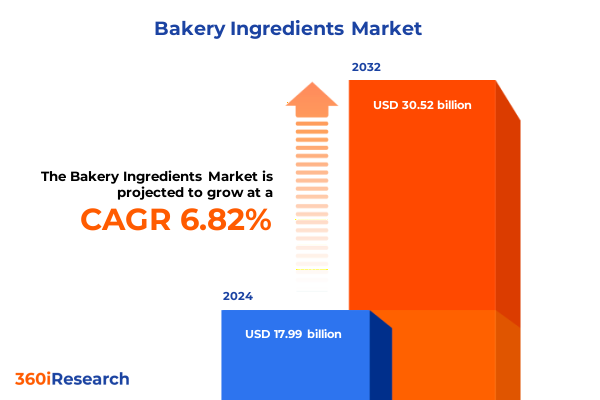

The Bakery Ingredients Market size was estimated at USD 19.03 billion in 2025 and expected to reach USD 20.12 billion in 2026, at a CAGR of 6.98% to reach USD 30.52 billion by 2032.

Navigating Shifting Consumer Demands and Ingredient Innovations That Are Reshaping the Bakery Ingredients Market Landscape

At the core of the global bakery industry is an intricate matrix of ingredients that underpin product quality, drive consumer appeal, and foster differentiation in an increasingly crowded marketplace. From artisanal artisan loaves to mass-market sweet treats, every formulation decision hinges on the functional attributes and sensory profiles of foundational raw materials. With ongoing shifts in dietary lifestyles, sustainability mandates, and technological advances, ingredient selection now represents both an operational imperative and a strategic lever for brand storytelling and consumer connection.

This executive summary distills the most salient drivers, dynamics, and competitive forces shaping the bakery ingredients landscape today. By synthesizing key trends in product innovation, regulatory shifts, trade measures, and end-user behaviors, we provide a comprehensive foundation for stakeholders to anticipate challenges, identify growth vectors, and align their strategic roadmaps accordingly. As you explore the following sections, you will gain clarity on the transformative shifts redefining ingredient sourcing, the ramifications of evolving trade policies, and tactical pathways to capture value across diverse customer segments.

Emerging Trends in Clean Label Preferences and Digitalization Are Transforming Ingredient Sourcing and Formulation Strategies in Baking

Consumer preferences and technological breakthroughs are spearheading a profound transformation in the bakery ingredients arena. Growing interest in clean-label solutions has accelerated the reformulation of staples such as leavening agents and liquid sweeteners to feature recognizable, minimally processed components. Concurrently, the pursuit of plant-based proteins and alternative flours has inspired bakers to explore almond flour, coconut flour, rice flour, and other niche options, thereby diversifying product lines and catering to gluten-sensitive or vegan demographics.

In parallel, digitalization and advanced analytics have begun to redefine ingredient sourcing and production scale-up. Data-driven quality control protocols and precision dosing systems are streamlining processes for dairy ingredients such as milk powder and cream cheese, reducing variability and waste. Across fats and oils, oil-refinement technologies and high-efficiency pressing methods are enhancing functional properties of soybean oil, canola oil, palm oil, and sunflower oil, supporting extended shelf life and improved mouthfeel. This convergence of consumer-centric demand signals and production innovation underscores the critical need for ingredient suppliers to adopt agile formulations and invest in R&D to maintain competitive differentiation.

Evaluating the Ramifications of 2025 United States Tariff Adjustments on Production Costs and Supply Chain Strategies for Baking Ingredients

In 2025, the United States introduced targeted tariff adjustments that have rippled through global bakery ingredient supply chains and cost structures. Tariffs have been selectively applied to certain imported commodities, including types of vegetable oils, specialty flours, and specific sugar derivatives. The immediate outcome has been upward pressure on landed costs for ingredients such as palm oil and high fructose corn syrup, prompting manufacturers to evaluate dealer networks and develop alternative sourcing strategies.

As a result, many producers have accelerated the diversification of their supply portfolios, strengthening domestic procurement of wheat flour, local milk powder, and domestically produced butter to offset elevated import duties. At the same time, traders have reconfigured logistics by leveraging near-shoring arrangements within the Americas to reduce transit time and duty liabilities. These adjustments have not only reshaped pricing negotiations but also reinforced the importance of traceability and tariff-compliance expertise within procurement teams. Looking ahead, ongoing policy monitoring and scenario planning remain essential to anticipate future trade shifts and mitigate potential disruptions across the bakery value chain.

Uncovering Crucial Market Segmentation Across Product Types End Users and Formats to Reveal Untapped Avenues in Bakery Ingredient Value Chains

The bakery ingredients landscape can be parsed through multiple dimensions to reveal where growth and innovation intersect. When viewed through the lens of product types, dairy ingredients emerge as a nuanced category encompassing cheese variants such as cheddar cheese, cream cheese, and mozzarella cheese alongside eggs and milk powder. Fats and oils extend from traditional butter, margarine, and shortening through an extensive portfolio of vegetable oils including canola oil, palm oil, soybean oil, and sunflower oil. Flour segmentation contrasts alternative flours like almond flour, coconut flour, and rice flour against wheat flours ranging from all-purpose to bread, cake, and whole wheat compositions. Leavening agents span baking powder, baking soda, and yeast, while sugar varieties include brown sugar, granulated sugar, and liquid sweeteners such as high fructose corn syrup, honey, and maple syrup.

Examining the end-user spectrum illuminates distinct operational realities. Commercial bakeries divide into artisan operations focused on small-batch craftsmanship and industrial facilities driving mass production. The foodservice channel encompasses hotels and cafeterias, quick service restaurants, and full-service restaurants, each demanding tailored shelf-stable and refrigerated solutions. Household usage splits between do-it-yourself baking aficionados seeking flexible ingredients and pre-mix product consumers prioritizing convenience.

Form factors play a decisive role in manufacturing and distribution. Dry formats manifest as both granules and powder mixes optimized for ease of handling, whereas liquid forms, including emulsions and syrups, deliver streamlined integration into automated lines. The axis of nature differentiates conventional ingredients from organic offerings, reflecting ongoing consumer willingness to pay a premium for perceived health and sustainability attributes. Finally, sales channels bifurcate into offline distribution via food distributors, hypermarkets and supermarkets, and specialty stores, complemented by online avenues comprised of direct sales models and e-commerce platforms.

This comprehensive research report categorizes the Bakery Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Nature

- Sales Channel

- End User

Analyzing Distinct Growth Drivers and Challenges Across Americas Europe Middle East Africa and Asia Pacific in the Bakery Ingredients Arena

Geographical dynamics reveal distinct stories across three major regions. In the Americas, established infrastructure and rigorous quality regulations underpin a mature market where innovation centers on premiumization and clean-label claims. Producers in North America and Latin America leverage robust grain economies to integrate locally sourced wheat flour, sugar variants, and vegetable oils, focusing on supply chain traceability and cost containment.

Across Europe, the Middle East, and Africa, regulatory standards and sustainability imperatives drive demand for organic dairy ingredients, plant-derived emulsifiers, and responsibly harvested palm oil. Manufacturers navigate a complex patchwork of tariffs and trade agreements that influence procurement strategies across advanced economies in Western Europe and emerging markets in the MEA subregions.

In the Asia-Pacific, dynamic demographic trends and evolving urban consumption patterns fuel rapid growth. Markets such as China, India, and Southeast Asia display heightened interest in rice flour conversion to bakery applications, creative leavening agent blends tailored for local preferences, and liquid sweeteners including honey and proprietary syrup mixes. This region’s appetite for convenience and on-trend flavors continues to challenge global suppliers to adapt formulations and channel strategies to cater to mobile-first and e-retail-driven consumption behaviors.

This comprehensive research report examines key regions that drive the evolution of the Bakery Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Strategies and Collaboration Models Among Leading Suppliers Shaping the Competitive Shape of the Bakery Ingredients Market

Leading ingredient suppliers are charting competitive courses through a combination of strategic partnerships, technology licensing, and targeted acquisitions. Major agribusiness players have invested heavily in proprietary emulsification platforms, while specialty ingredient houses are collaborating with research start-ups to develop enzyme-driven texture enhancers for clean-label bakery batters. These collaborations often extend to joint ventures with regional distributors, ensuring local market access and technical support.

Parallel to these efforts, top companies are optimizing upstream integration, securing feedstock through long-term contracts with grain cooperatives and dairy farms. Sustainability commitments, such as regenerative agriculture programs and carbon footprint reduction targets, have become central to supplier value propositions. Such initiatives not only elevate brand positioning but also resonate with end-users seeking resilient supply chains that adhere to strict social and environmental governance principles.

Moreover, corporate innovation centers are accelerating formulation cycles by deploying advanced analytics to forecast consumer trends and simulate processing outcomes. Advanced pilot plants and virtual reality-assisted R&D labs enable rapid prototyping of novel blends, from moisture-retention dairy emulsions to next-generation alternative flour composites. This multifaceted competitive landscape underscores that future leadership will hinge on an ecosystem approach blending technical excellence, sustainability leadership, and agile go-to-market execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bakery Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK International

- Angel Yeast Co., Ltd.

- Archer-Daniels-Midland Company

- Associated British Foods plc

- Bakels Group

- Cargill, Incorporated

- Corbion N.V.

- Dawn Food Products, Inc.

- DSM-Firmenich AG

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lallemand Inc.

- Lesaffre International S.A.

- Puratos NV

- Rich Products Corporation

- Tate & Lyle PLC

- Wilmar International Limited

Delivering Strategic Recommendations for Supply Chain Agility Portfolio Diversification and Sustainability Leadership in the Bakery Ingredients Industry

Industry leaders must prioritize the orchestration of end-to-end supply chain resilience to navigate ongoing tariff volatility and raw material scarcity. By cultivating multi-sourcing strategies for critical inputs such as wheat flour, palm oil, and high fructose corn syrup, companies can mitigate price shocks and logistical bottlenecks. In addition, investing in digital traceability platforms that integrate blockchain or advanced ERP modules will bolster transparency and compliance across global networks.

Simultaneously, portfolio diversification remains paramount. Product development teams should explore adjacent segments-from enzyme-backed leavening innovations to hybrid formulations combining conventional and organic components-to capture premium segments and address evolving dietary trends. Collaboration with co-manufacturers and end-users can yield co-branded offerings that leverage distribution strengths while sharing development risks.

Finally, a steadfast focus on sustainability leadership and cost efficiency will differentiate best-in-class operators. Implementing circular economy principles in packaging, adopting renewable energy in manufacturing, and establishing regenerative sourcing protocols for dairy and plant ingredients not only align with net-zero objectives but also appeal to value-conscious consumers. By executing on these strategic imperatives, industry leaders can secure competitive advantage and drive profitable growth amid an ever-shifting market landscape.

Explaining the Rigorous Mixed Method Research Approach Integrating Primary Stakeholder Interviews Secondary Data and Expert Validation Processes

This analysis is underpinned by a rigorous mixed-method research framework. Primary research consisted of in-depth interviews with over one hundred executives across ingredient manufacturers, commercial bakery operators, foodservice chains, and household consumer panels. These conversations provided qualitative insights into formulation challenges, procurement strategies, and emerging demand signals.

Complementing this, secondary research leveraged publicly available data from government trade databases, industry association publications, financial filings, and authoritative white papers. We conducted systematic data triangulation to validate patterns in tariff implications, ingredient pricing trends, and region-specific consumption dynamics. Advanced analytics tools were utilized to analyze supply chain risk profiles and forecast scenario impacts without relying on market sizing assumptions.

Throughout the engagement, findings were peer-reviewed by subject-matter experts with decades of experience in food science, agribusiness, and regulatory affairs. This validation process ensured robustness, eliminated bias, and reinforced the practical relevance of all strategic recommendations. The result is a deeply actionable roadmap designed to support decision-makers in navigating the complex bakery ingredients environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bakery Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bakery Ingredients Market, by Product Type

- Bakery Ingredients Market, by Form

- Bakery Ingredients Market, by Nature

- Bakery Ingredients Market, by Sales Channel

- Bakery Ingredients Market, by End User

- Bakery Ingredients Market, by Region

- Bakery Ingredients Market, by Group

- Bakery Ingredients Market, by Country

- United States Bakery Ingredients Market

- China Bakery Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Consolidating Key Findings and Strategic Imperatives to Navigate Opportunities and Challenges in the Evolving Bakery Ingredients Environment

The evolving bakery ingredients landscape is characterized by a confluence of consumer-driven innovation, regulatory complexities, and dynamic trade environments. Clean-label and plant-based trends continue to redefine formulation strategies, while 2025 tariff adjustments underscore the need for diligent supply chain management. Segment-specific opportunities span from premium cheese blends and alternative flour composites to tailored liquid sweetener solutions, supported by a growing shift toward organic and niche formats.

Regionally, mature markets in the Americas emphasize traceability and cost optimization, EMEA balances sustainability imperatives with regulatory alignments, and Asia-Pacific prioritizes rapid innovation cycles to meet localized taste preferences. Leading suppliers forge competitive advantage through collaborative R&D, upstream integration, and sustainability programs, fostering resilience and differentiation.

Looking ahead, success in the bakery ingredients sector will depend on an integrated strategy that unites supply chain agility, portfolio expansion, digital traceability, and sustainability leadership. By synthesizing these core elements, stakeholders can effectively navigate market challenges, capitalize on emerging growth vectors, and position their organizations for sustained performance in an increasingly competitive global environment.

Act Now to Engage with Ketan Rohom for Bespoke Bakery Ingredients Market Insights and Secure Competitive Advantage Through Comprehensive Report Access

By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, you can secure immediate access to a deeply researched and actionable bakery ingredients market report tailored to your strategic priorities. The report provides nuanced insights into consumer drivers, product segmentation, regional dynamics, and competitive positioning, enabling you to refine your product portfolio, optimize supply chains, and accelerate innovation pipelines. Our team stands ready to arrange a personalized consultation, walking you through key findings and highlighting how these insights map directly to your growth objectives. Reach out today to arrange your briefing and receive a comprehensive proposal that outlines customized engagement models, including executive workshops, ongoing advisory support, and dedicated data dashboards. Don’t miss the opportunity to leverage this timely intelligence to outmaneuver competitors, de-risk procurement strategies, and capitalize on emerging market spaces in the bakery ingredients sphere. Act now to transform insights into impactful decisions and sustain leadership in an increasingly dynamic market environment.

- How big is the Bakery Ingredients Market?

- What is the Bakery Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?