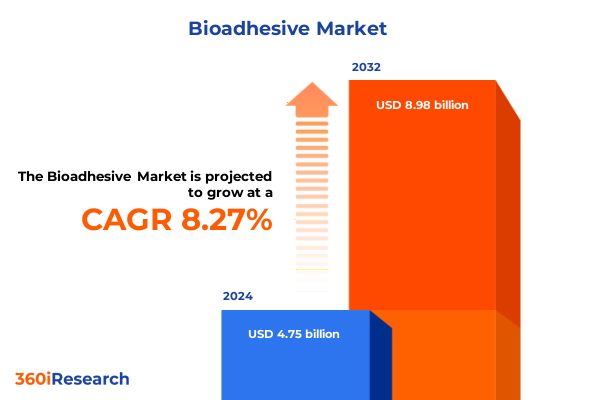

The Bioadhesive Market size was estimated at USD 5.14 billion in 2025 and expected to reach USD 5.56 billion in 2026, at a CAGR of 8.30% to reach USD 8.98 billion by 2032.

Unveiling the Emergence of Bio-Based Adhesive Solutions Revolutionizing Industrial Performance and Medical Bonding Innovations with a Global Sustainability Focus

The bioadhesive industry has emerged as a dynamic frontier in adhesive technology, propelled by a confluence of environmental mandates, shifting consumer preferences, and advanced medical applications. Sustainability has become a central pillar in the development of bioadhesives, with manufacturers increasingly turning to biopolymer-derived materials that demonstrate both high performance and biodegradability. The use of agricultural by-products-such as citrus peels and soybean residues-in adhesive formulations not only enhances environmental credentials but also aligns with circular economy principles by valorizing waste streams and reducing reliance on virgin petrochemical resources.

Beyond their ecological benefits, bioadhesives are attaining traction in healthcare due to their inherent biocompatibility and reduced toxicity. In medical settings, bioadhesives are finding applications in wound care, surgical sealants, and drug delivery systems, offering alternatives to conventional synthetics that may evoke adverse reactions. This healthcare demand is forecast to grow at an annual rate of 8% through the next decade, underscoring the vital role of bioadhesives in advancing patient-centric solutions.

With the global market estimated at approximately USD 9.88 billion in 2024 and projected to sustain double-digit growth, industry stakeholders recognize the strategic importance of bioadhesives across consumer goods, packaging, and specialty industries. As market participants navigate evolving regulations and competitive pressures, this report unpacks core trends, tariff impacts, segmentation nuances, and regional dynamics to equip decision-makers with the insights required for informed investments and sustainable innovation.

Charting the Paradigm Shift Toward Sustainable Plant, Marine, and Hybrid Bioadhesive Technologies Shaping the Next Generation of Eco-Friendly Bonding Solutions

The bioadhesive landscape is undergoing a profound transformation driven by regulatory imperatives, technological breakthroughs, and mounting consumer demand for eco-conscious materials. Regulatory frameworks in both North America and Europe are increasingly mandating reduced volatile organic compound (VOC) emissions from adhesive products. In 2022, the U.S. Environmental Protection Agency tightened VOC limits for industrial adhesives by 15%, prompting manufacturers to accelerate the adoption of plant-based and more benign chemistries that comply with these evolving standards.

Concurrently, technological innovation is reshaping performance parameters. Nanotechnology-enabled bioadhesives, incorporating nanocellulose and other nanofibers, are demonstrating enhanced bonding strength, durability, and flexibility while maintaining biodegradability, thereby bridging the gap between sustainability and industrial-grade performance. These hybrid formulations are poised to unlock applications in demanding sectors such as automotive lightweighting and high-strength packaging.

Moreover, the rise of marine-derived biopolymers-such as alginates from seaweed extracts-adds a new dimension to raw material sourcing. Seaweed-based adhesives exhibit competitive adhesion properties in paper and packaging uses, with recent research showing adhesive strengths surpassing those of commercial solid glues without emitting formaldehyde or heavy metals. As bioadhesive developers diversify raw material portfolios, the resulting innovation wave is set to redefine bonding technologies across industries.

Analyzing the Comprehensive Effect of 2025 United States Tariff Measures on Raw Material Sourcing Cost Structures and Supply Chain Resilience for Bioadhesives

In 2025, the United States enacted a formidable series of tariffs that directly influence the cost structures and sourcing strategies of bioadhesive manufacturers. On March 4, an additional ad valorem tariff of 20% was imposed on all polyurethane raw materials imported from China, compounding existing duties and provoking immediate cost ripples for downstream adhesive producers reliant on these intermediates. Earlier in the year, a blanket 25% tariff was applied to a broad spectrum of specialty chemicals and intermediates sourced from major trading partners, including China, India, and Germany, affecting high-value solvents and performance polymers integral to advanced bioadhesive formulations.

Base chemicals such as ethylene, propylene, and titanium dioxide now carry tariffs ranging from 10% to 15%, elevating feedstock costs across the bioadhesive supply chain. Although certain bulk chemicals-like polyethylene and polypropylene-have been exempted from the most severe measures, the overall tariff framework injects price volatility that has prompted manufacturers to renegotiate supplier contracts or accelerate domestic sourcing initiatives to hedge against global uncertainties.

European imports of plastics and polymeric intermediates face a universal 10% tariff under these new directives, reshaping transatlantic trade flows and catalyzing regional supplier development as U.S. producers seek to capture displaced demand. As a result, bioadhesive players are pursuing diversified raw material portfolios, reinforcing supplier partnerships, and exploring synthetic biotechnology routes to mitigate tariff exposure and preserve competitive margins.

Illuminating Critical Segment Dimensions from Product and Raw Material Sources to Adhesive Types and Multifunctional Application Needs in Bioadhesives

Insight into the bioadhesive market emerges most clearly when examining its multifaceted segmentation framework. From a product perspective, four distinct categories-animal-based, mixed blends, plant-based, and synthesized-highlight the balance between tradition and innovation, with plant-derived adhesives outpacing animal sources due to regulatory and consumer preferences. The raw material dimension offers further granularity; adhesives sourced from agricultural inputs such as corn extracts and soy derivatives deliver scalability and cost efficiency, while marine-sourced options-drawing on fish derivatives and seaweed extracts-contribute unique functional properties and environmental appeal.

The adhesive type segmentation underscores performance- and application-driven choices. Permanent formulations are essential for load-bearing applications, whereas pressure sensitive variants address flexible packaging and disposable consumer goods. Temporary adhesives, incorporating solutions such as gaffer tapes and removal-friendly bonds, cater to event production and specialized industrial processes requiring residue-free removal and repositionability.

Functionality-based segmentation distinguishes products by their biodegradability, heat resistance, and waterproofing capabilities, reflecting a drive toward tailored performance under diverse environmental conditions. Finally, the application landscape spans cosmetics and personal care, medical interventions, and non-medical uses-including automotive components, packaging solutions, and wood and furniture assembly-each underpinned by nuanced requirements for bonding strength, safety, and regulatory compliance.

This comprehensive research report categorizes the Bioadhesive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Products

- Raw Material Source

- Adhesive Type

- Functionality

- Application

Unraveling Distinct Regional Drivers Spanning the Americas, EMEA Policy Landscapes, and Asia-Pacific Growth Trajectories in the Global Bioadhesive Market

Regional dynamics in the bioadhesive market reveal divergent growth drivers shaped by regulatory frameworks, industry adoption rates, and manufacturing infrastructure. In the Americas, a robust manufacturing ecosystem coupled with favorable government incentives for green technologies has fostered leadership in medical and specialty packaging bioadhesives. North America alone accounted for nearly a quarter of global revenue in 2023, reflecting strong innovation pipelines and domestic capacity to produce high-value bio-based formulations.

The Europe, Middle East & Africa (EMEA) region is characterized by stringent environmental statutes such as the EU’s REACH regulations, which limit formaldehyde content and volatile organic compounds in adhesives. These requirements have accelerated shifts toward plant- and marine-sourced bioadhesives, supported by certification schemes that validate sustainable credentials and command premium positioning among eco-sensitive brands.

Asia-Pacific stands out as the fastest-growing regional market, driven by rapid industrialization, expanding packaging and construction sectors, and increasing R&D investments in bio-based materials. Governments across China, India, and Japan are prioritizing supply chain localization and sustainable manufacturing, creating fertile ground for bioadhesive adoption in functional packaging and automotive segments. By embracing renewable feedstocks and public-private collaborations, the Asia-Pacific market is poised for sustained expansion and technological leadership.

This comprehensive research report examines key regions that drive the evolution of the Bioadhesive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators Driving Bioadhesive Advancements through Sustainable Formulation, Strategic Partnerships, and Technological Breakthroughs

Leading companies in the bioadhesive sector are deploying strategic initiatives that underscore the industry’s shift toward sustainable formulation and advanced applications. Henkel AG & Co. KGaA has exemplified this trend through the launch of Loctite HB S ECO and Loctite CR 821 ECO in November 2023, delivering over 60% reduction in CO₂-equivalent emissions for timber construction while retaining high bonding performance. Arkema reinforced its market position in December 2024 by acquiring Dow’s flexible packaging laminating adhesives division, expanding capability in high-growth segments and integrating complementary R&D pipelines.

DuPont de Nemours, Inc. inaugurated a state-of-the-art adhesives production facility in East China, embedding advanced manufacturing execution systems to optimize outputs for transportation and lightweighting applications. This facility underscores DuPont’s commitment to scalable bio-based solutions aligned with global electrification trends. EcoSynthetix introduced DuraBind engineered biopolymers, marrying strong adhesion with improved sustainability for paper and packaging uses, while Adhesives Research, Inc. has funneled investments into bioadhesives tailored for transdermal drug delivery, reflecting the sector’s deepening nexus with life sciences.

On the innovation frontier, Biophilica’s September 2024 debut of a 100% bio-based adhesive has galvanized interest in fully sustainable chemistries, setting a precedent for future research collaborations and commercial rollouts that prioritize environmental integrity without compromising functionality.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioadhesive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Artivion, Inc

- Ashland Global Holdings Inc.

- BioBond Adhesives, Inc.

- Bostik SA by Arkema Group

- C.B. Adhesives Ltd.

- Cargill, Incorporated

- Danimer Scientific

- DuPont de Nemours, Inc.

- EcoSynthetix Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Ingredion Incorporated

- Jowat SE

- L.D. Davis Industries, Inc.

- Premier Starch Products Pvt. Ltd.

- Royal Avebe

- Sealock Ltd.

- Tate & Lyle PLC

- The Compound Company

- U.S. Adhesives, Inc.

- Weiss Chemie + Technik GmbH & Co. KG

- Yparex B.V.

Delivering Strategic Imperatives for Bioadhesive Industry Leaders to Enhance Supply Chain Agility, Embrace Innovation, and Secure Sustainable Competitive Advantage

Industry leaders should prioritize diversification of raw material sourcing to mitigate the cost volatility introduced by tariff fluctuations and geopolitical tensions. Establishing multi-region supplier networks and exploring biotechnology-based feedstocks will foster greater supply chain resilience and cost predictability.

Accelerating investment in hybrid formulations-melding nanotechnology with bio-derived polymers-will differentiate product portfolios and address performance gaps in high-temperature and demanding industrial applications. By collaborating with academic institutions and leveraging public research grants, companies can expedite the development of next-generation adhesives.

Embracing circular economy principles through waste valorization initiatives-such as converting agricultural by-products and marine biomass into adhesive precursors-can secure both environmental credentials and new revenue streams. Aligning product development with emerging sustainability certifications will unlock premium pricing and reinforce brand integrity.

Finally, adopting agile go-to-market strategies that target high-growth segments like medical devices, functional packaging, and eco-certified construction materials will optimize resource allocation. Scenario planning and real-time market intelligence tools should underpin strategic decision-making to navigate regulatory shifts and capitalize on evolving consumer demands.

Detailing a Rigorous Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Triangulation Techniques for Robust Market Insights

This research integrates both primary and secondary data collection to ensure robust and balanced insights. Primary research comprises in-depth interviews with C-suite executives, R&D leaders, procurement heads, and policy experts across key geographies, capturing firsthand perspectives on emerging trends and strategic priorities. These qualitative insights are complemented by survey data from industry participants to quantify adoption rates, cost pressures, and innovation pipelines.

Secondary research involved comprehensive analysis of government and trade association publications, corporate financial disclosures, patent filings, and peer-reviewed journals. Special emphasis was placed on regulatory documents such as the U.S. EPA VOC guidelines, EU REACH regulations, and recent U.S. tariff announcements to contextualize market shifts. Data triangulation techniques were applied to reconcile discrepancies and validate findings through cross-referencing multiple sources.

Quantitative data were analyzed using statistical methods to identify historical patterns and correlations, while scenario modeling assessed potential impacts of tariff fluctuations and regulatory changes on input costs and competitive dynamics. The combined methodology ensures that conclusions are grounded in empirical evidence and aligned with real-world market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioadhesive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioadhesive Market, by Products

- Bioadhesive Market, by Raw Material Source

- Bioadhesive Market, by Adhesive Type

- Bioadhesive Market, by Functionality

- Bioadhesive Market, by Application

- Bioadhesive Market, by Region

- Bioadhesive Market, by Group

- Bioadhesive Market, by Country

- United States Bioadhesive Market

- China Bioadhesive Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Affirming the Pivotal Role of Sustainable Bioadhesives in Redefining Industrial, Medical, and Packaging Adhesion Practices Worldwide

The evolution of bioadhesives underscores a pivotal transition from traditional petrochemical-based adhesives to advanced, bio-derived formulations that meet the dual imperatives of performance and environmental stewardship. Sustainability mandates and expanding medical applications are catalyzing innovation, spurring the deployment of plant- and marine-sourced materials as well as nanotechnology-enhanced hybrids.

The expansive tariff landscape in the United States has reshaped supply chain strategies, compelling manufacturers to diversify sourcing and invest in domestic or synthetic biotechnology routes. Meanwhile, segmentation insights reveal tailored solutions for diverse end uses-from gaffer tapes in event production to waterproof, heat-resistant adhesives for industrial assembly.

Regionally, the Americas lead through robust manufacturing capacities and regulatory incentives, EMEA is propelled by stringent environmental frameworks, and Asia-Pacific is poised for rapid growth underpinned by public-private partnerships and local market development. Key corporate players such as Henkel, Arkema, DuPont, EcoSynthetix, and Biophilica are setting benchmarks in sustainable product launches, strategic acquisitions, and facility expansions.

As the industry moves forward, actionable imperatives around supply chain resilience, hybrid technology investment, and circular economy integration will be critical for stakeholders seeking to capture emerging opportunities and maintain competitive advantage in the dynamic bioadhesive market landscape.

Connect with Ketan Rohom to Secure Your Comprehensive Bioadhesive Market Research Report and Propel Your Strategic Decision-Making and Growth Trajectories

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive bioadhesive market research report. Engage directly with our expert team to discuss tailored insights relevant to your strategic objectives and receive a personalized overview of the report’s in-depth analysis. By partnering with Ketan, you will gain priority access to critical data and actionable recommendations designed to enhance your decision-making and unlock new growth trajectories in the evolving bioadhesive landscape. Reach out today to elevate your market positioning and capitalize on emerging opportunities before your competitors do.

- How big is the Bioadhesive Market?

- What is the Bioadhesive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?