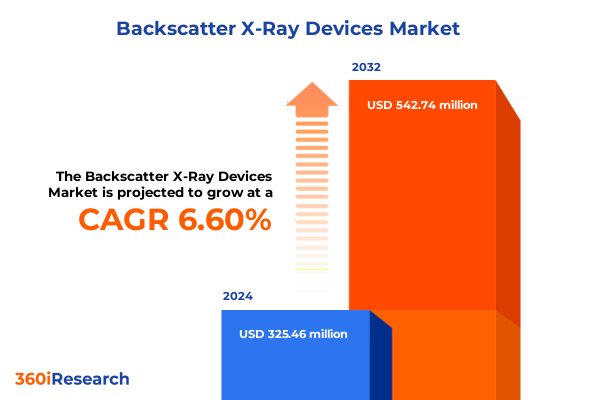

The Backscatter X-Ray Devices Market size was estimated at USD 346.18 million in 2025 and expected to reach USD 369.56 million in 2026, at a CAGR of 6.63% to reach USD 542.73 million by 2032.

Unveiling the Pivotal Role of Backscatter X-Ray Technology in Revolutionizing Safety, Security, and Non-Destructive Inspection Across Global Industries

Backscatter X-ray devices have emerged as a transformative force in inspection and security, ushering in new levels of visibility and anomaly detection that were once considered unattainable. By harnessing low-energy X-ray photons that scatter off surfaces and objects, these systems provide a non-intrusive means to visualize concealed threats, structural defects, and quality variances without penetrating through dense materials. As industries from aviation to oil and gas embrace more stringent safety standards, the ability to detect minute irregularities in luggage, pipelines, and medical instruments has become critical to operational integrity and public trust.

The evolution of backscatter X-ray technology is underpinned by advances in detector sensitivity, image processing algorithms, and portable system design. Fixed backscatter X-ray scanners stationed at security checkpoints handle high throughput demands, whereas handheld backscatter X-ray scanners enable agile, on-the-spot inspections for law enforcement and industrial maintenance. Continuous innovation is being driven by dual-energy and multi-view imaging approaches, alongside single-sided devices suited for rapid screening scenarios.

Regulatory agencies worldwide have recognized the heightened efficacy of backscatter X-ray systems, integrating them into mandatory inspection protocols for airports, critical infrastructure, and customs operations. This endorsement, coupled with growing concerns over public safety and asset protection, has elevated the technology from specialized applications toward widespread adoption. As a result, stakeholders across government, healthcare, transportation, and industrial sectors are evaluating how to integrate these systems within existing workflows to maximize detection accuracy and throughput efficiency.

Tracing the Transformative Shifts in Backscatter X-Ray Deployment Shaping Inspection Efficiency and Security Protocols Globally

Over the past decade, backscatter X-ray devices have transitioned from niche detection instruments into core components of security and inspection paradigms-an evolution fueled by both technological breakthroughs and shifting threat landscapes. The early reliance on single-sided backscatter imaging has given way to sophisticated multi-view deployments that capture detailed perspectives, enabling rapid three-dimensional reconstructions of inspected objects. Dual-energy systems now differentiate between organic and inorganic materials, empowering operators to identify concealed explosives, contraband, or structural defects with greater precision.

Simultaneously, the miniaturization of hardware and the integration of advanced image processing software have propelled handheld backscatter X-ray scanners into prominence. Compact form factors and simplified user interfaces have democratized access, allowing first responders and field technicians to conduct on-the-spot inspections that previously required bulky stationary units. This mobility has proven essential in emergency scenarios where time and flexibility are paramount.

Integration with artificial intelligence and machine learning algorithms represents the latest frontier in backscatter X-ray evolution. Automated anomaly detection and predictive maintenance capabilities are being incorporated to reduce operator fatigue and enhance throughput. Moreover, collaborative platforms linking device outputs to centralized analytics engines are enabling cross-site data aggregation, which supports continuous improvement of detection protocols and risk profiling. These transformative shifts underscore the technology’s progression from static scanners to dynamic, intelligent inspection ecosystems.

Analyzing the Cumulative Impact of 2025 United States Tariffs on the Backscatter X-Ray Device Supply Chain and Cost Structures

In 2025, the United States implemented a series of tariffs targeting imported backscatter X-ray components and finished systems, a move intended to bolster domestic manufacturing but which introduced notable cost implications throughout the supply chain. Essential parts such as detectors, high-voltage generators, and specialized shielding materials faced additional import duties, prompting original equipment manufacturers to reassess sourcing strategies and negotiate alternative supplier agreements. This reconfiguration elevated production expenses, which were subsequently passed on to end users and service providers.

While some domestic manufacturers accelerated investments in local production capacity to capture tariff-induced opportunities, the ramp-up required retooling and workforce training that extended lead times. Consequently, delivery schedules for newly ordered fixed and handheld scanners experienced intermittent delays. For industries reliant on tight maintenance windows-such as pipeline inspection teams and airport security operators-these timing fluctuations introduced operational friction that reverberated through maintenance cycles and security readiness.

In response, many organizations opted to retrofit existing backscatter X-ray units with upgraded software and replaceable detector modules, rather than procure entirely new systems at elevated prices. This trend toward modernization over replacement underscored the importance of modular design and aftermarket support. As import duties remain subject to political negotiation, stakeholders continue to monitor tariff reviews closely, seeking clarity on potential phase-downs or reciprocal measures from key trading partners.

Deriving Key Insights from Market Segmentation of Backscatter X-Ray Devices Across Types, Technologies, and Applications for Targeted Strategy

A granular examination of market segmentation reveals critical pathways for strategic positioning across diverse backscatter X-ray device categories. Solutions fall into two principal form factors: fixed backscatter X-ray scanners that anchor high-volume screening portals, and handheld backscatter X-ray scanners that facilitate agile inspections in constrained or mobile contexts. Strategic differentiation emerges as manufacturers emphasize ease of deployment, maintenance cycles, and user training requirements tailored to each modality.

Underpinning these form factors are distinct imaging technologies. Dual-energy backscatter systems leverage varying photon energies to discern material composition, optimizing threat detection in high-security environments. Multi-view backscatter systems capture multiple angles simultaneously, supporting comprehensive inspections in industrial quality assurance. Single-sided backscatter imaging offers streamlined workflows in rapid screening scenarios, trading depth for portability. By aligning product roadmaps with the operational nuances of each technology tier, vendors can address both broad-spectrum security mandates and specialized nondestructive testing tasks.

Applications of backscatter X-ray devices span industrial inspection, medical applications, and security and screening domains. Within industrial inspection, nondestructive testing, pipeline and structural inspection, and product quality assurance illustrate how backscatter imaging enhances asset integrity management and failure prevention. Medical applications encompass diagnostic imaging enhancements and radiation therapy support, where the noninvasive insights of backscatter complement conventional radiography. Security and screening segments extend from airport security checkpoints to border security posts, customs and cargo inspections, and public event screening operations, each with unique throughput, power, and regulatory requirements.

Finally, end-user industries-including commercial enterprises, government agencies, healthcare institutions, industrial operators, and transportation networks-exhibit varied adoption drivers and budgetary cycles. Commercial entities prioritize cost-effective risk mitigation, government bodies focus on compliance and public safety, healthcare facilities weigh patient comfort and image clarity, industrial firms demand ruggedized performance, and transportation systems require seamless integration with existing infrastructure. Tailoring product features and service offerings to these sectors enhances market resonance and long-term customer loyalty.

This comprehensive research report categorizes the Backscatter X-Ray Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End-User Industry

Uncovering Critical Regional Dynamics Influencing Adoption and Innovation Trajectories in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption trajectory and innovation footprint of backscatter X-ray devices across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, regulatory frameworks established by agencies such as the Transportation Security Administration have driven widespread deployment of fixed and handheld systems at airports, seaports, and transportation hubs. Concurrently, robust oil and gas infrastructure projects in North and South America have spurred demand for pipeline and structural inspection capabilities, reinforcing the region’s status as a mature yet evolving market.

Across Europe, the Middle East & Africa, stringent safety and environmental regulations have catalyzed technology upgrades in border security and customs screening. European Union directives aimed at harmonizing cross-border security standards have encouraged public-private partnerships and equipment modernization programs. In the Middle East, rapid infrastructure development combined with heightened event security needs has accelerated procurement of advanced imaging solutions. Africa’s adoption remains nascent but displays significant potential, driven by expanding transportation corridors and resource extraction initiatives.

In the Asia-Pacific region, burgeoning trade volumes and large-scale construction activities underpin growth in industrial inspection applications, while expanding air travel and maritime traffic bolster security screening deployments. Nations such as Japan and Australia prioritize dual-energy and multi-view capabilities for advanced material identification, whereas emerging markets in Southeast Asia concentrate on cost-effective, single-sided systems to address basic screening requirements. A diverse regulatory environment across the region underscores the need for adaptable solutions that balance performance, price, and compliance.

This comprehensive research report examines key regions that drive the evolution of the Backscatter X-Ray Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Leading Companies Driving Innovations and Competitive Differentiation in the Global Backscatter X-Ray Device Market

Major players in the backscatter X-ray device arena are demonstrating differentiated approaches to capturing market share through product innovation, strategic partnerships, and targeted expansions. One leading provider has focused on integrating artificial intelligence into its dual-energy platforms, enabling automated threat recognition algorithms that reduce manual interpretation and enhance throughput in high-traffic environments. Another competitor has leveraged multi-view backscatter systems in collaboration with industrial equipment manufacturers, embedding imaging modules directly into nondestructive testing rigs for seamless operational workflows.

Emerging companies are carving out niches with lightweight handheld units tailored for law enforcement and emergency response applications, emphasizing ergonomic designs and rapid image processing. Several established defense contractors have entered the commercial arena, leveraging their expertise in ruggedized hardware to offer backscatter X-ray solutions capable of withstanding extreme field conditions. Additionally, select vendors are investing in cloud-based analytics platforms that aggregate inspection data across multiple sites, fostering predictive maintenance and condition monitoring capabilities.

Strategic alliances between device manufacturers and software providers are also advancing integrated ecosystems that encompass hardware, image analytics, and maintenance services. These collaborations not only streamline procurement and support but also facilitate continuous upgrades via over-the-air software releases. Collectively, these company-level initiatives underscore a competitive landscape defined by technological leadership, service innovation, and cross-sector partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Backscatter X-Ray Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Science and Engineering, Inc.

- Amptek Inc.

- analyticon instruments gmbh

- Astrophysics Inc.

- Autoclear LLC

- FLIR Systems, Inc.

- Gilardoni S.p.A

- Lancs Industries

- LAURUS Systems, Inc.

- Leidos Holdings, Inc.

- LINEV Systems US, Inc.

- Lomini Ltd.

- Micro-X Limited

- MinXray, Inc.

- Nuctech Company Limited by Tsinghua Tongfang Co., Ltd.

- Rapiscan Systems Inc. by OSI Systems, Inc.

- Scan-X Security Ltd.

- Scanna MSC Ltd.

- Shanghai Eastimage Equipment Co., Ltd.

- Shenzhen Uni X-ray Technology Limited

- Smiths Detection Group Limited

- Tek84, Inc.

- Teledyne ICM

- Varex Imaging Corporation

- Videray Technologies, Inc.

- Viken Detection

- VOTI Detection Inc.

- Westminster Group Plc

Pioneering Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position in Backscatter X-Ray

Industry leaders seeking to capitalize on backscatter X-ray technology’s momentum should pursue a multipronged approach centered on innovation, partnerships, and customer-centric service models. Prioritizing investment in next-generation dual-energy and multi-view imaging platforms will address the rising complexity of security threats and the precision demands of nondestructive industrial inspections. Concurrently, developing modular hardware architectures will enable seamless field upgrades and retrofit options, extending product lifecycles and strengthening value propositions.

Collaboration with regulatory authorities and standard-setting bodies can facilitate early alignment with evolving compliance requirements, reducing market entry barriers and expediting certification processes. Building ecosystems that integrate cloud-based analytics and machine learning-driven anomaly detection will differentiate offerings while providing clients with actionable insights that drive operational efficiencies. To maximize market penetration, forging strategic alliances with systems integrators and maintenance service providers will broaden deployment channels and enhance aftersales support.

Furthermore, tailored training programs and certification courses will empower end users to optimize device utilization and interpret imaging outputs accurately. Establishing regional support hubs in key markets can mitigate service latency and foster local partnerships. By aligning product roadmaps with the nuanced needs of commercial enterprises, government agencies, healthcare facilities, industrial operators, and transportation networks, market leaders can secure sustainable competitive advantage while responding dynamically to emerging trends.

Detailing Robust Research Methodologies Underpinning the Comprehensive Analysis of Backscatter X-Ray Device Market Dynamics and Trends

The insights presented in this analysis are grounded in a robust research methodology designed to ensure comprehensive coverage and analytical rigor. Secondary research encompassed a review of publicly available sources, including regulatory filings, white papers, technical standards, and patent databases, to map technological advancements and compliance frameworks. Vendor websites, industry association publications, and conference proceedings were systematically analyzed to track product launches and strategic initiatives.

Primary research involved in-depth interviews with senior executives, technical experts, and end users across security, industrial, and healthcare sectors. These qualitative engagements provided nuanced perspectives on application-specific requirements, procurement drivers, and operational challenges. Data triangulation was achieved by cross-referencing insights from multiple stakeholder interviews with quantitative data points derived from device shipment statistics and adoption rates.

A multi-layered segmentation framework was applied to dissect the market across device form factors, imaging technologies, application domains, and end-user industries. Regional mapping ensured that the analysis accounted for distinct regulatory landscapes and infrastructure maturity. Throughout the process, iterative validation sessions with subject-matter experts helped refine assumptions and enhance the accuracy of strategic implications. This methodological rigor underpins the credibility of the findings and recommendations articulated herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Backscatter X-Ray Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Backscatter X-Ray Devices Market, by Type

- Backscatter X-Ray Devices Market, by Technology

- Backscatter X-Ray Devices Market, by Application

- Backscatter X-Ray Devices Market, by End-User Industry

- Backscatter X-Ray Devices Market, by Region

- Backscatter X-Ray Devices Market, by Group

- Backscatter X-Ray Devices Market, by Country

- United States Backscatter X-Ray Devices Market

- China Backscatter X-Ray Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings and Strategic Imperatives for Stakeholders in the Evolving Backscatter X-Ray Device Ecosystem

This executive summary distills pivotal findings from an exhaustive study of backscatter X-ray devices, revealing a landscape defined by rapid technological evolution, regulatory momentum, and market diversification. The shift toward dual-energy and multi-view systems, coupled with the emergence of portable handheld scanners, underscores a broadening spectrum of application scenarios-from high-throughput airport security checks to remote industrial inspections. The enactment of tariffs in 2025 introduced short-term cost pressures and supply chain recalibrations, yet also stimulated domestic manufacturing initiatives and encouraged modular upgrade strategies.

Segmentation analysis highlighted clear value propositions for each form factor and technology tier, aligning product capabilities with the operational imperatives of diverse end-user industries. Regional insights illuminated the distinct adoption drivers across the Americas, EMEA, and Asia-Pacific, reflecting variations in regulatory frameworks, infrastructure investments, and risk profiles. Competitive dynamics feature both established defense and security contractors and agile newcomers doubling down on AI integration and service ecosystems.

For stakeholders contemplating their next moves in this evolving ecosystem, the strategic imperatives are clear: invest in adaptable hardware platforms, forge cross-sector partnerships, embrace advanced analytics, and maintain close alignment with regulatory changes. By synthesizing technological trends, market segmentation insights, and regional dynamics, organizations can chart a roadmap that balances innovation with operational resilience. This confluence of factors positions backscatter X-ray technology as a cornerstone of future-ready inspection and security strategies.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Backscatter X-Ray Market Research Report Today

For organizations seeking to harness unparalleled intelligence on backscatter X-ray devices, connecting with Ketan Rohom offers a direct conduit to comprehensive market analysis and tailored strategic guidance. As Associate Director of Sales & Marketing, Ketan brings extensive expertise in translating complex industry data into actionable insights that align with organizational objectives. Engage with him to explore how in-depth findings can inform procurement decisions, technology roadmaps, and partnership strategies. By securing the full research report, you gain exclusive access to granular data, expert interviews, and proprietary frameworks designed to support sustainable growth and competitive differentiation. Reach out to schedule a personalized consultation and take the decisive step toward leveraging the most authoritative intelligence in backscatter X-ray technology

- How big is the Backscatter X-Ray Devices Market?

- What is the Backscatter X-Ray Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?