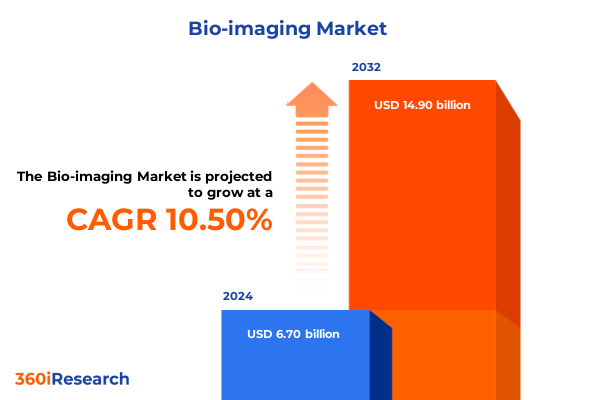

The Bio-imaging Market size was estimated at USD 7.38 billion in 2025 and expected to reach USD 8.13 billion in 2026, at a CAGR of 10.55% to reach USD 14.90 billion by 2032.

Unveiling How Cutting-Edge Bio-imaging Technologies Are Redefining Clinical Diagnostics, Research Breakthroughs, and Therapeutic Innovations Across Healthcare

Bio-imaging technologies have emerged as the cornerstone of modern healthcare, enabling clinicians to visualize anatomical structures and physiological processes with unprecedented precision. From minimally invasive endoscopy that sheds light on internal body cavities to advanced magnetic resonance imaging techniques revealing soft-tissue contrasts, these modalities collectively drive improvements in diagnostic accuracy and patient outcomes. Concurrently, nuclear imaging leverages radiotracers to map functional processes, while surgical microscopy offers surgeons magnified, high-resolution views of operative fields.

The integration of ultrasound and X-ray imaging into clinical workflows has expanded access to real-time, point-of-care diagnostics, reducing dependency on centralized imaging departments. Furthermore, the infusion of artificial intelligence into radiology workflows has led to over 340 FDA-approved AI tools that automate detection tasks and prioritize urgent cases, helping to streamline radiologist workloads and enhance diagnostic speed and accuracy-a shift observed in more than two-thirds of U.S. radiology departments that have adopted AI solutions to augment human oversight and improve throughput. As healthcare providers worldwide seek to balance efficiency, cost containment, and quality of care, bio-imaging stands at the forefront of medical innovation.

Advancements in hybrid imaging, which combine modalities such as positron emission tomography with computed tomography or magnetic resonance, are reshaping diagnostic paradigms by uniting metabolic and anatomical data in a single examination. The development of photon-counting CT scanners offers submillimeter resolution with reduced radiation exposure, further elevating imaging clarity and patient safety while underscoring the transformative potential of next-generation bio-imaging platforms.

Exploring the Transformative Shifts Propelling Bio-Imaging From Conventional Modalities to AI-Driven Solutions and Hybrid Imaging Platforms Shaping the Industry

The bio-imaging landscape is undergoing a profound transformation driven by technological convergence and evolving clinical demands. Artificial intelligence has transitioned from experimental research to routine clinical application, with radiology departments integrating generative AI into administrative workflows, such as report drafting and patient communication, to alleviate time-consuming tasks and allow radiologists to focus on complex image interpretation. Simultaneously, traditional machine-learning algorithms have demonstrated efficacy in areas like mammography and lung nodule detection, cementing AI’s role as a collaborative tool rather than a replacement for human expertise.

Hybrid imaging has matured to become a strategic differentiator, with healthcare facilities investing in PET/CT and PET/MRI systems to harness combined anatomical and functional insights. Hospitals and diagnostic centers are responding to guidelines that now endorse cardiovascular computed tomography angiography as a frontline modality for chest pain assessment, reinforcing the demand for specialized CT systems that support advanced applications such as fractional flow reserve computed tomography (FFR-CT). The shortage of highly trained technologists has further driven the integration of AI-enhanced protocols that automate patient centering and protocol selection, reduce retake rates, and enable higher throughput across MRI and CT platforms.

Point-of-care ultrasound (POCUS) exemplifies the shift toward decentralized imaging. Hand-held devices equipped with AI assistance empower primary care providers and emergency clinicians to perform bedside scans, addressing access challenges in resource‐limited settings and rural communities. Surveys indicate that 79% of caregivers believe AI will positively impact ultrasound image interpretation and streamline workflows, leading to broader adoption of POCUS within five years. This transition toward compact, AI-driven ultrasound systems underscores the industry’s trajectory toward more accessible, efficient, and democratized imaging solutions.

Analyzing the Cumulative Impact of United States Tariffs on Bio-Imaging Equipment and Critical Medical Device Supply Chains Throughout 2025

United States trade policy has introduced layered tariffs that reverberate across the bio-imaging equipment landscape, imposing costs that suppliers and providers must navigate. A 10% tariff remains in effect for most medical imaging imports from Europe, Asia, and other regions, directly affecting the landed price of high-end CT and MRI systems. For U.S. hospitals, this additional levy translates into $100,000 to $200,000 in incremental expenses for scanners priced between $1 million to $2 million, prompting some facilities to delay capital investments amid tightening budgets. Simultaneously, the administration’s directives under Section 301 have escalated duties on Chinese imports-initially set at 20%, then raised by 125% to a cumulative 145%-impacting a wide range of consumable components and modules critical to imaging device manufacturing.

These heightened tariffs extend to surgical and non-surgical respirators, masks, syringes, needles, and rubber gloves, with increases to 25% or higher depending on the product classification. Scheduled adjustments in 2025 introduce a 50% duty on rubber surgical gloves and disposable textile facemasks, compounding cost pressures for clinical disposables and ancillary supplies that constitute a significant portion of hospital budgets. The ripple effect of these tariffs threatens to erode supplier margins, strain procurement cycles, and heighten the risk of supply chain disruptions, particularly for devices reliant on multinational component sourcing.

Industry leaders such as GE Healthcare have already revised profit forecasts for 2025, attributing an anticipated $375 million in tariff-related costs predominantly to shipments between China and the U.S. The company expects its adjusted operating margins to contract from an estimated 16.7% to approximately 14.3%, while earnings per share may incur a one-time reduction of $1.75-though targeted mitigation strategies, including local-for-local manufacturing expansions across 43 international sites, aim to recapture value over the medium term. The cumulative impact of these tariff measures demands that stakeholders recalibrate sourcing strategies, explore tariff exclusion processes, and accelerate efforts toward supply chain resilience.

Uncovering Key Insights From Diverse Bio-Imaging Market Segmentation Across Technologies, Products, Modalities, Applications, and End Users

The bio-imaging market is dissected through multiple lenses that reveal distinct growth vectors and competitive dynamics. Technology segmentation distinguishes modalities ranging from endoscopy-where miniaturized optics and digital sensors enable high-definition visualization of internal cavities-to magnetic resonance imaging, where advanced coil designs and high-field magnets enhance soft-tissue contrast. Nuclear imaging continues to leverage radiotracer innovations to capture functional insights, while surgical microscopy integrates ergonomic optics and fluorescence techniques to support precision procedures. Ultrasound’s portability and cost-effectiveness sustain its widespread adoption, and X-ray imaging-augmented by digital detectors-remains fundamental to initial patient assessments.

Within product segmentation, imaging systems themselves embody the core hardware platforms, while instruments such as CT scanners, MRI machines, and ultrasound devices represent specialized equipment categories essential to diagnostic workflows. The reagent segment encompasses contrast media and radiopharmaceuticals that enhance image quality and specificity. Software solutions, spanning enterprise data management and advanced image analysis, are increasingly recognized as value-drivers for operational efficiency and decision support, leveraging artificial intelligence to automate measurements, detect anomalies, and facilitate quantitative reporting.

Modality segmentation highlights the divergence between two-dimensional imaging techniques, which deliver real-time planar views for rapid diagnostics, and three-dimensional imaging, which reconstructs volumetric datasets critical to surgical planning, oncology treatment assessment, and complex research applications. Application segmentation underscores the varied use cases-clinical diagnostics leverage imaging for disease detection; drug discovery exploits preclinical imaging to accelerate therapeutic development; research employs advanced modalities to investigate fundamental biological processes; and therapeutic imaging guides interventions, including image-guided surgeries.

End-user segmentation captures the spectrum of care settings that adopt bio-imaging technologies. Ambulatory surgical centers prioritize compact, high-throughput ultrasound and digital X-ray systems for surgical guidance. Diagnostic imaging centers emphasize multi-modality platforms and scheduling efficiencies to accommodate diverse patient volumes. Hospitals and clinics require comprehensive imaging suites, integrating large-bore MRI, CT, and hybrid systems to support inpatient and outpatient services.

This comprehensive research report categorizes the Bio-imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Modality

- Application

- End User

Revealing Regional Dynamics Shaping the Bio-Imaging Market in the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Strategic Investments

Regional dynamics significantly influence market maturation, regulatory environments, and investment flows across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust reimbursement frameworks and high healthcare expenditures underpin demand for premium imaging modalities. The U.S. point-of-care ultrasound market alone was valued at $444.7 million in 2023, driven by the increasing adoption of compact and handheld devices in emergency medicine and outpatient settings. Canadian and Latin American markets benefit from government-backed modernization initiatives that aim to mitigate diagnostic disparities in rural and underserved areas.

Europe Middle East & Africa exhibits a heterogeneous regulatory landscape shaped by varied approval pathways and healthcare funding models. European providers are rapidly integrating AI-enabled MRI and CT solutions showcased at leading conferences such as the European Congress of Radiology, while Middle Eastern health systems invest in state-of-the-art imaging centers to support growing medical tourism sectors. African markets, though smaller in installed base, present opportunity for leapfrogging legacy technologies through partnerships with global OEMs and local stakeholders.

Asia-Pacific stands out as the fastest-growing region, propelled by expanding healthcare infrastructure, rising chronic disease prevalence, and government-led incentive programs. China’s medical device exports to the U.S. face pressure from elevated tariffs, prompting domestic and international vendors to establish local manufacturing sites to circumvent duties-a trend exemplified by Chinese radiology companies that have insulated themselves from 145% tariffs through U.S.-based factories. India, Japan, and Southeast Asian nations continue to scale diagnostic capacities, with private-sector investments fueling the acquisition of hybrid imaging and AI-driven platforms.

This comprehensive research report examines key regions that drive the evolution of the Bio-imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Profile Insights of Leading Bio-Imaging Industry Players Driving Innovation and Market Resilience Amid Evolving Healthcare Challenges

Leading players in the bio-imaging sector demonstrate diverse strategies to maintain competitive advantage amid technological disruption and policy headwinds. GE Healthcare has recalibrated its 2025 guidance, attributing margin contractions to global tariff levies that could reduce profit margins by approximately 240 basis points while committing $375 million in tariff-related costs primarily from U.S.-China trade flows. The company’s emphasis on local-for-local manufacturing and duty exemption pursuits illustrates a broader industry pivot toward supply chain localization.

Siemens Healthineers continues to spearhead photon-counting CT development, with its Naeotom Alpha scanner earning FDA approval as the first significant CT innovation in a decade and accounting for 40% of exports to the U.S. market prior to tariff escalations. The introduction of helium-independent MRI platforms such as MAGNETOM Flow and advanced PET/CT systems like Biograph Trinion reflect the company’s commitment to sustainable, AI-enhanced imaging solutions that address both clinical and environmental imperatives.

Philips has bolstered its MRI portfolio with the SmartSpeed Precise dual-AI engine, capable of reducing scan times by up to threefold and automating 80% of procedural workflows, thereby enhancing throughput and diagnostic precision across its helium-free BlueSeal scanners. The firm’s expansion into cloud-based quantitative reporting through Smart Reading underscores the growing importance of software and service revenue streams in a hardware-centric industry.

Emerging vendors, including Lunit and Aidoc, have secured thousands of clinical installations for their AI-driven image analysis tools, signaling increased competition in the software domain. Strategic alliances between device manufacturers and AI specialists are accelerating the integration of intelligent applications that extend beyond detection to encompass workflow orchestration, billing support, and regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BaySpec, Inc.

- Bracco S.p.A.

- Bruker Corporation

- Canon Medical Systems Corporation

- Digirad Corporation

- Esaote S.p.A

- Fujifilm Holdings Corporation

- GE HealthCare Technologies, Inc.

- Hitachi Medical Corporation

- HT BioImaging Ltd

- iThera Medical GmbH

- Kitware, Inc.

- Koninklijke Philips N.V.

- Lantheus Medical Imaging, Inc.

- M Squared Lasers Ltd.

- MARS Bioimaging Limited

- Medtronic PLC

- MobileODT Ltd by Liger Medical LLC

- Perspectum Ltd.

- Quibim, S.L.

- RadNet, Inc.

- Rivanna Medical, Inc.

- Samsung Medison Co., Ltd.

- Siemens Healthineers

Developing Actionable Recommendations for Industry Leaders to Navigate Bio-Imaging Market Disruptions and Capitalize on Emerging Opportunities

Industry leaders should prioritize the integration of AI and machine-learning capabilities into core imaging platforms by forging partnerships with specialized software developers. This alignment can unlock new value propositions, such as zero-click workflows and cloud-based quantitative reporting, that address clinical efficiency and reimbursement constraints. Simultaneously, organizations must diversify supply chains through regional manufacturing hubs and strategic inventory buffers to mitigate the financial and operational impacts of tariff fluctuations.

Investments in point-of-care ultrasound infrastructure and training programs will expand diagnostic reach and reinforce care delivery models in both urban and rural markets. Healthcare institutions should explore scalable POCUS ecosystems that combine handheld hardware, AI-driven guidance, and robust documentation tools to streamline billing and compliance efforts. These initiatives are essential for capitalizing on growing demand for decentralized imaging solutions.

To cultivate sustainable growth, companies should accelerate eco-friendly technology development-such as helium-independent MRI cooling and energy-efficient CT detectors-to align with global environmental mandates and reduce total cost of ownership for providers. Collaborative models involving OEMs, regulatory bodies, and clinical stakeholders will expedite the adoption of green imaging platforms.

Lastly, stakeholders must pursue targeted market entry strategies in high-growth regions by leveraging localized partnerships, engaging payers on value-based care proposals, and tailoring service offerings to meet regional regulatory and reimbursement requirements. A nuanced understanding of local dynamics is critical for securing long-term access and driving incremental revenue streams.

Detailing Comprehensive Research Methodology Employed to Ensure Rigorous Analysis, Reliable Data Collection, and Insightful Bio-Imaging Market Findings

This analysis draws upon a rigorous multi-method research framework combining both primary and secondary data sources. Primary research included in-depth interviews with executives from leading medical device companies, radiologists, procurement specialists, and healthcare policy experts to capture firsthand insights into technology adoption, tariff impacts, and regional market dynamics.

Secondary research leveraged peer-reviewed journals, regulatory filings, government trade databases, and conference proceedings from entities such as the U.S. Trade Representative, Radiological Society of North America, European Congress of Radiology, and company press releases. Trade press articles and financial disclosures provided context on tariff rulings, supplier strategies, and product validations.

Quantitative data were triangulated through statistical analysis of import-export flows, hospital procurement records, and reimbursement schedules. Qualitative insights were coded thematically to identify recurring challenges and strategic responses across stakeholder groups. Validation panels, comprising radiology department leaders and industry consultants, reviewed preliminary findings to ensure accuracy, relevance, and applicability to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-imaging Market, by Product

- Bio-imaging Market, by Technology

- Bio-imaging Market, by Modality

- Bio-imaging Market, by Application

- Bio-imaging Market, by End User

- Bio-imaging Market, by Region

- Bio-imaging Market, by Group

- Bio-imaging Market, by Country

- United States Bio-imaging Market

- China Bio-imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on Bio-Imaging Market Evolution, Strategic Imperatives and the Path Forward for Healthcare Innovation and Growth

The bio-imaging sector is poised at an inflection point where technological innovation, policy interventions, and evolving care models converge to redefine diagnostic and therapeutic possibilities. Advances in AI and hybrid imaging platforms are unlocking new clinical workflows that enhance accuracy, efficiency, and patient safety, while tariff dynamics are reshaping supply chain strategies and cost structures. Segmentation analyses reveal nuanced growth opportunities across modalities, product types, applications, and end-user environments, demanding bespoke market approaches.

Regional insights highlight divergent trajectories, with mature markets prioritizing AI integration and sustainability, and emerging regions accelerating infrastructure expansion through public-private collaborations. Leading companies demonstrate adaptability through localized manufacturing, strategic partnerships, and a balanced hardware-software portfolio, setting benchmarks for resilience in a rapidly evolving landscape.

As healthcare stakeholders navigate this complex environment, the imperative to foster collaboration, invest in eco-friendly innovations, and cultivate flexible supply networks has never been greater. The collective momentum of technological evolution and strategic foresight will chart the path for sustainable growth and transformative patient care in the years ahead.

Engage With Associate Director of Sales & Marketing, Ketan Rohom, to Secure Your Copy of the Comprehensive Bio-Imaging Market Research Report

To secure the comprehensive market research report and gain deeper strategic insights into the dynamic bio-imaging landscape, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s extensive findings, answer specific questions, and arrange access to data tailored to your organization’s needs. Engaging with Ketan ensures you receive personalized support and detailed analysis to inform critical investment, partnership, and product development decisions. Don’t miss this opportunity to leverage expert-driven research for actionable intelligence and a competitive edge.

- How big is the Bio-imaging Market?

- What is the Bio-imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?