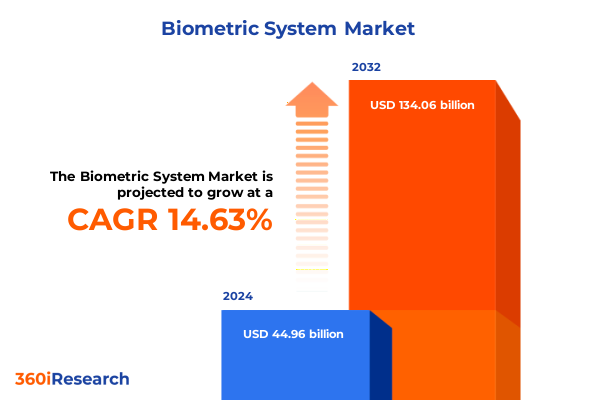

The Biometric System Market size was estimated at USD 51.22 billion in 2025 and expected to reach USD 58.46 billion in 2026, at a CAGR of 14.73% to reach USD 134.06 billion by 2032.

Exploring the Evolution of Biometric Systems and Their Pivotal Role in Redefining Modern Security Protocols with Advanced Identification Technologies

Biometric identification technologies have evolved from niche security measures into indispensable components of modern authentication infrastructures. Over the past decade, advancements in algorithmic precision, sensor miniaturization, and computing power have broadened the applicability of biometric systems across consumer devices, enterprise access control solutions, and government identity programs. Today, facial recognition cameras built into smartphones, fingerprint modules embedded in point-of-sale terminals, and iris scanners deployed at high-security facilities exemplify how diverse biometric modalities have become seamlessly integrated into everyday interactions. Consequently, organizations are pursuing more robust identity frameworks to combat fraud, streamline user experiences, and comply with increasingly stringent data protection standards.

As these technologies gain traction, they are reshaping perceptions of identity assurance and privacy. The convergence of biometric systems with artificial intelligence and cloud computing has enabled real-time matching, adaptive liveness detection, and decentralized template storage models. Moreover, enhancements in user enrolment processes and mobile SDKs have significantly lowered barriers to implementation, allowing mid-sized enterprises to capitalize on what was once the exclusive domain of large security integrators. In light of these developments, it is essential for stakeholders across industries to grasp how biometric ecosystems are redefining trust boundaries and setting new benchmarks for secure, frictionless interactions.

Unveiling Transformative Shifts that Are Reshaping the Biometric Market Landscape Driven by Technological Innovations and Regulatory Dynamics

The biometric market has witnessed transformative shifts driven by breakthroughs in deep learning, sensor diversification, and regulatory harmonization. In particular, the maturation of multimodal authentication-where systems validate more than one human trait-has heightened accuracy and resilience against spoofing attacks. As a result, enterprises in sectors ranging from banking to telecommunications now embed multiple biometric layers, such as face and voice or fingerprint and vein, into a unified verification workflow, elevating both security and user convenience.

Furthermore, privacy regulations like the California Consumer Privacy Act and the EU’s GDPR have spurred innovation around template encryption, consent management, and on-device processing. Such legislative drivers have prompted providers to adopt privacy-by-design principles, enabling biometric data to remain secure and non-transferable beyond its point of capture. Simultaneously, deployments of edge AI have diminished reliance on centralized servers, which reduces latency and heightens resilience against service discontinuities. Collectively, these advances illustrate how the intersection of technology and policy is forging a new era in which biometric solutions can both comply with privacy mandates and deliver superior performance.

Assessing the Cumulative Impact of United States 2025 Tariffs on Biometric System Supply Chains Components and Global Market Dynamics

The imposition of U.S. tariffs on select hardware components and sensor modules throughout 2025 has created a complex environment for biometric system providers and end-users alike. As import duties on camera assemblies, fingerprint sensors, and microelectromechanical system (MEMS) components rose, supply chain partners faced increasing inventory costs and contractual renegotiations. Consequently, original equipment manufacturers have had to reassess their sourcing strategies, shifting partial production to regional suppliers or renegotiating long-term agreements to mitigate margin pressures.

In addition, ongoing trade frictions have introduced scheduling uncertainties that ripple through project timelines, affecting everything from municipal access control rollouts to corporate identity program expansions. Service integrators have responded by diversifying their component portfolios and accelerating qualification processes for alternative suppliers. Meanwhile, software vendors have emphasized modular licensing models to reduce the hardware-dependency of their offerings. Together, these adaptations demonstrate how the tariff landscape is catalyzing greater supply chain resilience and driving industry stakeholders to explore near-shoring options and strategic stockpiling as mechanisms to preserve program delivery commitments.

Unlocking Key Segmentation Insights to Understand Diverse Biometric Deployment Models Across Technologies Components Users and Applications

A nuanced examination of biometric market segmentation reveals critical insights into how technology choices, component offerings, end-user focuses, and applications define competitive positioning. Across technology dimensions, face recognition and fingerprint modalities continue to lead deployments, while emerging corridors in iris and vein recognition-particularly finger vein and palm vein-are carving out specialized use cases that demand higher liveness assurance. This trend underscores the importance of modality diversification, which enables solution providers to tailor their platforms for sectors with stringent anti-spoofing requirements.

When considering authentication modes, the distinction between single-modal and multi-modal systems illuminates varying priorities for user convenience versus fortified security. Similarly, the balance of hardware, software, and services within a solution portfolio shapes go-to-market approaches: integration and consulting services pair with support and maintenance contracts to accompany robust hardware foundations, while algorithms, application software, and middleware components act as differentiators in platform flexibility. Moreover, end-user verticals like BFSI, consumer electronics, government and defense, healthcare, retail, and telecom each draw on unique application scenarios-ranging from access control and fraud prevention to customer identification and time-and-attendance management-while deployment mode choices between cloud-based and on-premises infrastructures highlight divergent risk appetites and scalability needs.

This comprehensive research report categorizes the Biometric System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Authentication Mode

- End User

- Application

Analyzing Regional Variations and Strategic Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Biometric Markets

Regional analyses reveal distinct market characteristics shaped by regulatory frameworks, infrastructure maturity, and investment priorities. In the Americas, demand for biometric solutions is heavily influenced by financial services implementations, border security initiatives, and enterprise access management strategies. Progressive privacy legislation in North America has prompted solution architects to emphasize on-device biometric matching and tokenization, fostering a security posture that balances user convenience with compliance requirements.

Across Europe, the Middle East, and Africa, a patchwork of data privacy regulations and security mandates drives adoption of both legacy and advanced biometric systems. European agencies lean on facial recognition and fingerprint technologies in law enforcement and passport control, whereas Middle Eastern governments prioritize large-scale identity programs that integrate biometric registries into national ID frameworks. African markets are witnessing growth in mobile-first authentication models, addressing financial inclusion and remote verification challenges. Meanwhile, Asia-Pacific remains a high-growth frontier, buoyed by extensive national identity schemes, mobile wallet expansions, and smart city projects. Countries like China and India are scaling iris and facial recognition at urban transit hubs, while Southeast Asian economies adopt mobile vein-based wallet authentication, underscoring the region’s embrace of biometric innovation.

This comprehensive research report examines key regions that drive the evolution of the Biometric System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Focus of Leading Biometric System Providers Driving Differentiation and Market Leadership

Leading biometric system providers are differentiating through strategic partnerships, technology roadmaps, and service models that address evolving security and privacy imperatives. Companies with established hardware portfolios are deepening software capabilities by integrating advanced AI-driven algorithms and middleware platforms that streamline third-party integrations. At the same time, pure-play software vendors are forging alliances with cloud providers to offer scalable, API-centric authentication services, catering to developers and enterprise IT teams seeking rapid deployment paths.

Furthermore, service-oriented firms are amplifying their consulting and integration offerings, supporting complex deployments that span multiple modalities and cross-regional regulations. This trend highlights the importance of end-to-end managed solutions that deliver not only robust sensor hardware but also ongoing support, maintenance, and optimization services. As a result, market leaders are actively investing in research and development to bolster liveness detection, edge AI capabilities, and frictionless user experiences, positioning themselves for long-term leadership in an increasingly crowded landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biometric System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anviz, Inc.

- Apple Inc.

- ASSA ABLOY AB

- Aware, Inc. by Mimecast Services Limited

- BioCatch Ltd.

- BioConnect Inc.

- BioID GmbH

- Cognitec Systems GmbH

- EyeLock LLC by VOXX International Corporation

- FACEPHI BIOMETRICS Ltd.

- Fingerprint Cards AB

- Fujitsu Limited

- IDEMIA France SAS

- IDEX Biometrics ASA

- IriTech, Inc.

- M2SYS, Inc.

- NEC Corporation

- Next Biometrics Group ASA

- Nuance Communications, Inc.

- Precise Biometrics AB

- Suprema Inc.

- Synaptics Incorporated

- TECH5 SA

- Thales Group

- ZKTeco Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Navigate Competitive Pressures Regulatory Challenges and Accelerate Biometric Adoption

Industry leaders should prioritize strategic investments in multimodal authentication platforms that integrate emerging modalities such as vein recognition alongside established fingerprint and facial systems. By doing so, organizations can deliver heightened anti-spoofing performance while addressing sector-specific compliance demands. In tandem, cultivating partnerships with cloud and edge AI providers will ensure that solutions scale seamlessly and maintain low latency, even as transaction volumes rise.

Additionally, companies must reevaluate supply chain architectures to mitigate the impact of evolving tariff regimes. Diversifying component sourcing and developing qualification processes for regional suppliers can bolster resilience and preserve deployment timelines. Equally important is the adoption of privacy-centric design patterns, including decentralized template storage and user consent management, to reinforce data protection postures and foster customer trust. By combining technological agility with regulatory foresight and supply chain elasticity, industry players can position themselves for sustained growth and competitive advantage.

Detailing the Robust Research Methodology That Underpins Biometric Market Analysis Ensuring Data Integrity Credibility and Analytical Rigor

This analysis is grounded in a robust research framework that integrates both primary and secondary data sources. Primary insights were gathered through in-depth interviews with industry executives, solution architects, and end-user organizations across key sectors. Secondary data was synthesized from publicly available regulatory documents, white papers, journal publications, and technology vendor disclosures. A structured triangulation process corroborated qualitative findings with documented use cases and vendor roadmaps.

Additionally, the methodology employed a hybrid top-down and bottom-up approach to ensure comprehensive coverage of market dynamics. Segmentation analyses were validated through cross-sectional comparisons and expert panel reviews, while the impact of U.S. tariffs was quantified through scenario planning and supply chain mapping exercises. Quality assurance steps, including peer reviews and editorial audits, were undertaken to guarantee analytical rigor and data integrity throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biometric System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biometric System Market, by Component

- Biometric System Market, by Technology

- Biometric System Market, by Authentication Mode

- Biometric System Market, by End User

- Biometric System Market, by Application

- Biometric System Market, by Region

- Biometric System Market, by Group

- Biometric System Market, by Country

- United States Biometric System Market

- China Biometric System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Strategic Conclusions on Emerging Biometric Trends Market Dynamics and Growth Enablers to Guide Stakeholder Decision Making

In conclusion, biometric technologies stand at the cusp of a transformative phase defined by modality convergence, heightened privacy imperatives, and supply chain realignments. As face, fingerprint, iris, and vein recognition systems continue to mature, their integration with AI and distributed computing frameworks will redefine how organizations secure identities and streamline experiences. The evolving tariff landscape in the United States underscores the need for strategic sourcing and supply chain flexibility, while regional market nuances highlight varied adoption drivers across the globe.

Looking ahead, stakeholders poised for success will be those that embrace a holistic approach-melding technological innovation with regulatory compliance and service excellence. By aligning segmentation strategies with end-user requirements, leveraging regional strengths, and prioritizing multimodal resilience, businesses can harness the full potential of biometric solutions. Ultimately, the dynamic interplay of security demands, user expectations, and policy influences will shape a biometric ecosystem that is both robust and adaptive.

Engage with Ketan Rohom to Access Comprehensive Biometric Market Intelligence and Drive Strategic Success with In-Depth Research Insights

Elevate your strategic advantage and uncover the competitive differentiators you need to stay ahead in the fast-evolving biometric landscape. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to gain privileged access to the comprehensive market research report that delivers deep qualitative insights, rigorous analysis, and action-ready recommendations. By working directly with Ketan Rohom, you will benefit from personalized guidance on how best to leverage the intelligence within the report to optimize your product roadmap, tailor your go-to-market strategies, and align your organizational objectives with emerging industry trajectories.

Seize this opportunity to transform uncertainty into actionable clarity. Reach out to Ketan Rohom to schedule a tailored briefing session, explore sample content, and secure your copy of the report designed to empower executive decision makers, product innovators, and strategic planners. Take the next decisive step to position your organization at the forefront of biometric innovation and capitalize on the emerging opportunities outlined in this meticulously researched analysis.

- How big is the Biometric System Market?

- What is the Biometric System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?