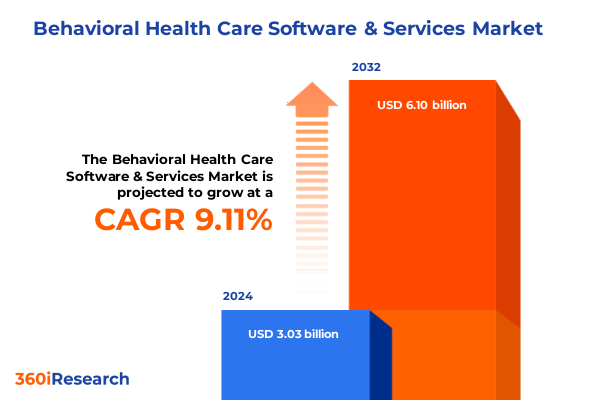

The Behavioral Health Care Software & Services Market size was estimated at USD 3.30 billion in 2025 and expected to reach USD 3.58 billion in 2026, at a CAGR of 9.18% to reach USD 6.10 billion by 2032.

Setting the Stage for a New Era in Behavioral Health Care Software and Services through Innovation Integration and Patient-Centric Solutions Driving Industry Transformation

The landscape of behavioral health care software and services is at a pivotal juncture, defined by rapid technological advancements, shifting policy environments, and escalating patient expectations. Against a backdrop of growing prevalence of mental health disorders and substance use challenges, providers and software vendors alike are embracing digital tools to fill critical gaps in access and quality. Remote patient monitoring platforms and telehealth solutions have transcended niche offerings to become integral components of modern care delivery, fostering continuity of care even amid disruptive global events. Meanwhile, robust data analytics capabilities are empowering clinicians and administrators to derive actionable insights from vast troves of patient data, optimizing treatment pathways and enhancing population health outcomes.

As the market matures, stakeholders are navigating an increasingly complex ecosystem where software and services converge. Consultancy engagements are guiding health systems through digital transformation initiatives, while managed service providers ensure sustained operational performance and regulatory compliance. Cloud-based deployment models are gaining traction, offering scalability and security advantages over on-premise installations. Simultaneously, modular software architectures facilitate interoperability with electronic health record systems, enabling seamless data exchange and integrated care coordination. The convergence of these trends underscores a broader paradigm shift toward holistic, patient-centric solutions that extend beyond point tools to deliver end-to-end care management experiences tailored to emerging behavioral health needs.

Mapping the Transformative Shifts Fueling the Evolution of Behavioral Health Care Software and Services Ecosystems in a Post-Pandemic Digital Age

The behavioral health care technology ecosystem has undergone a profound transformation in recent years, fueled by a confluence of regulatory, clinical, and technological catalysts. Government initiatives promoting value-based care and parity in mental health coverage have created powerful incentives for adoption of data-driven management platforms. Concurrently, the ubiquity of smartphones and the proliferation of digital therapeutics have democratized patient engagement, enabling individuals to access self-guided interventions and real-time support outside traditional clinical settings. In turn, software vendors have accelerated their roadmap investments to integrate artificial intelligence and machine learning algorithms, offering predictive analytics for risk stratification and personalized treatment planning.

Moreover, behavioral health is increasingly recognized as a critical component of holistic wellness, propelling interdisciplinary integration between mental health specialists and primary care providers. Practice management systems are evolving to accommodate this integration by automating referral workflows and synchronizing patient records across diverse care settings. Telehealth has expanded its reach beyond synchronous video visits, embracing asynchronous messaging and remote patient monitoring technologies to ensure continuous patient-provider connection. These transformative shifts have redefined expectations for scalability, user experience, and security, challenging incumbent platforms to innovate or cede ground to more agile entrants.

Assessing the Far-Reaching Cumulative Impact of United States Trade Tariffs on Behavioral Health Care Software and Services Supply Chains and Cost Dynamics

Recent trade policies have introduced new headwinds for behavioral health care technology providers that rely on global supply chains and cross-border software services. The cumulative impact of tariffs enacted in early 2025 has reverberated through both hardware procurement cycles and licensing agreements for international software modules. For instance, increased duties on specialized monitoring devices and telehealth peripherals have translated into higher capital expenditures for ambulatory centers and home care providers. These cost pressures have prompted service providers to explore alternative sourcing strategies and renegotiate vendor contracts to preserve margins while maintaining quality standards.

On the software front, tariffs targeting data hosting and cloud infrastructure services used by multinational vendors have led to elevated operating costs. As a result, subscription pricing models are under scrutiny, with many companies absorbing incremental fees in the short term to avoid client attrition. However, the downstream effect is a slower rate of new license acquisitions among smaller clinics and community health organizations. In response, some software vendors have localized data centers within the United States and optimized code bundles to reduce cross-border transfer fees. These adaptive measures underscore the resilience of the industry but also highlight the lingering uncertainties posed by evolving trade policies on long-term investment planning.

Revealing Strategic Segmentation Insights across Component Services and Software Application Domains and Diverse End User Settings

A nuanced understanding of market segmentation reveals critical drivers of growth and opportunity across service and software offerings, application domains, and end-user settings. Within the services component, consulting engagements and implementation projects are leading client digital transformation roadmaps, while managed services and training support foster ongoing system optimization and user adoption. Conversely, software solutions have bifurcated into cloud-hosted applications that deliver rapid deployment and scalability advantages, and on-premise installations that address regulatory compliance and data sovereignty concerns for larger health systems.

On the application front, data analytics platforms are evolving beyond population health management to incorporate advanced predictive analytics and intuitive reporting and visualization dashboards, enabling proactive intervention strategies. Electronic health records systems are enhancing clinical documentation workflows through e-prescribing and integrated order management. Patient engagement tools are becoming more omnichannel, blending mobile apps, patient portals, appointment reminders, and telephonic support to boost adherence and satisfaction. Practice management systems now automate patient registration, scheduling, and task management, streamlining administrative burdens. Revenue cycle management solutions are tackling billing and invoicing complexities alongside claims and denial management processes. Telehealth offerings are diversifying to include asynchronous messaging, remote patient monitoring, and video consultations, ensuring continuous care access.

Finally, the end-user landscape is characterized by distinct requirements from ambulatory centers, clinics, home care providers, and hospitals. Ambulatory centers prioritize agility and modular integration, clinics seek cost-effective turnkey systems, home care providers demand lightweight remote monitoring tools, and hospitals require robust, enterprise-grade platforms with deep customizability. This layered segmentation underscores the imperative for vendors to align product roadmaps and service portfolios with the specific demands of each stakeholder group.

This comprehensive research report categorizes the Behavioral Health Care Software & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

Uncovering Regional Dynamics Driving Adoption and Innovation in Behavioral Health Care Software and Services across Americas Europe Middle East and Africa and Asia-Pacific

Regional nuances are shaping investment priorities and adoption trajectories across the global behavioral health technology market. In the Americas, rising awareness of mental health parity and robust reimbursement frameworks are driving rapid uptake of comprehensive electronic health records and revenue cycle management platforms. North American providers show a particular appetite for cloud-hosted services, fueled by advanced network infrastructures and favorable regulatory guidance on telehealth reimbursements.

Europe, Middle East and Africa present a mosaic of varied regulatory landscapes, where stringent data privacy directives in the European Union have catalyzed demand for on-premise solutions and localized data centers, whereas emerging markets in the Middle East and Africa are leap-frogging legacy infrastructures by embracing mobile-first patient engagement and telehealth models to address provider shortages. Cross-border collaboration initiatives and funding programs are further accelerating the modernization of behavioral health care delivery in these regions.

Asia-Pacific markets demonstrate a burgeoning demand for scalable software services that can accommodate vast, diverse populations and disparate care settings. Governments in key markets are investing in integrated digital health strategies, with a focus on remote patient monitoring to extend care to rural communities. Language localization, interoperability with national health information exchanges, and flexible deployment models are critical success factors for vendors targeting this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Behavioral Health Care Software & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Driving Innovation and Market Influence in the Behavioral Health Care Software and Services Sector

The competitive landscape of behavioral health care software and services is defined by a diverse mix of global technology giants, specialized clinical software vendors, and innovative digital health start-ups. Major incumbents leverage vast R&D budgets to integrate artificial intelligence and machine learning capabilities into their core offerings, while also securing strategic acquisitions to expand their service portfolios. Meanwhile, emerging challengers capitalize on agile development cycles and deep clinical domain expertise to introduce niche solutions that address specific pain points such as real-time patient engagement or predictive risk modeling.

Strategic partnerships between software providers and health systems are becoming more prevalent, enabling co-development of customized modules and iterative enhancements based on direct end-user feedback. Some vendors have established dedicated centers of excellence that offer consulting, implementation, and managed services under one umbrella, creating seamless handoffs between advisory and operational execution. Pricing models vary widely, from subscription-based tiered offerings to value-based arrangements tied to patient outcomes, reflecting an industry in search of sustainable monetization frameworks that align stakeholder incentives.

Overall, the market is witnessing consolidation at the higher end, with a select cohort of platform leaders extending their reach through bundled solutions, while a fertile ecosystem of mid-tier players and start-ups continues to challenge traditional paradigms with disruptive approaches to care delivery and patient experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Behavioral Health Care Software & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accumedic Computer Systems, Inc.

- Advanced Data Systems Corporation

- AdvancedMD, Inc.

- BestNotes, LLC

- Boehringer Ingelheim Pharmaceuticals, Inc.

- CentralReach, LLC

- Cerner Corporation by Oracle Corporation

- ContinuumCloud, Inc.

- Core Solutions, Inc.

- Epic Systems Corporation

- Holmusk, Inc.

- ICANotes, LLC

- Infor-Med Inc.

- InSync Healthcare Solutions

- Kareo, Inc. by Tebra Technologies, Inc.

- Kipu Health, Inc.

- Limbic Incorporated

- Meditab Software Inc.

- Netsmart Technologies, LLC

- NextGen Healthcare, Inc.

- Oliva Health Ltd.

- Oracle Corporation

- Procentive, Inc.

- Qualifacts Systems, Inc.

- Streamline Healthcare Solutions

- Sunwave Health, Inc.

- The Echo Group

- TheraNest, Inc.

- TherapyNotes, LLC

- Valant Behavioral Health, Inc.

- WellSky Corporation

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Behavioral Health Care Software and Services

To capitalize on growth opportunities, industry leaders should prioritize the development of interoperable, modular architectures that seamlessly integrate with legacy health information systems and third-party digital health tools. By adopting open-API frameworks, vendors can enable bi-directional data exchange and foster collaborative networks with payers, providers, and patient advocacy groups. Additionally, expanding cloud-native capabilities while maintaining robust security and compliance controls will satisfy the dual needs for scalability and data privacy across diverse regulatory environments.

Furthermore, providers and vendors alike must invest in advanced analytics and AI-driven insights to transition from reactive to proactive care models. Predictive algorithms that flag early warning signs and risk factors for mental health deterioration can inform preventive interventions and resource allocation, ultimately improving patient outcomes and reducing avoidable costs. Equally important is the inclusion of multi-channel patient engagement strategies that blend digital therapeutics, telephonic coaching, and community resources to foster sustained behavioral change.

Finally, forging strategic alliances and managed service partnerships will enable organizations to deliver end-to-end solutions with minimal friction. Joint ventures with specialty software houses or academic research institutions can accelerate innovation roadmaps, while white-glove implementation services and ongoing user training will drive adoption and satisfaction. By aligning commercial imperatives with clinical best practices, industry stakeholders can secure long-term value creation and market leadership.

Detailing a Rigorous Research Methodology Combining Primary and Secondary Data Collection and Expert Validation for Behavioral Health Care Market Analysis

This research study employs a comprehensive, multi-phased approach that integrates both primary and secondary data collection to ensure depth and reliability of insights. Secondary research involved systematic review of peer-reviewed journals, government publications, regulatory filings, and reputable industry news outlets to establish foundational knowledge of market trends and policy developments. Primary research included in-depth interviews with senior executives from provider organizations, software vendors, payers, and technology partners, complemented by detailed surveys targeting care managers and IT decision-makers to capture first-hand perspectives on adoption drivers and barriers.

Quantitative data was triangulated through the consolidation of financial performance metrics, deployment statistics, and usage analytics sourced from public company disclosures and proprietary databases. Qualitative inputs were validated via a panel of recognized clinical and technology experts to assess the feasibility and scalability of emerging solution architectures. The research methodology also encompassed scenario analysis and sensitivity testing to evaluate the potential impact of regulatory changes, tariff adjustments, and macroeconomic variables on stakeholder decision-making.

Throughout the research process, rigorous data quality protocols were applied, including cross-verification of sources, anonymization of proprietary respondent information, and adherence to ethical guidelines for data collection and reporting. This robust methodological framework ensures that the strategic insights and recommendations presented in this report are grounded in empirical evidence and reflective of current and emerging market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Behavioral Health Care Software & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Behavioral Health Care Software & Services Market, by Component

- Behavioral Health Care Software & Services Market, by Application

- Behavioral Health Care Software & Services Market, by End User

- Behavioral Health Care Software & Services Market, by Region

- Behavioral Health Care Software & Services Market, by Group

- Behavioral Health Care Software & Services Market, by Country

- United States Behavioral Health Care Software & Services Market

- China Behavioral Health Care Software & Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Concluding Insights Synthesizing Key Trends and Strategic Imperatives for Stakeholders in the Behavioral Health Care Software and Services Market

As behavioral health care software and services continue their trajectory toward deeper integration and digital sophistication, stakeholders must stay attuned to evolving patient expectations, regulatory shifts, and technological breakthroughs. The transition to value-based care frameworks underscores the importance of analytics-driven decision support, while the normalization of telehealth has permanently expanded care access models. Additionally, the recalibration of global supply chains and the implementation of new trade tariffs have highlighted the need for adaptive sourcing and pricing strategies.

The market’s segmentation across service components, software deployment models, application domains, and end-user settings offers abundant avenues for specialization and differentiation. Regional nuances further necessitate tailored approaches to compliance, infrastructure investment, and partnership development. Against this backdrop, the competitive landscape is both consolidating at the top and fragmenting through the emergence of smaller, focused innovators. Such dynamics present both challenges and opportunities for established players and new entrants alike.

In conclusion, the convergence of clinical, technological, and economic forces is reshaping the behavioral health care software and services market into a dynamic, patient-centric ecosystem. Organizations that harness interoperable platforms, predictive analytics, and agile delivery models will be best positioned to deliver comprehensive, cost-effective care solutions. As the industry evolves, ongoing vigilance and strategic adaptability will be paramount for sustained success and market leadership.

Take the Next Step by Securing Comprehensive Behavioral Health Care Software and Services Market Insights through a Personalized Consultation with Ketan Rohom

To gain a nuanced understanding of evolving market dynamics, contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan possesses deep expertise in guiding stakeholders through complex behavioral health technology landscapes and can provide tailored recommendations based on your organization’s unique requirements. By engaging with Ketan, you will receive a customized demonstration of the comprehensive market research report, highlighting the most relevant strategic insights for your objectives. Schedule a consultation today to explore how robust data and actionable analysis can inform your next strategic move. Elevate your competitive positioning and accelerate decision-making by securing this essential resource now.

- How big is the Behavioral Health Care Software & Services Market?

- What is the Behavioral Health Care Software & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?