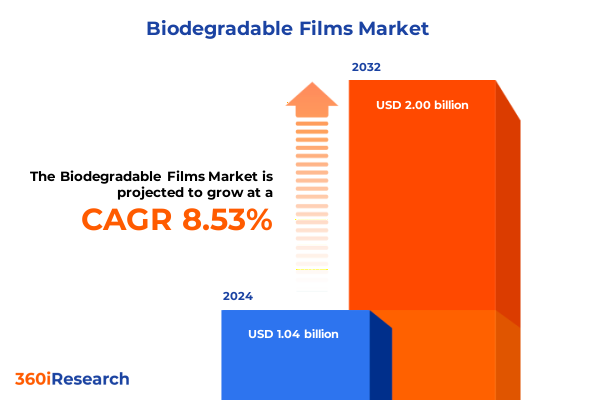

The Biodegradable Films Market size was estimated at USD 1.11 billion in 2025 and expected to reach USD 1.20 billion in 2026, at a CAGR of 8.70% to reach USD 2.00 billion by 2032.

Setting the Stage for Sustainable Innovation with Biodegradable Films in a Rapidly Evolving Environmental and Regulatory Ecosystem

The global push toward sustainable packaging solutions has placed biodegradable films at the forefront of innovation, driven by mounting environmental concerns and evolving regulatory mandates. As public awareness of plastic pollution intensifies, companies are under increasing pressure to adopt materials that decompose without leaving harmful microplastics. In parallel, government bodies worldwide are implementing stringent policies to curb single-use plastics, with the European Union’s Directive on single-use plastics prohibiting certain items and mandating collection and recycled content targets by mid-2025. The convergence of consumer demand and regulatory enforcement is fueling research in advanced bio-polymers, prompting significant investment in next-generation biodegradable film technologies that offer competitive performance compared to traditional plastics.

Innovation in biopolymer formulations is expanding the application scope of biodegradable films beyond simple packaging to agricultural coverings, medical drapes, and industrial protection layers. Breakthroughs in material science have enabled the development of films that balance mechanical strength, barrier properties, and controlled compostability. Moreover, the United States Department of Commerce has signaled potential incentives and tariff adjustments to nurture domestic production of bio-based materials, aiming to reduce reliance on imported feedstocks and strengthen supply-chain resilience. Against this backdrop, stakeholders are realigning their strategies to capitalize on these transformative market dynamics.

This executive summary synthesizes the critical themes shaping the biodegradable films market: from disruptive regulatory actions to segmentation frameworks that inform targeted growth strategies. By examining the drivers, challenges, and opportunities across materials, forms, compostability levels, applications, regions, and key industry players, this report equips decision-makers with the insights needed to navigate a rapidly evolving landscape. Transitioning from environmental necessity to commercial viability, biodegradable films are poised to redefine material usage across industries.

Decades of Innovation and Collaboration Forge a Revolutionary Path for Biodegradable Films to Disrupt Conventional Plastics Use

Over the past decade, collaboration between material scientists, industry leaders, and regulatory agencies has catalyzed a revolution in biodegradable film development. Initially constrained by performance trade-offs and high costs, bio-based materials have now achieved benchmarks that rival conventional plastics for tensile strength, transparency, and heat resistance. Strategic partnerships between polymer producers and film converters have accelerated scale-up, enabling the rapid introduction of new compostable grades suited for varied end-use conditions.

Simultaneously, digitalization and advanced analytics are transforming product design and manufacturing workflows. Data-driven process optimization is minimizing batch variability, improving resource efficiency, and facilitating continuous improvement cycles. AI-enabled modeling tools are predicting degradation pathways and lifespan under different end-of-life scenarios, empowering formulators to fine-tune material blends for home compost, industrial compost, or marine biodegradability. These capabilities are fostering a competitive ecosystem in which nimble start-ups leverage agile R&D to challenge established conglomerates.

In addition, consumer goods companies and major retailers are embedding sustainability objectives into procurement policies, pledging to phase out single-use plastics and transition to certified compostable alternatives. These commitments have triggered long-term supply agreements and co-development programs, further de-risking R&D investments. As a result, the market landscape is shifting from niche novelty to mainstream adoption, setting the stage for a new era in which biodegradable films disrupt traditional polymer applications across packaging, agriculture, medical, and industrial segments.

Navigating the Complex Web of United States Tariffs and Policy Shifts That Are Reshaping Supply Chains and Cost Structures in 2025

The introduction of sweeping tariff measures in early 2025 has added complexity to the economic equation for biodegradable film producers and converters. Under the administration’s reciprocal tariff policy, a universal 10% duty on all imports came into force on April 5, 2025, with higher specific rates applied to key trading partners, including a 30% levy on Chinese-origin materials announced on May 12, 2025. These duties encompass critical intermediates such as lactic acid monomers, polyhydroxyalkanoate (PHA) resins, and starch feedstocks, directly affecting the cost base of polylactic acid (PLA) and starch blend films.

In response, suppliers have accelerated plans for regional production hubs. Initiatives to expand domestic fermentation of lactic acid and produce PLA locally aim to circumvent duties and lower logistical overhead. At the same time, nearshoring strategies are gaining traction, with manufacturers in North America exploring partnerships and joint ventures to build end-to-end biopolymer complexes. Meanwhile, consolidations among feedstock suppliers are anticipated as they seek scale efficiencies to offset tariff-driven cost pressure.

Although these measures have introduced short-term pricing volatility and supply-chain adjustments, they are also catalyzing a stronger domestic infrastructure for bio-based material production. Long-term, the tariff environment may stimulate innovation and investment in proprietary feedstock pathways, bolstering the resilience of the biodegradable films market against global trade uncertainties.

Uncovering Powerful Segmentation Perspectives That Illuminate Diverse Material Types, Forms, Compostability Levels, and Application Verticals

A nuanced understanding of market segmentation illuminates the diverse material, form, compostability, and application dimensions that define growth opportunities in biodegradable films. Material-type diversity spans cellulose films derived from wood pulp for natural packaging solutions, polyhydroxyalkanoates engineered for high-performance applications, polylactic acid produced from renewable sugar sources, and starch blends that combine cost-effectiveness with biodegradability. Film form factors range from flexible bags and pouches designed for retail and waste-collection uses, through multilayer co-extruded films offering tailored barrier properties, to sturdy films and sheets employed in protective coverings and industrial liners.

Compostability ratings introduce further differentiation: home compostable grades facilitate small-scale biodegradation in residential settings, industrially compostable resins are optimized for controlled large-scale composting facilities, and marine biodegradable formulations ensure safe degradation in aquatic ecosystems. Application verticals encompass agricultural films-spanning greenhouse covers that regulate microclimates, mulch films that support soil health, and plant pots designed to decompose in field conditions-alongside consumer goods such as household items and personal care packaging specified for compostable disposal streams. Industrial applications include temporary floor protection films and protective covers that are integral to construction and renovation projects. In medical settings, surgical drapes and wound dressings leverage sterile-grade biodegradable films, while traditional packaging use cases cover food packaging films tailored for shelf stability and shopping bags engineered to meet retail sustainability pledges.

This comprehensive research report categorizes the Biodegradable Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Compostability

- Application

Analyzing Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Reveal Growth Drivers and Market Opportunities in Biodegradable Films

Regional market dynamics are shaped by differentiated regulatory frameworks, consumer behaviors, and infrastructure maturity across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, North America leads with significant capacity expansions in domestic biopolymer production, driven by federal and state incentives for sustainable packaging and agricultural innovations. Latin America is emerging as a key source of feedstocks-particularly sugarcane and cassava-for PLA and starch blends, supported by government programs that promote rural development and circular agricultural systems.

In Europe, robust policy instruments under the European Green Deal and Single-Use Plastics Directive are accelerating the shift to compostable films, with harmonized composting standards and strong Extended Producer Responsibility schemes. The Middle East and Africa region displays a growing appetite for biodegradable films in foodservice and medical applications, although end-of-life waste-management systems remain under development. Meanwhile, the Asia-Pacific region continues to exhibit the fastest overall growth, with China, Thailand, and Japan investing in both upstream biopolymer facilities and downstream film-conversion capabilities. Rising consumer awareness, mandatory labeling requirements, and expanding industrial composting infrastructure underpin rapid adoption across the region.

This comprehensive research report examines key regions that drive the evolution of the Biodegradable Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Disruptors That Are Shaping Competitive Landscapes in Biodegradable Film Production and Technology Advancement

Leading participants in the biodegradable films market combine legacy polymer expertise with focused innovation in bio-based materials. NatureWorks LLC stands out as a premier manufacturer of polylactic acid (PLA) biopolymers under the brand Ingeo, advancing its global footprint with new production capacity and platform technologies for biaxially oriented PLA films. BASF SE has developed the ecovio brand, blending petroleum-based PBAT and PLA to deliver certified home and industrial compostable films for agricultural mulch, waste-collection bags, and injection-molded coffee capsules. TotalEnergies Corbion, a joint venture between TotalEnergies and Corbion NV, promotes Luminy PLA grades with strong barrier performance for flexible and rigid packaging, leveraging sugarcane feedstocks and global licensure agreements.

Novamont SpA has pioneered the Mater-Bi family of biodegradable films, integrating starch, cellulose, and vegetable oils in Italian biorefineries to address organic waste management and soil protection with certified mulching films and packaging liners. Danimer Scientific, now part of Teknor Apex as of July 2025, champions PHA-based resins that biodegrade in any environment, collaborating with partners to introduce home-compostable extrusion coatings for cups and flexible films. These firms exemplify the strategic alignment of advanced research, feedstock integration, and end-use application development that is accelerating the maturation of the biodegradable films landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodegradable Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BIOTEC GmbH

- Corbion N.V.

- Danimer Scientific, Inc.

- FKuR Kunststoff GmbH

- Mitsubishi Chemical Holdings Corporation

- NatureWorks LLC

- Novamont S.p.A.

- Synbra Technology B.V.

- Taghleef Industries S.p.A.

Strategic Recommendations Empowering Industry Leaders to Harness Sustainability Trends, Operational Efficiency, and Market Expansion in Biodegradable Films

Industry leaders should prioritize investments in integrated biopolymer supply chains to mitigate tariff-induced cost pressures and secure feedstock supply. Establishing or expanding in-region fermentation capacity for lactic acid and PHA precursors can reduce import duties, lower transport risks, and enhance sustainability credentials. Simultaneously, companies should adopt circular design principles, co-developing multilayer and mono-material film structures that facilitate recyclable or compostable end-of-life solutions within existing collection systems.

Collaborating with end-users through joint development agreements will accelerate the adoption of custom film grades that meet specific performance criteria for barrier properties, mechanical strength, and biodegradation timelines. Cross-sector partnerships can also enable shared R&D platforms for emerging technologies such as enzymatic recycling and advanced composting accelerants. Moreover, embedding digital traceability-from feedstock origin to end-of-life outcome-will strengthen claims verification and support premium positioning in sustainability-driven procurement frameworks.

Finally, companies should engage proactively with policymakers and industry consortia to shape harmonized standards for compostability and food contact safety. By participating in regulatory working groups and certification bodies, organizations can ensure that forthcoming guidelines reflect practical production realities and foster market confidence in biodegradable film solutions.

Revealing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation Processes

This research synthesizes insights from a rigorous multi-step methodology integrating both primary and secondary data to ensure robust and actionable conclusions. Primary research comprised over 50 in-depth interviews with C-level executives, product development leads, and procurement specialists across leading biopolymer producers and film converters. These dialogues provided qualitative intelligence on strategic priorities, technological hurdles, and end-user adoption drivers.

Secondary research entailed extensive analysis of industry publications, patent filings, sustainability reports, and regulatory filings. Key sources included company press releases, academic journals on polymer science, and policy documents such as the EU Single-Use Plastics Directive and U.S. tariff legislation. Data triangulation techniques were employed to validate conflicting information and reconcile quantitative statements with qualitative insights. Market segmentation frameworks were developed through cross-referencing product catalogs and certification databases for compostable grades.

To ensure accuracy and impartiality, a panel of independent experts reviewed the findings at key milestones, refining assumptions and validating conclusions. Final data underwent consistency checks and peer review before publication, guaranteeing that the report presents an objective, comprehensive, and contemporary portrait of the biodegradable films market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodegradable Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodegradable Films Market, by Type

- Biodegradable Films Market, by Form

- Biodegradable Films Market, by Compostability

- Biodegradable Films Market, by Application

- Biodegradable Films Market, by Region

- Biodegradable Films Market, by Group

- Biodegradable Films Market, by Country

- United States Biodegradable Films Market

- China Biodegradable Films Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Forward-Looking Perspectives to Illuminate the Future Trajectory of the Biodegradable Films Industry

The transition toward biodegradable films reflects a confluence of environmental urgency, regulatory momentum, and technological advancement. As the industry evolves from nascent innovation to mature commercialization, stakeholders must navigate a dynamic terrain of tariff impacts, feedstock diversification, and end-of-life infrastructure development. The alignment of diverse segmentation angles-from material types to application niches-underscores the importance of tailored strategies for capturing growth in specific sub-markets.

Regional variations in policy and infrastructure highlight the necessity for geographic agility, as market leaders leverage domestic production incentives, nearshoring, and tailored composting initiatives to optimize supply chains. Meanwhile, the emergence of high-performance biopolymers and collaborative R&D platforms portends a wave of differentiated products that will redefine quality and sustainability benchmarks across industries. The interplay between corporate commitments to circularity and consumer demand for eco-friendly solutions will continue to drive innovation trajectories.

Looking ahead, the biodegradable films sector stands at a pivotal inflection point: sustained investment in integrated production systems, digital traceability, and standards harmonization will determine which organizations capitalize on the transformative potential of compostable materials. By synthesizing the key trends, challenges, and competitive dynamics, this executive summary offers a strategic roadmap for navigating the next chapter of growth and impact in the biodegradable films ecosystem.

Engage with Ketan Rohom to Acquire In-Depth Market Research Insights and Drive Strategic Decisions in the Biodegradable Films Ecosystem Today

Ready to elevate your strategic decisions in the biodegradable films sector? Reach out to Associate Director, Sales & Marketing Ketan Rohom to access the complete market research report, analyze proprietary data, and secure your competitive advantage in an industry defined by rapid innovation and regulatory change.

Connect directly with Ketan Rohom to obtain tailored insights that address your unique business challenges, from navigating tariff landscapes to optimizing production processes and capitalizing on emerging applications. Your inquiry will unlock bespoke advisory support and a comprehensive suite of analytical tools designed to empower data-driven decisions.

Act now to gain early visibility into breakthrough technologies, regional growth drivers, and best-in-class practices that leading organizations are deploying today. Partner with Ketan Rohom to transform informed analysis into executable strategies, mitigating risk and maximizing opportunity across the biodegradable films ecosystem.

- How big is the Biodegradable Films Market?

- What is the Biodegradable Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?