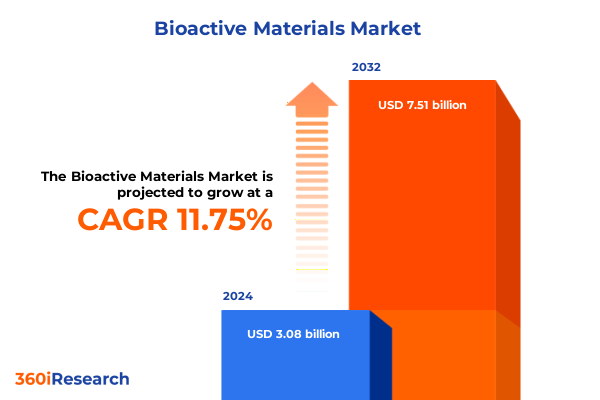

The Bioactive Materials Market size was estimated at USD 3.39 billion in 2025 and expected to reach USD 3.74 billion in 2026, at a CAGR of 11.99% to reach USD 7.51 billion by 2032.

Unveiling the Strategic Importance and Emerging Frontiers of Bioactive Materials in Modern Regenerative Medicine and Healthcare Innovation

The field of bioactive materials represents a pivotal convergence of advanced material science and clinical innovation, driving breakthroughs in regenerative medicine, implantable devices, and therapeutic platforms. By harnessing the ability to interact with biological tissues at the molecular level, these materials support cell adhesion, promote tissue regeneration, and modulate physiological responses. As a result, bioactive materials are rapidly reshaping treatment paradigms across orthopedics, dental care, cardiovascular interventions, and tissue engineering.

Emerging developments in biomaterial chemistries and surface functionalization techniques are enabling more precise control over cellular responses, fostering accelerated healing and reducing the risk of complications. With interdisciplinary research efforts uniting chemistry, biology, and engineering, the landscape now encompasses bioresorbable polymers, osteoconductive ceramics, metallic composites, and multifunctional glass-ceramics. This diversity of solutions reflects the sector’s robust potential to deliver patient-specific, minimally invasive therapies.

Despite its remarkable promise, the bioactive materials domain must navigate complex regulatory pathways, manufacturing scalability challenges, and supply chain constraints. Nonetheless, strategic collaborations between academic institutions, medical device innovators, and material suppliers are laying the groundwork for next-generation products. By examining the technological drivers and stakeholder dynamics, this report uncovers the foundational factors shaping the evolution of bioactive materials in contemporary healthcare.

Exploring How Advanced Manufacturing Techniques and Smart Biomaterials Are Disrupting Traditional Approaches to Tissue Integration and Therapeutic Efficacy

Additive manufacturing has catalyzed a transformative shift in how bioactive materials are designed and fabricated. Three-dimensional bioprinting techniques now allow for patient-specific implants that precisely replicate anatomical geometries while incorporating living cells and bioactive agents directly into the scaffold structure. These advances enable more effective tissue integration and accelerated healing by combining personalized form factors with localized therapeutic delivery.

Simultaneously, smart implant technologies are redefining device functionality by integrating responsive materials and embedded sensors that monitor physiological conditions in real time. Shape memory alloys and piezoresistive coatings, for instance, can adapt to mechanical loads and provide data on implant integrity, reducing the risk of failure and enabling proactive clinical interventions. In parallel, the emergence of bioresorbable metallic alloys-engineered to degrade in synchrony with tissue regeneration-eliminates the need for secondary removal surgeries and minimizes long-term complications. This convergence of material innovation and digital health instrumentation is setting a new standard for therapeutic efficacy and patient safety.

Analyzing the Layered Consequences of 2025 U.S. Trade Tariffs on Raw Materials and Device Components in the Bioactive Materials Ecosystem

In April 2025, the United States implemented a broad 10% global tariff on nearly all healthcare-related imports, including active pharmaceutical ingredients, medical devices, and critical material inputs. This tariff has directly increased the cost of sourcing specialized compounds and device components from international suppliers, compelling manufacturers to reassess their global procurement strategies and explore alternative sourcing options or domestic production capabilities. At the same time, targeted tariffs on Chinese imports of key drug precursors-pegged at rates as high as 245%-have further inflated costs for bioresorbable polymers and antimicrobial agents often sourced from Asia, placing additional pressure on R&D budgets and product affordability.

Moreover, strategic tariff increases under Section 301 have raised duties on raw materials essential to bioactive device manufacturing. Starting January 1, 2025, polysilicon and solar-grade wafers face a 50% duty, while specific tungsten products are subject to a 25% levy. Although these materials are traditionally associated with the electronics sector, they play a crucial role in plasma spray coatings and thin-film deposition processes integral to bioactive glass and ceramic implant coatings. As a result, developers are experiencing higher input costs and longer lead times, prompting a reconfiguration of supply chains and accelerated efforts to qualify domestic material substitutes.

In-depth Examination of Market Dynamics Across Material Types, Functionalities, Form Factors, Applications, and End Use Industries Driving Segment-Specific Growth

The bioactive materials market can be deconstructed through a multifaceted segmentation framework that illuminates the distinct drivers and value propositions of each category. Material type segmentation spans high-strength metallic alloys, versatile polymers, osteoconductive ceramics, engineered composites, and bioactive glass formulations. Each material class presents a balance of mechanical performance, biocompatibility, and degradation profiles, influencing its suitability for specific clinical indications.

Functionality segmentation further refines this picture by differentiating materials engineered to deliver antimicrobial protection, those designed for dynamic biointeractive signaling, bioresorbable systems that dissolve in harmony with tissue regeneration, and osteoconductive substrates optimized for bone ingrowth. The interplay between functionality and material chemistry informs both device design and regulatory pathways.

Form factor segmentation encompasses surface coatings applied via plasma spray, sol-gel, physical and chemical vapor deposition methods, as well as flexible films, particulate granules, powder formulations, and three-dimensional scaffolds. These form factors dictate the manufacturing approach, implantation method, and clinical workflow.

Application segmentation captures the broad spectrum of use cases, from cardiovascular stents and dental restorations to drug delivery vehicles such as hydrogels, microparticles, and nanoparticles, ophthalmic devices, orthopedic implants, and tissue engineering constructs. Finally, end use industry segmentation highlights the role of biomedical device manufacturers, cosmetics formulators, pharmaceutical developers, and research laboratories, each leveraging bioactive materials to advance therapeutic innovation.

This comprehensive research report categorizes the Bioactive Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Functionality

- Form Factor

- Application

- End Use Industry

Comprehensive Regional Analysis Highlighting Distinct Drivers and Barriers Shaping the Bioactive Materials Landscape Across Global Territories

In the Americas, robust investment in research and development infrastructure and the presence of leading medical device clusters have fostered a thriving ecosystem for bioactive materials. Regulatory pathways through the U.S. Food and Drug Administration and Health Canada support accelerated approvals for innovative therapies, while strategic public–private partnerships are fueling early-stage technology maturation and commercialization efforts.

Europe, the Middle East and Africa exhibit distinctive regional dynamics shaped by the European Medical Device Regulation, which emphasizes stringent clinical evidence and post-market surveillance. This environment has incentivized suppliers to invest in comprehensive biocompatibility assessments and long-term outcome studies. Additionally, regional initiatives aimed at bolstering local manufacturing capabilities are driving collaborations between academic consortia and industrial partners, particularly in Germany, France and the Gulf Cooperation Council member states.

Asia-Pacific remains a high-growth frontier, underpinned by expansive contract manufacturing networks in China and India and rapidly evolving regulatory frameworks in Japan, South Korea and emerging Southeast Asian markets. Government-backed innovation funds and favorable tax incentives are supporting the scaling of bioactive material production, particularly for cost-sensitive applications. Cross-border partnerships and technology transfer agreements are further enabling regional players to gain traction in global supply chains.

This comprehensive research report examines key regions that drive the evolution of the Bioactive Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Differentiation and Technological Advancement in the Bioactive Materials Sector

Leading manufacturers are strategically expanding their portfolios through targeted R&D investments, licensing agreements, and collaborations with academic institutions. SCHOTT AG has leveraged its advanced glass technology to develop a range of standardized and customizable bioactive glass products for orthopedics and dental applications, positioning itself at the forefront of clinical outcome innovations. Similarly, Johnson & Johnson’s DePuy Synthes business unit has integrated bioactive glass technologies into bone graft substitutes and implant coatings, capitalizing on its global distribution network and regulatory expertise to accelerate market adoption.

Specialist firms such as Mo-Sci Corporation have differentiated themselves by offering precision-engineered glass microspheres and particulate formulations tailored to specific medical indications, while NovaBone Products has focused on optimizing graft handling characteristics and controlled resorption profiles to enhance surgical efficiency. Stryker Corporation has augmented its regenerative solutions lineup through partnerships that enable the co-development of antimicrobial and osteoconductive implant coatings. Emerging players such as BonAlive Biomaterials, Synergy Biomedical and Noraker are gaining traction by advancing proprietary compositions and sol-gel processing methods, underscoring the competitive intensity and breadth of innovation within the bioactive materials sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioactive Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ametex Inc.

- Arthrex Inc.

- B. Braun AG

- BASF SE

- Baxter International, Inc.

- Berkeley Advanced Biomaterials

- Biomatlante SAS

- Bioretec Ltd.

- Cam Bioceramics BV

- Collagen Matrix, Inc.

- Cook Medical LLC

- CoorsTek, Inc.

- Danimer Scientific

- Dentsply Sirona Inc.

- DSM-Firmenich AG

- DSM Biomedical

- Heraeus Holding GmbH

- Invibio Ltd.

- Johnson & Johnson

- Medtronic Plc

- MycoWorks

- Noraker SA

- OSARTIS GmbH

- Septodont Holding SA

- Smith & Nephew plc

- Terumo Corporation

- W. L. Gore & Associates, Inc.

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Roadmap Offering Practical Steps for Industry Leaders to Navigate Regulatory Complexities and Accelerate Bioactive Material Adoption

Industry leaders should prioritize the establishment of resilient supply chains by qualifying multiple domestic and international suppliers for critical raw materials, while simultaneously investing in process optimization to mitigate the impact of tariff fluctuations. Building modular manufacturing capabilities that can pivot between coatings, scaffold production and composite fabrication will enable companies to adapt rapidly to shifting demand patterns and regulatory requirements.

Collaborative engagements with clinical research centers and key opinion leaders can accelerate the generation of high-quality clinical evidence, supporting faster regulatory approvals and fostering payer acceptance. Moreover, integrating digital tools such as predictive analytics and quality-by-design frameworks into R&D pipelines can streamline material selection and reduce time-to-market for novel formulations.

To capture emerging opportunities in high-growth regions, organizations should establish localized partnerships and invest in technology transfer initiatives that align with regional regulatory landscapes. By adopting a proactive approach to sustainability-such as incorporating bioresorbable components and green manufacturing practices-companies can enhance their ESG profiles and meet the evolving demands of stakeholders.

Rigorous Research Framework Detailing Data Collection, Analytical Techniques, and Validation Methodologies Underpinning the Bioactive Materials Study

This study employs a hybrid research methodology integrating both primary and secondary data collection to ensure a robust analytical foundation. Primary research involved in-depth interviews with material scientists, device manufacturers, regulatory experts, and end users to capture firsthand perspectives on technological trends, clinical needs, and market dynamics. Insights from these stakeholder engagements were systematically triangulated to validate emerging themes.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patent databases, regulatory filings, industry white papers, and conference proceedings. Proprietary datasets were leveraged to map global supply chains and quantify material production capacities. Segmentation analyses were structured around five key dimensions-material type, functionality, form factor, application, and end use industry-to enable targeted insights and benchmarking across each category.

Quantitative data were subjected to rigorous quality checks, including outlier analysis and consistency verification against multiple sources. The research framework also integrates scenario planning and sensitivity analyses to assess the potential impact of macroeconomic and policy shifts on the bioactive materials ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioactive Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioactive Materials Market, by Material Type

- Bioactive Materials Market, by Functionality

- Bioactive Materials Market, by Form Factor

- Bioactive Materials Market, by Application

- Bioactive Materials Market, by End Use Industry

- Bioactive Materials Market, by Region

- Bioactive Materials Market, by Group

- Bioactive Materials Market, by Country

- United States Bioactive Materials Market

- China Bioactive Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Core Insights Underscoring Key Learnings and Summarizing the Strategic Imperatives for Stakeholders in Bioactive Materials Innovation

Throughout this executive summary, the transformative momentum within the bioactive materials landscape has become evident, driven by advances in additive manufacturing, smart implant technologies, and innovative material formulations. The confluence of these technological shifts, alongside evolving regulatory and trade environments, underscores the imperative for stakeholders to adopt agile strategies in sourcing, R&D, and clinical validation.

Key segmentation insights reveal that differentiated material classes and specialized functionalities each require tailored commercialization approaches, while regional analyses highlight the need for locale-specific compliance and partnership models. Competitive profiling illuminates how leading organizations are leveraging strategic collaborations and differentiated capabilities to secure market positions.

As the industry moves forward, prioritizing resilient supply chains, fostering dynamic partnerships, and embedding sustainability principles will be critical to sustaining innovation and delivering improved patient outcomes. By aligning strategic initiatives with robust data-driven insights, stakeholders can navigate emerging challenges and capitalize on the vast potential of bioactive materials.

Engaging Invitation to Connect with Ketan Rohom for Exclusive Access to the Full Bioactive Materials Market Research Report and Tailored Insights

For an in-depth exploration of this dynamic field and to gain tailored strategic insights, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in bioactive materials and a nuanced understanding of market drivers, enabling him to guide you through the report’s comprehensive findings and how they apply to your organization’s goals.

Engaging with Ketan will allow you to discuss customized data packages, identify priority segments of interest, and receive guidance on leveraging this research to inform your product development, supply chain optimization, and partnership strategies. By connecting with Ketan, you’ll secure exclusive access to proprietary analyses, executive briefings, and ongoing updates that keep you ahead of emerging trends in bioactive materials.

Don’t miss the opportunity to empower your decision-making with robust, actionable intelligence. Contact Ketan Rohom today to purchase the full market research report and unlock the strategic advantages that only this level of insight can deliver.

- How big is the Bioactive Materials Market?

- What is the Bioactive Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?