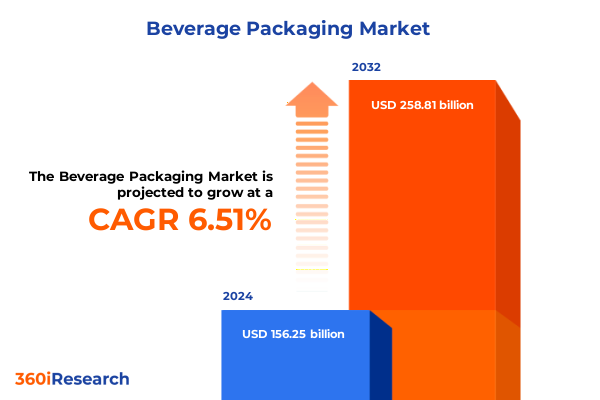

The Beverage Packaging Market size was estimated at USD 166.64 billion in 2025 and expected to reach USD 176.47 billion in 2026, at a CAGR of 6.49% to reach USD 258.81 billion by 2032.

Setting the Stage for the Future of Beverage Packaging in a Rapidly Evolving Global Market Driven by Sustainability and Innovation

The global beverage packaging landscape stands at the confluence of rapid innovation, shifting consumer preferences, and intensifying regulatory pressures. Industry leaders are reevaluating traditional approaches in favor of solutions that prioritize sustainability, cost efficiency, and enhanced brand engagement. In this context, an overarching introduction sets the stage by outlining the fundamental drivers and the urgent need for agile strategic planning. By examining how rising environmental concerns, technological advancements, and evolving distribution models intersect, this introductory overview aims to ground readers in the key elements that shape market dynamics today.

This discussion opens with a reflection on the pivotal role packaging plays in delivering product quality, ensuring safety, and conveying brand authenticity. It then transitions into highlighting the influence of regulatory frameworks targeting material waste reduction and extended producer responsibility. Finally, it underscores the transformative potential of emerging technologies-such as advanced digital printing and smart packaging-to create differentiated consumer experiences. Through this holistic lens, decision-makers are invited to appreciate the complexity of the field and the myriad opportunities for value creation.

Uncovering the Transformative Shifts Reshaping Beverage Packaging through Digitalization Sustainability and Consumer-Centric Experiences

In recent years, the beverage packaging sector has undergone a series of transformative shifts, each redefining the criteria for success. Foremost among these is the accelerating commitment to sustainability, where stakeholders are redesigning packaging ecosystems to reduce carbon footprints and facilitate circularity. Brands and converters have adopted lightweighting strategies, sought renewable feedstocks for plastics, and explored the integration of recycled content. Concurrently, governments across major markets have instituted regulations mandating minimum recycled content levels, driving the industry toward higher standards of environmental stewardship.

Another significant evolution is the rise of digitalization and personalized packaging experiences. With digital printing technologies reaching commercial maturity, small-batch customization has become economically viable, enabling brands to engage consumers through limited-edition campaigns and targeted messaging. Moreover, the integration of smart packaging-leveraging QR codes, NFC technology, and sensors-has facilitated enhanced supply chain transparency and data-driven consumer engagement. As e-commerce continues its upward trajectory, packaging design must also accommodate the demands of direct-to-consumer fulfillment, requiring robustness against damage and waste reduction during transit.

These shifts are not occurring in isolation; they are converging to create a competitive landscape where agility, innovation, and sustainability-performance are non-negotiable. Companies that navigate these trends proactively are positioned to capture incremental value, strengthen brand equity, and align with consumer expectations in an era defined by consciousness and connectivity.

Assessing the Cumulative Impact of 2025 Tariff Measures on the United States Beverage Packaging Industry and Supply Chain Dynamics

The implementation and expansion of tariffs in 2025 have had a pronounced impact on the beverage packaging industry within the United States. Building on earlier trade measures under Section 232 and Section 301, the cumulative effect of duties on aluminum, steel, and selective polymer imports has altered cost structures and supply chain strategies. Aluminum producers faced levies that increased raw material costs, prompting packaging converters to reassess sourcing options and negotiate long-term agreements to mitigate volatility. Meanwhile, elevated steel tariffs have rippled through manufacturers of steel cans and closures, further complicating procurement planning.

Beyond metals, additional duties on certain plastic resins and imported glass components have introduced complexities in material selection. Stakeholders have responded by exploring alternative suppliers in tariff-exempt jurisdictions and investing in domestic production capabilities. These shifts have also spurred consolidation within the value chain, as smaller converters seek partnerships or mergers to achieve economies of scale and resilience against duty-related cost pressures. Although some of the surcharges have been partially absorbed to preserve customer relationships, the overall margin compression has underscored the strategic necessity of flexible, multi-sourced supply networks.

Looking ahead, the trajectory of trade policy remains a key variable for industry participants. Companies that have proactively diversified supply lines and invested in tariff-insulated materials are better positioned to navigate potential policy reversals or further adjustments. As stakeholders continue to monitor the regulatory environment, the capacity to adapt procurement, manufacturing, and pricing frameworks will be vital for sustaining competitive advantage in the evolving tariff landscape.

Key Segmentation Insights Revealing Diverse Market Perspectives across Beverage Types Materials Formats Channels and Operation Modes

A nuanced understanding of segmentation provides invaluable guidance for targeting strategic initiatives and resource allocation. When analyzed by beverage type, market participants can differentiate between alcoholic beverages-encompassing beer, spirits, and wine-and non-alcoholic categories such as carbonated soft drinks, which include cola and energy drinks, alongside juice, dairy products like flavored milk, milk, and yogurt drinks, and water. This segmentation reveals distinct packaging requirements and performance criteria, from barrier properties in carbonated formats to temperature resilience for dairy.

Material type segmentation highlights the critical trade-offs across glass, metal, paper and paperboard, and plastic. Metal packaging, subdivided into aluminum and steel, offers superior barrier protection and recyclability benefits, whereas glass brings premium positioning and inert characteristics at the cost of weight and fragility. Paper-based formats are emerging as lightweight and renewable solutions, while plastic continues to dominate due to versatility and cost-effectiveness. Packaging format segmentation further refines strategic perspectives by examining bottles-across glass, metal, and plastic variants-alongside cans, which include aluminum and steel, cartons split between aseptic and non-aseptic designs, pouches ranging from sachets to stand-up configurations, and Tetra Pak formats designed for extended shelf life.

Distribution channel insights reveal that the consumer journey varies significantly across convenience stores, online retail, and supermarkets or hypermarkets, each demanding tailored packaging features for shelf appeal, logistics efficiency, and tamper evidence. Operation type segmentation-covering automated, manual, and semi-automated processes-illuminates the capital intensity and scalability constraints faced by converters. By integrating these dimensions, strategic planners can align product portfolios, capital investments, and innovation roadmaps with specific segment needs, driving both operational efficiency and market responsiveness.

This comprehensive research report categorizes the Beverage Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Beverage Type

- Material Type

- Packaging Format

- Operation Type

- Distribution Channel

Unveiling Critical Regional Dynamics and Growth Drivers Shaping the Beverage Packaging Landscape across Americas EMEA and Asia Pacific Markets

Regional dynamics exert a profound influence on the beverage packaging industry, reflecting variations in regulatory frameworks, consumer preferences, and manufacturing capabilities. In the Americas, the emphasis on sustainability and recyclability has catalyzed investments in recycled-content initiatives and lightweight material innovations, driven by both state-level regulations and voluntary industry commitments. The proximity to major aluminum and glass production hubs facilitates agile supply chains, while consumer demand for premium and craft beverages continues to stimulate packaging differentiation and premiumization strategies.

Across Europe, the Middle East, and Africa, the regulatory landscape has been a primary catalyst for change. The Extended Producer Responsibility directives in the European Union, coupled with ambitious recycling targets, have accelerated the shift toward reusable bottle schemes and mono-material packaging designs. In the Middle East, rising disposable incomes and rapid urbanization are fueling growth in single-serve formats, whereas in Africa, affordability and durability remain key, promoting sturdy plastic and metal solutions adapted to local distribution challenges.

In the Asia-Pacific region, innovation is being driven by both high-growth markets and technology leaders. Countries such as Japan and South Korea are pioneering smart packaging applications and advanced barrier materials, while China’s scale supports aggressive expansion of PET bottle recycling infrastructure. Southeast Asian markets are witnessing a dual trend: premium imported beverages demanding sophisticated packaging aesthetics and locally produced options focusing on cost-effectiveness and environmental compliance. These regional insights underscore the need for tailored strategies that reflect localized market conditions and regulatory expectations.

This comprehensive research report examines key regions that drive the evolution of the Beverage Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players Driving Innovation Operational Excellence and Strategic Growth in the Beverage Packaging Sector

Leading companies in the beverage packaging arena have differentiated themselves through a combination of innovation, operational excellence, and strategic partnerships. Major aluminum can producers have ramped up investments in low-carbon smelting technologies and closed-loop recycling systems to meet corporate sustainability goals. Glass manufacturers are exploring lightweight container designs that preserve aesthetics while reducing transportation costs and carbon emissions. Meanwhile, paper and paperboard converters are collaborating with brand owners to pilot compostable and repulpable packaging alternatives that align with zero-waste initiatives.

Technology providers specializing in digital printing and automation have been particularly instrumental in enhancing production flexibility. By deploying advanced robotics and machine learning algorithms, these companies optimize line speeds, quality control, and changeover times across diverse packaging formats. Additionally, global packaging conglomerates are forming alliances with material innovators and waste management firms to secure end-of-life pathways and strengthen circularity commitments. These collaborations not only enhance resource efficiency but also fortify brand narratives around transparency and responsibility.

Smaller, niche players are carving out market share by focusing on specialized segments, such as premium craft beer packaging or functional beverage closures with enhanced ergonomic designs. Their agility in adopting novel materials-like bio-based resins or digital labels-demonstrates a willingness to experiment beyond traditional applications. Collectively, these strategic moves across the competitive spectrum illustrate how top-performing firms are harnessing R&D investments, supply chain integration, and multi-stakeholder partnerships to stay ahead of the curve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beverage Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albea S.A.

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- Berry Global Group, Inc.

- Can-Pack S.A.

- CCL Industries Inc.

- Crown Holdings, Inc.

- DS Smith Plc

- Greif, Inc.

- Huhtamäki Oyj

- Impress Group B.V.

- International Paper Company

- Kian Joo Group

- O-I Glass, Inc.

- Reynolds Group Holdings Ltd.

- SIG Combibloc Group AG

- Silgan Holdings Inc.

- Smurfit Kappa Group plc

- Tetra Pak International S.A.

- UACJ Corporation

- WestRock Company

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Challenges and Capitalize on Opportunities in Beverage Packaging

To thrive in the evolving beverage packaging landscape, industry leaders must adopt a multifaceted approach that balances short-term resilience with long-term strategic positioning. First, prioritizing investment in sustainable materials and closed-loop recycling programs enables companies to meet regulatory mandates and cater to eco-conscious consumers. Concurrently, expanding supplier networks across tariff-friendly jurisdictions mitigates exposure to trade policy disruptions and enhances negotiation leverage.

Next, embracing digitalization across the value chain-from design and prototyping to production and distribution-unlocks efficiency gains and consumer engagement opportunities. Integrating data analytics into packaging operations allows for real-time monitoring of equipment performance and material utilization, driving continuous improvement. Furthermore, collaborating with technology partners to incorporate smart features such as QR codes and NFC chips not only enriches brand storytelling but also facilitates direct communication channels with end-users.

Lastly, cultivating agile organizational structures that foster cross-functional innovation and rapid decision-making is essential. By leveraging cross-industry partnerships and participating in consortia focused on sustainability and circular economy initiatives, companies can accelerate the development of groundbreaking solutions while sharing the burden of infrastructure investment. Through these strategic recommendations, industry players can position themselves to capitalize on emerging trends, weather policy uncertainties, and deliver differentiated value to both consumers and stakeholders.

Comprehensive Research Methodology Detailing Data Sources Analytical Frameworks and Validation Techniques Ensuring Robust Insights

This research draws upon a rigorous methodology designed to ensure the validity and reliability of its insights. Primary data collection involved structured interviews with senior executives from leading packaging firms, raw material suppliers, and brand owners, providing firsthand perspectives on strategic priorities and innovation roadmaps. Complementary surveys captured quantitative measures of investment trends, technology adoption rates, and operational challenges across global regions.

Secondary research included a comprehensive review of industry publications, trade association reports, and regulatory filings to contextualize primary findings within broader market dynamics. Data triangulation was employed to cross-verify information from disparate sources, ensuring consistency and mitigating bias. An analytical framework integrating PESTEL and Porter’s Five Forces models facilitated a structured assessment of external pressures and competitive structures. Finally, internal validation workshops with subject matter experts enabled iterative refinement of key themes and the testing of hypotheses against real-world scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beverage Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beverage Packaging Market, by Beverage Type

- Beverage Packaging Market, by Material Type

- Beverage Packaging Market, by Packaging Format

- Beverage Packaging Market, by Operation Type

- Beverage Packaging Market, by Distribution Channel

- Beverage Packaging Market, by Region

- Beverage Packaging Market, by Group

- Beverage Packaging Market, by Country

- United States Beverage Packaging Market

- China Beverage Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Future Trajectory of Beverage Packaging Highlighting Critical Factors for Sustainable Innovation and Competitive Advantage

In conclusion, the beverage packaging sector is poised for a dynamic period of evolution, driven by sustainability imperatives, technological breakthroughs, and the unfolding consequences of trade policies. The interplay of these forces demands proactive strategies that align material innovation with regulatory compliance and consumer demand for experiential engagement. Companies that excel will be those that integrate digital capabilities, diversify supply chains, and commit to circular economy principles without sacrificing performance or cost efficiency.

As the industry moves forward, continuous monitoring of tariff developments and regulatory shifts will be critical, alongside sustained investment in R&D and cross-sector collaborations. Embracing a culture of agility and open innovation will empower organizations to navigate uncertainties and seize emerging opportunities. Ultimately, the packaging choices made today will shape brand perceptions, environmental outcomes, and competitive positioning for years to come, reaffirming the importance of informed strategic leadership in this vital domain.

Engage with Associate Director Sales & Marketing Ketan Rohom for Tailored Beverage Packaging Insights and Secure Your Exclusive Research Report Today

For organizations seeking to capitalize on the extensive insights presented in this comprehensive beverage packaging research, engaging directly with an experienced industry liaison offers unparalleled benefit. By reaching out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, stakeholders can receive personalized consultation tailored to their unique strategic priorities. Through this dedicated interaction, potential investors and corporate decision-makers can explore specific dimensions of the study, request custom data analyses, and gain clarity on how the findings align with their operational objectives.

Partnering with Ketan Rohom ensures that clients are equipped with the precise intelligence needed to drive innovation in packaging design, optimize supply chain resilience, and stay ahead of regulatory and tariff-driven shifts. Whether the focus is on sustainable materials adoption, digital printing enhancement, or navigating complex tariff landscapes, this direct engagement accelerates decision-making and empowers leadership teams to implement findings swiftly. Take the next step toward securing a competitive edge by connecting with Ketan Rohom today to purchase the full report and unlock bespoke solutions for your organization’s beverage packaging challenges.

- How big is the Beverage Packaging Market?

- What is the Beverage Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?