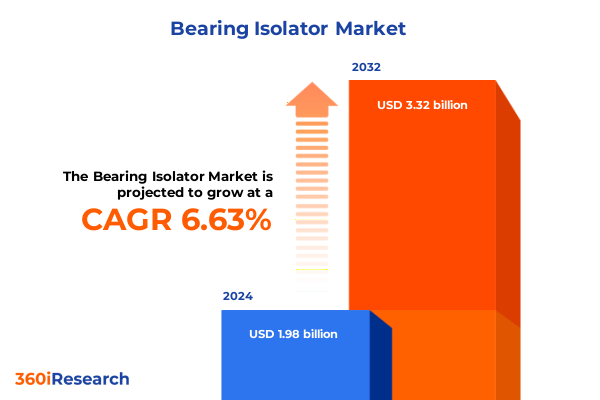

The Bearing Isolator Market size was estimated at USD 2.11 billion in 2025 and expected to reach USD 2.25 billion in 2026, at a CAGR of 6.68% to reach USD 3.32 billion by 2032.

Discover the critical role of bearing isolators in safeguarding rotating equipment and ensuring uninterrupted industrial operations under varied conditions

Bearing isolators represent a pivotal innovation in the protection of rotary equipment, serving as an essential barrier against contaminants that threaten the integrity of critical bearings. In industrial contexts where reliability and longevity are paramount, the adoption of robust isolator solutions has emerged as a foundational component of asset management strategies. As production facilities contend with harsher operating conditions and increasingly stringent regulatory expectations, bearing isolators play a transformative role in safeguarding machinery performance and mitigating unplanned shutdowns.

Transitioning from conventional seal technologies, bearing isolators leverage advanced design principles to create non-contact or low-friction interfaces that significantly reduce wear and maintenance requirements. This evolution not only enhances the lifecycle of bearings but also delivers measurable improvements in operational efficiency and safety. By combining labyrinth, magnetic, and seal-less configurations, these solutions address a diverse range of application demands, ensuring that rotating assets remain protected even in the most challenging environments.

Ultimately, understanding the functional attributes and strategic importance of bearing isolators lays the groundwork for appreciating their broader market implications. In this executive summary, we distill the latest industry developments, tariff impacts, segmentation insights, regional dynamics, and actionable recommendations that industry leaders must consider to achieve optimal equipment reliability and competitive advantage.

Explore the revolutionary technological advances and evolving operational imperatives that are reshaping the global bearing isolator market trajectory

The bearing isolator landscape has undergone a fundamental metamorphosis driven by both technological breakthroughs and evolving operational requirements. In recent years, the integration of magnetic field principles and non-contact labyrinth designs has accelerated the shift away from traditional contact seals, ushering in a new era of maintenance-free protection. These technological strides have been complemented by advancements in material science, with high-performance alloys and engineered plastics enabling isolators to withstand extreme temperatures, corrosive media, and abrasive particulates.

Simultaneously, operational demands have intensified as end users pursue higher throughput and extended service intervals. This imperative has catalyzed the adoption of monitoring-enabled isolators that incorporate sensors to detect pressure differentials, lubricant degradation, and particulate ingress in real time. The convergence of smart diagnostics and rugged hardware embodies a transformative shift where proactive maintenance strategies supplant reactive repair approaches, ultimately enhancing uptime and reducing total cost of ownership.

Moreover, sustainability considerations have reshaped procurement priorities, driving demand for isolator solutions that minimize lubricant consumption and eliminate environmentally harmful sealants. This eco-conscious mindset is redefining supplier selection criteria and reinforcing the importance of lifecycle assessment. As a result, industry stakeholders are navigating a dynamic landscape where technical innovation, regulatory pressures, and environmental stewardship intersect to redefine the future of bearing protection.

Understand the comprehensive repercussions of the 2025 tariff adjustments on bearing isolator procurement strategies and supply chain resilience

In 2025, the imposition of tariffs on imported bearing isolators into the United States has generated palpable shifts in supply chain strategies and vendor dynamics. Domestic manufacturers have leveraged these protective measures to secure incremental production capacity, while international suppliers have explored alternative sourcing routes in regions not subject to increased duties. Consequently, procurement teams have been compelled to reassess vendor agreements, factoring in total landed costs and duty mitigation mechanisms such as tariff engineering and bonded warehousing.

These cumulative tariff effects have also influenced product pricing structures, leading to adjustments in maintenance budget allocations and capital planning frameworks. As companies seek to offset higher acquisition costs, there has been a marked uptick in the preference for high-durability isolators capable of delivering extended operating intervals. This trend underscores a broader strategic pivot toward value-added solutions that justify premium pricing through demonstrable performance benefits.

Furthermore, the regulatory environment has catalyzed collaboration between supply chain executives and engineering teams to optimize inventory levels and ensure critical spares are readily available. This alignment has reinforced cross-functional decision-making and enhanced risk management protocols in the face of tariff volatility. Ultimately, the 2025 tariff landscape has served as a catalyst for supply chain innovation, prompting stakeholders to embrace resilient sourcing models that reconcile cost pressures with operational reliability.

Delve into the multifaceted segmentation framework illuminating the diverse technological preferences and performance requirements across bearing isolator applications

The bearing isolator market can be dissected across multiple dimensions of segmentation, each revealing unique performance criteria and customer preferences. When analyzing isolator types, non-contact labyrinth designs have gained traction for low-friction applications, while contacting labyrinth options remain prevalent in heavy-duty scenarios. Standard labyrinth variants continue to serve general-purpose needs, whereas magnetic isolators-both active and passive-offer advanced sealing performance through electromagnetic repulsion techniques. Seal-less configurations further diversify the landscape, with gas film isolators excelling in ultra-high-speed contexts and liquid film solutions preferred in lubricated systems requiring minimal wear.

From an application standpoint, the utility of bearing isolators spans a broad spectrum of rotating equipment. Agitators and gearboxes often rely on labyrinth styles to manage moderate contamination levels, whereas process pumps demand robust seal-less options to handle fluid-specific challenges. Pumps and compressors present further complexity: centrifugal units typically incorporate seal-less gas film isolators for performance at elevated speeds, while reciprocating compressors favor magnetic isolators to counteract pulsation effects. Meanwhile, turbines embody a critical use case, with gas, hydro, steam, and wind variants each necessitating tailored isolator technologies engineered for unique pressure and particulate conditions.

Installation type also informs procurement decisions, distinguishing between new installations where design integration is optimized from the outset and retrofit scenarios that require adaptable solutions capable of accommodating existing shaft dimensions. End use industries inject another layer of differentiation: chemical operations prioritize corrosion-resistant materials, marine applications demand saline-tolerant constructs, mining sectors focus on abrasion resilience, oil & gas facilities emphasize pressure containment, and power generation assets require high-temperature endurance. By mapping customer requirements against these segmentation axes, suppliers can align product portfolios to deliver targeted performance outcomes.

This comprehensive research report categorizes the Bearing Isolator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Installation Type

- Application

- End Use Industry

Examine how regional market dynamics and industrial priorities in the Americas, EMEA, and Asia-Pacific are influencing bearing isolator adoption

Regional dynamics shape demand patterns and competitive landscapes within the bearing isolator market. In the Americas, the presence of established manufacturing hubs and stringent environmental regulations has driven the uptake of advanced isolator solutions characterized by low emissions and extended service intervals. End users in this region increasingly prioritize predictive maintenance and digital integration, fostering a preference for isolators embedded with diagnostic capabilities and remote monitoring features.

Across Europe, the Middle East & Africa, the market exhibits a hybrid profile marked by mature economies seeking efficiency gains alongside emerging regions focused on infrastructure expansion. European operators emphasize compliance with rigorous safety standards and lifecycle cost reduction, often collaborating with local suppliers to customize isolator designs. In the Middle East, the proliferation of petrochemical and power generation projects has spurred demand for isolators capable of withstanding extreme ambient conditions, while African markets are gradually adopting these technologies as industrialization advances.

In Asia-Pacific, rapid industrial growth and aggressive capital investment are propelling market expansion, particularly in manufacturing powerhouses and resource extraction geographies. Local fabrication facilities are scaling up production to meet domestic consumption, even as international vendors compete on technological differentiation and aftermarket support. The region’s diverse energy portfolio-including fossil fuels, renewables, and heavy industries-continues to fuel innovation in isolator design, driving continuous performance enhancements and cost optimization efforts.

This comprehensive research report examines key regions that drive the evolution of the Bearing Isolator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore the strategic maneuvers and technological innovations that distinguish leading bearing isolator suppliers in a dynamic competitive arena

The competitive landscape of bearing isolators is defined by a blend of established engineering specialists and agile technology innovators. Many leading entities have expanded their portfolios through strategic acquisitions, integrating complementary seal and bearing technologies to broaden end-to-end solutions. Collaboration with equipment OEMs has emerged as a salient strategy, enabling isolator suppliers to co-develop tailor-made products optimized for specific machinery configurations and performance criteria.

Research and development investments are concentrated on enhancing diagnostics, materials, and manufacturing processes. Companies pioneering additive manufacturing for isolator components are unlocking design freedoms that improve flow dynamics and contamination control. Others are refining magnetic circuit designs to maximize repulsive sealing forces while minimizing power consumption. Service and aftermarket capabilities also differentiate market players; firms offering condition-based maintenance programs and digital twins are capturing greater wallet share by embedding themselves within customer reliability frameworks.

Furthermore, several enterprises are forging partnerships with industrial automation providers to integrate isolators into broader asset management systems. This convergence underscores a shift from standalone hardware offerings toward holistic, software-enabled platforms that deliver actionable insights across the equipment lifecycle. Such strategic moves position these companies to capitalize on the growing demand for connected solutions that deliver visibility, performance, and predictive analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bearing Isolator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.W. Chesterton Company

- Advanced Sealing International (ASI)

- AESSEAL

- Baldor Electric Company, Inc.

- EagleBurgmann

- Elliott Group

- Flowserve Corporation

- Garlock Sealing Technologies

- Inpro

- Isomag Corporation

- John Crane

- Parker Hannifin Corporation

- SKF AB

- The Timken Company

- Waukesha Bearings Corporation

Implement integrated smart diagnostics, resilient supply chain practices, and sustainability-driven material strategies to enhance isolator performance and reliability

Industry leaders must prioritize the convergence of smart diagnostics and robust isolator mechanics to stay ahead of evolving reliability demands. Integrating sensors within isolator assemblies will deliver real-time insights into contaminant ingress and pressure differentials, empowering maintenance teams to transition from scheduled to condition-based interventions. Concurrently, adopting advanced materials with superior abrasion and chemical resistance will ensure isolators maintain integrity under increasingly aggressive operating conditions.

Supply chain resilience can be enhanced through dual sourcing strategies and localized inventory planning, mitigating the impact of geopolitical fluctuations and tariff adjustments. Engaging in early collaboration with isolator manufacturers during equipment design phases will streamline integration and reduce retrofit complexity. Moreover, aligning procurement criteria with sustainability objectives-such as reduced lubricant usage and recyclable component design-will reinforce corporate environmental commitments while optimizing total cost of ownership.

To capitalize on competitive differentiation, executive teams should explore strategic partnerships with digital platform providers to extend isolator functionality into comprehensive asset performance management solutions. By linking isolator health data with enterprise resource planning and maintenance management systems, organizations can unlock predictive analytics capabilities and drive continuous improvement across their rotating equipment portfolios.

Understand the comprehensive research methodology combining targeted primary interviews, secondary literature reviews, and analytical triangulation ensuring robust market insights

This analysis was developed through a rigorous research framework combining primary and secondary inputs to ensure comprehensive coverage and data integrity. Primary research entailed in-depth discussions with rotating equipment engineers, maintenance specialists, and procurement decision-makers to collect firsthand insights into isolator performance criteria, adoption drivers, and pain points. Supplementary interviews with technology providers and supply chain experts offered context on emerging innovations and tariff impact responses.

Secondary research involved systematically reviewing industry standards, technical whitepapers, and relevant patent filings to map the evolution of isolator designs and material advances. Trade publications and regulatory documentation provided a backdrop for understanding regional market regulations and sustainability mandates. Data triangulation was achieved by cross-validating these qualitative insights against publicly disclosed financial statements, equipment installation case studies, and aftermarket service records.

Analytical methodologies included comparative benchmarking of isolator configurations, trend analysis of material and diagnostic technology adoption, and scenario planning to assess tariff-induced supply chain shifts. These combined approaches yielded a holistic perspective that captures both the technological intricacies and strategic imperatives influencing bearing isolator market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bearing Isolator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bearing Isolator Market, by Type

- Bearing Isolator Market, by Installation Type

- Bearing Isolator Market, by Application

- Bearing Isolator Market, by End Use Industry

- Bearing Isolator Market, by Region

- Bearing Isolator Market, by Group

- Bearing Isolator Market, by Country

- United States Bearing Isolator Market

- China Bearing Isolator Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Reflect on how advanced materials, smart diagnostics, and strategic market dynamics converge to shape the future of bearing isolator solutions

Bearing isolators have evolved from simple mechanical barriers into sophisticated, sensor-enabled solutions that address the twin imperatives of reliability and efficiency in rotating equipment. The interplay of advanced materials, magnetic circuit innovations, and smart diagnostics has reshaped supplier offerings and end-user expectations alike. Meanwhile, regulatory changes and tariff structures have acted as catalysts for supply chain optimization and value-driven procurement approaches.

Segmenting the market by type, application, installation, and end use industry reveals critical differentiation points for product development and go-to-market strategies. Regional insights underscore how local regulations, industrial growth patterns, and technological adoption cycles directly influence isolator preferences across the Americas, EMEA, and Asia-Pacific. Comparatively, leading companies are leveraging partnerships, acquisitions, and digital integration to secure competitive advantages and deepen customer engagements.

Looking ahead, the convergence of predictive maintenance, sustainability goals, and supply chain resilience will define the next wave of growth opportunities. Stakeholders equipped with a clear understanding of segmentation nuances, regional dynamics, and competitive best practices will be well positioned to harness the full potential of bearing isolator technologies in safeguarding critical assets and driving operational excellence.

Unlock Strategic Advantage by Securing the Definitive Bearing Isolator Report through Personalized Engagement with Our Sales Leadership

Engaging with our Associate Director of Sales & Marketing, Ketan Rohom, will provide you with personalized guidance and tailored support to harness the full potential of this in-depth bearing isolator analysis and elevate your strategic planning to new heights. Reach out today to acquire the comprehensive market research report that offers actionable insights, robust methodology details, and the critical intelligence necessary for informed decision-making in a complex industrial environment. Take the next step toward optimizing asset reliability, reducing downtime risks, and driving sustainable growth by securing your copy of the definitive bearing isolator report now.

- How big is the Bearing Isolator Market?

- What is the Bearing Isolator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?