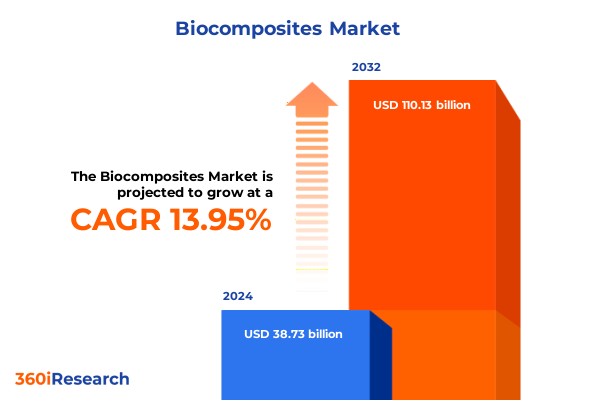

The Biocomposites Market size was estimated at USD 43.64 billion in 2025 and expected to reach USD 49.18 billion in 2026, at a CAGR of 14.13% to reach USD 110.13 billion by 2032.

Pioneering Foundations of Eco-Conscious Material Science to Unlock the Promise of Next-Generation Biocomposite Solutions Across Industries

Biocomposites represent a new frontier in sustainable material science by combining natural reinforcements with polymer matrices to create high-performance, eco-conscious solutions. Driven by mounting environmental mandates and escalating consumer expectations for greener products, the industry is transitioning from traditional composites toward renewable, bio-based alternatives. This strategic shift aligns with global commitments to reduce carbon footprints, minimize dependency on fossil feedstocks, and address end-of-life disposal challenges inherent in conventional plastics.

As governments enact stricter regulations aimed at curbing emissions and promoting circular economy models, manufacturers and downstream users are compelled to reassess material choices. Collaborations between material scientists, original equipment manufacturers, and sustainability experts are central to overcoming technical barriers related to durability, cost competitiveness, and processing adaptability. Consequently, biocomposites are emerging as pivotal enablers across multiple industries, driving innovation in design, manufacturing workflows, andLifecycle management practices.

Charting the Evolutionary Tectonic Shifts Reshaping the Biocomposite Material Landscape in Response to Technological and Environmental Imperatives

Recent years have witnessed a series of transformative developments redefining the biocomposite landscape. Breakthroughs in fiber treatment and coupling technologies have significantly enhanced interfacial bonding between reinforcements and polymer matrices, resulting in materials that rival or surpass traditional glass fiber composites in mechanical performance. Concurrent advancements in polymer science have broadened the palette of bio-based matrices, with innovations in polyhydroxyalkanoates and polylactic acid delivering improved thermal stability and processability.

Moreover, the convergence of digital manufacturing and advanced analytics has streamlined optimization of composite formulations, accelerating time-to-market for novel products. Meanwhile, evolving environmental standards and consumer-driven sustainability mandates are reshaping procurement strategies, prompting brands to integrate life-cycle assessments into material selection processes. Together, these dynamics are propelling the industry toward a more resilient, transparent, and environmentally aligned future.

Assessing the Aggregate Consequences of 2025 United States Tariff Policies on Supply Chain Dynamics and Cost Structures in Biocomposite Production

The introduction of elevated import duties by the United States in 2025 on select natural fibers and bio-based polymers has compounded cost pressures for biocomposite manufacturers. At a time when material inputs were already subject to volatility due to climatic conditions affecting agricultural yields, the additional tariff burden has triggered a strategic reassessment of supply chain configurations. Producers have responded by pursuing closer integration with domestic biomass suppliers, accelerating vertical partnerships to secure reliable fiber and polymer feedstocks.

In parallel, the tariff environment has catalyzed investment in material substitution and process innovation, as companies seek to offset increased input costs. Alternative reinforcements, including locally sourced wood flour and emerging agro-residual fibers, have gained traction as cost-effective supplements. These shifts underscore a broader recalibration of sourcing strategies, with stakeholders balancing the imperatives of sustainability, price stability, and supply chain resilience under the evolving trade regime.

Unveiling Crucial Segmentation Dimensions to Illuminate the Diverse and Nuanced Pathways Within the Rapidly Expanding Biocomposite Ecosystem

A granular examination of biocomposite segmentation reveals how each dimension shapes industry trajectories. From a reinforcement perspective, natural fiber solutions such as flax, hemp, jute, and kenaf deliver unique strength-to-weight advantages for performance-critical applications, while wood flour continues to serve as a cost-conscious, readily available reinforcement with consistent quality profiles. This diversity of reinforcement types enables material scientists to fine-tune composite characteristics to specific design requirements.

When considering applications, the automotive sector remains a primary growth driver by incorporating biocomposites into interior panels, structural components, and trim elements, leveraging the materials’ weight reduction and carbon footprint benefits. Meanwhile, construction players are exploring biocomposite boards and cladding for sustainable building envelopes. In the consumer goods arena, everyday products from furniture to electronics enclosures are capitalizing on improved tactile properties. Packaging innovations span flexible films for consumer-facing goods and rigid containers for food and pharmaceuticals, each demanding tailored process conditions.

Manufacturing methodologies including compression molding, extrusion, injection molding, and thermoforming play a pivotal role in achieving targeted performance and cost objectives. Each process offers distinct processing windows, cycle times, and scalability parameters, which manufacturers align with application-specific volume and mechanical requirements. Matrix selection further enriches material design, with bio-based polymers like polyhydroxyalkanoates and polylactic acid addressing environmental preferences, while synthetic polymers such as polyethylene and polypropylene provide proven processability and supply security. Ultimately, final biocomposite forms-including fibers, pellets, profiles, and sheets & films-cater to diverse fabrication workflows, from additive manufacturing to continuous extrusion lines, underscoring the need for an integrative approach to material selection and process engineering.

This comprehensive research report categorizes the Biocomposites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Reinforcement Type

- Manufacturing Process

- Matrix Type

- Form

- Application

Revealing Distinct Regional Dynamics Driving Growth Patterns and Strategic Imperatives Across Americas Europe Middle East and Africa and AsiaPacific Biocomposite Markets

Regional dynamics are deeply influencing the adoption and evolution of biocomposite technologies. Within the Americas, regulatory incentives and sustainability targets at federal and state levels are driving significant uptake of bio-based materials in automotive and packaging sectors. North American manufacturers are scaling pilot projects into full production lines, supported by tax credits and grants that reward low-carbon materials and circular economy initiatives.

In Europe, the Middle East, and Africa, stringent environmental directives and extended producer responsibility schemes are elevating the importance of renewable content in construction and consumer goods. Fragmented but accelerating legislation across EU member states, combined with growing demand for recycled and bio-based products, has prompted multinational brands to harmonize sustainability criteria across regional operations. Meanwhile, Asia-Pacific markets are witnessing rapid industrialization and expanding consumer bases, fueling experiments with locally sourced fibers and hybrid biocomposite formulations. Government-led research consortia and industrial partnerships in key economies are catalyzing deployment at scale, balancing cost competitiveness with the imperative to reduce environmental footprints.

This comprehensive research report examines key regions that drive the evolution of the Biocomposites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players and Strategic Collaborators Shaping Innovation and Competitive Positioning Within the Biocomposite Sector

The competitive arena in biocomposites is anchored by a mix of global chemical and polymer giants, specialized material innovators, and emerging agile startups. Established companies are leveraging extensive R&D infrastructures to refine formulations and processing techniques, while startups are challenging conventional paradigms through niche applications and rapid prototyping. Strategic joint ventures are emerging between global polymer suppliers and natural fiber processors, reflecting a shared commitment to sustainability and performance.

In addition, cross-industry collaborations are accelerating technology transfer, as automakers, building material producers, and consumer goods brands seek early access to proprietary biocomposite solutions. These partnerships are not only enhancing material portfolios but also facilitating end-to-end supply chain integrations. As companies navigate tariff headwinds and regulatory evolutions, the capacity to forge symbiotic alliances and diversify technology pipelines has become a defining competitive advantage in the biocomposite sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biocomposites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Environmental Recycling Technologies, Inc.

- Anhui Guofeng Wood-Plastic Composite Co., Ltd.

- Arkema S.A.

- BASF SE

- Bcomp Ltd.

- Fiberon LLC

- FiberWood LLC

- FlexForm Technologies, LLC

- Green Bay Decking LLC

- Green Dot Holding LLC

- Hemka B.V.

- Huntsman Corporation

- Jelu-Werk J. Ehrler GmbH & Co. KG

- Lurun Group Co., Ltd.

- Meshlin Composites Zrt

- Mitsubishi Plastics, Inc.

- Newtechwood Ltd.

- RBT BioComposites GmbH

- Sappi Limited

- Stora Enso Oyj

- Tecnaro GmbH

- Trex Company, Inc.

- UFP Industries, Inc.

- UPM-Kymmene Oyj

- Yixing Hualong New Material Lumber Co., Ltd.

Translating Analytical Insights Into Strategic Roadmaps for Operational Excellence and Sustainable Growth in the Biocomposite Industry

Leaders in the biocomposite arena should prioritize investment in R&D programs that explore next-generation natural fiber treatments and polymer chemistries to enhance performance while maintaining environmental integrity. Emphasizing collaborative development with academic institutions and research centers can unlock breakthroughs in interfacial adhesion and recyclability, ensuring sustained material improvements. Equally important is the advancement of scalable processing technologies that minimize energy consumption and optimize throughput, thereby aligning operational efficiency with sustainability goals.

Simultaneously, establishing strategic partnerships across the value chain-from feedstock providers to OEMs-can bolster supply security and foster joint innovation. Stakeholders should engage with standardization bodies to develop certification frameworks and quality benchmarks for biocomposites, enhancing transparency and market credibility. By integrating digital process monitoring and life-cycle assessment tools, companies can demonstrate verifiable environmental impact reductions to regulators and end customers, further solidifying their competitive edge.

Documenting Rigorous Methodological Approaches and Data Validation Techniques Underpinning Comprehensive Biocomposite Market Analysis

This research harnessed a comprehensive multi-phase methodology, beginning with an extensive review of academic literature, industry whitepapers, and regulatory publications to contextualize the current state of biocomposite technologies. Primary data was gathered via structured interviews with material scientists, manufacturing engineers, and sustainability experts across leading corporations and research institutions. Insights from these discussions were validated through cross-comparison with case studies and product specifications from recognized industry leaders.

Quantitative analyses employed data triangulation techniques to reconcile findings from suppliers, end users, and trade associations. Qualitative assessments evaluated technology readiness levels, regulatory drivers, and strategic initiatives. Peer review sessions with external domain specialists ensured objectivity and mitigated bias. The combination of robust secondary research and primary stakeholder engagements underpins the credibility and depth of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biocomposites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biocomposites Market, by Reinforcement Type

- Biocomposites Market, by Manufacturing Process

- Biocomposites Market, by Matrix Type

- Biocomposites Market, by Form

- Biocomposites Market, by Application

- Biocomposites Market, by Region

- Biocomposites Market, by Group

- Biocomposites Market, by Country

- United States Biocomposites Market

- China Biocomposites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Findings to Illuminate Strategic Trajectories and Catalyze Informed Decision Making in the Biocomposite Value Chain

The synthesized findings underscore the critical interplay between technological innovation, regulatory landscapes, and strategic partnerships in shaping the biocomposite industry’s trajectory. Enhanced fiber treatments and polymer formulations are unlocking performance benchmarks that meet demanding application requirements, while evolving trade policies and environmental mandates continue to influence sourcing decisions and cost structures.

Moving forward, organizations that adeptly integrate segmentation insights, leverage regional strengths, and cultivate collaborative networks will be best positioned to capitalize on the expanding biocomposite opportunity. Vigilance in monitoring emerging tariffs, standards, and competitor strategies, coupled with targeted R&D investments and process optimizations, will be essential for securing a leadership position in this dynamic, sustainability-driven market.

Engage with Associate Director Ketan Rohom to Secure In-Depth Biocomposite Industry Intelligence and Enhance Strategic Market Positioning

We invite industry stakeholders and decision-makers to engage directly with Associate Director Ketan Rohom to explore tailored insights and secure an authoritative biocomposite market research report that addresses your strategic imperatives and informs operational roadmaps

By connecting with Ketan Rohom, you gain access to comprehensive analyses, in-depth discussions regarding regional dynamics and segmentation intelligence, and bespoke recommendations aligned with your organizational goals. This collaboration ensures you remain ahead of emerging trends and regulatory shifts while leveraging the full potential of sustainable biocomposite solutions

- How big is the Biocomposites Market?

- What is the Biocomposites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?