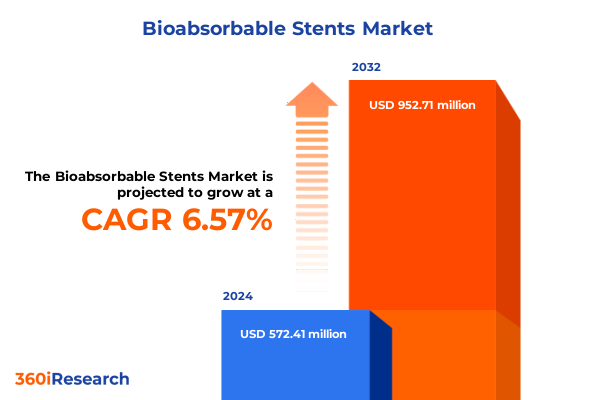

The Bioabsorbable Stents Market size was estimated at USD 607.56 million in 2025 and expected to reach USD 645.65 million in 2026, at a CAGR of 6.63% to reach USD 952.71 million by 2032.

Reframing Coronary Intervention Paradigms Through Bioabsorbable Stents That Eliminate Permanent Metallic Implants and Support Natural Vessel Healing

Cardiovascular disease remains the leading cause of morbidity and mortality worldwide, with coronary artery disease accounting for millions of deaths annually. Traditional metallic stents, while effective in restoring vessel patency, leave a permanent implant that can provoke late adverse events, compromise vascular dynamics, and impede future interventions. Recognizing these challenges, the interventional cardiology field has pursued next-generation solutions that support vessel healing temporarily before safely disappearing from the arterial wall. The concept of bioabsorbable stents has attracted substantial research and development efforts, promising a paradigm shift in percutaneous coronary intervention by eliminating permanent foreign bodies and fostering natural vessel remodeling

Early clinical studies of polymer-based scaffolds demonstrated feasibility but uncovered higher rates of late scaffold thrombosis and inflammatory responses due to thick struts and slow degradation profiles. In response to these setbacks, innovators have turned to metal-based and hybrid materials to optimize mechanical strength, control degradation rates, and improve deliverability. The modern landscape of bioabsorbable stents reflects a rich tapestry of material science, engineering refinements, and clinical learnings aimed at overcoming the limitations of first-generation devices.

Material and Clinical Innovations That Redefined Bioresorbable Scaffold Design to Overcome First-Generation Limitations and Expand Clinical Applications

The bioabsorbable stents landscape has undergone profound transformation, driven by material innovations and clinical insights gained from the shortcomings of early polymer scaffolds. Initially, polymer-based devices pioneered the concept of temporary vessel support but were hampered by strut thickness, delayed endothelialization, and adverse late outcomes. Large-scale trials revealed that poly-L-lactic acid scaffolds could increase scaffold thrombosis and late lumen loss, prompting a reevaluation of device design and material selection.

Responding to these challenges, magnesium-based stents emerged as a compelling alternative. Magnesium alloys offer superior radial strength and more favorable degradation kinetics, resorbing within 12 to 24 months while minimizing inflammatory byproducts. The introduction of refined metal alloys, surface electropolishing, and drug-eluting coatings has enabled next-generation scaffolds to deliver controlled drug release and enhanced safety profiles. The Magmaris scaffold, with its sirolimus-eluting polymer coating and near-complete magnesium resorption by one year, exemplifies this shift toward metallic bioabsorbable platforms.

Moreover, the field is witnessing expansion beyond coronary applications, with early trials evaluating bioabsorbable devices in peripheral artery disease and pediatric interventions. These devices benefit from thinner struts, improved radiopacity, and advanced coating technologies that combine inorganic and organic layers for optimized biocompatibility. As device designs evolve, they integrate computational modeling, intravascular imaging guidance, and digital health tools to achieve precise sizing, deployment, and long-term monitoring. The culmination of these transformative shifts has set the stage for a new era in vascular intervention where temporary scaffolding gives way to durable healing.

Analyzing the Realities of Newly Imposed Section 301 Tariffs on Medical Device Imports and Their Consequences for Supply Chains and Profitability

In April 2025, the United States government reinstated Section 301 tariffs on many Class I and II medical devices, signaling a significant policy shift for the medtech industry. The levies include a 10% baseline duty on devices imported from various trading partners, with higher rates for specific regions. Medical device manufacturers reliant on offshore production now confront increased input costs and disrupted supply chains, prompting concerns about healthcare affordability and access.

Industry analysts from GlobalData warn that these measures could accelerate supply chain diversification efforts, as companies seek to mitigate the risks of tariff exposure by nearshoring production and qualifying alternative suppliers. However, complex manufacturing requirements for high-precision implants and limited domestic production capacity pose significant obstacles to rapid reshoring. Firms such as Zimmer Biomet have anticipated profit reductions in the tens of millions due to import duties, while cardiovascular device revenues face potential headwinds if costs are fully passed through to healthcare providers and patients.

The cardiovascular device sector, traditionally supported by low tariff exemptions, now braces for one-time earnings adjustments and ongoing margin pressure. Medical device trade associations have appealed for targeted exclusions, emphasizing the humanitarian mission of these products. In the near term, companies may absorb some cost increases, optimize logistics, and accelerate digital procurement strategies to preserve competitive positioning. Over the long term, persistent tariff uncertainty could influence capital investment decisions, drive consolidation, and reshape regional manufacturing footprints across the industry.

Unraveling the Multidimensional Segmentation Framework That Drives Tailored Device Designs and Clinical Applications of Bioresorbable Stents

The bioabsorbable stents sector encompasses diverse material classes, each offering distinct degradation profiles and mechanical properties. Metal-based scaffolds leverage iron, magnesium, and zinc alloys to achieve high radial strength and controlled resorption, while polymer-based devices utilize poly-L-lactic acid, polycaprolactone, polydioxanone, and polyglycolic acid to modulate healing dynamics. These material innovations address the need for temporary vessel support followed by natural remodeling without the long-term presence of a permanent implant.

Alongside material diversity, the market is segmented by drug-eluting versus non-drug-eluting types, reflecting a balance between antiproliferative therapies and simplicity of design. Drug-eluting scaffolds integrate agents such as sirolimus to prevent neointimal hyperplasia, whereas non-drug-eluting devices emphasize streamlined manufacturing and rapid resorption. Degradation time further differentiates offerings, ranging from scaffolds designed to disappear in under 12 months to those engineered for extended vessel patency beyond two years, aligning device lifespan with clinical healing requirements.

Clinical applications span coronary artery disease, neurovascular interventions, pediatric vascular anomalies, and peripheral artery disease, each imposing unique device performance and resorption considerations. End users vary from academic and research institutions pioneering early adoption to ambulatory surgical centers, specialized cardiac centers, and large hospital systems, each navigated through offline and online distribution channels tailored to procurement and inventory management preferences. This segmentation framework underpins a nuanced understanding of end-user needs, clinical contexts, and supply partnerships driving technology adoption.

This comprehensive research report categorizes the Bioabsorbable Stents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- Degradation Time

- Application

- End User

- Distribution Channel

Examining Geographic Dynamics in Regulatory Approvals, Clinical Adoption, and Manufacturing Strategies Across Major Global Regions

The Americas continue to lead bioabsorbable stent adoption, supported by robust cardiovascular research ecosystems, reimbursement pathways, and established percutaneous intervention volumes. In the United States, despite tariff pressures, manufacturers collaborate with consortia and regulatory bodies to secure device approvals and coverage decisions. Real-world registries and post-market surveillance initiatives bolster confidence in emerging platforms, though supply chain resilience remains a strategic focus amid shifting trade policies.

Europe, Middle East & Africa (EMEA) represents a pioneer region for bioabsorbable scaffolds, benefiting from CE mark approvals that predate many other jurisdictions. Early adopters in Germany, France, and the Nordic countries have contributed critical clinical insights through first-in-man trials and multicenter registries, establishing best practices for implantation techniques and patient selection. However, ongoing geopolitical and tariff uncertainties have prompted manufacturers to diversify manufacturing footprints and partner with regional contract organizations to mitigate import risks.

Asia-Pacific markets exhibit accelerated growth driven by rising cardiovascular disease burden, progressive regulatory pathways, and willingness to participate in clinical studies. Countries such as Singapore, South Korea, and Australia have hosted key clinical trials, while China and India explore localized production of next-generation scaffolds to address widening treatment gaps. Collaborative research networks and digital health infrastructures facilitate rapid knowledge exchange, positioning the region as a critical node in the global bioabsorbable stents value chain.

This comprehensive research report examines key regions that drive the evolution of the Bioabsorbable Stents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovations and Clinical Outcomes from Leading Manufacturers in Metallic, Polymer, and Novel Scaffold Platforms

Biotronik has emerged as a leader in metallic bioabsorbable scaffolds with its Magmaris platform. BIOSOLVE-II and BIOSOLVE-III pooled data demonstrate sustained safety and clinical performance up to 24 months, with low target lesion failure rates and zero definite or probable scaffold thrombosis. The device’s magnesium backbone and sirolimus-eluting PLLA coating offer strong radial support and fast absorption, securing CE mark approval and widespread adoption across Europe and select international markets.

REVA Medical’s Fantom scaffold represents an evolution in polymer-based scaffolds through its Tyrocore desaminotyrosine polycarbonate backbone. Its inherent radiopacity and reduced strut thickness of 125–95 µm enable precise implantation and favorable healing patterns, as evidenced by the FANTOM II trial’s low major adverse cardiac event rates at 6 and 12 months. Despite early financial challenges, the device’s design attributes have influenced polymer scaffold development strategies and underscored the importance of visibility and deliverability in clinical practice.

Abbott’s experience with the Absorb bioresorbable scaffold yielded critical lessons about device thickness, deployment technique, and patient selection. Discontinuation of Absorb in 2017 followed safety signals from multiple trials, prompting Abbott to refocus on its Xience Sierra platform and next-generation resorbable concepts. This pivot underscores the necessity of rigorous trial design, performance benchmarking, and iterative innovation in bringing safe, effective bioabsorbable stents to market.

Medtronic is exploring polymer-free drug-filled stents through its RevElution trial, investigating a novel platform that elutes therapeutic agents without polymer carriers. Early results suggest potential to address inflammatory responses associated with polymer coatings, expanding the spectrum of resorbable and semi-resorbable scaffold technologies under clinical evaluation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioabsorbable Stents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arterius Ltd

- B. Braun SE

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Cardionovum GmbH

- Elixir Medical Corporation

- ELLA – CS, s.r.o.

- JW Medical Systems Ltd. Biosensors International Group, Ltd.

- Kaneka Corporation

- Kyoto Medical Planning Co. Ltd.

- Lepu Medical Technology Co. Ltd.

- Meril Life Sciences

- Microport Scientific Corporation

- OrbusNeich Medical Group Holdings Limited

- Q3 Medical Group

- Reva Medical

- SafeGuard Surgical, Inc.

- Shandong Hua'an Biotechnology

- Sino Medical Sciences Technology Inc.

- Svelte Medical Systems Inc

- Terumo Corporation

- WEGO HEALTHCARE (SHENZHEN) CO., LTD

- Zorion Medical Inc.

Strategic Measures for Manufacturers to Strengthen Supply Chains, Advance Material Innovations, and Secure Regulatory Support

Industry leaders should prioritize supply chain resilience by diversifying sourcing strategies and collaborating with regional manufacturing partners. Accelerating qualification of alternate suppliers for critical alloy components can mitigate the impact of tariffs and geopolitical uncertainties, as recommended by GlobalData for the medtech sector.

Investing in next-generation magnesium and zinc alloy research offers a dual benefit of improved mechanical performance and tailored degradation profiles. Manufacturers can leverage the Triune Principle of magnesium alloy design-balancing biocompatibility, mechanical strength, and degradation-to accelerate the development of high-performing scaffolds, as outlined by leading academic reviews.

Engagement with regulatory authorities to secure targeted tariff exemptions for life-saving medical devices can preserve pricing stability and ensure patient access. Coordinated advocacy through industry associations and data-driven impact assessments will strengthen exemption petitions and highlight the humanitarian mission of cardiovascular implants.

Finally, collaboration on real-world evidence generation through global registries and post-market surveillance will validate long-term safety and performance across patient subgroups. Integrating intravascular imaging, digital health monitoring, and artificial intelligence protocols can refine patient selection, optimize deployment techniques, and drive iterative product enhancements.

Detailed Explanation of the Multi-Tiered Research Approach Combining Secondary Sources, Expert Consultations, and Data Validation Processes

This analysis is informed by a comprehensive multi-tiered research methodology that combines extensive secondary research, primary expert interviews, and rigorous data triangulation. Secondary research encompassed peer-reviewed literature, clinical trial registries, regulatory filings, and leading news outlets to ensure a robust foundation of factual accuracy.

Key opinion leaders and industry executives were consulted to validate findings and provide qualitative context regarding material development, clinical practice shifts, and tariff implications. Quantitative insights were cross-checked against public trial outcomes and trade association reports to maintain consistency and reliability.

A structured approach to content synthesis prioritized clarity and logical flow, with each section undergoing multiple rounds of editorial review. This process ensured alignment with professional standards for market research, facilitating actionable conclusions and strategic recommendations tailored to stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioabsorbable Stents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioabsorbable Stents Market, by Material

- Bioabsorbable Stents Market, by Product Type

- Bioabsorbable Stents Market, by Degradation Time

- Bioabsorbable Stents Market, by Application

- Bioabsorbable Stents Market, by End User

- Bioabsorbable Stents Market, by Distribution Channel

- Bioabsorbable Stents Market, by Region

- Bioabsorbable Stents Market, by Group

- Bioabsorbable Stents Market, by Country

- United States Bioabsorbable Stents Market

- China Bioabsorbable Stents Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights on Market Dynamics, Technological Progress, and Strategic Imperatives in the Bioabsorbable Stents Sector

The evolution of bioabsorbable stents reflects a dynamic convergence of material science, clinical experience, and regulatory landscapes. From the early polymer scaffolds to the latest magnesium and zinc alloys, each iterative breakthrough has addressed prior limitations and broadened therapeutic possibilities. While recent U.S. tariffs have introduced supply chain challenges, they also underscore the importance of resilient sourcing and strategic manufacturing partnerships.

Segmentation insights reveal that device performance must align with material characteristics, drug-elution strategies, degradation timelines, and specific clinical applications. Regional dynamics highlight varied adoption patterns shaped by regulatory frameworks and healthcare infrastructure, while key company initiatives demonstrate the competitive impetus to innovate and refine scaffold technologies.

Looking ahead, actionable recommendations emphasize the need for diversified supply chains, targeted alloy research, regulatory engagement, and collaborative real-world evidence generation. By integrating these strategic imperatives, industry leaders can navigate tariff headwinds, accelerate clinical adoption, and deliver transformative vascular interventions that ultimately restore vessel health without permanent implants.

Connect with the Associate Director for Exclusive Access to a Comprehensive Bioabsorbable Stents Market Research Report

Engage directly with Associate Director, Sales & Marketing Ketan Rohom to secure comprehensive insights and strategic guidance tailored to your organization’s objectives. By partnering with this expert, you gain access to a fully detailed market research report that spans material innovations, regulatory landscapes, tariff implications, and competitive dynamics in the bioabsorbable stents sector. Reach out today to elevate decision-making with data-driven analysis, uncover emerging opportunities, and position your enterprise at the forefront of vascular intervention advancements. Your next breakthrough in cardiovascular care awaits-initiate a conversation and transform insights into action.

- How big is the Bioabsorbable Stents Market?

- What is the Bioabsorbable Stents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?