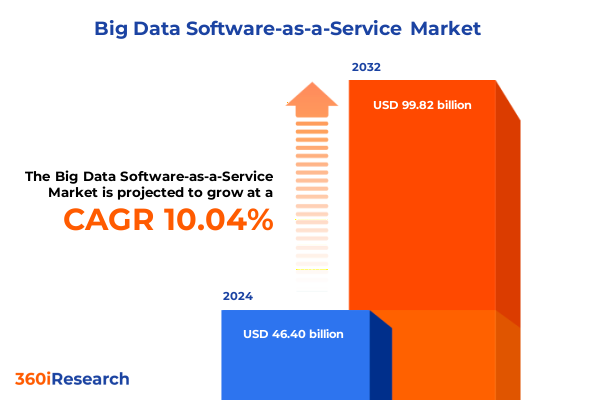

The Big Data Software-as-a-Service Market size was estimated at USD 50.40 billion in 2025 and expected to reach USD 54.75 billion in 2026, at a CAGR of 10.25% to reach USD 99.82 billion by 2032.

Setting the Stage for Disruptive Growth: Understanding the Big Data Software-as-a-Service Revolution and Its Strategic Imperatives

The ascendance of cloud-native architectures combined with exponential data generation has positioned Big Data Software-as-a-Service as a pivotal catalyst for organizational innovation. Enterprises of all sizes are recognizing that harnessing advanced analytics, real-time data integration, and AI-driven intelligence is no longer a luxury but a core imperative. Through the delivery of scalable, secure, and continuously updated solutions, software-as-a-service platforms are reshaping how businesses extract actionable insights from vast, complex datasets. As traditional on-premises deployments reach their scalability limits, SaaS-based delivery models are delivering unmatched flexibility, rapid time to value, and reduced total cost of ownership.

Against this backdrop, decision-makers face mounting pressure to select solutions that not only address immediate data processing needs but also anticipate emerging challenges such as regulatory compliance, data sovereignty, and evolving threat landscapes. This executive summary distills the transformative forces at play in the big data SaaS ecosystem, examines the multifaceted impact of recent policy and market shifts, and provides a strategic lens through which leaders can align their digital initiatives. By understanding both the technological underpinnings and the broader business implications, stakeholders can confidently chart a course toward sustained growth and competitive advantage.

Unprecedented Digital Acceleration and Cloud Innovation Shaping the Next Generation of Big Data Software-as-a-Service Solutions

In recent years, five major currents have converged to redefine the Big Data Software-as-a-Service landscape at an unprecedented pace. First, the proliferation of cloud computing has dismantled the constraints of static infrastructure, enabling elastic scaling of storage and compute resources that can dynamically adapt to data volumes and performance demands. This has, in turn, fueled the evolution of microservices and containerization patterns, which decouple development cycles and foster continuous delivery of features and enhancements.

Second, the integration of artificial intelligence and machine learning capabilities directly within SaaS platforms has transformed raw data into predictive insights. This embedding of AI pipelines accelerates time to value by automating anomaly detection, trend forecasting, and decision support, freeing data teams to focus on strategic interpretation rather than manual data wrangling. Third, edge and hybrid architectures are emerging as critical enablers for organizations operating in industries where data latency, privacy, or intermittent connectivity are paramount concerns. By processing data at or near its source, hybrid cloud models strike a balance between centralized analytics and local operational resilience.

Fourth, the democratization of analytics through intuitive interfaces and low-code/no-code tooling is broadening the user base beyond specialized data scientists to include business analysts, domain experts, and even frontline staff. Such accessibility is driving a cultural shift toward data fluency and evidence-based decision-making at every organizational level. Finally, the ascent of data fabric and data mesh paradigms is promoting federated governance and self-service capabilities that align with enterprise architecture frameworks. By enabling policy-driven access controls, lineage tracking, and metadata management, these approaches ensure that agility does not come at the expense of security or compliance.

Evaluating the Ripple Effects of 2025 United States Tariffs on Software Supply Chains, Service Delivery and Big Data SaaS Economics

The tariffs enacted by the United States in early 2025 introduced levies on a broad spectrum of imported goods, including specialized servers, networking hardware, and certain advanced semiconductors essential to the cloud infrastructure underpinning many Big Data SaaS offerings. As these duties have taken full effect, vendors have experienced incremental input cost increases that have rippled through their pricing frameworks. Some service providers have absorbed a portion of these costs to maintain competitive subscription rates, while others have passed them through directly, prompting customers to reassess budget allocations.

In parallel, supply chain dynamics have shifted as providers seek to mitigate escalatory import expenses. This has led to a greater emphasis on domestic hardware sourcing and strategic partnerships with regional OEMs, which adds complexity to procurement cycles but also reduces exposure to tariff volatility. The impact has been most pronounced for SaaS firms operating on thin margins or those in the early growth stages, where capital efficiency is critical. Established vendors with diversified supplier networks have capitalized on economies of scale to buffer their customer base from steep price escalations.

Moreover, the tariff-induced recalibration has catalyzed innovation in software optimization, with providers accelerating efforts to decouple performance from raw hardware capacity. Container density enhancements, smarter resource scheduling, and AI-driven infrastructure automation have all received renewed focus as levers to offset hardware cost inflation. Finally, these developments are influencing go-to-market strategies; some SaaS vendors are rolling out pre-negotiated regional pricing tiers and unlimited-use bundles designed to offer cost certainty in an increasingly unpredictable regulatory environment.

Decoding Market Dynamics Through Detailed Component, Organization Size, Deployment Model, Application, and Industry Vertical Segmentation

A nuanced view of the Big Data SaaS market reveals distinct patterns when dissected by component, organizational scale, deployment archetype, application purpose, and vertical focus. The division between services and software plays out as a continuum of solution depth: core platforms deliver foundational data integration, management, and analytics capabilities, while professional services and support and maintenance layers overlay bespoke customization, continuous performance tuning, and security safeguards.

When considering adoption through the lens of organization size, large enterprises often prioritize comprehensive platforms that can unify globally distributed data estates and integrate with extensive legacy systems. In contrast, small and medium enterprises gravitate toward modular, purpose-built SaaS suites that can be rapidly implemented and scaled incrementally without the need for extensive in-house IT expertise. This divergence underscores the importance of tiered pricing and packaging models that resonate with each cohort’s unique risk tolerance and governance requirements.

The choice of deployment model further accentuates these differences. Organizations operating under strict data sovereignty or industry regulations frequently opt for private or hybrid cloud constructs that furnish both centralized analytics and on-premises control. Meanwhile, public cloud deployments remain the de facto standard for greenfield digital-native companies seeking maximum agility and cost efficiency. Each deployment archetype brings trade-offs in terms of governance frameworks, latency profiles, and total cost of ownership.

Across applications, data analytics continues to dominate funding, yet data integration is emerging as the critical enabler that ensures disparate data sources coalesce into a unified analytic fabric. Data management and data security functions are critical pillars that uphold data integrity, lineage, and compliance, and they work in concert with data visualization tools that translate complex insights into intuitive dashboards and reports. Finally, the diversity of industry verticals-from banking, capital markets, and insurance within the financial sector, to healthcare payers, hospitals, and biotech in life sciences, to automotive, discrete, and process manufacturing, to e-commerce, hypermarkets, and specialty retail, as well as energy, government, and telecom-demonstrates that each segment’s domain-specific workflows and regulatory contexts drive tailored SaaS solution enhancements.

This comprehensive research report categorizes the Big Data Software-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Industry Vertical

- Application

Comparative Analysis of the Americas, EMEA, and Asia-Pacific Regions Revealing Divergent Growth Drivers and Strategic Opportunities

Geographical context plays a pivotal role in shaping Big Data SaaS demand, with each region exhibiting unique inflection points. In the Americas, market maturity is characterized by early adopter institutions in finance, technology, and retail that leverage large-scale analytics ecosystems to deliver customer personalization and operational efficiency. North American customers have set high benchmarks for service-level agreements, demanding stringent performance and uptime commitments from providers, which in turn fuels continuous innovation in scalability and reliability.

Across Europe, Middle East & Africa, regulatory and cultural diversity present a mosaic of adoption drivers and barriers. The emphasis on data privacy regulations such as GDPR and emerging regional mandates elevates governance, consent management, and localized data residency as critical purchasing criteria. Vendors that maintain strong partnerships with regional integrators and channel partners have enjoyed higher traction by aligning their offerings with country-specific compliance frameworks and language requirements.

In the Asia-Pacific region, burgeoning digital transformation initiatives in markets such as China, India, Australia, and Southeast Asia are accelerating SaaS consumption. High-growth enterprises are building competitive advantage through analytics-driven product innovation and intelligent automation. Meanwhile, infrastructure investments by hyperscale cloud providers are driving down barriers to entry, enabling midsize organizations to deploy advanced big data capabilities with minimal capital expenditure. This democratization of access is positioning Asia-Pacific as the fastest-growing region for new SaaS subscription volumes.

This comprehensive research report examines key regions that drive the evolution of the Big Data Software-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Disruptors Driving Competitive Differentiation in the Big Data Software-as-a-Service Arena

The competitive landscape is defined by a select group of hyperscale cloud incumbents, pure-play analytics vendors, and specialized disruptors all vying for market share through differentiated value propositions. Cloud-native platforms offering serverless architectures and built-in AI pipelines are distinguishing themselves from legacy database roots by enabling instant elasticity and advanced cognitive services out of the box. Meanwhile, established infrastructure providers are rapidly enhancing their managed service portfolios to incorporate data warehouse and data lake capabilities.

Innovation hotspots include high-performance query engines, universal data connectors, and real-time streaming frameworks that cater to event-driven workloads. Companies are also embedding pre-trained machine learning models to jump-start initiatives in fraud detection, customer churn prediction, and supply chain optimization. Partnerships and alliances with system integrators, independent software vendors, and consulting firms are becoming critical for extending solution reach into industry verticals that require deep domain expertise.

Consolidation activities have picked up pace as competition intensifies, with acquisitions and joint ventures enabling firms to fill portfolio gaps and accelerate time to market. At the same time, mid-tier players are pursuing specialization strategies, focusing on areas such as edge analytics for industrial IoT or compliance-centric platforms for regulated industries. These parallel forces of aggregation and differentiation are sharpening the market dynamic, challenging vendors to continuously innovate while maintaining operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Big Data Software-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Cloudera, Inc.

- Databricks, Inc.

- Google LLC

- Hewlett Packard Enterprise

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce

- SAP SE

- Snowflake Inc.

- Splunk Inc.

- Teradata

Strategic Imperatives and Tactical Playbooks for Industry Leaders to Capitalize on Emerging Big Data SaaS Opportunities and Mitigate Risks

To capitalize on market momentum and navigate headwinds, industry leaders should adopt a multi-pronged strategic approach. First, embedding AI and machine learning capabilities natively within every module of the platform accelerates pathway to insights and strengthens competitive positioning. Investments in automated feature engineering, model explainability, and continuous retraining will be key differentiators as data volumes expand.

Second, refining pricing strategies to align with consumption patterns and value realization ensures customers see clear ROI. Introducing usage-based billing, outcome-focused packages, and bundling analytics with professional services can deepen customer relationships and unlock expanded wallet share. Third, pursuing joint go-to-market initiatives with hyperscale cloud providers and niche system integrators amplifies reach into underserved segments, particularly where compliance or industry specialization is essential.

Additionally, prioritizing data governance and security by embedding policy-driven controls and real-time threat detection helps build trust with enterprise buyers and mitigates regulatory risk. Embracing hybrid cloud and edge computing models will cater to latency-sensitive use cases and address geographic data residency requirements. Finally, aligning product roadmaps with vertical-specific workflows-from financial risk analytics to real-time patient monitoring in healthcare-ensures solutions resonate deeply with end users, driving faster adoption and stickier engagements.

Comprehensive Research Framework Combining Primary Interviews, Secondary Data Sources, and Rigorous Analytical Techniques for Big Data SaaS Assessment

This research combined a rigorous blend of primary and secondary data collection to ensure comprehensive market coverage and analytical rigor. Primary research consisted of in-depth interviews with executives at leading cloud service providers, data platform vendors, systems integrators, end-user organizations, and industry experts. These conversations provided qualitative insights into buying motivations, implementation challenges, and future technology roadmaps.

Secondary research encompassed the review of vendor white papers, public financial disclosures, regulatory filings, industry consortia publications, and targeted trade press. Quantitative data was triangulated across multiple sources to validate trends related to adoption rates, service consumption, and competitive positioning. A structured segmentation framework was applied to categorize the market by component, organization size, deployment model, application, and vertical, ensuring analysis granular enough to guide distinct go-to-market strategies.

Analytical methodologies included top-down and bottom-up sizing approaches, product portfolio mapping, and scenario analysis to model the impacts of regulatory shifts and macroeconomic variables. Assumptions and limitations were documented to provide transparency around data confidence levels and potential areas for ongoing monitoring. This structured process underpins the actionable insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Big Data Software-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Big Data Software-as-a-Service Market, by Component

- Big Data Software-as-a-Service Market, by Deployment Model

- Big Data Software-as-a-Service Market, by Industry Vertical

- Big Data Software-as-a-Service Market, by Application

- Big Data Software-as-a-Service Market, by Region

- Big Data Software-as-a-Service Market, by Group

- Big Data Software-as-a-Service Market, by Country

- United States Big Data Software-as-a-Service Market

- China Big Data Software-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesis of Core Findings Highlighting Critical Success Factors and Future Outlook for Big Data Software-as-a-Service Market Stakeholders

The Big Data Software-as-a-Service landscape is at an inflection point characterized by rapid technological evolution, shifting regulatory environments, and intense competitive dynamics. Core findings underscore the importance of flexible deployment architectures, AI-embedded analytics, and robust data governance as foundational pillars for success. Meanwhile, the cumulative impact of U.S. tariffs in 2025 has accelerated innovation in software optimization and prompted strategic supplier diversification.

Segmentation analysis reveals that success hinges on tailoring offerings to distinct customer cohorts-whether global enterprises seeking unified data estates or small and medium businesses prioritizing rapid deployment and simplicity. Regional insights highlight divergent adoption patterns, with North America leading on performance benchmarks, EMEA governed by compliance imperatives, and Asia-Pacific poised for high-growth trajectory driven by digital transformation agendas.

Competitive profiling shows that market leadership will depend on a balance between scale-enabled capabilities and vertical-centric specialization. Providers that align product roadmaps with the intricacies of specific industry workflows stand to achieve higher customer retention and expanded share of wallet. Ultimately, the ability to integrate advanced analytics seamlessly into business processes while maintaining cost efficiency and regulatory alignment will define the winners in this fiercely contested market.

Engage with Our Associate Director to Unlock Deeper Insights and Secure Your Competitive Edge with the Full Big Data SaaS Market Research Report

Don’t let uncertainty slow your strategic progress. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to access the complete Big Data Software-as-a-Service market research report and gain a commanding edge over your competition. Through a personalized consultation, you can explore detailed insights into market segmentation, regional dynamics, regulatory impacts, and competitive positioning tailored to your organization’s unique context. Ketan will guide you through the report’s comprehensive findings and answer any questions you have, ensuring you derive maximum value from the research. Schedule your briefing today to transform knowledge into action and confidently navigate the evolving big data SaaS landscape.

- How big is the Big Data Software-as-a-Service Market?

- What is the Big Data Software-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?