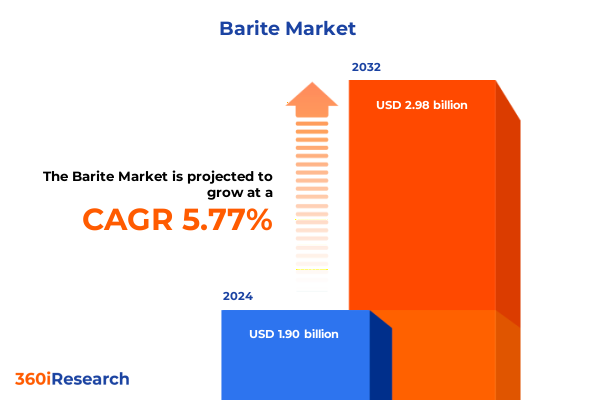

The Barite Market size was estimated at USD 1.26 billion in 2025 and expected to reach USD 1.37 billion in 2026, at a CAGR of 9.77% to reach USD 2.42 billion by 2032.

Strategic overview of the barite market as a critical enabler of drilling, industrial performance materials, and advanced healthcare uses

Barite, a barium sulfate mineral valued for its high specific gravity and chemical inertness, sits at the heart of several mission‑critical value chains. In energy, it is the dominant weighting agent in drilling fluids, enabling safe well control in both conventional and unconventional reservoirs. In advanced materials, it serves as a functional filler in paints, coatings, plastics, and rubber, where its density, opacity, and stability enhance performance. In healthcare, pharmaceutical-grade barite is a key radiopaque material used in medical imaging contrast media and radiation-shielding systems, linking this industrial mineral directly to patient outcomes.

As global energy systems evolve, barite demand patterns are being reshaped rather than displaced. Oil and gas drilling activity remains essential for energy security and petrochemical feedstock supply, even as renewables expand. High-pressure, high-temperature wells, deeper offshore plays, and more complex unconventional developments are increasing the technical demands placed on drilling fluids, and therefore on barite quality and consistency. At the same time, the expansion of diagnostic imaging capacity in emerging economies and ongoing innovation in high-performance coatings and engineered polymers are broadening the mineral’s industrial and medical footprint.

This executive summary provides a strategic lens on those developments, emphasizing what they mean for upstream miners, midstream processors, oilfield service providers, industrial manufacturers, and healthcare-related users. It explores how shifts in trade policy, particularly in the United States, intersect with evolving regional production hubs to influence supply security and pricing. In doing so, it equips senior decision-makers with a concise but analytically grounded foundation for re‑evaluating sourcing strategies, investment priorities, and collaboration models across the global barite ecosystem.

Transformational forces reshaping barite from a bulk commodity into a performance-critical, tightly specified industrial mineral

The barite landscape is undergoing a structural transition driven by the convergence of energy system change, industrial innovation, and regulatory pressure. On the energy side, operators continue to pursue more technically challenging wells, including deepwater offshore developments and high-pressure, high-temperature onshore plays. These projects demand drilling fluids with tighter rheological control and higher density stability, which in turn heightens requirements for barite purity, particle size distribution, and contaminant control. Industry standards that once prioritized only density are increasingly complemented by specifications that address solubility, heavy metal content, and performance under extreme conditions.

Concurrently, there is an unmistakable shift in how barite is perceived in industrial and healthcare applications. In paints and coatings, formulators are moving toward lower volatile organic compound systems and more durable exterior finishes, using barite as a functional filler to improve abrasion resistance, weatherability, and optical properties. In plastics and rubber, the mineral is being engineered into compounds that support lighter-weight components without sacrificing mechanical strength. In healthcare, continued growth in X‑ray and CT scan installations in rapidly urbanizing regions, combined with aging populations in developed markets, is underpinning robust demand for high-purity barite used as a medical imaging contrast medium and in radiation-shielding concretes and panels.

Overlaying these sectoral dynamics is an evolving regulatory and sustainability context. Environmental enforcement has tightened in several producing countries, prompting mine consolidations and investments in more efficient beneficiation techniques. At the same time, large buyers in oil and gas and specialty chemicals are demanding greater traceability, including documentation of mining practices, waste management, and community impacts. Finally, digitalization is transforming how barite is specified, ordered, and monitored in use, with data from drilling operations and industrial plants feeding back into quality assurance protocols and long-term supplier selection. Together, these transformative shifts are pushing the market away from purely commodity-based transactions toward more differentiated, performance- and compliance-driven relationships along the value chain.

Cumulative 2025 United States tariff actions are reshaping barite supply security, cost structures, and sourcing strategies

United States trade policy in 2025 is marked by a renewed assertiveness that extends and amplifies measures introduced in earlier years. New and expanded tariffs on steel and aluminum imports, including the termination of prior country-specific exemptions and the reset of duties to 25 percent across a wide range of origins, have increased equipment and infrastructure costs for the energy and construction sectors. In parallel, targeted tariff increases on Chinese industrial inputs such as tungsten products, wafers, and polysilicon, effective from the beginning of 2025, illustrate a broader willingness to use trade tools to influence strategic supply chains. These moves occur against a backdrop of additional tariffs on selected finished goods and vehicles, which collectively reinforce a more protectionist posture.

For barite, which remains an industrial mineral where the United States relies significantly on imports from countries including China, India, Mexico, and Morocco, this policy environment has a cumulative, indirect impact even though barite itself is not explicitly highlighted in recent tariff announcements. First, higher tariffs on steel and aluminum increase the cost of drilling rigs, tubulars, and pressure control equipment, which elevates the overall cost base of exploration and production programs. As operators and drilling fluid service providers look to offset these increases, procurement strategies for weighting agents such as barite come under sharper scrutiny, favoring long-term contracts with reliable suppliers and, where feasible, more efficient use of material through optimized fluid design.

Second, the broadening of tariffs to cover a wider set of industrial products and the removal of some product exclusion processes increase compliance complexity for mineral importers in general. While barite may be imported under classifications different from those directly cited, importers face greater uncertainty regarding future reclassifications, country-specific surcharges, or secondary measures tied to geopolitical developments. The introduction of an executive order imposing a 25 percent tariff on all goods from countries that import Venezuelan oil further underscores how quickly the trade environment can change and how wide a range of products can be caught within broader geopolitical objectives.

Third, the cumulative effect of these tariffs is to accelerate diversification of supply chains. U.S. buyers are increasingly evaluating alternate sources in the Americas, in-country beneficiation options close to major shale basins, and strategic stockholding to buffer against customs delays or sudden duty changes. For global producers, this environment rewards those capable of offering transparent origin documentation, flexible logistics, and the ability to route shipments through lower-risk corridors. In practical terms, the 2025 tariff landscape acts less as a single shock and more as a persistent headwind that reshapes cost curves, risk premiums, and long-term contracting behavior across the barite ecosystem.

Segmentation by type, form, grade, application, and channel reveals distinct barite value pools and performance-driven differentiation

Viewed through a segmentation lens, the barite market reveals distinct performance and strategy imperatives along each dimension. From a type perspective, natural barite still underpins the majority of drilling-fluid and filler demand thanks to its availability, cost profile, and ability to meet established density specifications. Synthetic variants, while representing a smaller share, play a growing role where ultra-high purity, narrow particle size distributions, or specialized radiological properties are required, particularly in healthcare-related applications and niche chemical processes.

Form is an equally important differentiator. Ground barite remains the workhorse form for drilling fluids and many filler applications, balancing cost, performance, and ease of handling in bulk. Micronized forms, by contrast, target high-end coatings, plastics, and rubber where smooth surface finish, low abrasion, and precise rheology control are key. Crude ore continues to move in international trade where local grinding capacity is either constrained or being expanded, especially near major oil and gas basins. Precipitated barite, produced via chemical routes, segments into specialty applications requiring consistent, very high purity, often in catalysts, advanced composites, and certain pharmaceutical formulations, where its controlled morphology delivers differentiated value.

Grade segmentation overlays these physical forms. Standard grades meet typical drilling program requirements and dominate non-critical filler uses, while high-purity grades cater to demanding coatings, engineered plastics, and radiation-shielding materials in both industrial and healthcare environments. Chemical grade material, with tightly controlled impurity profiles, is aligned with barium-based chemical production and specialized applications where even trace contaminants can affect downstream reactions or regulatory compliance.

Route to market is also evolving. Traditional offline sales channels, built around long-term supply agreements, tendering, and direct technical collaboration, continue to dominate large-volume flows into oil and gas operators and drilling fluid service providers. In parallel, a second layer of distribution operates via direct sales, distributors, and traders that aggregate demand from chemical producers, paint and coating manufacturers, plastic and polymer processors, rubber product manufacturers, pharmaceutical and healthcare companies, and agrochemical producers. Within this network, online sales platforms have begun to capture a growing share of standardized grades and smaller lot sizes, especially for filler and specialty uses where faster quoting and transactional transparency provide a competitive edge.

Application and end-user segmentation brings these patterns into clear focus. Drilling fluids remain the anchor application, with onshore drilling in shale and tight formations driving steady baseline volumes and offshore drilling demanding higher-specification grades for challenging high-pressure wells. Filler uses in paints and coatings, plastics, and rubber form a diversified industrial demand base that is sensitive to construction, automotive, and consumer goods cycles but also benefits from ongoing material substitution trends. Radiology, including imaging contrast media and radiation-shielding products, sits at the intersection of mineral processing and healthcare quality standards, pulling through the highest-purity grades. Across these applications, the most successful suppliers are those that align product development, quality control, and service models to the specific performance and regulatory needs of each end-user segment rather than treating barite as a single undifferentiated commodity.

This comprehensive research report categorizes the Barite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Grade

- Distribution Channel

- Application

- End User

- Distribution Channel

Regional contrasts across the Americas, EMEA, and Asia-Pacific redefine barite supply security, downstream demand, and strategic priorities

Regional dynamics introduce another layer of complexity and opportunity for barite stakeholders. In the Americas, the United States and Canada anchor demand through their extensive onshore shale and tight oil programs, complemented by offshore activity in the Gulf of Mexico. While domestic barite resources exist, the United States has long relied on imports to satisfy drilling requirements, especially for high-specification material. This import dependence, combined with the evolving tariff regime, has intensified interest in regional sources from Mexico and other Latin American countries, as well as investments in domestic grinding and logistics infrastructure near key basins. Meanwhile, emerging deepwater projects and expanding petrochemical and industrial bases in Brazil, Guyana, and other parts of South America are gradually adding to regional demand for both drilling-grade and filler-grade material.

Across Europe, the Middle East, and Africa, the picture is highly heterogeneous. In Europe, declining legacy production from some mature oil and gas provinces is offset by ongoing activity in the North Sea and Eastern Mediterranean, where barite is essential for complex offshore wells. Simultaneously, Europe’s advanced coatings, plastics, and rubber industries sustain a steady pull for filler-grade material, while strict environmental standards drive demand for consistent, low-contaminant barite in both industrial and radiological uses. In the Middle East, sustained investments in upstream oil and gas, including expansion projects in major reservoirs and sour gas developments, underpin structurally high demand for drilling fluids and weighting agents. Africa contributes both as a producer and consumer, with countries such as Morocco holding significant barite resources that feed global markets, while newer oil and gas plays and infrastructure programs on the continent expand regional consumption.

Asia-Pacific stands out as both the largest production hub and a rapidly evolving demand center. China and India are among the leading barite producers globally, and their material supports domestic oil and gas activity as well as a wide array of industrial uses in coatings, plastics, rubber, and chemicals. Policy-driven environmental enforcement and industry consolidation in parts of this region have encouraged investments in more modern mining and beneficiation operations, which can benefit export customers seeking higher and more consistent quality. At the same time, expanding radiology infrastructure, urban construction, and automotive and consumer goods manufacturing across Asia-Pacific contribute to diversified demand beyond drilling. For global buyers, the region therefore represents both an essential supply base and a dynamic set of end markets, making regional partnerships and local market intelligence increasingly important to long-term strategy.

This comprehensive research report examines key regions that drive the evolution of the Barite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evolving strategies of leading barite producers, processors, and buyers are redefining competitive advantage across the value chain

The competitive landscape in barite is characterized by a mix of integrated mining and processing companies, regional producers, oilfield service providers, and specialized chemical and materials firms. At the upstream end, established barite miners with long-life deposits and access to port or rail infrastructure hold a structural advantage, particularly when they can offer consistent quality, flexible logistics, and proven adherence to environmental and social standards. Many of these producers are moving beyond raw ore sales toward more value-added ground, micronized, and high-purity products, seeking closer alignment with the requirements of drilling fluid formulators and industrial formulators.

Oilfield service providers exert significant influence over specification and supplier selection in the drilling fluids segment. They often act as both formulators and distributors, bundling barite into integrated mud systems sold to oil and gas operators. Their priorities include not only price and density, but also performance track record in specific basins, reliability of supply under tight project timelines, and the ability to support technical optimization of fluid systems to reduce overall well construction costs. In recent years, these companies have become more proactive in dual-sourcing and qualifying alternative origins, reflecting heightened risk awareness around trade disruptions and regulatory shifts.

On the industrial and medical side, specialty chemical producers, paint and coating manufacturers, plastic and polymer processors, rubber product manufacturers, pharmaceutical and healthcare companies, and agrochemical producers are shaping demand for more narrowly defined barite grades. Here, competition centers on the ability to deliver tailored particle size distributions, low impurity levels, and documentation that supports compliance with product safety and environmental regulations. Niche players with expertise in precipitated and high-purity barite can command premium positioning, provided they can scale production and maintain consistent quality. Across all these segments, leading companies are investing in closer technical collaboration with customers, digital tools for inventory visibility and order tracking, and sustainability reporting that differentiates their products in increasingly scrutinized supply chains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Elements

- Andhra Pradesh Mineral Development Corporation Ltd.

- Anglo Pacific Minerals Ltd.

- Ashapura Microns LLP

- Baker Hughes Company

- Barium & Chemicals, Inc.

- CIMBAR RESOURCES, INC.

- Demeter O&G Supplies Sdn Bhd

- Excalibur Minerals Corp.

- Fengchen Group Co.,Ltd

- Foshan Onmillion Nano materials Co., Ltd

- Guizhou Redstar Development Co., Ltd

- Halliburton Company

- Hebei Xinji Chemical Group Co. Ltd.

- Huntsman International LLC

- International Earth Products LLC

- Junsei Chemical Co.,Ltd.

- Merck KGaA

- Nippon Chemical Industrial Co., Ltd.

- P & S Barite Mining Co., Ltd.

- PVS Chemicals

- Sachtleben Minerals GmbH & Co. KG

- Sakai Chemical Industry Co. Ltd.

- Shaanxi Fuhua Chemical Co., Ltd.

- Shenzhou Jiaxin Chemical Co., Ltd.

- SLB Limited

- Solvay S.A.

- Yunfu Hongzhi New Materials Co., Ltd.

Actionable strategies to strengthen barite supply resilience, enhance application performance, and navigate regulatory and trade uncertainty

For industry leaders, the emerging barite landscape calls for a shift from transactional procurement and opportunistic sales to integrated, scenario-based planning. One of the most immediate priorities is to diversify supply while maintaining or improving quality. This involves qualifying multiple origins for critical grades, investing in joint ventures or toll-grinding arrangements near key consuming regions, and building relationships that extend beyond price negotiation into shared planning for mine development, processing upgrades, and logistics resilience. As tariff regimes and customs practices evolve, such deep partnerships become an important hedge against sudden disruptions.

Equally important is elevating barite from a generic cost item to a lever for performance and risk management. In drilling, this means working with fluid service providers and operators to optimize formulations that reduce overall well construction costs, limit non-productive time, and enhance safety through more predictable density control. In industrial and radiological applications, it means co-developing grades that improve coating durability, plastic and rubber performance, or imaging and shielding outcomes, thereby strengthening long-term customer loyalty and reducing vulnerability to low-cost substitutes.

Leaders should also institutionalize structured monitoring of regulatory, environmental, and social expectations in key producing and consuming countries. This includes tracking changes in mining and environmental legislation, health and safety standards, and community expectations, as well as trade policy moves that may affect specific supply routes. By embedding such monitoring into enterprise risk management and procurement governance, companies can move from reactive responses to early, proactive adjustments. Finally, articulating clear sustainability narratives around responsible sourcing, waste reduction, and community engagement can differentiate barite suppliers and users in the eyes of investors, regulators, and end customers, turning what has historically been a low-visibility mineral into a visible contributor to corporate responsibility commitments.

Robust, multi-source research methodology underpins the barite market insights, segmentation analysis, and trade policy assessment

The insights synthesized in this executive summary are grounded in a structured research methodology designed to capture both the physical realities of the barite value chain and the evolving context in which it operates. At the core of the analysis is a comprehensive review of authoritative secondary sources, including geological surveys, government statistical releases, customs and trade data, technical standards, and industry association publications. Resources such as the U.S. Geological Survey’s Mineral Commodity Summaries and related data releases provide an essential factual foundation on production, reserves, trade flows, and industrial uses for barite and related minerals.

To complement this quantitative backbone, the research process integrates a qualitative layer derived from company disclosures, technical papers, and public statements from oil and gas operators, drilling fluid service providers, chemical producers, and advanced materials and healthcare firms. These sources illuminate how organizations are responding to practical challenges such as tightening quality specifications, environmental and safety requirements, and shifts in customer expectations. Trade policy developments, including tariff decisions and related executive and regulatory actions in the United States and other major economies, are tracked through official government announcements and reputable news outlets, ensuring that the analysis of 2025 trade dynamics reflects the latest publicly available information.

Analytically, the research employs segmentation by type, form, grade, distribution channel, application, end user, and region to map distinct value pools and risk exposures. Cross-segmentation is used to understand, for example, how offshore drilling demand in the Americas differs in its barite quality and logistics requirements from radiology-driven demand growth in Asia-Pacific. Scenario thinking is applied to assess how changes in drilling activity, environmental enforcement, or tariffs could affect supplier strategies and buyer behavior. Throughout, emphasis is placed on triangulation and consistency checking across sources and perspectives, with the goal of providing decision-makers with a coherent, defensible narrative rather than isolated data points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barite Market, by Type

- Barite Market, by Form

- Barite Market, by Grade

- Barite Market, by Distribution Channel

- Barite Market, by Application

- Barite Market, by End User

- Barite Market, by Distribution Channel

- Barite Market, by Region

- Barite Market, by Group

- Barite Market, by Country

- United States Barite Market

- China Barite Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Conclusion: Barite’s evolving strategic role demands proactive, segmented, and risk-aware strategies from industry decision-makers

Taken together, the trends highlighted in this executive summary underscore that barite remains a strategically important mineral at the intersection of energy security, industrial performance, and healthcare quality. Its role as the dominant weighting agent in drilling fluids ensures that it will continue to track, in nuanced ways, the evolution of global oil and gas activity rather than simply declining in the face of energy transition. Simultaneously, its functions as a filler in paints, coatings, plastics, and rubber, and as a critical input for radiology and radiation shielding, tie it to structural drivers such as urbanization, infrastructure renewal, automotive and consumer goods production, and expanding access to medical diagnostics.

The barite market, however, is no longer shaped solely by geology and drilling cycles. Environmental enforcement in producing regions, increasingly stringent quality and safety standards, and growing expectations around traceability and responsible sourcing are redefining what constitutes a competitive product offering. In parallel, the cumulative impact of shifting trade policies, particularly in the United States during 2025, is raising the stakes for supply chain design, contractual arrangements, and risk management practices. Companies that treat barite purely as a bulk commodity may find themselves exposed to price volatility, supply disruptions, and reputational risks that could have been mitigated through more strategic planning.

For executives, the central message is that barite deserves board-level attention commensurate with its role in enabling core operations and products. By understanding the differentiated dynamics across types, forms, grades, applications, end users, and regions, and by proactively adapting to regulatory, environmental, and trade developments, stakeholders can secure reliable access to the right material at the right quality and cost. This, in turn, supports safer drilling, better-performing industrial and healthcare products, and stronger long-term competitive positioning in markets that depend on this often-overlooked yet essential mineral.

Take the next step with Ketan Rohom to turn barite market intelligence into confident, execution-ready strategic action

Securing a decisive vantage point in the barite value chain requires more than ad‑hoc data scans and informal supplier conversations. It demands a structured view of how type, form, grade, application, end user, and regional dynamics intersect with shifting trade and tariff regimes. The full market research report underpinning this executive summary has been designed precisely to support that level of decision-making rigor.

By engaging with the complete study, leaders gain access to a coherent narrative that connects resource availability, processing capabilities, quality specifications, and demand from drilling fluids, fillers, and radiology across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. Beyond static snapshots, the report explains how evolving regulations, tariffs, and sustainability expectations are likely to alter sourcing strategies, capital allocation priorities, and product development roadmaps. This allows executives to benchmark their current positioning, identify blind spots, and validate or challenge internal planning assumptions.

To translate these insights into practical action, readers are encouraged to connect with Ketan Rohom, Associate Director, Sales & Marketing, who can guide you through the report structure, key analytical modules, and available license options. In consultation, you can determine the most appropriate package for your organization, whether the priority is board-level briefing materials, deeper technical appendices for procurement and technical teams, or tailored cuts of the data focused on specific regions or applications.

Taking this next step ensures that strategic planning for barite procurement, processing investments, product portfolio design, and customer engagement rests on an integrated, research-backed evidence base. Rather than reacting to supply disruptions, tariff changes, or shifting customer requirements after the fact, your teams can move first, align internal stakeholders, and execute with confidence grounded in objective market intelligence.

- How big is the Barite Market?

- What is the Barite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?