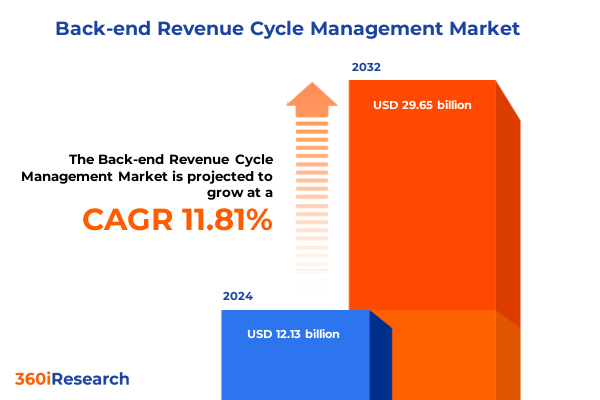

The Back-end Revenue Cycle Management Market size was estimated at USD 13.42 billion in 2025 and expected to reach USD 14.85 billion in 2026, at a CAGR of 11.98% to reach USD 29.65 billion by 2032.

Exploring the Crucial Role of Back-End Revenue Cycle Management in Enhancing Healthcare Financial Operations and Organizational Performance

Back-end revenue cycle management stands as a pivotal function in today’s healthcare ecosystem, serving as the backbone that supports financial viability and clinical excellence. At its core, this discipline integrates multiple operational processes-from claims submission through denial management and payment collection-to ensure that healthcare providers maintain a steady revenue inflow while delivering high-quality patient care. By adopting a holistic approach that aligns clinical audits, coding accuracy, and seamless patient access, organizations can transform administrative burden into strategic advantage.

The evolution of this market reflects a convergence of technological innovation, regulatory evolution, and increasing pressures on healthcare finances. Providers now face heightened expectations to deliver cost-efficient services without compromising patient experience. Meanwhile, the complexity of payer requirements and reimbursement models has intensified the need for robust revenue cycle infrastructure. In response, leading institutions are embracing sophisticated analytics, automated workflows, and integrated platforms to drive transparency, accelerate cash flow, and mitigate operational risk.

Uncovering the Paradigm Shifts Revolutionizing Back-End Revenue Cycle Management Through Technological Innovation and Policy Evolution in Healthcare Delivery

Healthcare delivery is undergoing transformative shifts driven by the convergence of automation, artificial intelligence, and value-based care imperatives, fundamentally reshaping back-end revenue cycle processes. As payers pivot toward outcome-based reimbursement, providers must adopt intelligent adjudication engines that evaluate claims against clinical data in real time. Machine learning algorithms now assist in predictive denial management by flagging high-risk claims prior to submission, thereby reducing write-offs and accelerating reimbursements. Concurrently, robotic process automation has streamlined repetitive tasks such as eligibility verification and payment posting, freeing up skilled staff to focus on exception handling and strategic initiatives.

In parallel, regulatory changes continue to redefine operational requirements, with interoperability mandates enforcing the secure exchange of patient data across platforms. This has prompted the integration of claims management systems with electronic health records, ensuring that clinical documentation aligns seamlessly with billing codes. Furthermore, the shift toward patient-centric care has introduced new dynamics, as providers enhance transparency through patient portals that offer real-time invoice tracking and payment options. Together, these forces have elevated back-end revenue cycle management from a transactional function to a transformative lever for organizational growth.

Equally significant is the growing role of cloud-based architectures, which enable scalable deployments and rapid configuration in response to evolving payer rules. Hybrid cloud solutions, in particular, allow large health systems to maintain sensitive patient and financial records on-premises while leveraging public cloud services for advanced analytics and workflow orchestration. This hybrid approach fosters agility, cost containment, and compliance with data sovereignty requirements, positioning revenue cycle leaders to capitalize on continuous innovation without disrupting established governance frameworks.

Assessing the Broad Implications of Recent United States Tariff Measures on 2025 Healthcare Revenue Cycle Management Infrastructure and Costs

The imposition of new tariff measures by the United States in early 2025 has exerted significant pressure on the cost structures of revenue cycle management solutions, particularly those reliant on imported hardware components and offshore service providers. Equipment essential for on-premises server infrastructure, such as networking routers and specialized storage arrays sourced from international suppliers, has seen direct cost escalation. This trend has accelerated the migration toward cloud-native revenue cycle platforms, where capital expenditure on hardware is replaced by subscription-based operating expenses, mitigating exposure to geopolitical and trade fluctuations.

Moreover, tighter margins arising from increased import duties have compelled service bureaus to reassess offshore coding and claims adjudication contracts. Organizations with operations in regions subject to heightened tariffs are now diversifying vendor portfolios to include nearshore and domestic partners, ensuring supply chain resilience and predictable cost management. These strategic adjustments underscore the broader imperative of balancing operational efficiency with fiscal prudence, reinforcing the value of integrated platforms that can dynamically allocate workloads across global and local resources in response to tariff volatility.

Revealing Critical Insights From Multidimensional Segmentation That Illuminate Back-End Revenue Cycle Management Market Dynamics Across Service and Deployment Profiles

A nuanced understanding of the back-end revenue cycle management landscape emerges when exploring service type segmentation, which encompasses auditing services, billing and payment, claims management, coding management, and patient access services. Within auditing services, clinical audits and compliance audits offer complementary value by ensuring documentation accuracy and regulatory adherence. The billing and payment sphere, differentiated by electronic billing and payment collections, drives efficiency through automation of invoicing and payment posting. Claims management, with its claim submission and denial management facets, enhances recovery rates by optimizing submission workflows and proactive appeals. In coding management, specialized domains in anesthesia, clinical, and surgical coding reflect the granularity required to capture complex case mix indices. Finally, patient access services in insurance verification, patient scheduling, and pre-registration elevate front-end engagement to reduce downstream denials and expedite revenue capture.

When evaluating end users, ambulatory surgical centers, hospitals, and physician practices each present distinct priorities. Ambulatory surgical centers demand lightweight, fast-deploying billing solutions that support high-volume procedural workflows. Hospitals require comprehensive platforms integrated with enterprise resource planning and clinical documentation systems to manage diverse service lines and payer portfolios. Physician practices prioritize user-friendly interfaces and robust insurance verification tools to streamline patient check-in and reduce administrative overhead.

Deployment preferences further refine market dynamics, as cloud-based solutions gain traction for their scalability and reduced maintenance burden, hybrid solutions deliver a balance of control and flexibility, and on-premises solutions continue to serve large enterprises with stringent data governance and integration requirements. Organization size segmentation highlights divergent needs: large enterprises seek enterprise-grade feature sets and global deployment capabilities, medium enterprises value flexible pricing models and modular functionality, whereas small enterprises favor turnkey solutions with minimal IT support demands.

Components segmentation outlines a dual focus on services and software, where consulting and integration services enable seamless adoption and optimization, and healthcare billing software and revenue cycle management software deliver core functional capabilities. Application segmentation spans administrative, clinical, and financial applications, tying hospital administration and patient scheduling to front-end efficiency, clinical workflow management and patient data management to compliance and documentation quality, and claims processing and revenue management to financial performance. Each segmentation dimension offers strategic insight into evolving buyer preferences, technology adoption patterns, and service expectations.

This comprehensive research report categorizes the Back-end Revenue Cycle Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Components

- Application

- End User

- Deployment Type

- Organization Size

Analyzing Regional Patterns and Divergent Trends Across the Americas Europe Middle East Africa and Asia-Pacific in Back-End Revenue Cycle Management Adoption

Regional landscapes in back-end revenue cycle management exhibit distinct trajectories, reflecting regulatory frameworks, healthcare infrastructure maturity, and digital transformation initiatives. The Americas leverage established payer systems and robust reimbursement models, driving widespread adoption of end-to-end platforms. In the United States, value-based programs incentivize providers to invest in analytic capabilities that optimize care pathways and revenue outcomes. Canada, with its publicly funded system, focuses on interoperability and cost containment, spurring demand for solutions that integrate provincial health records with financial modules.

In Europe, the Middle East, and Africa, disparate regulatory environments and funding mechanisms shape adoption patterns. Western European nations are advancing centralized health data exchanges and promoting compliance with stringent data privacy protocols, which necessitate advanced security features in revenue cycle platforms. Meanwhile, the Gulf Cooperation Council is channeling significant investment into healthcare infrastructure, creating opportunities for cloud-based and hybrid deployments. Sub-Saharan Africa presents both challenges and potential, where solutions must accommodate variable connectivity and deliver offline-capable functionalities to support rural and urban providers alike.

The Asia-Pacific region combines rapid digital adoption with diverse market maturity. Countries like Australia and New Zealand have integrated advanced electronic health record ecosystems, enabling sophisticated claims adjudication and revenue analytics. In Southeast Asia and India, burgeoning private healthcare networks seek scalable, cost-effective platforms that can be deployed across multisite operations. China’s evolving regulatory climate and emphasis on domestic digital sovereignty are fostering growth in locally developed solutions that cater to national standards and language requirements.

This comprehensive research report examines key regions that drive the evolution of the Back-end Revenue Cycle Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting the Strategic Positioning and Innovative Initiatives of Leading Companies Shaping the Back-End Revenue Cycle Management Ecosystem

Industry leaders have pursued differentiated strategies to capture value in the back-end revenue cycle management domain. Established providers have focused on expanding cloud-native offerings and embedding AI-driven capabilities within their core platforms. Strategic partnerships and acquisitions have enabled these players to augment functionality in areas such as denial analytics, patient financial engagement, and real-time claims adjudication. At the same time, emerging specialists have carved niches by delivering modular, microservice-based solutions that address specific workflow bottlenecks and integrate seamlessly with broader healthcare IT ecosystems.

Investment in R&D has become a hallmark of leading companies, with significant allocation toward machine learning models that refine coding accuracy and predictive reimbursement risk scoring. Organizations have also bolstered professional service arms to support implementation, change management, and ongoing optimization. This consultative approach ensures that clients not only deploy technology effectively but also adapt organizational processes and talent capabilities to maximize return on their investment.

Additionally, market contenders are differentiating through customer-centric capabilities such as patient payment estimation tools and mobile-enabled dashboards for executive oversight. The integration of third-party data sources, including social determinants of health and patient satisfaction metrics, has enabled providers to adopt a more holistic revenue cycle strategy that aligns financial outcomes with quality and engagement objectives. As competitive intensity escalates, companies with the agility to innovate rapidly and maintain high service quality will consolidate their leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Back-end Revenue Cycle Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACU-SERVE CORP

- Allzone Management Services Inc.

- Ascribe Healthcare Solutions Pvt. Ltd.

- Athenahealth, Inc.

- Calpion Inc

- CodaMetrix, Inc.

- Cognizant Technology Solutions Corporation

- Conifer Health Solutions, LLC

- Currance Inc.

- eClinicalWorks, LLC

- EnableComp LLC

- Enter Inc.

- Epic Systems Corporation

- Experian Information Solutions, Inc.

- FinThrive

- Forcura, LLC

- GE HealthCare Technologies Inc.

- GeBBS Healthcare Solutions, Inc.

- Hexplora

- JK TECH

- KG Invicta Services Private Limited

- Nath Healthcare

- NXGN Management, LLC

- Optum, Inc.

- Oracle Corporation

- PayrHealth, LLC

- Quest Diagnostics Incorporated

- R1 RCM, Inc.

- The SSI Group

- Veradigm LLC

- Waystar Health

- WebPT, Inc.

Delivering Actionable Strategic Guidance for Healthcare Executives to Optimize Back-End Revenue Cycle Management and Drive Organizational Value Creation

Healthcare executives should prioritize the adoption of cloud-based revenue cycle platforms that support seamless scalability and reduce capital expenditures, while carefully architecting hybrid deployments to balance data sovereignty and performance requirements. By implementing advanced automation tools, organizations can eliminate manual touchpoints in eligibility verification and payment posting, reallocating staff to analytical and patient-centric roles that drive revenue resilience and satisfaction.

It is essential to integrate artificial intelligence and predictive analytics into claims management workflows to proactively identify denial risk and automate appeals. Providers should engage in strategic partnerships with specialized service bureaus that offer deep domain expertise in coding and compliance, thereby augmenting in-house capabilities and ensuring adherence to evolving regulatory requirements.

Leaders must cultivate cross-functional governance structures that align revenue cycle, clinical documentation, and IT teams around shared performance metrics. This collaborative model fosters a culture of continuous improvement, enabling rapid iteration of denial reduction strategies and process refinements. Further, investing in workforce development programs that upskill staff on new technologies and regulatory changes will sustain high levels of productivity and reduce turnover.

Finally, benchmarking performance against peer institutions and leveraging comprehensive data dashboards will enable organizations to track progress in net revenue collection, days in accounts receivable, and denial rates. Such visibility empowers decision-makers to adapt tactics swiftly, ensuring that revenue cycle management remains a competitive advantage rather than a cost center.

Detailing the Rigorous Mixed-Method Research Framework Employed to Ensure Robust and Objective Insights Into Back-End Revenue Cycle Management Practices

The research methodology applied to this analysis combined primary and secondary data collection, ensuring a balanced perspective grounded in real-world practices and comprehensive literature. Primary insights were gathered through in-depth interviews with senior revenue cycle leaders, coding specialists, and IT architects from a diverse cross-section of healthcare providers, capturing firsthand experiences with platform adoption and process transformation. Concurrently, a detailed review of industry white papers, regulatory documents, and peer-reviewed studies provided context on emerging technologies, interoperability mandates, and payer trends.

Quantitative data analysis involved evaluating anonymized client performance metrics across multiple deployments, focusing on key operational indicators such as claim denial rates, speed of adjudication, and patient payment cycles. Qualitative assessments incorporated scenario-based evaluations of deployment models-cloud, hybrid, and on-premises-to ascertain governance, security, and total cost of ownership considerations. This mixed-method approach enabled the triangulation of findings, validating strategic insights and informing tailored recommendations that address the multifaceted challenges of modern revenue cycle management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Back-end Revenue Cycle Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Back-end Revenue Cycle Management Market, by Service Type

- Back-end Revenue Cycle Management Market, by Components

- Back-end Revenue Cycle Management Market, by Application

- Back-end Revenue Cycle Management Market, by End User

- Back-end Revenue Cycle Management Market, by Deployment Type

- Back-end Revenue Cycle Management Market, by Organization Size

- Back-end Revenue Cycle Management Market, by Region

- Back-end Revenue Cycle Management Market, by Group

- Back-end Revenue Cycle Management Market, by Country

- United States Back-end Revenue Cycle Management Market

- China Back-end Revenue Cycle Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Highlight the Transformative Impact of Back-End Revenue Cycle Management on Healthcare Financial Sustainability and Efficiency

The synthesis of technological advances, regulatory pressures, and shifting care delivery models underscores the pivotal role of back-end revenue cycle management in sustaining healthcare financial health. From cloud-native architectures that mitigate tariff risks to AI-powered denial prevention, the capabilities examined in this report demonstrate how providers can navigate complexity and secure financial stability while maintaining patient-centric operations. Segmentation insights reveal that a one-size-fits-all approach no longer suffices; instead, tailored solutions aligned with service type, end-user context, and deployment preferences are essential.

Regional variations further highlight the need for adaptive strategies that consider local regulatory landscapes and infrastructure maturity. Leading companies have illustrated paths to success through strategic innovation and service excellence, while the recommended actionable steps offer a clear blueprint for executives seeking to enhance operational efficiency and revenue integrity. As healthcare continues to evolve, organizations that embrace these comprehensive insights and methodologies will be best positioned to unlock value from their revenue cycle investments.

In conclusion, this executive summary provides a cohesive narrative of the forces shaping back-end revenue cycle management. By understanding the interconnected drivers and deploying targeted solutions, healthcare providers can transform revenue cycle functions into a strategic lever that supports long-term viability and patient care objectives.

Engage With Associate Director Sales and Marketing to Secure Exclusive Access to the Comprehensive Back-End Revenue Cycle Management Market Research Report

To explore the intricacies of back-end revenue cycle management and gain tailored intelligence that will inform your strategic planning, reach out to Associate Director, Sales and Marketing Ketan Rohom. His expertise in aligning detailed market insights with organizational objectives will ensure you obtain actionable recommendations and competitive differentiation. Engage directly to secure customized data, unlock exclusive analysis, and make informed investment decisions that drive financial resilience and operational excellence.

- How big is the Back-end Revenue Cycle Management Market?

- What is the Back-end Revenue Cycle Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?