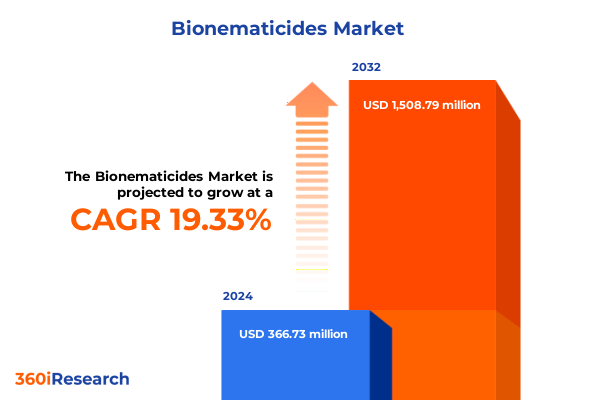

The Bionematicides Market size was estimated at USD 438.52 million in 2025 and expected to reach USD 517.23 million in 2026, at a CAGR of 19.30% to reach USD 1,508.79 million by 2032.

Introduction to Bionematicides and Their Role in Sustainable Crop Protection Amidst Evolving Pest Pressures and Regulatory Shifts Impacting Crop Health Outcomes

Crop damage inflicted by plant-parasitic nematodes has emerged as a critical challenge for modern agriculture, with global yield losses estimated between 20 and 40 percent annually. FAO highlights that such losses threaten efforts to meet Sustainable Development Goal 2 and feed a growing population while preserving ecosystem integrity. As climate change intensifies pest pressures, the reliance on chemical nematicides has become unsustainable due to environmental and health concerns, prompting regulators worldwide to withdraw or restrict many traditional active ingredients to safeguard human health and biodiversity.

In response to these constraints, bionematicides have gained prominence as a more targeted, eco-friendly alternative. By harnessing living organisms, botanical extracts, or microbial metabolites, these products offer precise activity against nematodes while minimizing non-target impacts. Recent research underscores the potential of microbial antagonists such as fungi and bacteria to disrupt nematode life cycles, and plant-derived compounds to induce systemic resistance in crops. Although still evolving in consistency and performance compared to synthetic options, ongoing innovation in formulation and mode-of-action is rapidly enhancing their efficacy and adoption across diverse cropping systems.

Transformative Technological Innovations, Regulatory Milestones and Industry Collaborations Reshaping the Global Bionematicides Landscape Across Diverse Agricultural Environments

The global shift toward more stringent regulation has accelerated the withdrawal of conventional chemical nematicides, with many fumigants and non-fumigants no longer permissible under modern frameworks. In the European Union, fumigants such as metam-Na and metam-K were banned in several member states after 2018, and non-fumigants like fenamiphos have been revoked due to failure to renew pursuant to EU Regulation 2020/1246. These changes reflect broader regulatory pressure to reduce environmental contamination and safeguard human health, creating both challenges and opportunities for biological alternatives.

Simultaneously, technological innovations are reshaping control options. New synthetic nematicides such as fluensulfone, fluopyram and emerging candidates are more selective and safer, complementing biologicals in integrated pest management programs. At the same time, microbial solutions that leverage Nec-trophagous fungi and bacterial species are advancing through refined fermentation and formulation techniques, offering growers a wider array of tools. Proposed registration of novel actives like cyclobutrifluram underscores the integrated landscape of chemistries and biologicals collaborating to address nematode management demands.

Industry collaborations and strategic acquisitions further underscore this transformation. Bayer’s 2024 acquisition of Prophyta expanded its fungal-based biocontrol capacity, while ecosystem partnerships such as the exclusive Velsinum™ distribution agreement between Bayer and Ecospray leverage natural garlic-derived nematicidal compounds. Likewise, MustGrow Biologics’ collaboration with Bayer on mustard-based biocontrol technologies exemplifies cross-sector innovation designed to meet escalating demand for sustainable solutions.

Cumulative Effects of United States Tariffs Imposed in 2025 on the Bionematicides Supply Chain, Pricing Structures and Trade Dynamics

In response to Executive Orders issued in early 2025, overlapping tariffs on imported agricultural inputs have been subject to a non-stacking directive, limiting cumulative duties on the same article. This measure, applied retroactively to entries from March 4, 2025, ensures that products facing multiple tariff actions under various authorities incur only a single rate, easing potential cost burdens for importers of biological and chemical crop protection products alike. Agencies have been tasked with updating HS code guidance and enforcement mechanisms to implement these changes by May 16, 2025.

Despite non-stacking provisions, the introduction of a 10 percent reciprocal tariff on goods from all countries effective April 5, 2025, and the maintenance of prior duties on China and India under 301 actions have collectively elevated the cost base for imported bionematicides. The uncertainty surrounding final duties and the need for customs reclassification have prompted distributors to reassess supply chains and price structures, with end users facing higher input costs and potential delays in product availability.

Key Segmentation Insights Unveiling Formulation, Source, Application Method, Crop Type and Distribution Channel Dynamics in the Bionematicides Market

Bionematicides are developed in a variety of formulations to meet specific application requirements and crop protection goals. Emulsifiable concentrates offer ease of mixing and soil mobility, while granules provide targeted placement and reduced drift. Liquid formulations support precise dosing in seed and drip-irrigation setups, and wettable powders deliver stable active ingredient loading for broad-acre applications. These differentiated formats enable formulators to optimize performance across diverse field conditions and handling protocols.

Underlying sources of bionematicides are classified into biochemical agents, microbial products and natural extracts. Biochemical modalities often utilize plant-derived compounds or purified metabolites, whereas microbial offerings encompass bacteria and fungi, including nematophagous strains tailored to attack parasitic nematodes. Within microbial categories, bacterial species are deployed for their rapid colonization and metabolite excretion, while fungal biocontrol agents form specialized structures to parasitize nematode eggs and juveniles.

Application methods influence distribution and efficacy. Foliar sprays allow systemic uptake of metabolites in certain formulations, but soil treatments and fumigation remain integral for targeting soil-dwelling stages. Seed treatment delivers protective layers around emerging roots, while fumigation and liquid injections facilitate deep soil coverage in high-value cropping zones. Choice of delivery method is guided by nematode pressure, crop sensitivity and compliance with environmental regulations.

Crop type segmentation further refines product selection. In field crops such as cereals, grains, oilseeds and pulses, broad-spectrum soil treatments are common, whereas in fruits, vegetables, turf and ornamentals, specialized formulations and application timings are adapted to crop phenology and market requirements. Within fruits and vegetables, categories such as berries, cucurbits and tree nuts each present distinct nematode management challenges, driving tailored research and development efforts.

Distribution channels span offline networks, including ag retail cooperatives and dedicated distributors, and online platforms that facilitate direct access and digital agronomic support. While offline channels remain dominant for volume sales and technical service in large-scale operations, online portals are gaining traction for specialty crops and rapid reorder cycles, particularly in regions with well-established e-commerce infrastructure.

This comprehensive research report categorizes the Bionematicides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Source

- Application Method

- Crop Type

- Distribution Channel

Regional Dynamics and Growth Drivers Highlighting the Americas, EMEA and Asia-Pacific Markets Within the Bionematicides Industry

In the Americas, streamlined EPA registration review processes for low-risk biopesticides have accelerated market access, reducing lead times for new bionematicide products and encouraging investment in advanced formulations. Producers in the United States benefit from clear guidance under FIFRA and FQPA, while Canada and Brazil pursue parallel regulatory enhancements. Brazil’s Agrocete launch of a bionematicide, backed by a R$12 million investment and field trials demonstrating up to 96% reduction in root infestation, exemplifies the region’s shift toward scalable biological solutions.

Within Europe, Middle East and Africa, regulatory harmonization challenges persist amid divergent national standards. The European Union’s updated pesticide regulation and the withdrawal of certain chemical nematicides have opened space for biological alternatives, yet varied approval timelines and compliance requirements create complexity. Partnerships such as Bayer’s exclusive distribution of Ecospray’s garlic-derived Velsinum™ across EMEA illustrate the strategic alliances needed to navigate fragmented markets and ensure consistent product availability.

Asia-Pacific markets display heterogeneous adoption patterns driven by regulatory reforms and agricultural scale. China and India continue to phase out highly hazardous pesticides, prompting growers to adopt biological inputs. India’s proposed bans on several organophosphates have catalyzed interest in microbial and biochemical nematicides, while Southeast Asian countries are investing in local biocontrol manufacturing to reduce import dependence. These dynamics underscore the region’s role as both a producer and consumer of bionematicide technologies.

This comprehensive research report examines key regions that drive the evolution of the Bionematicides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Spotlighting Leading Innovations, Strategic Partnerships and Emerging Players Driving the Bionematicides Market Forward

Bayer has established a leading position through targeted acquisitions and collaborations, notably the integration of Prophyta’s fungal-based fermentation capabilities in 2024. This move expanded Bayer’s supply capacity for living spores and supported the commercial launch of brands such as BioAct for nematode suppression. Concurrently, Bayer’s licensing of Ecospray’s garlic-derived nematicide under the Velsinum™ trademark highlights a dual strategy of internal R&D and external partnerships.

Corteva Agriscience leverages its broad crop protection portfolio and global distribution network to introduce biological nematicides alongside established chemical solutions. While Corteva’s Enlist herbicide trait system remains a flagship product, the company is expanding its biological pipeline through collaborations with emerging biocontrol innovators, driving integration of microbial agents into integrated pest management frameworks.

MustGrow Biologics demonstrates the entrepreneurial edge in mustard-based biocontrol technologies, securing a commercial license agreement with Bayer for soil applications in EMEA. This partnership underscores the shift toward diversified actives and highlights the potential value of plant-derived compounds in nematode management, particularly in high-value vegetable and tuber crops.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bionematicides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Agricultural Solutions Ltd

- Andermatt Biocontrol AG

- BASF SE

- Bayer CropScience AG

- Bioceres Crop Solutions Corp

- Biotech International Limited

- BioWorks Inc

- Certis USA LLC

- Coromandel International Limited

- Corteva Agriscience

- Dhanuka Agritech Limited

- FMC Corporation

- Gowan Company

- Koppert

- Lallemand Inc

- Marrone Bio Innovations Inc

- Novozymes AG

- PI Industries Limited

- Sumitomo Chemical Co Ltd

- Syngenta Crop Protection AG

- T Stanes & Company Limited

- UPL Limited

- Valent BioSciences Corporation

- W Neudorff GmbH KG

Actionable and Forward-Looking Recommendations for Industry Leaders to Navigate Risks, Leverage Opportunities and Drive Bionematicides Growth Strategically

Industry leaders should prioritize alignment with integrated pest management programs by investing in combined efficacy trials that assess bionematicide performance alongside cultural and chemical controls. Demonstrating product efficacy within IPM frameworks will support regulatory approvals and drive grower confidence, as FAO-backed Farmer Field Schools have shown the effectiveness of holistic pest management training in reducing reliance on chemical inputs and sustaining crop yields.

Companies must also engage proactively with regulatory agencies to streamline data submission and risk assessments. Leveraging EPA’s biopesticide registration guidance and pre-submission meetings can accelerate time-to-market, reduce uncertainty, and optimize resource allocation. Collaborative pre-submission discussions facilitate clarity on data requirements, enabling a more efficient pathway to registration under FIFRA and analogous frameworks globally.

To mitigate supply chain risks and tariff volatility, organizations should diversify sourcing strategies by coupling local production with strategic import agreements. Investing in regional manufacturing hubs and forging partnerships with contract fermentation and formulation facilities will enhance resilience against evolving trade policies and reduce lead times for critical biological inputs. Finally, digital platforms can amplify technical support, enable real-time monitoring of nematode pressure, and foster data-driven product recommendations for end users, enhancing customer engagement and adoption rates.

Comprehensive Multi-Stage Research Methodology Detailing Data Sources, Verification Processes and Analytical Frameworks Underpinning the Bionematicides Study

This study employed a multi-stage research methodology combining primary and secondary data to ensure comprehensive coverage of the bionematicides landscape. Secondary research sources included regulatory databases from the U.S. EPA, FAO technical reports, peer-reviewed articles in Frontiers in Plant Science and PubMed journals, and regional industry news outlets. Publicly available patent filings, Federal Register notices, and company press releases were analyzed to track product pipelines and strategic partnerships.

Primary research comprised expert interviews with agronomists, regulatory specialists, and R&D leaders to validate market drivers, adoption patterns, and technological barriers. Quantitative data on regulatory timelines and product registrations were triangulated with qualitative insights on field performance and grower feedback. Data synthesis was guided by an analytical framework assessing regulatory, technological, commercial, and competitive dimensions, ensuring robust insights and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bionematicides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bionematicides Market, by Formulation

- Bionematicides Market, by Source

- Bionematicides Market, by Application Method

- Bionematicides Market, by Crop Type

- Bionematicides Market, by Distribution Channel

- Bionematicides Market, by Region

- Bionematicides Market, by Group

- Bionematicides Market, by Country

- United States Bionematicides Market

- China Bionematicides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives Synthesizing Key Findings, Strategic Implications and Long-Term Outlook for the Bionematicides Sector

This executive summary has synthesized critical insights into how bionematicides are redefining nematode management through converging regulatory, technological, and commercial trends. As traditional chemical options face heightened scrutiny and withdrawal, biological alternatives have demonstrated the capacity to deliver targeted efficacy, environmental safety, and compatibility with integrated pest management systems.

Regional market dynamics reflect differentiated regulatory and adoption landscapes, from streamlined reviews in the Americas to regulatory harmonization challenges in EMEA and evolving demand in Asia-Pacific. Leading agribusinesses have responded with strategic acquisitions, partnerships, and licensing agreements, while emerging innovators continue to expand the scope of microbial and botanical actives.

To capitalize on these opportunities, industry stakeholders must foster regulatory collaboration, invest in robust efficacy validation, diversify supply chains, and leverage digital engagement tools. By integrating these approaches, organizations can navigate trade and tariff complexities and position themselves for sustainable growth in the expanding bionematicides sector.

Take Action Today Connect Directly with Ketan Rohom to Access Definitive Bionematicides Market Intelligence and Purchase Your Customized Report

For decision-makers seeking to deepen their understanding of the bionematicides sector and secure a competitive advantage in sustainable crop protection, the comprehensive market research report offers unparalleled insights. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to gain access to the full suite of analysis, strategic recommendations, and exclusive data that will inform your product development, go-to-market strategies, and regulatory alignment. Engage directly with an expert to discuss your organization’s priorities, customize the report to your needs, and initiate the procurement process that will position you at the forefront of this dynamic industry.

- How big is the Bionematicides Market?

- What is the Bionematicides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?