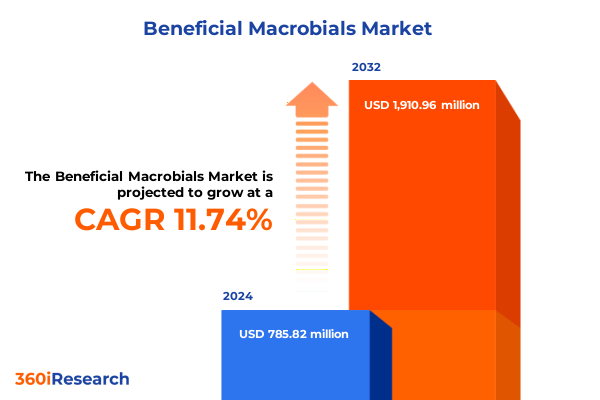

The Beneficial Macrobials Market size was estimated at USD 880.17 million in 2025 and expected to reach USD 974.70 million in 2026, at a CAGR of 11.71% to reach USD 1,910.96 million by 2032.

Unveiling the Critical Role and Far-Reaching Potential of Beneficial Macrobials in Driving Sustainable and Resilient Crop Production Practices Worldwide

Beneficial macrobials have emerged as a cornerstone of modern agricultural innovation, offering sustainable solutions to enhance soil health, bolster plant immunity, and improve crop yields. These living microorganisms operate through multiple modes of action-fixing atmospheric nitrogen, solubilizing essential nutrients, and stimulating plant growth regulators-to deliver environmentally friendly alternatives to conventional chemical inputs. As global food security challenges intensify alongside concerns regarding environmental degradation, water scarcity, and soil fertility loss, adoption of these biological tools has gained significant momentum. Moreover, evolving consumer preferences for residue-free produce and stringent regulatory mandates aimed at reducing synthetic agrochemicals have further accelerated the uptake of macrobial technologies.

This introductory section sets the stage for our executive summary by underscoring the transformative potential of beneficial macrobial solutions within the broader context of regenerative agriculture and circular bioeconomy principles. It outlines how stakeholders-from seed producers and input suppliers to farmers and policymakers-are converging around microbial-based strategies to meet dual imperatives of productivity and sustainability. By framing current market drivers, technological enablers, and policy catalysts, this overview equips decision-makers with foundational understanding needed to navigate the complexities and opportunities presented by the burgeoning macrobial sector.

Exploring the Dynamic Technological Advancements and Regulatory Harmonization That Are Reshaping the Beneficial Macrobial Landscape for Next-Generation Agriculture

The landscape for beneficial macrobial technologies is undergoing rapid transformation, fueled by technological breakthroughs, evolving regulatory frameworks, and heightened stakeholder collaboration. Precision agriculture platforms are increasingly integrating microbial data, enabling real-time monitoring of soil microbiomes and targeted delivery of formulations. Concurrent advances in formulation science-such as encapsulation techniques and controlled-release carriers-have dramatically improved microbial viability, shelf life, and field performance under diverse environmental conditions.

Regulatory harmonization across key markets has also played a pivotal role in accelerating product registrations and reducing time-to-market for novel strains. Government agencies in Europe and North America are adopting more streamlined approval processes, recognizing the low ecological risks posed by native soil organisms and the urgent need for sustainable inputs. In parallel, digital traceability systems are empowering end users with transparency regarding strain provenance, application protocols, and environmental footprints, strengthening trust throughout the value chain.

Alongside these technological and regulatory shifts, growing investment activity-especially through strategic partnerships between agri-tech startups and legacy chemical companies-has fostered cross-sector innovation. These collaborations are driving the discovery of new macrobial consortia and synergistic combinations with biostimulants, illuminating pathways to unlock previously untapped yield potentials. As a result, market participants are better positioned than ever before to harness the benefits of a biology-driven agricultural revolution.

Assessing the Multifaceted Effects of the 2025 United States Tariffs on Raw Materials, Supply Chains, and Cost Structures in the Beneficial Macrobial Industry

The imposition of a 25 percent tariff on certain microbial raw materials and formulation constituents in early 2025 has introduced multifaceted challenges across the supply chain. Manufacturers reliant on imported fermentation substrates have experienced increased cost pressures, which have reverberated throughout formulation, distribution, and end-user pricing. In response, several suppliers have diversified sourcing strategies by establishing regional production hubs closer to key consumption markets, effectively mitigating transportation costs and tariff exposure.

Trade policy uncertainty has also prompted a reassessment of inventory management and procurement cycles. Companies have shifted from “just-in-time” practices towards strategic stockpiling of critical inputs, balancing higher working capital demands against the risk of supply disruptions. Meanwhile, tariff-driven cost increases have incentivized process innovations, including on-site enzyme recovery and substrate recycling, which serve to curtail reliance on tariffed goods.

Despite these headwinds, the industry has shown resilience through collaborative advocacy and engagement with regulatory authorities. Joint industry forums have successfully negotiated tariff exemptions for select bio-inputs deemed essential for environmental stewardship. Looking ahead, continued dialogue between stakeholders and policymakers will be crucial to aligning trade rules with sustainability objectives, ensuring that tariff structures do not inadvertently hinder the adoption of low-impact farming practices.

Uncovering Critical Segmentation Insights Across Product Types, Microorganism Categories, Formulations, Distribution Channels, and Application Sectors Driving Strategic Decisions

Insight into the market’s complex architecture emerges when examining its foundational segments. Based on product type, offerings range from nitrogen-fixing biofertilizers that enhance soil nutrient dynamics to phosphate-solubilizing and potash-mobilizing variants that improve plant uptake of key minerals. Complementing these are biopesticides, encompassing biofungicides targeting soil-borne pathogens, bioinsecticides designed for sustainable pest management, and bionematicides that protect root systems. Biostimulants round out the portfolio with amino acids that support stress tolerance, humic substances driving soil structure improvement, and seaweed extracts known for their plant growth regulatory properties.

When viewed through the lens of microorganism type, the market extends across Actinomycetes-led by Streptomyces species prized for antibiotic production-and a diverse array of bacteria including Azospirillum, Bacillus, and Rhizobium, each selected for their unique plant growth-promoting traits. Fungal actants, such as Mycorrhiza, foster improved nutrient exchange between soil and roots, while Trichoderma species fortify plant defenses against disease.

Considering formulation form, stakeholders must navigate choices between dry granules and powders that offer ease of handling, and liquid vehicles like aqueous suspensions and emulsifiable concentrates that facilitate precision application. Distribution channels further influence market access, with conventional offline models coexisting alongside burgeoning digital platforms that deliver products directly to end users. Finally, application domains span agriculture’s row crops-corn, soybean, and wheat-and vegetable systems such as potato and tomato; horticulture segments like apple and citrus fruit crops and ornamental plant categories including indoor and landscape varieties; as well as turf and ornamental landscapes where microbial interventions support green spaces.

This comprehensive research report categorizes the Beneficial Macrobials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Microorganism Type

- Form

- Distribution Channel

- Application

Revealing Key Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific That Influence Adoption and Growth of Beneficial Macrobiials

Regional variations in adoption patterns paint a nuanced picture of market maturity and growth trajectories. In the Americas, the combination of advanced agricultural infrastructure in the United States and the expansion of precision farming in Brazil has spurred widespread integration of microbial inputs. Regulatory stability and government incentive programs promoting reduced chemical usage have further catalyzed uptake among large-scale growers and co-operatives.

Across Europe, Middle East, and Africa, a rising focus on circular economy principles and carbon neutrality targets has translated into policy support for biological solutions. European Union directives incentivizing soil health management have driven comprehensive field trials, while Middle Eastern initiatives aimed at combating desertification are leveraging drought-tolerant microbial formulations. In Sub-Saharan Africa, partnerships between development agencies and local agri-tech firms are accelerating knowledge transfer and enabling scalable, climate-resilient practices.

In the Asia-Pacific region, dynamic growth reflects the dual influence of population pressure and evolving consumer awareness. Countries like India and China are investing heavily in sustainable intensification programs that feature macrobial seed treatments and foliar sprays. Southeast Asian markets are witnessing increased distribution through e-commerce channels, facilitating entry for smallholder farmers into advanced microbial ecosystems. This regional tapestry underscores the need for tailored strategies that align product profiles, education initiatives, and distribution models with local agronomic realities.

This comprehensive research report examines key regions that drive the evolution of the Beneficial Macrobials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Partnerships and Innovations Shaping the Competitive Landscape of Beneficial Macrobials

Leading entities in the beneficial macrobial domain are distinguished by robust research pipelines, strategic alliances, and vertically integrated operations that span strain discovery to commercialization. Global chemical and life-science corporations with established fermentation infrastructure have leveraged their scale to optimize production efficiency while expanding portfolios through targeted acquisitions of specialized biotech startups. Conversely, nimble innovators have focused on niche applications, deploying advanced genomics platforms to identify high-potential strains and cultivate consortia formulations that address specific crop challenges.

Partnership models have evolved to include licensing agreements, co-development alliances, and distribution pacts, enabling rapid market entry across geographies. Several frontrunners have also established dedicated application labs and demonstration farms, facilitating farmer adoption through hands-on validation and customized service packages. Meanwhile, a wave of strategic partnerships with precision agriculture technology providers is forging integrated solutions that marry microbial inputs with data-driven agronomic insights.

Sustainability commitments have become a key differentiator, with market-leading firms publicizing carbon footprint reductions achieved through microbial substitution of synthetic fertilizers. By transparently reporting environmental impact metrics and securing third-party certifications, these companies are enhancing brand trust and aligning with institutional investor mandates. Collectively, these strategic initiatives underscore how organizational agility and cross-sector collaboration define leadership in the evolving macrobial market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beneficial Macrobials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andermatt Group AG

- Applied Bio-nomics Ltd

- Atlántica Agrícola

- BASF SE

- Bayer AG

- BioBee Sde Eliyahu Ltd

- Biobest Group NV

- BioFirst Group

- Bioline AgroSciences Ltd

- BioWorks, Inc

- Certis Biologicals Ltd

- Corteva Inc

- FMC Corporation

- Gowan Company

- IPL Biologicals Limited

- Koninklijke Koppert B.V.

- Lallemand Inc

- Marrone Bio Innovations Inc

- Novonesis

- PI Industries Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- T.Stanes and Company Limited

- UPL Limited

- Valent BioSciences LLC

Delivering Actionable Strategic Recommendations for Industry Leaders to Harness Emerging Opportunities and Mitigate Risks in the Beneficial Macrobial Market

To capitalize on emerging opportunities, industry leaders should prioritize deepening their R&D capabilities while forging strategic collaborations. Investing in high-throughput screening platforms and advanced bioinformatics will streamline strain selection and formulation optimization, accelerating the introduction of differentiated products. Simultaneously, partnerships with digital agriculture firms can unlock novel delivery mechanisms, such as precision drones and sensor-integrated application tools, to maximize efficacy and reduce input waste.

Supply chain resilience demands geographical diversification of manufacturing and a shift towards circular production models. By establishing regional fermentation hubs and leveraging local biomass feedstocks, companies can mitigate tariff exposure, reduce logistics costs, and uphold sustainability credentials. Engaging proactively with policymakers to shape science-based regulations will also ensure that trade policies and registration frameworks are conducive to future innovations.

Marketing strategies should emphasize evidence-based storytelling, showcasing field trial outcomes and environmental benefits through digital platforms and interactive demonstration events. Building end-user education programs in collaboration with agronomic advisors will foster trust and drive trial adoption among growers. Finally, stakeholders must integrate environmental, social, and governance metrics into strategic planning, signaling commitment to responsible stewardship and strengthening appeal to conscious investors.

Detailing a Robust Research Framework Combining Primary Interviews Secondary Data Analysis Expert Consultations and Rigorous Validation for Credible Insights

Our analysis rests on a comprehensive framework that combines rigorous secondary research with targeted primary engagement. The initial phase involved exhaustive review of scholarly publications, patent filings, regulatory dossiers, and industry white papers to map technological trends and formulation breakthroughs. Concurrently, proprietary databases and trade statistics were leveraged to identify supply chain patterns and tariff developments.

In the second phase, structured interviews were conducted with a diverse cross-section of stakeholders, including R&D directors, regulatory experts, distribution partners, and commercial farmers. These qualitative insights were synthesized with quantitative inputs to validate market dynamics and refine segmentation parameters. Expert panels provided critical feedback on emerging applications, formulation preferences, and regional adoption barriers.

Data triangulation methods were employed to reconcile discrepancies between public records, proprietary surveys, and expert observations. All information underwent multiple rounds of peer review and methodological audit to ensure consistency and replicability. Analytical models were stress-tested against historical events-such as prior tariff adjustments and regulatory changes-to confirm their predictive robustness. This rigorous approach ensures that the insights presented are both reliable and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beneficial Macrobials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beneficial Macrobials Market, by Product Type

- Beneficial Macrobials Market, by Microorganism Type

- Beneficial Macrobials Market, by Form

- Beneficial Macrobials Market, by Distribution Channel

- Beneficial Macrobials Market, by Application

- Beneficial Macrobials Market, by Region

- Beneficial Macrobials Market, by Group

- Beneficial Macrobials Market, by Country

- United States Beneficial Macrobials Market

- China Beneficial Macrobials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Summarizing Core Takeaways and Strategic Implications to Illuminate the Path Forward for Stakeholders in the Beneficial Macrobial Ecosystem

Beneficial macrobial technologies stand at the nexus of sustainability and productivity, offering a compelling pathway to address global agricultural challenges. By synthesizing trends in technological innovation, regulatory evolution, and market segmentation, this executive summary illuminates how the industry is poised for continued expansion. Key drivers include increased demand for eco-friendly inputs, digital agriculture integration, and supportive policy frameworks that recognize the low environmental footprint of microbial solutions.

However, forces such as trade policy shifts, formulation complexities, and localized agronomic constraints underscore the need for strategic agility. Stakeholders must adopt a holistic perspective-balancing R&D investments with collaborative partnerships, supply chain resilience, and end-user engagement-to fully realize the promise of these biological tools. The segmentation and regional insights provided herein guide targeted decision-making, while the recommended actions offer a roadmap for translating insights into impact.

Ultimately, the convergence of science, technology, and market dynamics creates a transformative moment for beneficial macrobials. Stakeholders equipped with the intelligence and strategies detailed in this report will be best positioned to lead the shift toward more sustainable and productive agricultural systems globally.

Take Action Today to Secure Comprehensive Market Insights and Drive Your Strategic Objectives by Connecting with Ketan Rohom, Associate Director Sales & Marketing

To explore the full depth of this market research and unlock tailored strategic insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. This personalized engagement will ensure you receive guidance on how our comprehensive analysis can inform product development, go-to-market strategies, and risk mitigation plans.

Engaging with Ketan Rohom will open opportunities for a detailed discussion of the report’s granular findings, including segmentation trends, regional dynamics, regulatory impacts, and competitive intelligence. Whether you seek to optimize your product portfolio, navigate evolving trade policies, or identify high-potential partnerships, this consultation will arm you with actionable recommendations.

Don’t miss the chance to translate these insights into quantifiable business value. Contact Ketan today to secure your copy of the report and embark on a data-driven journey toward sustainable growth and competitive advantage in the beneficial macrobial market.

- How big is the Beneficial Macrobials Market?

- What is the Beneficial Macrobials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?