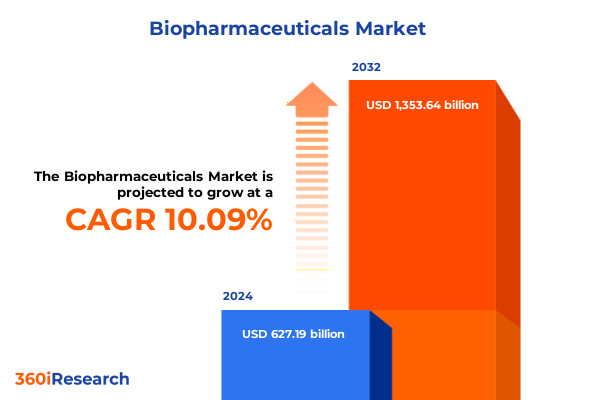

The Biopharmaceuticals Market size was estimated at USD 690.04 billion in 2025 and expected to reach USD 749.33 billion in 2026, at a CAGR of 10.10% to reach USD 1,353.64 billion by 2032.

Unveiling the Evolving Dynamics of the Biopharmaceutical Sector and Its Strategic Imperatives for Driving Sustainable Growth and Patient Outcomes

The biopharmaceutical sector has experienced unparalleled momentum over the past decade as advances in molecular biology, genetic engineering, and personalized medicine converge to redefine therapeutic possibilities. Fueled by a robust pipeline of biologics, cell and gene therapies, and mRNA-based platforms, organizations worldwide are charting a trajectory toward more targeted, efficacious, and safe interventions. In this context, the complex interplay between research breakthroughs and evolving regulatory frameworks demands strategic clarity from stakeholders aiming to balance innovation with compliance and cost efficiency.

As clinical development costs escalate and time-to-market pressures intensify, decision-makers must navigate an environment shaped by stringent safety requirements, increasing public scrutiny, and growing demand for real-world evidence. In parallel, accelerated approval pathways and adaptive licensing models are opening new avenues for market entry, yet they introduce layers of complexity in pharmacovigilance and post-market surveillance. This underscores the necessity for robust risk-management frameworks that align with both global regulatory expectations and shifting payer models.

Moreover, patient-centricity continues to emerge as a pivotal force shaping product design and commercialization strategies. Real-time patient data capture, digital therapeutics integration, and decentralized trial methodologies are becoming essential components of a comprehensive value proposition. As a result, organizations are reorienting investments toward data-driven insights and collaborative ecosystems that bridge the gap between laboratory discoveries and meaningful clinical impact.

In light of these dynamics, this executive summary provides a structured analysis of transformative shifts, tariff impacts, segmentation insights, regional nuances, competitive landscapes, and actionable recommendations tailored for leaders seeking to harness the full potential of the biopharmaceutical revolution.

Key Technological and Regulatory Inflection Points Redefining the Biopharmaceutical Value Chain and Unlocking Novel Therapeutic Possibilities

The rapid convergence of cutting-edge technologies and regulatory innovations is reshaping the biopharmaceutical landscape in profound ways. Breakthroughs in gene editing and gene therapy have unlocked possibilities for curative treatments in previously intractable indications. Concurrently, mRNA and nucleic acid-based modalities have demonstrated remarkable adaptability, as evidenced by their pivotal role in pandemic response efforts. These technological inflection points are catalyzing novel approaches to drug discovery, where artificial intelligence and machine learning are streamlining target identification, lead optimization, and predictive safety assessments.

Equally transformative is the shift toward integrated data ecosystems that enable seamless collaboration across the research continuum. Real-world evidence, powered by electronic health records and wearable technologies, is informing adaptive trial designs and accelerating regulatory decision-making. In parallel, regulatory bodies are pioneering flexible frameworks such as conditional approvals and rolling reviews, encouraging early engagement between sponsors and authorities. This regulatory evolution fosters a more iterative dialogue that balances expedited access with rigorous oversight.

Financial models are concurrently adapting to support these innovations. Outcome-based contracting and value-sharing agreements are emerging as viable mechanisms to align stakeholder incentives and manage lifecycle investments. Moreover, the decentralization of clinical trials through telemedicine, at-home sample collection, and virtual monitoring is expanding patient access and diversity, while reducing overhead costs and operational complexity.

Taken together, these inflection points underscore a paradigm shift from incremental improvements to disruptive innovation. As a result, organizations must cultivate agile capabilities, strategic partnerships, and robust data governance to capitalize on emerging opportunities and maintain competitive advantage in an increasingly dynamic marketplace.

Assessing the Full-Spectrum Consequences of Newly Instituted U.S. Tariffs on Biopharmaceutical Supply Chains and Competitive Dynamics in 2025

The introduction of new U.S. tariffs on key pharmaceutical raw materials and finished products in 2025 has precipitated a cascade of operational and strategic adjustments across biopharmaceutical supply chains. By imposing additional duties on active pharmaceutical ingredients and bioprocessing equipment imports, these measures have elevated input costs and compressed margin structures for manufacturers reliant on global sourcing. Consequently, many organizations are reevaluating their procurement strategies and exploring nearshoring or reshoring initiatives to mitigate tariff exposure and enhance supply chain resilience.

Indeed, the cumulative impact extends beyond cost inflation. With increased inbound duties, contract development and manufacturing organizations face pressure to renegotiate service agreements and absorb or pass through additional expenses. This dynamic has also prompted a reassessment of supplier diversification, with stakeholders seeking partnerships in tariff-exempt or preferential trade zones. Simultaneously, logistics networks are adapting to new customs procedures and documentation requirements, leading to extended lead times and inventory management challenges.

Moreover, the ripple effects of tariff-induced cost escalation are influencing pricing negotiations with payers and health systems. As reimbursement entities grapple with budget constraints, there is heightened scrutiny on drug unit costs and total cost of care. Payers are thus intensifying emphasis on pharmacoeconomic evidence and outcome-based agreements to ensure sustainable access. In response, manufacturers are augmenting value demonstration strategies and deepening engagement with formulary committees to preserve market access.

Looking forward, these tariff-driven dynamics underscore the necessity for strategic agility and holistic risk management. Organizations that proactively realign supply networks, optimize end-to-end operations, and reinforce value propositions will be best positioned to navigate the evolving U.S. trade and regulatory environment.

Revealing Segmentation Layers That Drive Market Divergence Across Therapies Technology Platforms Sales Channels Products and Administration Routes

A nuanced understanding of market segmentation reveals how distinct dimensions shape competitive dynamics and investment priorities across the biopharmaceutical ecosystem. In the realm of therapeutic domains, oncology continues to command significant attention, driven by innovations in immuno-oncology and targeted hematological therapies, while autoimmune indications such as inflammatory bowel disease and rheumatoid arthritis benefit from next-generation biologics and small molecule modulators. Major cardiovascular subsegments like heart failure and hypercholesterolemia are witnessing a resurgence of interest as novel monoclonal antibodies and peptide conjugates challenge traditional small molecule treatments. At the same time, the infectious disease landscape is being redefined by advances in antiviral agents and novel vaccine platforms that address emerging pathogens.

On the technological front, cell culture processes-particularly mammalian systems-remain the backbone of complex biologic manufacturing, but they are increasingly augmented by microbial expression systems for cost-effective biosimilar production. Gene therapy vectors, both viral and nonviral, are transitioning from experimental stages to commercial reality, owing to improved safety profiles and scalable manufacturing techniques. Hybridoma technologies and recombinant DNA methods continue to underpin antibody development, yet they are increasingly integrated with high-throughput screening platforms and computational modeling to accelerate lead optimization.

Distributional segmentation underscores the importance of omnichannel approaches, combining direct-to-patient models with hospital and retail pharmacy networks to enhance access and adherence. The growing penetration of online pharmacies complements traditional channels, facilitating home delivery and remote dispensing. Product categorizations, spanning biosimilars and generics, reflect varied regulatory pathways and competitive intensity, while routes of administration-from subcutaneous injectables to inhalation therapies-dictate formulation strategies and patient convenience considerations.

Through this lens of layered segmentation, stakeholders can pinpoint high-growth niches and tailor resource allocation for maximum strategic impact.

This comprehensive research report categorizes the Biopharmaceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Area

- Technology

- Product Type

- Route Of Administration

- Distribution Channel

Illuminating Regional Biopharmaceutical Market Variations and Strategic Imperatives Spanning the Americas Europe Middle East Africa and Asia Pacific Territories

Across the Americas, Europe, the Middle East, Africa, and Asia-Pacific, regional market dynamics exert a profound influence on biopharmaceutical innovation, investment, and access strategies. In North America, robust R&D infrastructure, coupled with favorable intellectual property protections and advanced clinical research networks, sustains leadership in biologics development and commercialization. At the same time, Latin American markets are experiencing gradual expansion, as local manufacturing capacities and regulatory harmonization efforts mature, creating opportunities for technology transfer and collaborative ventures.

In Europe, the Middle East, and Africa region, regulatory convergence driven by agencies such as the European Medicines Agency fosters streamlined approvals across multiple jurisdictions. Europe’s emphasis on health technology assessments and evidence-based pricing models shapes commercialization strategies and drives differentiated market approaches. In parallel, emerging economies in the Middle East and North Africa are investing in biotechnology hubs and incentives to attract foreign direct investment, while sub-Saharan Africa remains focused on addressing infectious diseases through public-private partnerships and local vaccine production initiatives.

The Asia-Pacific region exhibits a dichotomy between mature and developing markets. Japan and Australia maintain sophisticated regulatory frameworks and strong biosimilar adoption, while China and India are rapidly scaling local biomanufacturing capabilities with government support for innovation and export growth. Southeast Asian nations are enhancing pharmacovigilance and quality control standards, which is catalyzing influx of global players and licensing agreements. Across all these territories, evolving payer dynamics and pricing reforms are compelling manufacturers to adopt flexible access models and regional partnership strategies.

Collectively, these regional nuances highlight the imperative for tailored market entry, regulatory engagement, and supply chain configurations that align with localized stakeholder expectations and policy environments.

This comprehensive research report examines key regions that drive the evolution of the Biopharmaceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators and Their Strategic Positioning Driving Competitive Edge and Collaboration in a Rapidly Evolving Market

Leading players in the biopharmaceutical sector are continually refining their strategic positioning to capitalize on emerging scientific innovations and address evolving unmet needs. Global incumbents leverage expansive portfolios encompassing monoclonal antibodies, cell therapies, and small molecule drugs to maintain market leadership. Among these, organizations with vertically integrated manufacturing networks are optimizing cost structures and accelerating time-to-market, while those focusing on strategic alliances and licensing agreements are enhancing pipeline diversity without disproportionate capital investments.

Simultaneously, specialist firms and biotech startups are disrupting traditional models through focused expertise in niche modalities such as gene editing, CAR-T therapies, and RNA interference. By fostering deep collaborations with academic institutions and contract manufacturing partners, these entities are scaling breakthrough therapies from proof-of-concept to commercialization. As a result, larger organizations are pursuing targeted acquisitions and equity investments to secure access to novel platforms and proprietary technologies.

Moreover, a growing number of companies are embracing digital transformation initiatives to modernize R&D functions and drive operational excellence. Investments in artificial intelligence for predictive analytics, cloud-based data sharing for cross-functional teams, and automated bioprocessing solutions are creating competitive differentiation. Leadership also entails proactive engagement with regulatory bodies to shape policy frameworks and expedite clinical development pathways.

Finally, sustainability has emerged as a critical dimension of corporate strategy. Environmental, social, and governance commitments are influencing site selection, supply chain practices, and patient support programs, thereby enhancing brand reputation and long-term value creation. Together, these strategic orientations underscore a multifaceted competitive landscape where agility, innovation, and collaborative ecosystems are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopharmaceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Biogen Inc.

- Bristol‑Myers Squibb Company

- CSL Limited

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Gilead Sciences Inc.

- GlaxoSmithKline plc

- Intas Pharmaceuticals Ltd.

- Johnson & Johnson

- Kyowa Kirin Co. Ltd.

- Merck & Co. Inc.

- Novartis International AG

- Novo Nordisk A/S

- Pfizer Inc.

- Roche Holding AG

- Sanofi S.A.

Actionable Strategic Prescriptions for Industry Leaders to Navigate Disruptive Biopharmaceutical Trends and Capitalize on Emergent Opportunities

For industry leaders seeking to thrive in the rapidly evolving biopharmaceutical domain, adopting a forward-looking mindset and agile operational models is essential. First, investing in integrated data platforms that unify preclinical, clinical, and real-world information will enable more accurate decision-making and predictive modeling, thereby reducing development timelines and optimizing resource allocation. Moreover, forging strategic partnerships with academic institutions, technology providers, and contract research organizations can accelerate access to specialized capabilities and foster co-innovation.

Concurrent diversification of supply chain networks should be prioritized to mitigate geopolitical risks and tariff impacts. Nearshoring key manufacturing steps and qualifying alternative suppliers in low-tariff jurisdictions will enhance continuity and cost efficiency. In addition, organizations must proactively engage with regulatory authorities to navigate evolving frameworks, advocate for clear guidance on emerging modalities, and secure accelerated pathways for high-value therapies.

Furthermore, embedding patient-centric approaches across the product lifecycle will strengthen stakeholder relationships and differentiate value propositions. Leveraging digital health tools for remote monitoring, decentralized trials, and adherence support can elevate patient engagement and generate robust real-world evidence. Coupled with outcome-based contracting negotiations, these measures will align stakeholder incentives and reinforce the economic rationale for innovative therapies.

Finally, senior executives should champion sustainability and diversity initiatives as integral components of corporate strategy. By setting measurable environmental targets, promoting equitable clinical trial representation, and investing in community partnerships, organizations will build resilient reputations and unlock new avenues for growth in an increasingly socially conscious market.

Detailing Rigorous Methodological Framework Employed to Ensure Data Integrity Analytical Rigor and Unbiased Insights in Biopharma Market Research

The insights presented in this report are grounded in a comprehensive methodological framework designed to ensure data integrity, analytical rigor, and unbiased perspectives. Primary research was conducted through structured interviews and consultations with senior executives, scientific experts, policy makers, and thought leaders across the biopharmaceutical value chain. These interactions provided qualitative depth on emerging trends, regulatory developments, and strategic priorities shaping the industry.

Secondary research involved exhaustive review of corporate filings, patent databases, regulatory agency publications, clinical trial registries, and peer-reviewed literature. This enabled triangulation of quantitative and qualitative findings, ensuring robust validation of market dynamics and strategic imperatives. Data on therapeutic pipelines, technology adoption, and distribution channel evolution was collected from proprietary and publicly available sources, then cross-referenced to identify convergence points and potential divergences.

Analytical processes incorporated scenario planning, comparative benchmarking, and risk assessment models to evaluate the impact of variables such as tariff changes, technological breakthroughs, and policy shifts. Emphasis was placed on transparency of assumptions and methodological consistency across segments and regions. Quality assurance protocols included peer review by independent industry analysts and iterative refinement of insights based on stakeholder feedback.

Through this rigorous approach, the report delivers actionable, evidence-based guidance that equips decision-makers with a clear understanding of current challenges and future opportunities within the biopharmaceutical ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopharmaceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopharmaceuticals Market, by Therapeutic Area

- Biopharmaceuticals Market, by Technology

- Biopharmaceuticals Market, by Product Type

- Biopharmaceuticals Market, by Route Of Administration

- Biopharmaceuticals Market, by Distribution Channel

- Biopharmaceuticals Market, by Region

- Biopharmaceuticals Market, by Group

- Biopharmaceuticals Market, by Country

- United States Biopharmaceuticals Market

- China Biopharmaceuticals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives to Chart the Future Trajectory of the Biopharmaceutical Industry Amidst Ongoing Innovation and Policy Shifts

The analyses detailed throughout this executive summary underscore the transformative forces reshaping the biopharmaceutical sector and the strategic imperatives they generate. From technological breakthroughs in gene therapy and data-driven drug discovery to the material effects of newly implemented tariffs on supply chain economics, the industry is navigating a confluence of innovation, regulation, and global trade dynamics. This multifaceted environment demands that organizations cultivate adaptability, forge collaborative ecosystems, and maintain a relentless focus on patient outcomes.

Strategic segmentation insights have highlighted the diverse drivers at play across therapeutic areas, technology platforms, distribution channels, product typologies, and administration routes, illustrating the necessity for tailored approaches to market engagement. Regional nuances further emphasize that success depends on localized regulatory acumen, flexible access models, and culturally attuned commercialization strategies. Moreover, an analysis of competitive positioning reveals that both established multinationals and nimble specialty firms must harness digital transformation and sustainability commitments to create lasting differentiation.

Ultimately, ongoing success in the biopharmaceutical industry will be defined by the capacity to align scientific innovation with operational excellence and stakeholder value creation. By integrating the recommendations and insights herein into strategic planning, organizations can chart a resilient path forward, anticipate disruptive inflection points, and deliver therapies that meaningfully improve patient lives across the globe.

Engage with Ketan Rohom Today to Unlock Comprehensive Biopharmaceutical Market Insights and Propel Strategic Decision Making with a Customized In-Depth Report

The comprehensive market insights and strategic analysis presented in this report offer invaluable guidance for senior executives and functional leaders. To explore detailed findings, customized data sets, and tailored strategic recommendations, engage with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise will ensure that your organization receives a bespoke presentation of the research, aligning insights with your strategic objectives.

Connect with Ketan today to secure access to the full report and equip your leadership with the critical knowledge needed to drive competitive advantage and patient-centric innovation within the biopharmaceutical landscape.

To initiate this engagement, request a sample executive summary excerpt or schedule a consultation with Ketan to align the report’s findings with your enterprise objectives. Early engagement ensures priority access to complementary briefings and post-purchase advisory support

- How big is the Biopharmaceuticals Market?

- What is the Biopharmaceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?