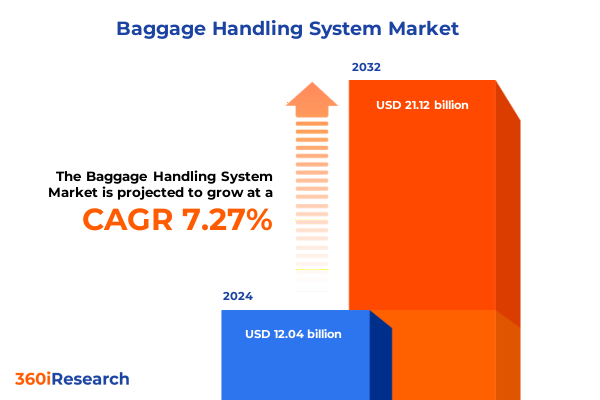

The Baggage Handling System Market size was estimated at USD 12.86 billion in 2025 and expected to reach USD 13.76 billion in 2026, at a CAGR of 7.33% to reach USD 21.12 billion by 2032.

Understanding the Critical Role of Advanced Baggage Handling Systems in Modern Airport and Logistics Operations for Enhanced Efficiency

The efficiency of baggage handling systems underpins the seamless movement of millions of travelers’ belongings every day, making it a cornerstone of modern airport and logistics operations. Airports and transport providers alike must ensure that each piece of luggage navigates through a complex network of conveyors, sorters, and screening devices with minimal delay and maximum accuracy. As passenger volumes continue to rebound and rise, the resilience and adaptability of baggage handling infrastructures have never been more critical.

Amid evolving security regulations, rising customer expectations for faster and more transparent handling, and the push toward sustainable practices, stakeholders across the ecosystem are compelled to rethink traditional approaches. New entrants and established players alike are investing in automation technologies, advanced detection systems, and data-driven monitoring to reduce mishandles, enhance throughput, and lower operational costs. This introduction outlines the pivotal themes addressed in the report, including how shifting regulatory landscapes, emerging solutions, and strategic imperatives converge to redefine the baggage handling industry today.

Navigating Technological Disruptions and Operational Innovations Shaping the Future of Baggage Handling Ecosystems Globally

The baggage handling landscape is undergoing a profound metamorphosis, driven by a convergence of digital technologies and operational innovations. Over the past decade, the integration of Internet of Things sensors, machine learning algorithms, and real-time tracking platforms has elevated system visibility and predictive maintenance capabilities. As a result, conveyor belts and sortation machinery are no longer viewed as isolated mechanical components but as nodes within a dynamic, interconnected network.

Simultaneously, heightened security concerns have accelerated the adoption of automated explosive detection solutions such as high-speed CT scanners that can process thousands of bags per hour while distinguishing true threats with greater precision. In parallel, radio frequency identification systems have matured to offer both active and passive tracking across diverse airport zones, enabling seamless handoffs from check-in to reclaim. These advancements are reshaping workforce roles, necessitating new skill sets in data analytics and equipment diagnostics. Against this backdrop, industry participants must navigate the dual imperatives of integrating cutting-edge technologies and retraining staff to harness their full potential without disrupting daily operations.

Assessing the Comprehensive Effects of United States Tariffs Introduced in 2025 on Global Baggage Handling Supply Chain Dynamics

In 2025, a series of tariff adjustments by the United States government introduced new duties on imported mechanical and electronic components critical to baggage handling infrastructures. The immediate effect has been an uptick in procurement costs for modular conveyor assemblies, radio frequency tagging devices, and CT explosive detection scanners, which in turn has pressured budgeting and deployment timelines for airport authorities and logistics providers.

Many stakeholders have responded by diversifying their supply chains to include regional manufacturers in Europe and Asia-Pacific, thereby mitigating the impact of elevated import duties. Some operators have opted for phased rollouts, prioritizing high-traffic hubs to preserve capital while exploring long-term agreements that lock in favorable pricing. Moreover, original equipment manufacturers are collaborating more closely with local integrators to localize assembly and service functions, effectively reducing tariffs on the final value of imported equipment.

Unveiling Key Insights Across Type Technology End User Function and Component Segments Driving Baggage Handling System Strategies

A detailed segmentation of the baggage handling market reveals nuanced performance drivers tied to the type of equipment, underlying technologies, end-user profiles, system functions, and individual components. When examining type, the conveyor system segment-encompassing inline conveyors, sidewall belts, and tilt tray sorters-continues to deliver baseline throughput, while destination coded vehicles leverage radio frequency tagging and unmanned vehicle solutions to optimize direct bag transfers between check-in and screening zones. Pneumatic systems, with their pressure and vacuum subsystems, remain a niche alternative for compact terminal environments.

From a technology perspective, barcode systems built around one-dimensional and two-dimensional codes represent a cost-effective tracking solution, but CT explosive detection technology has gained prominence through both high-speed and standard-speed scanners that balance screening intensity with throughput requirements. RFID platforms, offering both active and passive tags, have become integral to end-to-end visibility strategies, especially in airports handling diverse flight portfolios.

Considering end users, large, medium, and small regional airports each exhibit distinct investment horizons; large hubs focus on modernization and capacity expansion, while regional airports prioritize cost containment and modular upgrades. Similarly, logistics and transport companies allocate resources between domestic operations and international supply corridors, tailoring system capabilities to cross-border compliance and multilingual tracking demands.

Functional segmentation highlights the dualities of check-in and loading workflows-ranging from automatic baggage drop units equipped with intuitive user interfaces to manual handling areas that still rely on seasoned staff-and the reclaim and departure stages, where compact reclaim systems, linear conveyors, and revolving carousels cater to terminals of varying spatial footprints.

Finally, drilling down to component-level insights reveals a diverse ecosystem: belt, overhead, and roller conveyors each serve distinct volume and spatial requirements; destination coded vehicle parts such as programmable logic controllers and precision wheels and motors underpin vehicular reliability; horizontal and vertical diverters facilitate dynamic routing; and screening devices, including explosive trace detectors and X-ray machines, anchor compliance and threat-detection protocols.

This comprehensive research report categorizes the Baggage Handling System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Technology

- Operation Mode

- Function

- End User

- Deployment Mode

Analyzing Regional Dynamics Influencing Adoption of Baggage Handling Systems in Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping system investment and adoption. In the Americas, stakeholder priorities center on scaling legacy infrastructures and integrating advanced security screening mandates. North American airports frequently pilot collaborative initiatives with federal agencies to trial emerging threat-detection solutions, while Latin American operators emphasize cost-effective retrofits and workforce training to uplift operational reliability.

Within Europe, Middle East, and Africa, a broad spectrum of infrastructure maturity influences purchasing cycles. Major European hubs often lead in digital twin implementations to simulate baggage flow under peak loads, whereas Middle Eastern airports leverage expansive greenfield developments to incorporate state-of-the-art automated sorting and reclaim systems from project inception. African carriers and terminals focus on phased technology introductions, balancing capital constraints with the need for robust security protocols.

Asia-Pacific markets are characterized by rapid passenger growth and diversified terminal sizes. Large metropolitan airports in China and India accelerate deployment of high-speed CT scanners and RFID-enabled tracking to manage surging volumes, while Southeast Asian transport companies emphasize collaborative digital platforms to unify cross-border logistics. In Australia and Japan, the focus shifts to system sustainability and lifecycle management, with investments in energy-efficient conveyors and predictive maintenance analytics.

This comprehensive research report examines key regions that drive the evolution of the Baggage Handling System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Competitive Differentiation and Strategic Partnerships in the Global Baggage Handling Market

The competitive landscape features a blend of established engineering firms and specialized technology providers. Key incumbents differentiate themselves through expansive global service networks, modular product architectures, and end-to-end solution portfolios that combine mechanical sortation with advanced detection and tracking. Several prominent names have invested heavily in research centers dedicated to digitalizing baggage flow, integrating artificial intelligence to preemptively reroute items around mechanical bottlenecks.

Strategic partnerships and joint ventures have also emerged as critical mechanisms for innovation. Collaboration between original equipment manufacturers and software developers has led to unified control platforms, enabling centralized monitoring of cross-site operations. Some integrators have successfully positioned themselves as one-stop providers by bundling consulting, installation, and lifecycle support services, thereby simplifying procurement for airport and logistics operators. Meanwhile, emerging players are carving out niches in specialized technologies, such as explosive trace detection and rail-guided autonomous vehicles, challenging legacy suppliers with leaner cost structures and faster deployment timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baggage Handling System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstef Group

- Amadeus IT Group SA

- Babcock International Group PLC

- Beumer Group

- Brock Solutions

- Daifuku Co., Ltd.

- Dalmec Inc.

- Diversified Conveyors International, LLC

- Duravant LLC

- FIVES Group

- G&S Airport Conveyor

- KieTek International, Inc.

- KineMatik SA

- Leonardo S.p.A.

- Logplan, LLC

- Mpac Group plc

- Omega Aviation, Inc.

- Pteris Global Limited

- SATS Ltd.

- Sick AG

- Siemens AG

- SITA N.V.

- Smiths Detection Group Ltd.

- Vanderlande Industries B.V.

- Victory Ground Support Equipment

Strategic Imperatives for Industry Stakeholders to Enhance Operational Resilience and Drive Growth Through Baggage Handling Innovations

To remain competitive and resilient, industry leaders must adopt a multifaceted strategic approach. Investing in scalable automation solutions will not only boost throughput in high-volume airports but also enable modular expansions at regional terminals. Complementing this, deploying advanced analytics platforms that harness data from barcode readers, RFID tags, and conveyor sensors can drive predictive maintenance programs, reducing unplanned downtime and optimizing resource allocation.

Securing diversified supplier networks mitigates the risks associated with geopolitical tariffs and component shortages, while fostering local partnerships can shorten lead times and reduce total cost of ownership. Furthermore, elevating workforce capabilities through targeted training in digital toolsets and safety protocols will ensure seamless integration of new technologies. Integrators should also explore cross-industry collaborations to access breakthrough materials and sustainable power solutions, aligning baggage handling infrastructures with broader environmental and energy-efficiency goals.

Robust Research Framework Combining Qualitative Expert Interviews Quantitative Data Analysis and Industry Trend Synthesis for Credible Insights

This analysis is grounded in a comprehensive research framework that blends qualitative insights from in-depth interviews with airport operations managers, logistics executives, and technology vendors, with quantitative data gathered from industry databases, trade publications, and regulatory filings. The methodology prioritized triangulation to validate trends observed across multiple sources, ensuring robustness and minimizing bias. Wherever possible, real-world performance metrics-such as baggage throughput rates and mean time between failures-were incorporated to contextualize technological capabilities.

Regional case studies provided nuance, highlighting how disparate regulatory environments and passenger profiles influence procurement decisions. Segmentation analysis was conducted by mapping product functionality, technology readiness levels, user adoption patterns, and component lifecycles. Peer reviews by independent subject-matter experts were employed to assess the validity of interpretations and to refine strategic recommendations. The outcome is a holistic perspective that balances macroeconomic forces, evolving security mandates, and the practical realities of terminal operations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baggage Handling System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baggage Handling System Market, by System Type

- Baggage Handling System Market, by Technology

- Baggage Handling System Market, by Operation Mode

- Baggage Handling System Market, by Function

- Baggage Handling System Market, by End User

- Baggage Handling System Market, by Deployment Mode

- Baggage Handling System Market, by Region

- Baggage Handling System Market, by Group

- Baggage Handling System Market, by Country

- United States Baggage Handling System Market

- China Baggage Handling System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Illuminate Future Directions and Facilitate Informed Investment Decisions in Baggage Handling Technologies

In synthesizing the findings, it becomes evident that the baggage handling market is at an inflection point where operational efficiency, security compliance, and customer experience converge. Automation and digitalization are no longer optional enhancements but critical enablers of future readiness. While tariff dynamics pose short-term cost pressures, they also catalyze supplier diversification and local partnerships, strengthening supply chain resilience in the long run.

As airports and logistics operators chart their modernization journeys, strategic investments in modular, scalable solutions will deliver both immediate performance gains and the flexibility to adapt to evolving passenger profiles and regulatory requirements. The integration of analytics, AI-driven routing, and advanced screening technologies promises to reduce mishandles, accelerate baggage throughput, and elevate overall service quality. Stakeholders equipped with a clear understanding of segmentation intricacies and regional nuances are best positioned to make informed decisions, ensuring that baggage handling systems continue to support seamless travel experiences and reliable cargo operations.

Unlock Tailored Market Intelligence on Baggage Handling Systems by Engaging with Ketan Rohom for Comprehensive Strategic Insights

For a deeper exploration of the factors transforming baggage handling systems-from technological breakthroughs to tariff impacts-and to gain customized strategic guidance, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in synthesizing complex market intelligence into actionable roadmaps ensures your organization stays ahead of operational challenges and capitalizes on emerging opportunities. Engage directly to discuss your specific needs, understand tailored insights, and secure a comprehensive report that equips your team with the clarity and confidence to make high-impact decisions. Elevate your competitive position by leveraging expert analysis and customized recommendations designed to optimize efficiency, enhance passenger experience, and future-proof your baggage handling investments.

- How big is the Baggage Handling System Market?

- What is the Baggage Handling System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?