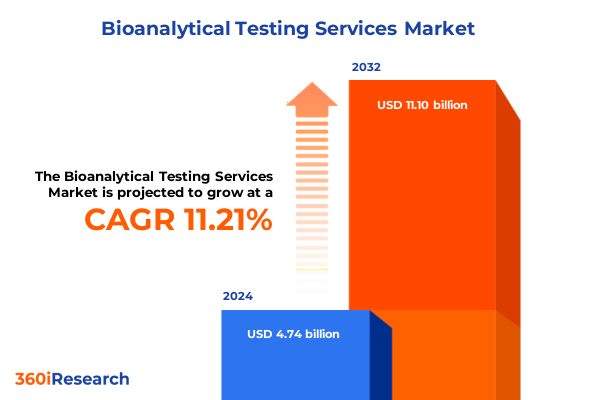

The Bioanalytical Testing Services Market size was estimated at USD 5.22 billion in 2025 and expected to reach USD 5.75 billion in 2026, at a CAGR of 11.37% to reach USD 11.10 billion by 2032.

Laying the Foundation for Advanced Bioanalytical Testing Amidst Rapid Scientific Change and Complex Regulatory Expectations

In today’s fast-evolving life sciences environment, the significance of robust bioanalytical testing services has never been more pronounced. Companies and research institutions alike face mounting pressure to accelerate drug development timelines, ensure regulatory compliance, and harness emerging biomarkers that unlock new therapeutic frontiers. Consequently, executives require a clear framing of the forces at play, as well as a strategic overview of key dimensions that shape the competitive landscape. This introduction delivers precisely that context by outlining the core drivers, prevailing challenges, and strategic imperatives that inform decision-making at the highest levels of research and development.

By establishing foundational insights into technological innovation, regulatory dynamics, and shifting stakeholder expectations, this section sets the stage for deeper exploration into the transformations and market drivers detailed in subsequent chapters. Stakeholders can expect a concise yet authoritative orientation that highlights why bioanalytical testing services will remain integral to scientific breakthroughs and commercial success.

Unveiling the Pivotal Transformations Redefining Bioanalytical Testing Through Technological Innovation and Integrated Platforms

The bioanalytical testing landscape is undergoing one of its most profound transformations in recent history. Leading laboratories are integrating advanced mass spectrometry platforms with machine learning-driven data analytics to deliver unprecedented sensitivity and throughput. At the same time, modular and automated workflows are erasing traditional bottlenecks, enabling seamless sample tracking and digital quality assurance across multinational networks. These technological leaps, coupled with evolving expectations around personalized medicine and real-world evidence generation, are forcing service providers to rethink legacy operating models and invest in next-generation capabilities.

Furthermore, the confluence of interdisciplinary scientific collaboration and regulatory modernization has reshaped how assays are validated, documented, and monitored. Regulators are increasingly open to alternative validation approaches that leverage synthetic controls and real-time monitoring, provided transparency and traceability standards are upheld. As a result, organizations that proactively align with these frameworks gain first-mover advantages, especially when pursuing accelerated approvals for complex biologics or cell and gene therapies. In this context, understanding and anticipating these shifts becomes paramount for any stakeholder seeking to capitalize on emerging opportunities within bioanalytical testing.

Analyzing the Far-Reaching Cumulative Effects of Newly Enforced United States Tariffs on Bioanalytical Testing Supply Chains

Early in 2025, the United States implemented a suite of tariffs targeting imported reagents, consumables, and high-precision analytical instruments critical to bioanalytical workflows. While initial estimates suggested limited downstream effects, the cumulative impact has begun to ripple across global supply chains. Laboratories in North America have experienced longer lead times for key chemicals and higher landed costs for mass spectrometers, directly influencing project budgets and timelines. In turn, decision-makers have been compelled to reassess procurement strategies, inventory management protocols, and partnership arrangements to mitigate financial pressures.

Moreover, the tariffs have driven a resurgence of nearshoring efforts, with several contract research organizations expanding domestic manufacturing capabilities for select consumables. This trend underscores a broader strategic pivot toward supply chain resilience, as stakeholders seek to buffer against future trade disruptions. In parallel, some service providers have diversified their instrument portfolios to include alternatives sourced from non-tariffed markets, thereby balancing performance requirements with cost considerations. Taken together, these adjustments underscore how policy levers can reshape operational priorities and competitive dynamics within bioanalytical testing services.

Illuminating Critical Segmentation Insights Across Service Types Technologies Applications and End Users in Bioanalytical Testing Services

A nuanced understanding of market segmentation reveals where competitive intensity converges with targeted growth opportunities within bioanalytical testing. Service types span a spectrum from biomarker analysis to pharmacokinetic studies, each demanding distinct scientific expertise and instrumentation. Biomarker analysis alone bifurcates into genetic, metabolite, and protein biomarkers, while DMPK services encompass both in vitro and in vivo ADME evaluations. Genetic toxicology further drills into Ames tests, chromosomal aberration assays, and micronucleus examinations, all of which underpin safety assessments for novel compounds. Adding to this complexity, specialized immunoassay protocols and comprehensive pharmacokinetic profiling round out the service portfolio, creating multiple avenues for differentiation based on scientific depth and turnaround times.

Likewise, technology segmentation delineates the capabilities that laboratories leverage to achieve analytical precision. Gas chromatography-mass spectrometry advances through chemical ionization and electron impact modalities, while high-performance liquid chromatography unfolds across ion exchange, reverse phase, and size exclusion configurations. Immunoassays-from ELISA to multiplex bead-based multiplexing and radioimmunoassay-address diverse sensitivity needs, whereas liquid chromatography-tandem mass spectrometry platforms such as Orbitrap, quadrupole time-of-flight, and triple quadrupole systems offer unmatched specificity. Nuclear magnetic resonance spectroscopy, whether via carbon-13 or proton-based nuclei, provides orthogonal structural data that enhances confidence in molecular characterization.

This segmentation further extends to applications and end users, unveiling a multidimensional matrix of demand drivers. In biotechnology and pharmaceutical development, rigorous clinical diagnostics and environmental testing applications call for specialized bioanalytical support, just as food and beverage safety assessments hinge on precise trace-level quantitation. End users range from academic research institutes pioneering translational studies to contract research organizations executing outsourced projects, hospitals and clinics conducting therapeutic drug monitoring, and pharmaceutical and biotechnology companies orchestrating global clinical trials. These intersecting segmentation axes illuminate where service excellence, technological prowess, and domain expertise align to create competitive advantage.

This comprehensive research report categorizes the Bioanalytical Testing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology

- Application

- End User

Revealing Key Regional Dynamics Shaping Bioanalytical Testing Demand and Infrastructure Developments Across the Americas EMEA and Asia-Pacific

Geographic dynamics play a pivotal role in shaping the reach and performance of bioanalytical testing services. In the Americas, robust regulatory frameworks in the United States and Canada support rapid assay deployment, while investments in domestic manufacturing infrastructure for critical consumables have gained momentum post-tariff implementations. This region continues to benefit from a mature network of contract research organizations and academic collaborations, which fuel demand for high-throughput platforms and advanced biomarker studies.

Turning to Europe, the Middle East, and Africa, harmonization initiatives under the European Medicines Agency foster cross-border trial conduct and shared databases that expedite multi-center studies. Simultaneously, emerging markets in Eastern Europe, the Gulf Cooperation Council, and sub-Saharan Africa are witnessing growing investments in laboratory capacity building, presenting new opportunities for service providers to establish regional hubs. Asia-Pacific represents a dynamic frontier characterized by rapid expansion in China’s domestic CRO sector, significant R&D outlays in Japan and South Korea, and burgeoning clinical trial activity in India, Australia, and Southeast Asia. These markets are also embracing digital health initiatives, which elevate the importance of federated data management and secure cloud-based analytics.

This comprehensive research report examines key regions that drive the evolution of the Bioanalytical Testing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation Partnerships and Service Expansion in Bioanalytical Testing

Industry leaders have responded to market pressures and technological complexity through a series of strategic initiatives, mergers, and partnerships. Leading contract research organizations have invested in end-to-end solutions that integrate digital sample management with advanced data analytics, while select pure-play bioanalytical specialists have forged alliances with instrument vendors to co-develop next-generation assay platforms. Some companies have pursued bolt-on acquisitions to expand capacity, particularly in regions where nearshoring trends are gaining traction.

In parallel, several established players have accelerated their push into cell and gene therapy analytics by establishing dedicated bioassay teams and validating platform-agnostic methods for viral vector characterization. Strategic collaborations with academic centers and biotechnology innovators have also proliferated, enabling co-development of proprietary biomarkers that command premium pricing and drive long-term client loyalty. Collectively, these corporate maneuvers underscore the criticality of agility, cross-sector expertise, and collaborative innovation in maintaining leadership positions within the bioanalytical testing market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioanalytical Testing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- ICON plc

- Intertek Group plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Lonza Group AG

- Medpace Holdings, Inc.

- Pharmaceutical Product Development, LLC

- Sartorius AG

- SGS SA

- Syneos Health Inc.

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

Empowering Industry Leaders with Actionable Recommendations to Navigate Emerging Challenges Enhance Operational Excellence and Accelerate Value Creation

To thrive amid evolving scientific and regulatory landscapes, industry leaders should prioritize investments that enhance both operational efficiency and analytical depth. Organizations can start by deploying automated sample preparation and data processing pipelines, which minimize hands-on time and reduce variability across high-volume workflows. In addition, cultivating strategic partnerships with emerging technology providers can fast-track access to novel assay modalities, from microfluidic platforms to digital immunoassays.

Moreover, diversifying supplier relationships and strengthening domestic manufacturing capabilities will safeguard against supply chain disruptions and tariff-induced cost increases. Simultaneously, engaging with regulatory bodies early-through collaborative working groups or pre-submission consultations-can clarify validation expectations and accelerate study approvals. Ultimately, the most forward-looking leaders will integrate sustainable practices, invest in workforce upskilling for bioinformatics and data science, and embrace continuous feedback loops to refine service offerings in real time. Such a holistic approach empowers organizations to deliver higher value, foster client trust, and secure lasting competitive advantage.

Outlining a Rigorous Research Methodology Integrating Primary and Secondary Approaches to Ensure Comprehensive and Reliable Market Insights

This report’s insights derive from a rigorous two-fold research methodology, combining primary and secondary approaches to ensure both depth and reliability. The primary phase involved extensive engagement with senior executives at leading contract research organizations, instrument manufacturers, and end-user laboratories through in-depth interviews and targeted surveys. These engagements provided firsthand perspectives on technology adoption timelines, procurement strategies, and perceived barriers to market entry.

Complementing this, the secondary research phase encompassed a comprehensive review of peer-reviewed journal articles, regulatory guidance documents, conference proceedings, and white papers. This synthesis of publicly available information was triangulated with proprietary data sources and validated against expert inputs, ensuring consistency and credibility. Throughout the process, quality control measures-such as cross-validation of data points, methodological peer review, and iterative hypothesis testing-guaranteed that the resulting analysis accurately reflects current market realities and emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioanalytical Testing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioanalytical Testing Services Market, by Service Type

- Bioanalytical Testing Services Market, by Technology

- Bioanalytical Testing Services Market, by Application

- Bioanalytical Testing Services Market, by End User

- Bioanalytical Testing Services Market, by Region

- Bioanalytical Testing Services Market, by Group

- Bioanalytical Testing Services Market, by Country

- United States Bioanalytical Testing Services Market

- China Bioanalytical Testing Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Drawing Conclusive Perspectives on the Future Trajectory of Bioanalytical Testing Services Amidst Ongoing Scientific and Regulatory Evolutions

As the bioanalytical testing services market continues its trajectory of rapid evolution, organizations that blend scientific excellence with operational agility will define the next era of innovation. The convergence of automated workflows, digital analytics, and regulatory modernization creates a fertile ground for service providers to differentiate through bespoke offerings and strategic partnerships. At the same time, proactive responses to trade policies and supply chain vulnerabilities highlight the importance of resilience in sustaining growth.

Looking ahead, the integration of real-world evidence, advanced biomarker panels, and cell and gene therapy assays will unlock new dimensions of clinical development and therapeutic monitoring. Consequently, decision-makers must maintain a forward-leaning posture, continually evaluating emerging technologies, refining validation frameworks, and expanding global footprints. By doing so, industry leaders will not only meet the demands of today’s research community but also anticipate the scientific breakthroughs of tomorrow.

Take the Next Step to Access Comprehensive Bioanalytical Testing Market Insights and Elevate Your Strategic Decision-Making Today

To unlock the full potential of these insights and equip your organization with a robust roadmap for growth within the bioanalytical testing services market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging directly with our team, you will gain personalized guidance on how to leverage this comprehensive report for strategic advantage. Schedule a consultation to discuss specific chapters, tailored competitive analyses, or deeper drill-downs into technology and regional breakdowns. Secure your advantage today by partnering with an expert resource dedicated to catalyzing your next phase of innovation and market leadership.

- How big is the Bioanalytical Testing Services Market?

- What is the Bioanalytical Testing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?