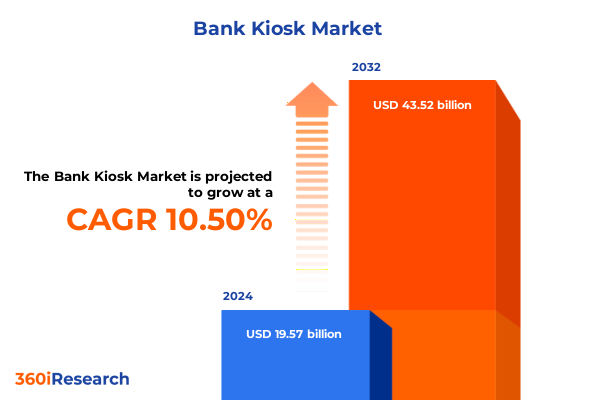

The Bank Kiosk Market size was estimated at USD 21.45 billion in 2025 and expected to reach USD 23.51 billion in 2026, at a CAGR of 10.63% to reach USD 43.52 billion by 2032.

Exploring The Evolution And Importance Of Self-Service Banking Kiosks In Modern Financial Institutions Which Enhance Customer Engagement And Efficiency

The dynamic landscape of self-service banking is witnessing a profound transformation as financial institutions increasingly adopt automated kiosks to meet evolving consumer expectations. Once confined to rudimentary cash dispensers, modern bank kiosks have matured into sophisticated machines offering a spectrum of services, from account opening to video-assisted teller transactions. This shift is driven by a convergence of factors: customer demand for convenience, cost optimization imperatives, and regulatory pressures to enhance accessibility. Consequently, banks are recalibrating their branch networks, leveraging kiosks to extend service footprints without incurring the overhead of full-scale branches.

In parallel, the proliferation of digital-first banking channels has heightened the stakes for physical touchpoints. Kiosks now serve as critical nodes in an omnichannel ecosystem, enabling seamless continuity between mobile apps, online portals, and in-branch services. Moreover, the integration of intuitive user interfaces, biometric authentication, and real-time analytics has elevated the role of kiosks from transactional endpoints to strategic engagement platforms. As these machines assume a central role in customer journeys, stakeholders across banking, retail, and technology sectors are recalibrating investment strategies to harness the efficiency, scalability, and personalization that bank kiosks deliver.

Identifying The Key Technological And Customer-Centric Shifts Transforming The Bank Kiosk Landscape For Seamless And Secure Digital Interactions

Over the past half-decade, the bank kiosk market has been reshaped by several decisive shifts. Technological advancements, particularly in artificial intelligence and machine learning, have enabled predictive maintenance, proactive security monitoring, and personalized service flows that adapt to customer profiles. At the same time, heightened consumer expectations for frictionless experiences have spurred the adoption of touchless interfaces, voice recognition, and multimodal interactions that reduce physical contact without sacrificing usability.

Concurrently, financial institutions have embraced kiosk networks as a cost-effective alternative to expanding branch footprints. The pandemic accelerated this trend, pushing banks to deploy contactless cash handling modules and remote teller assistance to serve customers while maintaining social distancing. Additionally, the shift towards open banking frameworks has compelled kiosk vendors to build APIs and integration layers that connect seamlessly with third-party platforms, enabling value-added services such as instant loan approvals and digital wallet top-ups. These converging forces underscore a broader transformation: bank kiosks are no longer passive dispensers of cash but active orchestrators of customer experiences within an increasingly digital financial ecosystem.

Analyzing The Compound Effects Of The 2025 United States Tariffs On Banking Kiosk Supply Chains Costs And Operational Strategies

In 2025, the United States implemented a series of tariffs targeting electronic components and subassemblies imported from certain regions, directly affecting the cost structure of bank kiosk hardware. Card readers, cash dispensers, enclosures, and sensors experienced incremental cost pressures as import duties were levied, compelling vendors to reassess sourcing strategies. These measures reverberated across the supply chain, prompting some manufacturers to diversify their supplier base or to accelerate nearshoring initiatives to mitigate tariff exposure.

The cumulative effect of these duties has been twofold. First, end users have observed a modest increase in acquisition costs for new deployable units, nudging some institutions to extend lifecycle management practices through enhanced maintenance and retrofitting of existing kiosks. Second, vendors have intensified investments in domestic assembly facilities and forged strategic partnerships with local component producers to secure tariff exemptions and streamline logistics. As a result, the market has entered an era where tariff risks are balanced by opportunities for supply chain resilience and greater control over manufacturing processes, reshaping procurement dialogues between banks and technology providers.

Unearthing Critical Segmentation Insights Across Types Services Components Applications And Deployment Models To Drive Market Understanding

A nuanced understanding of market segmentation reveals how varied kiosk formats and service profiles shape deployment strategies across institutions. When considering the type dimension, ATM kiosks retain prominence for routine cash withdrawals, while teller assist kiosks enable complex transactions under remote guidance, and video banking kiosks bridge the gap between digital channels and human support. Service segmentation highlights that cash dispensing and deposit functionalities remain foundational, yet account opening and bill payment services are increasingly integrated to streamline customer onboarding and routine account management workflows.

Exploring components, it becomes evident how hardware modules such as card readers, printers, and sensors interface with software layers-middleware, operating systems, and transaction management solutions-to ensure secure and reliable operations. Meanwhile, consulting, installation, maintenance, and support services undergird the total cost of ownership, guiding banks through technology selection, deployment, and ongoing optimization. Application-based insights show that in-branch installations focus on complementing traditional teller lines, drive-through kiosks cater to vehicular traffic with specialized fintech integrations, and off-branch units extend accessibility in nontraditional venues such as retail stores and transit hubs. Deployment model considerations reveal that cloud-based offerings accelerate time-to-value and support remote updates, whereas on-premise architectures appeal to institutions prioritizing data sovereignty and tight integration with legacy core systems.

This comprehensive research report categorizes the Bank Kiosk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service

- Component

- Application

- Deployment Model

Deciphering The Distinct Growth Dynamics And Adoption Patterns Of Banking Kiosks In Americas Europe Middle East Africa And Asia Pacific Markets

Geographic dynamics play a pivotal role in shaping bank kiosk adoption and innovation. In the Americas, leading financial institutions undertake modernization programs to revitalize branch networks, deploying advanced kiosks equipped with contactless cash dispensers and biometric authentication to enrich customer experiences while optimizing operational costs. Regulatory frameworks in Canada and the United States prioritize accessibility, bolstering kiosk installations in underserved communities and enhancing financial inclusion objectives.

Across Europe, the Middle East, and Africa, heterogeneous maturity levels drive differentiated strategies. Western European markets emphasize compliance with stringent data protection regulations, driving demand for kiosks with robust encryption and audit features, whereas Middle Eastern banking hubs invest in high-end video banking systems to cater to digitally savvy populations. Sub-Saharan Africa’s focus on unbanked and underbanked segments accelerates kiosk deployments in microfinance and remittance corridors, leveraging mobile connectivity to facilitate remote transactions.

In Asia-Pacific, rapid urbanization and digital payment ecosystems catalyze kiosk innovations in both retail and banking contexts. Advanced economies such as Japan and Australia prioritize seamless integration with mobile wallets and loyalty platforms, while emerging markets including India and Southeast Asia leverage drive-through and off-branch units to deliver banking services in densely populated areas and expand financial outreach.

This comprehensive research report examines key regions that drive the evolution of the Bank Kiosk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating The Strategies And Competitive Advantages Of Leading Players Shaping The Future Of The Global Bank Kiosk Ecosystem

Competitive dynamics within the bank kiosk ecosystem are defined by technology prowess, regional reach, and breadth of service offerings. NCR Corporation continues to leverage its long-standing ATM expertise by expanding modular kiosk platforms that support remote monitoring and predictive maintenance. Diebold Nixdorf underscores omnichannel integration through partnerships with cloud service providers, enabling unified user interfaces across mobile, online, and physical touchpoints.

Nautilus Hyosung focuses on expanding its presence in Asia-Pacific and Latin America by tailoring kiosks for high-volume cash markets, investing in cash recycling modules to reduce refill frequencies. GRG Banking, with its stronghold in China, emphasizes software-driven differentiation, embedding advanced encryption and AI-powered video analytics within its kiosks. Meanwhile, emerging regional players and value-added resellers enhance niche offerings through specialized services, such as multilingual support and localized payment gateway integrations, positioning themselves as agile alternatives to global incumbents.

Amid these trajectories, alliances between fintech innovators and traditional kiosk providers are forging new service paradigms, integrating blockchain-based remittance solutions and real-time loyalty program management directly at the kiosk interface. This confluence of strategies underscores a competitive landscape where scale and specialization coexist to address diverse bank kiosk requirements worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bank Kiosk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurionpro Solutions Limited

- Cisco Systems, Inc.

- Diebold Nixdorf, Incorporated

- Fiserv, Inc.

- Fujitsu Limited

- Glory Ltd.

- GRG Banking Co., Ltd.

- Hitachi-Omron Terminal Solutions Co., Ltd.

- Hyosung TNS Co., Ltd.

- KAL ATM Software GmbH

- KIOSK Information Systems

- NCR Corporation

- Oki Electric Industry Co., Ltd.

- Sagemcom SAS

- Toshiba Tec Corporation

Delivering Practical And Impactful Recommendations To Empower Industry Leaders In Optimizing Deployment And Innovation In Bank Kiosk Solutions

For industry leaders seeking to capitalize on evolving market conditions, a series of targeted actions can drive sustainable growth and differentiation. Prioritizing modular hardware architectures reduces upgrade cycles and accommodates emerging technologies without necessitating full system replacements. Simultaneously, investing in cloud-native software frameworks ensures rapid feature deployments and seamless integration with digital banking platforms, accelerating time-to-market for new services.

In parallel, strengthening ties with regional component suppliers mitigates tariff risks and enhances supply chain agility, while strategic alliances with cybersecurity experts fortify kiosks against sophisticated threats and comply with evolving data protection standards. Furthermore, embedding advanced analytics at both the device and network level provides real-time visibility into performance metrics and user interactions, informing continuous improvement and personalized customer outreach.

Finally, forging partnerships with fintech ecosystems empowers kiosk networks to deliver value-added offerings, such as instant microloans, digital wallet top-ups, and cross-border payment services. By aligning these initiatives with robust change-management practices and stakeholder engagement frameworks, decision-makers can ensure smooth rollouts, foster user adoption, and maximize return on investment across diverse operational settings.

Detailing The Comprehensive Research Methodology And Data Triangulation Approach Underpinning The Insights On Bank Kiosk Technologies And Market

This research synthesizes insights from a rigorous methodology combining primary and secondary data collection. Primary research encompassed in-depth interviews with senior executives from commercial banks, community credit unions, and kiosk integrators, providing qualitative perspectives on investment drivers, deployment challenges, and technology preferences. In parallel, discussions with hardware manufacturers and software developers yielded granular details on product road maps, component sourcing strategies, and emerging security protocols.

Secondary research involved comprehensive analysis of industry publications, regulatory filings, patent databases, and technical white papers to validate market trends and identify competitive positioning. Data triangulation was achieved by cross-referencing vendor financial reports, technology adoption case studies, and macroeconomic indicators, ensuring the robustness of insights without relying on proprietary database projections. Each thematic assertion was corroborated through multiple sources to minimize bias and enhance veracity.

The study’s scope encompassed global kiosk deployments across retail, banking, and mixed-use environments, with a focus on technological integration, regulatory compliance, and service innovation. This multidimensional approach underpins the credibility of the findings and equips stakeholders with actionable intelligence aligned to real-world operational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bank Kiosk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bank Kiosk Market, by Type

- Bank Kiosk Market, by Service

- Bank Kiosk Market, by Component

- Bank Kiosk Market, by Application

- Bank Kiosk Market, by Deployment Model

- Bank Kiosk Market, by Region

- Bank Kiosk Market, by Group

- Bank Kiosk Market, by Country

- United States Bank Kiosk Market

- China Bank Kiosk Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing The Strategic Imperatives And Outlook For Stakeholders Leveraging Advanced Banking Kiosks To Drive Growth And Enhance Customer Experiences

In synthesis, the bank kiosk market stands at a pivotal juncture, shaped by rapid technological advances, shifting consumer expectations, and evolving regulatory frameworks. Self-service machines now deliver an expanding array of services-from routine cash transactions to digital account opening-serving as essential touchpoints within omnichannel banking strategies. Moreover, the 2025 tariff adjustments have underscored the importance of resilient supply chains and diversified sourcing models, prompting stakeholders to explore domestic manufacturing and strategic alliances.

Segmentation analysis highlights how type, service, component, application, and deployment dimensions inform procurement and deployment choices, while regional insights reveal nuanced adoption trajectories across the Americas, EMEA, and Asia-Pacific. The competitive landscape, dominated by incumbents such as NCR, Diebold Nixdorf, Nautilus Hyosung, and GRG Banking, is enriched by agile entrants forging fintech partnerships and delivering localized solutions. To thrive, industry participants must embrace modular designs, cloud-enabled architectures, proactive cybersecurity, and data-driven service enhancements.

These imperatives coalesce into a strategic blueprint for decision-makers, guiding optimal resource allocation, technology selection, and partnership development. By adhering to the recommendations outlined, banking institutions and technology providers can harness the full potential of kiosks to drive operational excellence, meet regulatory requirements, and deliver superior customer experiences in an increasingly digital financial ecosystem.

Connect With Ketan Rohom Associate Director Sales And Marketing To Unlock Exclusive Insights And Secure Your Comprehensive Bank Kiosk Market Report Today

To explore the full spectrum of insights, trends, and strategic recommendations presented in this comprehensive bank kiosk market research report, readers are encouraged to connect directly with Ketan Rohom, Associate Director of Sales and Marketing. Engaging with Ketan unlocks immediate access to exclusive data analyses, in-depth market narratives, and tailored support for procurement and licensing. His expertise will guide you through the report’s distinctive modules, ensuring you identify the segments and regional dynamics most relevant to your organization’s growth objectives. By initiating this dialogue, stakeholders benefit from personalized demonstrations, clarity on deployment considerations, and access to supplementary materials that complement the primary findings. Whether you seek to refine procurement strategies, align product road maps, or gain a competitive edge through actionable intelligence, Ketan Rohom is well-positioned to facilitate your acquisition process. Reach out today to secure your copy and begin leveraging the detailed research that will empower your decision-making and accelerate your market success.

- How big is the Bank Kiosk Market?

- What is the Bank Kiosk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?