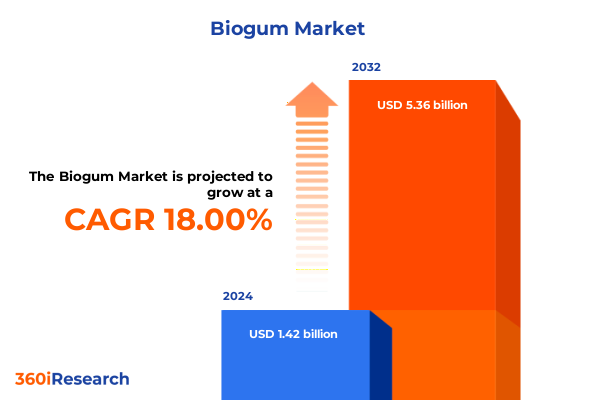

The Biogum Market size was estimated at USD 1.68 billion in 2025 and expected to reach USD 1.96 billion in 2026, at a CAGR of 17.97% to reach USD 5.36 billion by 2032.

Unveiling the Global Chewing Gum Landscape Amidst Dynamic Consumer Trends and Regulatory Shifts Shaping Future Market Pathways

The chewing gum industry has evolved significantly over the past decade, reflecting broader shifts in consumer lifestyles, health considerations, and regulatory environments. As individuals balance busy schedules with growing wellness priorities, chewing gum has transcended its traditional role as a simple breath freshener to become a multifunctional product addressing cognitive focus, appetite control, and even dental health. This evolution is underpinned by the convergence of technological innovation in formula development and material science, alongside more stringent quality and safety standards enforced by regulatory bodies.

In this landscape of rapid change, stakeholders must understand how diverse factors-from ingredient sourcing and cost structures to consumer segmentation and distribution models-are reconfiguring competitive dynamics. Leading manufacturers are investing heavily in new formulations, such as sugar-free blends sweetened with sugar alcohols and high-intensity sweeteners, to cater to health-conscious demographics. Meanwhile, premium natural and organic variants are gaining traction among consumers seeking clean-label options. Simultaneously, emerging markets in Asia-Pacific and parts of Latin America are presenting fresh avenues for growth, prompting established players to recalibrate their regional strategies.

As the sector continues to mature, staying ahead requires a nuanced appreciation of the interplay between consumer demand, supply chain resilience, and policy developments. This report delivers a rigorous foundational overview designed to inform your strategic planning and pinpoint the most promising opportunities in the global chewing gum arena.

Navigating Paradigm-Altering Changes in Consumer Behavior Sustainability Demands and Technological Integrations Transforming Chewing Gum Offerings

Over the past few years, the chewing gum sector has witnessed transformative shifts driven by changing consumer expectations and broader societal trends. Increased awareness of oral health has prompted manufacturers to reformulate products with functional ingredients, such as xylitol and sorbitol, which offer therapeutic benefits beyond simple breath freshening. Concurrently, sustainability imperatives are reshaping supply chain priorities, with brands seeking biodegradable or compostable packaging alternatives to align with environmental commitments.

At the same time, digital platforms have redefined how consumers discover and purchase chewing gum. Direct-to-consumer channels, including brand-operated websites and e-commerce platforms, now serve as critical touchpoints for product launches and consumer engagement. This paradigm shift has accelerated data-driven marketing initiatives, enabling companies to tailor promotional campaigns and product assortments based on real-time feedback and purchasing patterns.

Furthermore, the integration of advanced manufacturing technologies-such as continuous mixing processes and precision extrusion-has improved production efficiency and product consistency. These innovations have not only lowered operational costs but have also provided the flexibility to develop niche variants, from functional chewing gums enriched with vitamins to novel flavored pellets targeting younger demographics. As we move forward, the synergy between consumer-centric innovation and operational excellence will continue to redefine competitive benchmarks within the industry.

Assessing the Compounded Effects of the United States’ 2025 Tariff Adjustments on Ingredient Costs and Competitive Dynamics Across the Chewing Gum Value Chain

In 2025, new tariff measures implemented by the United States government have introduced notable complexities throughout the chewing gum supply chain. These measures, aimed at balancing domestic production interests and international trade dynamics, have elevated import duties on key raw materials such as sugar, glucose, and synthetic sweeteners. As a result, ingredient costs have risen, exerting pressure on manufacturers to reassess sourcing strategies and explore alternative suppliers in tariff-exempt regions.

Consequently, companies have adopted dual-pricing mechanisms and renegotiated long-term contracts to mitigate the financial burden. Some manufacturers have shifted a greater portion of production to duty-friendly locales, leveraging free trade agreements to preserve margin integrity. This geographic realignment, however, brings its own challenges, requiring robust quality assurance protocols to ensure consistency across disparate facilities.

Additionally, the tariff adjustments have influenced competitive pricing on retail shelves, leading to tighter margins for mass-market brands. In response, many players are differentiating through premiumization-emphasizing natural ingredients, functional benefits, and sustainable packaging-to justify higher shelf prices. These initiatives, in turn, have spurred a wave of partnerships with ingredient innovators and packaging specialists, driving a new era of collaboration in the chewing gum ecosystem.

Looking ahead, the industry must remain vigilant as potential further trade policy shifts loom. By diversifying supply chains, optimizing production footprints, and prioritizing high-value product segments, businesses can navigate these headwinds while sustaining growth trajectories.

Deconstructing Consumer Preferences Through Detailed Segment Analysis of Product Flavor Packaging and Distribution Channels in the Chewing Gum Sector

A nuanced understanding of the chewing gum market emerges when examining the product types, flavor preferences, packaging formats, end-user demographics, and distribution pathways driving consumer choice. Within the product portfolio, distinctions between organic, sugar-based, and sugar-free offerings reveal diverse value propositions. Sugar-based variants, leveraging glucose and sucrose for sweetness, resonate with traditional palates, whereas sugar-free formulations sweetened with aspartame, sorbitol, and xylitol appeal to health-focused consumers seeking dental and caloric benefits.

Flavor plays a pivotal role, with fruit-infused variants delivering vibrant taste profiles that engage younger users, while mint remains the enduring go-to for freshness and universal appeal. Packaging formats further differentiate market positioning: compact pellets cater to on-the-go consumption, sticks uphold classic experiences, and tablets offer measured dosing for functional performance.

User segmentation underscores distinct usage occasions and purchase triggers. Adults often prioritize functional benefits-such as energy release or breath control-while children and teens are drawn by bold flavors and playful packaging designs. Distribution channels amplify these patterns: convenience stores drive impulse buys, retail grocery outlets in hypermarkets and supermarkets facilitate weekly replenishment, and vending machines deliver immediate access in transit hubs. Meanwhile, online storefronts, whether via brand websites or third-party e-commerce platforms, increasingly serve as platforms for subscription models and limited-edition releases. Together, these layers of segmentation illuminate pathways to tailor offerings that resonate at each stage of the consumer journey.

This comprehensive research report categorizes the Biogum market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor Type

- Packaging Format

- End User

- Distribution Channel

Revealing Regional Market Nuances and Growth Drivers Across the Americas EMEA and Asia-Pacific to Inform Strategic Expansion Decisions

Regional dynamics in the chewing gum market illustrate how cultural norms, regulatory regimes, and economic conditions shape consumption and growth potential. In the Americas, consumers demonstrate a high affinity for sugar-free and functional formulations, supported by robust distribution networks spanning convenience stores to supermarket chains. Innovative marketing campaigns, often partnering with influencers, have amplified engagement, particularly in health-conscious urban centers.

Across Europe, the Middle East, and Africa, or EMEA, stringent food safety regulations and rising disposable incomes are driving demand for premium and natural chewing gum variants. Manufacturers have responded by launching organic lines and limited-edition flavors that reflect local taste preferences. Growth in this region also benefits from cross-border trade agreements, which facilitate the movement of raw materials and finished goods, although varying tariff structures require careful navigation.

In Asia-Pacific, rapid urbanization and a burgeoning middle class have created fertile ground for market expansion. Sweet-flavor profiles, especially fruit and dessert-inspired blends, are gaining traction alongside health-oriented sugar-free products. E-commerce platforms and convenience retail formats are key growth engines, enabling brands to penetrate both metropolitan and tier-two city markets with tailored product offerings. These regional nuances underscore the importance of aligning product development, marketing, and distribution strategies with local consumer behaviors and regulatory landscapes to drive sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Biogum market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Chewing Gum Corporations’ Strategic Moves Innovations and Collaborations Shaping Competitive Positions Globally

Leading manufacturers are deploying multifaceted strategies to solidify market leadership and capitalize on emerging opportunities. Major global brands have accelerated their innovation pipelines, introducing functional chewing gums enriched with nootropic ingredients, vitamins, and natural extracts designed to support energy, focus, and wellness. These product launches are frequently accompanied by strategic collaborations with ingredient suppliers and research institutions to validate efficacy claims and enhance credibility.

At the same time, mergers and acquisitions continue to reshape the competitive landscape. Large conglomerates are acquiring niche players specializing in premium, organic, or region-specific variants to diversify portfolios and gain access to specialized distribution networks. Such transactions often include commitments to sustainability, with acquiring companies pledging investments in eco-friendly packaging solutions and carbon reduction initiatives.

Moreover, digital transformation remains a core focus area. Companies have revamped their direct-to-consumer platforms, incorporating subscription services and personalized promotions to foster brand loyalty. Data analytics tools enable real-time monitoring of consumer feedback, allowing agile adjustments to flavor assortments and marketing messages. Collectively, these strategic moves illustrate how leading players are leveraging innovation, consolidation, and digital engagement to maintain a competitive edge in an evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biogum market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canel’s, S.A. de C.V.

- Chewsy Gum Ltd.

- Consorcio Chicza S.C. de R.L. de C.V.

- Ford Gum & Machine Co., Inc.

- Gud Gum Pvt. Ltd.

- Gumlink A/S

- Honest Gum Pty Ltd.

- Lotte Corporation

- Mars, Incorporated

- MasterFoodeh Co.

- Milliways Ltd.

- Mondelez International, Inc.

- Perfetti Van Melle S.p.A.

- Perfora Oral Care Pvt. Ltd.

- Simply Gum, Inc.

- The Hershey Company

- The PUR Company Inc.

- Tootsie Roll Industries, LLC

- True Gum ApS

- Verve, Inc.

Crafting Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory Complexities in the Chewing Gum Market

To thrive in the current market environment, industry leaders must adopt proactive strategies that address both market opportunities and regulatory complexities. First, cultivating supply chain resilience through diversified sourcing and multipoint partnerships will mitigate exposure to tariff volatility and logistical disruptions. Prioritizing suppliers in regions with favorable trade agreements and fostering joint development projects can safeguard ingredient quality and cost predictability.

Second, investing in product differentiation remains paramount. Brands should accelerate the development of functional formats that address consumer demands for cognitive support, dental health benefits, and natural ingredients. Collaborations with nutraceutical and biotech innovators will expedite R&D cycles and strengthen health claims, ultimately commanding premium positioning.

Third, optimizing omnichannel distribution is critical for sustaining engagement across diverse consumer touchpoints. Integrating online subscription models with in-store promotions, and leveraging data analytics to personalize offers, will deepen customer relationships and increase lifetime value. Additionally, pilot programs for eco-friendly packaging pilots can reinforce corporate responsibility commitments and resonate with environmentally conscious consumers.

By aligning these initiatives with robust market intelligence-continuous monitoring of competitive actions, policy updates, and consumer sentiment-leaders can navigate complexities and seize growth opportunities. Ultimately, agility, innovation, and strategic collaboration will define the next wave of success in the chewing gum industry.

Outlining Rigorous Research Methodology Emphasizing Data Integrity Multisource Verification and Analytical Rigor Underpinning Chewing Gum Market Insights

Our research methodology integrates a comprehensive suite of qualitative and quantitative techniques to ensure the insights presented are grounded in rigorous analysis and transparent processes. Primary research includes in-depth interviews with senior executives across ingredient suppliers, packaging manufacturers, distributors, and leading chewing gum producers. These interviews uncover firsthand perspectives on innovation roadmaps, supply chain challenges, and regulatory impacts.

Complementing primary insights, we conducted extensive secondary research, sourcing data from government trade statistics, regulatory filings, and reputable industry publications. This multisource approach allowed us to cross-verify figures, reconcile discrepancies, and maintain a high level of data integrity. Advanced analytics tools were employed to process and normalize consumption data, price indices, and input cost trends across regions and product categories.

Additionally, we applied scenario analysis to assess the repercussions of potential policy shifts, such as further tariff escalations or sustainability mandates. Sensitivity testing ensured that our conclusions remain robust under varying market conditions. Finally, an expert advisory panel-comprising food scientists, regulatory specialists, and market strategists-reviewed our findings, providing critical validation and ensuring that strategic recommendations are both actionable and aligned with emerging industry standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biogum market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biogum Market, by Product Type

- Biogum Market, by Flavor Type

- Biogum Market, by Packaging Format

- Biogum Market, by End User

- Biogum Market, by Distribution Channel

- Biogum Market, by Region

- Biogum Market, by Group

- Biogum Market, by Country

- United States Biogum Market

- China Biogum Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Takeaways from Market Dynamics Consumer Behaviors and Policy Implications to Guide Future Decision-Making in the Chewing Gum Sector

This executive summary synthesizes the fundamental drivers and constraints shaping the global chewing gum industry. Consumer demand has shifted toward functional, health-oriented formulations and eco-conscious packaging, prompting manufacturers to innovate across product, process, and partnership dimensions. Simultaneously, new trade policies and tariff structures have redefined cost dynamics, leading to strategic realignment of production footprints and sourcing strategies.

Segment-level analysis reveals that sugar-free blends, particularly those sweetened with xylitol and sorbitol, garner strong traction among health-aware demographics, while flavor diversity-spanning fruit-infused to mint variants-remains a key differentiator. Packaging formats and distribution channels drive purchase behaviors; convenience retail formats stimulate impulse buys, and digital storefronts empower subscription and limited-edition models.

Region-specific insights highlight the Americas’ embrace of functional and sugar-free products, EMEA’s premiumization trend underpinned by regulatory rigor, and Asia-Pacific’s twin engines of urbanization and digital penetration. Industry leaders are responding through targeted M&A, digital transformation, and collaborative innovation. Looking ahead, the convergence of consumer-centric innovation and supply chain agility will determine success. Stakeholders who leverage deep market intelligence, embrace sustainable practices, and invest in strategic partnerships will be best positioned to navigate uncertainties and capture emerging opportunities.

Engage with Ketan Rohom to Secure Your Comprehensive Chewing Gum Market Research Report and Drive Strategic Growth in a Dynamic Industry Landscape

We invite you to connect with Ketan Rohom, our Associate Director of Sales & Marketing, to access an in-depth analysis tailored to your strategic needs. Through this partnership, you will gain unparalleled visibility into consumer behaviors, competitive maneuvers, and regulatory developments shaping the chewing gum industry. Ketan and his team will guide you through the report’s methodology, highlight critical insights, and advise on integrating findings into your corporate roadmap. Whether you are refining product portfolios, optimizing supply chains, or exploring untapped markets, this comprehensive report will serve as your blueprint for informed decision-making. Engage directly to secure your copy today and take decisive steps toward driving sustainable growth. We look forward to collaborating with you to unlock the full potential of the chewing gum market and transform insights into actionable outcomes that fuel your competitive advantage

- How big is the Biogum Market?

- What is the Biogum Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?