refine power-efficient, ruggedized devices tailored to the aviation environment, focusing on miniaturization and modular design to accommodate diverse platform requirements.

Furthermore, consulting and systems integration firms have played a pivotal role in orchestrating end-to-end solutions, guiding operators through digital transformation roadmaps and ensuring compliance with evolving safety and cybersecurity standards. Through collaborative ecosystems and open architecture frameworks, these companies have accelerated the deployment of holistic IoT solutions, underscoring the importance of interoperability and scalable design principles in modern aviation operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astronics Corporation

- Cisco Systems, Inc.

- Garmin Ltd.

- General Electric Company

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Panasonic Avionics Corporation

- Raytheon Technologies Corporation

- Safran SA

- Thales Group

- Viasat, Inc.

Delivering Practical Strategic Roadmaps to Enhance Operational Efficiency Resilience and Competitive Advantage in the Aviation IoT Sector

Industry leaders should prioritize the development of interoperable platforms that seamlessly integrate edge sensors, data pipelines, and analytics engines. By adopting open architecture frameworks and standardized communication protocols, organizations can facilitate modular upgrades and future-proof their IoT investments. Moreover, forging strategic alliances with telecommunications providers, satellite operators, and software vendors will be essential for constructing resilient, multi-layered connectivity infrastructures that span global flight routes.

In parallel, investing in cybersecurity measures at both the network and device levels must remain a top priority. Implementing zero-trust models, end-to-end encryption, and real-time threat intelligence loops will help safeguard mission-critical systems against emerging cyber threats. Equally important is the cultivation of an enterprise-wide data governance strategy, ensuring that data quality, privacy, and regulatory compliance are upheld across all stages of the IoT lifecycle.

Leaders should also shift toward performance-based service agreements with MRO providers and technology integrators, aligning incentives around uptime targets and operational KPIs. Embracing AI-powered decision support tools and digital twins can further optimize maintenance workflows and crew scheduling, driving measurable gains in efficiency and cost control. Finally, by championing a culture of continuous innovation and leveraging pilot programs, organizations can rapidly validate emerging technologies, scale successful proofs of concept, and maintain a competitive edge in the fast-evolving aviation IoT domain.

Outlining Rigorous Data Collection Analysis and Validation Methodology Underpinning Comprehensive Aviation IoT Market Research

Our research methodology combined extensive primary and secondary data collection to capture the multifaceted dynamics of the Aviation IoT market. Primary insights were garnered through in-depth interviews with senior executives from airlines, OEMs, regulatory bodies, and technology providers, ensuring a diversified spectrum of perspectives. These qualitative inputs were complemented by detailed surveys targeting operational managers, IT architects, and maintenance teams to quantify adoption patterns and implementation challenges.

Secondary data sources included industry white papers, regulatory filings, trade association reports, and select academic publications. We employed rigorous data triangulation techniques to validate findings, cross-referencing multiple sources to ensure consistency and accuracy. Advanced analytical frameworks, such as SWOT analysis and Porter’s Five Forces, were leveraged to assess market drivers, competitive landscapes, and regulatory headwinds. Additionally, technology roadmapping sessions and vendor scoring models facilitated comparative evaluations of IoT solution providers.

Throughout the research process, stringent quality assurance protocols were maintained, involving peer reviews, data validation checks, and stakeholder feedback loops. This comprehensive approach underpins the credibility of our insights and equips decision-makers with a reliable foundation for strategic planning in the Aviation IoT arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation IoT Market, by Connectivity Technology

- Aviation IoT Market, by Platform

- Aviation IoT Market, by Component Type

- Aviation IoT Market, by Application

- Aviation IoT Market, by End User

- Aviation IoT Market, by Region

- Aviation IoT Market, by Group

- Aviation IoT Market, by Country

- United States Aviation IoT Market

- China Aviation IoT Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Strategic Insights to Navigate Future Challenges and Opportunities in the Aviation IoT Landscape

The convergence of advanced connectivity, edge computing, and AI analytics is redefining the capabilities of aviation organizations, enabling them to achieve unprecedented levels of operational efficiency, safety, and passenger satisfaction. As regulatory landscapes evolve and supply chain dynamics shift in response to tariff policies, stakeholders must remain agile, leveraging modular architectures and resilient procurement strategies to sustain competitive momentum.

Moreover, targeted investments in cybersecurity, data governance, and strategic partnerships will be instrumental in unlocking the full potential of IoT deployments. By embracing a culture of continuous innovation and deploying pilot initiatives that demonstrate clear ROI, operators can accelerate the adoption of transformative technologies. The insights presented in this summary underscore the importance of a holistic approach-one that integrates hardware, software, and services into a unified ecosystem designed for scalability and adaptability.

In closing, the Aviation IoT landscape offers a wealth of opportunities for forward-thinking organizations to differentiate themselves within the industry. Those that strategically align their technology roadmaps with emerging trends, regulatory requirements, and end-user expectations will be best positioned to navigate the complex terrain ahead and secure lasting growth and resilience.

Seize Critical Competitive Advantages Today by Partnering with Ketan Rohom to Secure Comprehensive Aviation IoT Market Intelligence and Strategic Growth

If your organization is ready to transcend conventional boundaries in aviation technology and harness the full potential of IoT-driven insights, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly with Ketan, you can access tailored guidance on integrating these research findings into your strategic planning, while also securing exclusive access to our comprehensive market research report. Take decisive action today to unlock the critical competitive advantages necessary for sustainable growth and enduring success in the rapidly evolving aviation IoT landscape.

- How big is the Aviation IoT Market?

- What is the Aviation IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?