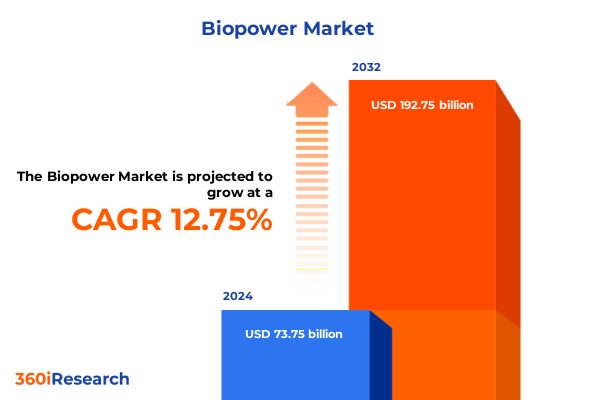

The Biopower Market size was estimated at USD 83.00 billion in 2025 and expected to reach USD 93.42 billion in 2026, at a CAGR of 12.78% to reach USD 192.75 billion by 2032.

Unveiling the Potential of Biopower to Drive Sustainable Energy Transitions and Foster Environmental Resilience Across Global Markets

The growing imperative for sustainable energy solutions has elevated biopower to a critical position within global decarbonization agendas. As societies confront the dual challenges of climate change and energy security, converting organic and waste-based resources into reliable power and heat has emerged as both an environmental and economic priority. Stakeholders ranging from technology developers to regulatory bodies are increasingly recognizing biopower’s capacity to deliver base-load generation while simultaneously addressing waste management and greenhouse gas reduction goals.

Biopower’s versatility spans a spectrum of conversion pathways, each offering unique advantages depending on feedstock availability and end user requirements. From advanced thermal processes to combined heat and power configurations, the sector is undergoing rapid evolution through innovation in efficiency, feedstock pre‐treatment, and carbon capture integration. This introduction sets the stage for an in-depth exploration of how technological breakthroughs, policy initiatives, and market forces are collectively shaping a more resilient and sustainable energy ecosystem.

Examining the Rapid Technological and Policy-Driven Transformations That Are Reshaping the Biopower Landscape Toward Greater Efficiency and Decarbonization

The biopower landscape is experiencing a wave of transformative change driven by breakthroughs in conversion technologies and the emergence of supportive policy frameworks. Innovations in gasification and pyrolysis are advancing reactor designs that operate at higher temperatures and pressures, unlocking new pathways to synthetic fuels and hydrogen co‐production. Meanwhile, advancements in anaerobic digestion are enabling more efficient methane capture from agricultural and municipal waste, effectively closing carbon loops and enhancing overall system performance.

Policy dynamics are also redefining the sector. Jurisdictions worldwide are introducing incentives such as renewable portfolio mandates, carbon credits, and tax structures that favor bio‐based power generation. These measures are accelerating the retirement of fossil‐based plants and facilitating the integration of distributed biopower assets into existing grids. At the same time, technology‐neutral procurement models are leveling the playing field, allowing emerging biopower solutions to compete alongside wind and solar in capacity auctions and long‐term offtake contracts.

Concurrently, digitalization is streamlining operational workflows within biopower facilities. The deployment of advanced monitoring systems and predictive analytics is reducing unplanned downtime, optimizing maintenance schedules, and enhancing resource utilization. As these technological and policy shifts converge, biopower is transitioning from a niche renewable option toward a mainstream energy resource capable of supporting complex grid requirements and sustainability objectives.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Biopower Supply Chains Investment and Market Dynamics

In 2025, the United States implemented a series of tariff measures aimed at safeguarding domestic industries and encouraging local manufacturing of biopower equipment. These tariffs span components such as gasifiers, turbines, and preconditioning systems, as well as certain feedstock handling equipment. The immediate effect has been an uptick in procurement costs for project developers that rely on specialized imports, prompting many to reassess supply chain strategies and long‐term procurement agreements.

The cumulative impact is multifaceted. On one hand, domestic suppliers are experiencing a surge in demand, driving investments into scaling production capacities and workforce development. On the other hand, developers confronted with higher capital expenditures are exploring alternative procurement approaches, including regional partnerships and in‐country fabrication of modular systems. This shift is also encouraging equipment manufacturers to accelerate localization of their production lines, reducing exposure to cross‐border tariff volatility.

Moreover, tariff-induced cost increases are influencing project finance structures. Lenders and investors are demanding more rigorous risk assessments and contingency planning around supply chain disruptions. As a result, strategic alliances and joint ventures have become more prevalent, fostering technology transfer and co‐investment models that mitigate tariff exposure while promoting domestic capacity building.

Unlocking Deep-Dive Perspectives Through Technology, Feedstock, End User, and Application Segmentation to Illuminate Biopower Market Nuances and Opportunities

A nuanced understanding of biopower market segmentation reveals critical insights into where growth and innovation intersect. When assessing technology pathways, anaerobic digestion stands out for its ability to convert wet organic matter into biomethane and digestate, offering dual benefits of energy generation and soil amendment production. Co‐firing strategies in existing coal plants provide an immediate opportunity to reduce carbon intensity without extensive infrastructure overhaul, while combustion, gasification, and pyrolysis each deliver distinct trade‐offs in feedstock versatility, energy yield, and emission profiles.

Examining feedstock classifications uncovers additional layers of strategic opportunity. Agricultural waste, including crop residues, presents a low‐cost, widely available resource stream that can be integrated into rural energy programs, whereas animal manure requires specialized handling but offers high methane potential in anaerobic digesters. Dedicated energy crops provide predictable yields but compete with land use priorities, while forestry residues demand robust collection logistics. Industrial byproducts and organic municipal solid waste round out a portfolio that supports circular economy objectives and waste diversion targets.

Delineating end user categories further sharpens market focus. Combined heat and power configurations deliver high overall efficiency for industrial sites and district energy systems, leveraging heat demand to maximize fuel utilization. Heat generation applications serve sectoral needs such as food processing and greenhouse operations, where thermal energy is paramount. Pure power generation facilities, meanwhile, can be designed for grid‐scale dispatchability, offering ancillary services and firm capacity in renewable energy portfolios.

Finally, parsing biopower by application context highlights variance in adoption drivers. Commercial installations often emphasize sustainability reporting and corporate carbon reduction goals. Industrial deployments prioritize energy security and cost stability, while residential systems focus on decentralized energy resilience. Each application set demands tailored technology stacks, financing mechanisms, and regulatory engagement strategies to unlock full value potential.

This comprehensive research report categorizes the Biopower market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Feedstock Type

- End User

- Application

Comparative Regional Dynamics Highlighting Distinct Drivers, Challenges, and Strategic Pathways Across the Americas, EMEA, and Asia-Pacific Biopower Ecosystems

Regional analysis underscores the Americas as a dynamic environment where policy incentives, resource diversity, and mature energy infrastructure converge to support biopower deployment. In North America, generous tax credits and state‐level renewable standards are catalyzing investments in advanced anaerobic digestion and co‐firing projects. Latin America’s abundant agricultural residues and nascent bioenergy policies position it as a growth frontier for both small‐scale digesters and large combustion plants.

Across Europe, the Middle East, and Africa, stakeholder priorities vary widely. The European Union’s focus on circular economy principles and stringent emissions targets has fostered an ecosystem of public‐private partnerships that accelerate technology adoption. In the Middle East, water scarcity and waste management challenges are steering interest toward pyrolysis and gasification solutions capable of treating municipal solids. Sub‐Saharan Africa’s energy access imperative, by contrast, is driving microgrid‐integrated biopower systems that leverage forestry residues and agricultural byproducts to electrify rural communities.

The Asia-Pacific region presents a juxtaposition of established markets and high‐growth economies. Japan and South Korea are investing in fuel‐flexible gasifiers and waste‐to‐energy facilities to meet stringent grid reliability and circularity mandates. Meanwhile, Southeast Asian nations with robust agricultural sectors are exploring large‐scale anaerobic digestion, pairing it with methane capture incentives to reduce greenhouse gas emissions. Australia’s focus on forestry waste and biomass co‐firing in coal plants highlights the region’s adaptability in integrating biopower with existing energy frameworks.

This comprehensive research report examines key regions that drive the evolution of the Biopower market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape and Technological Advancement Within the Global Biopower Sector

Leading organizations are distinguishing themselves through the development of next‐generation reactor designs, digital integration, and strategic partnerships. One prominent technology provider has introduced modular anaerobic digestion units that can be rapidly deployed in remote locations, reducing installation timelines and upfront capital burdens. Another specialist has achieved a milestone by combining gasification with carbon capture modules, enabling near‐zero emission footprints and opening pathways to synthetic fuel production.

Collaborations between equipment manufacturers and utilities are also redefining the competitive environment. A consortium of engineering firms and power producers has unveiled a co‐firing pilot program that integrates biomass co‐pelletization techniques, enhancing combustion stability and reducing emissions in existing thermal plants. At the same time, project developers are partnering with digital analytics firms to embed AI‐driven performance optimization tools into plant control systems, boosting uptime and operational margins.

The emergence of vertically integrated players is accelerating value chain consolidation. Firms that span feedstock procurement, system engineering, and off‐taker agreements can better absorb tariff shocks and streamline project financing. By leveraging integrated business models, these organizations are capturing end‐to‐end insights, cultivating long‐term supply contracts, and demonstrating robust project delivery capabilities that set new benchmarks for the global sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopower market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abengoa

- Air Liquide

- Alto Ingredients Inc.

- Archer Daniels Midland Company

- Bharat Heavy Electricals Limited (BHEL)

- Bunge North America, Inc.

- CropEnergies AG

- EnviTec Biogas AG

- Enviva

- Gevo Butamax Advanced Biofuels LLC

- Green Plains Inc.

- Moser Baer Clean Energy Limited

- Petrobras

- Praj Industries Limited

- Renewable Energy Group, Inc.

- Royal Dutch Shell Plc

- Scandinavian Biogas Fuels International AB

- Valero Energy Corporation

- VERBIO Vereinigte BioEnergie AG

- Wilmar International Limited

Translating Critical Insights Into Strategic Actions That Drive Operational Excellence, Capital Allocation, and Sustainable Growth in Biopower

To capitalize on the transformative momentum within biopower, industry leaders should first diversify feedstock portfolios by forging partnerships with agricultural cooperatives, waste management firms, and forestry operators. This approach not only stabilizes supply streams but also unlocks circularity benefits through co‐product valorization. Furthermore, directing research and development efforts toward hybrid conversion pathways-such as integrating anaerobic digestion with thermal gasification-can yield optimized energy outputs and novel revenue streams like bio‐derived chemicals.

Engaging proactively with regulatory bodies to advocate for technology‐neutral incentives and streamlined permitting processes is equally critical. By presenting empirical case studies that demonstrate environmental and economic benefits, stakeholders can shape policies that support biopower’s scalability. Simultaneously, adopting digital twins and advanced analytics will enhance project risk management. These tools enable scenario modeling for feedstock variability, tariff fluctuations, and maintenance cycles, ensuring more resilient project pipelines.

Finally, forging cross‐industry alliances can accelerate market adoption. Joint ventures between finance institutions, equipment manufacturers, and utility partners facilitate shared risk models and co‐investment structures. Such collaborations enable co‐development of financing solutions and performance‐based contracts, lowering barriers to entry for distributed energy projects. Through these combined strategic actions, organizations can secure competitive advantage, drive sustainable growth, and contribute meaningfully to global decarbonization objectives.

Detailing Rigorous and Transparent Research Methodologies That Ensure Robust Data Collection, Analytical Integrity, and Quality Assurance in Biopower Studies

This analysis is founded on a rigorous methodology combining both secondary and primary research techniques. The secondary phase encompassed the systematic review of industry publications, government policy documents, and peer‐reviewed journals, ensuring that all regulatory, technological, and market developments were captured with precision. Key sources included journal articles on conversion efficiencies, white papers on feedstock logistics, and regulatory dossiers on tariff implementations.

Primary insights were obtained through structured interviews with a diverse cross‐section of stakeholders, including technology manufacturers, project developers, feedstock suppliers, and policy experts. These interviews were conducted via virtual workshops and one‐on‐one consultations, yielding qualitative data on operational challenges, investment decision criteria, and future technology road maps. Quantitative validation was achieved through proprietary surveys targeting project finance institutions and utility procurement teams, providing empirical context for cost structures and risk mitigation practices.

To uphold analytical integrity, data triangulation techniques were employed throughout the research process. This entailed cross‐verifying interview findings against published case studies and corroborating survey responses with market transaction records. Quality assurance protocols included peer reviews by subject‐matter experts, consistency checks across data sets, and iterative revisions to ensure clarity and accuracy. The result is a comprehensive, transparent study that stakeholders can rely on for strategic decision support.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopower market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopower Market, by Technology

- Biopower Market, by Feedstock Type

- Biopower Market, by End User

- Biopower Market, by Application

- Biopower Market, by Region

- Biopower Market, by Group

- Biopower Market, by Country

- United States Biopower Market

- China Biopower Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders Committed to Advancing Biopower Adoption and Innovation

This executive summary has illuminated the critical factors shaping the future of biopower, from the emergence of advanced conversion pathways to the nuanced effects of tariff policies and regional dynamics. The integration of segmentation insights highlights opportunities to tailor technology deployments according to feedstock characteristics, end user demands, and application contexts. By synthesizing these findings, it becomes evident that strategic alignment across policy, technology, and finance will determine the pace and scale of biopower adoption.

Key imperatives include the need for flexible supply chains that can absorb policy shifts, investment in hybrid technology solutions that bridge conversion pathways, and proactive engagement with regulatory authorities to secure supportive frameworks. Regional analyses reveal distinct market entry strategies, whether leveraging tax incentives in North America, circular economy platforms in Europe, or waste‐to‐energy partnerships in Asia‐Pacific economies. Ultimately, the transformative potential of biopower rests on the sector’s ability to deliver reliable, low‐carbon energy while creating value from waste streams.

Stakeholders equipped with the insights provided in this report are positioned to navigate emerging challenges and seize strategic opportunities. The path forward demands collaborative innovation, robust risk management, and data‐driven decision making. By embracing these principles, organizations can solidify their leadership in the global transition toward cleaner, more resilient energy systems.

Connect Directly With Ketan Rohom to Secure Comprehensive Biopower Market Intelligence That Drives Strategic Decisions and Accelerates Organizational Growth

Elevate your strategic decision making by connecting with Ketan Rohom, whose sales and marketing leadership offers unparalleled guidance on leveraging biopower insights to drive your organization’s growth. By engaging directly with Ketan, you gain access to a tailored consultation that aligns the findings of this comprehensive market research with your specific operational priorities and investment objectives. This personalized dialogue will empower you to translate critical intelligence into action plans, fine-tune your project pipelines, and optimize resource allocation for maximum impact.

Partnering with Ketan allows you to streamline your path from data to deployment by drawing on expert analysis and proven methodologies designed to accelerate project timelines and minimize risk. Whether you seek to refine your technology portfolio, deepen your understanding of feedstock strategies, or navigate tariff implications, Ketan’s expertise ensures that you capitalize on emerging opportunities within the biopower sector. Schedule your consultation today to secure the strategic insights that will position your organization at the forefront of clean energy innovation.

- How big is the Biopower Market?

- What is the Biopower Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?