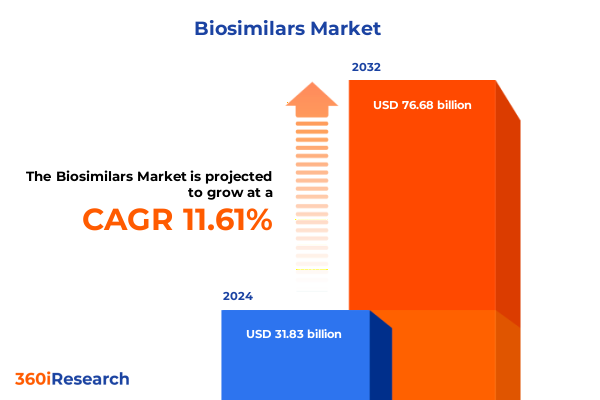

The Biosimilars Market size was estimated at USD 34.89 billion in 2025 and expected to reach USD 38.50 billion in 2026, at a CAGR of 10.73% to reach USD 71.24 billion by 2032.

Unlocking the Promise of Biosimilars Through Innovation, Affordability, and Enhanced Patient Access in Today’s Dynamic Healthcare Arena

In recent years, biosimilars have emerged as a cornerstone of efforts to enhance patient access to vital biologic therapies while containing healthcare costs. By providing highly similar alternatives to originator biologics, these products leverage rigorous regulatory frameworks to ensure safety, efficacy, and quality. The maturation of approval pathways across major markets, supported by comprehensive scientific guidelines and evolving interchangeability designations, has accelerated development timelines and fostered competitive markets. Moreover, an expanding pipeline of biosimilar candidates, driven by patent expiries of blockbuster biologics and escalating prevalence of chronic diseases such as oncology, diabetes, and autoimmune disorders, underscores the strategic importance of these therapies in modern healthcare portfolios.

Against this backdrop, today’s stakeholders-from manufacturers and payers to providers and policymakers-must navigate a rapidly transforming landscape. This report delves into transformative shifts affecting development and commercialization, evaluates the cumulative impact of recent United States tariff policies on supply chains, and delivers granular insights across product types, therapeutic indications, administration routes, and end users. By synthesizing regional dynamics and profiling leading companies, it offers actionable recommendations to strengthen market positioning and ensure sustainable growth in this evolving sector.

Navigating Transformative Shifts in Biosimilar Development, Regulation, and Commercialization to Forecast the Next Wave of Industry Evolution

The biosimilars landscape is undergoing profound transformation driven by several key forces. First, global regulatory authorities have converged toward clearer, more predictable approval pathways, harmonizing requirements for demonstrating biosimilarity, interchangeability, and extrapolation of indications. This shift not only streamlines development timelines but also encourages investment by reducing regulatory uncertainty. Concurrently, the biosimilar pipeline has surged in depth and diversity, encompassing products from monoclonal antibodies and growth hormones to next-generation insulin analogs, reflecting an industry-wide push to capitalize on upcoming patent expirations and unmet therapeutic needs.

Innovation in manufacturing and formulation is also reshaping the competitive landscape. Companies are adopting continuous bioprocessing, leveraging digital analytics, and forging strategic alliances to optimize production efficiencies and maintain stringent quality controls. At the same time, the rise of interchangeable designations in major markets is poised to boost physician confidence and facilitate substitution at the pharmacy level, planting the seeds for accelerated adoption. Adding further momentum, patient-centric innovations such as self-injectable and subcutaneous biosimilar formats are gaining traction, offering enhanced convenience, reduced healthcare burden, and expanded homecare potential.

Analyzing the Cumulative Economic and Operational Impacts of United States Tariffs on Biosimilars Supply Chains and Market Dynamics

Recent United States tariff policies have introduced new complexities into the biosimilars supply chain, with cascading effects on manufacturing costs, logistics, and market competitiveness. A key driver of cost inflation has been the imposition of 20–25% duties on active pharmaceutical ingredients sourced from China and India, coupled with 15% tariffs on medical packaging and laboratory equipment. In parallel, a sweeping 10% global tariff on nearly all healthcare imports has further elevated expenses for essential materials, from sterile vials to diagnostic reagents, challenging both branded and biosimilar developers alike.

These measures are reshaping procurement strategies, as companies must now balance the benefits of overseas sourcing against the financial penalties of tariffs. While some larger organizations can absorb initial cost hikes through inventory stockpiling or marginal price adjustments, smaller biosimilar manufacturers-with tighter margins-face heightened risk of operational disruption and supply shortages. Advocacy groups warn that sustained tariff pressures could translate into higher prices for patients or reduced pipeline investment, undermining the very cost-savings biosimilars were intended to deliver.

Looking ahead, industry leaders are exploring diversification of supplier networks, onshoring critical manufacturing steps, and leveraging free trade provisions where available. Yet, the cumulative impact of tariffs on biosimilar availability and affordability remains a focal concern for policymakers and healthcare stakeholders.

Key Segmentation Insights Revealing How Product Types, Therapeutic Indications, Administration Routes, and End Users Drive the Biosimilars Market Landscape

Diving into product type dynamics reveals that monoclonal antibodies and insulin biosimilars dominate both development activity and commercial launches, reflecting the high unmet need in oncology and diabetes. Emerging molecules such as granulocyte-colony stimulating factors and erythropoietins also play pivotal roles in blood disorder management, while growth hormones and interferons continue to broaden therapeutic footprints. Together, these product segments represent the vanguard of biosimilar innovation, driving competitive differentiation and portfolio diversification.

When viewed through the lens of therapeutic indications, oncology and autoimmune disorders lead adoption curves, propelled by clinician confidence in efficacy equivalence and reimbursement support. Diabetes and growth hormone deficiency markets remain steady growth contributors, buoyed by familiar administration frameworks and patient demand. Infectious disease biosimilars are emerging, while the nexus between chronic disease management and biosimilar therapies highlights the sector’s potential to reshape long-term treatment paradigms.

Administration route segmentation underscores a clear shift toward subcutaneous, self-injectable formulations, which enhance patient autonomy and reduce clinical burden compared to traditional intravenous regimens. Intramuscular options, though limited in volume, offer specialized delivery in certain therapeutic contexts. Meanwhile, end-user analysis shows hospitals retaining a leading share due to in-clinic administration, while clinics expand their footprint as outpatient settings embrace biosimilar infusion services and homecare environments grow in parallel with self-administered therapies.

This comprehensive research report categorizes the Biosimilars market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapeutic Area

- Route Of Administration

- Development Stage

- Manufacturing Technology

- End User

- Distribution Channel

Exploring Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Uncover Distinct Opportunities and Challenges

In the Americas, robust regulatory frameworks such as the Biologics Price Competition and Innovation Act in the United States have catalyzed biosimilar approvals and reimbursement pathways, enabling significant cost-savings for public and private payers. Stakeholder collaboration among payers, providers, and manufacturers has fostered formulary inclusion and substitution initiatives that further drive market adoption and patient access.

Across Europe, Middle East, and Africa, stringent guidelines from the European Medicines Agency underpin a diverse biosimilar portfolio, spanning insulins, monoclonal antibodies, and growth factors. Reimbursement mechanisms in key markets-including Germany, France, and the United Kingdom-have balanced budgetary pressures with incentives for prescriber uptake, supporting a mature biosimilar ecosystem that reduces healthcare expenditures while maintaining treatment standards.

The Asia-Pacific region stands out as a dynamic frontier, led by manufacturing powerhouses in India and China. Regulatory modernization efforts in Japan, South Korea, and Southeast Asia have streamlined approval timelines, while local partnerships and contract manufacturing organizations expand production capacity. These developments, coupled with rising healthcare infrastructure investment, position Asia-Pacific as the fastest-growing biosimilar market segment globally.

This comprehensive research report examines key regions that drive the evolution of the Biosimilars market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biosimilars Sector Players Highlighting Strategic Alliances, Pipeline Innovations, and Competitive Positioning Shaping the Industry Scene

Leading biosimilar developers are leveraging strategic alliances, robust pipelines, and geographic footprint expansions to secure competitive advantage. Sandoz has inked key collaborations with Shanghai Henlius Biotech and global partners to co-develop oncology and inflammatory disease biosimilars, reinforcing its leadership position in high-value therapeutic areas. Biocon Biologics continues to expand its biosimilar portfolio, securing regulatory approvals in the U.S. and Europe for products such as bevacizumab and aflibercept analogs, underscoring its integrated strategy spanning R&D, manufacturing, and commercialization.

Celltrion has made impactful launches in the United States with infliximab and rituximab biosimilars, driving cost reductions in autoimmune disease management. Amgen and Pfizer have also deepened their biosimilar pipelines through acquisitions and internal development, ensuring presence across monoclonal antibodies, growth factors, and insulin markets. Meanwhile, emerging players like Samsung Bioepis and Viatris (formerly Mylan) are forging co-development agreements and leveraging contract manufacturing to broaden their therapeutic portfolios and market reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biosimilars market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvotech S.A

- Amgen Inc.

- Apobiologix

- Apotex Inc.

- Biocon Limited

- BioFactura, Inc.

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Catalent, Inc

- Celltrion Healthcare Co.,Ltd.

- Coherus BioSciences

- Dr. Reddy's Laboratories Limited

- Eden Biologics, Inc.

- F. Hoffmann-La Roche AG

- Fresenius Kabi

- Innovent Biologics, Inc.

- Intas Pharmaceuticals Ltd.

- Kashiv BioSciences, LLC.

- Merck KGaA

- NeuClone

- Nippon Kayaku Co., Ltd.

- Novartis AG

- Panacea Biotec Limited

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Sanofi S.A.

- Shanghai Henlius Biotech, Inc.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific, Inc.

Actionable Recommendations for Industry Stakeholders to Strengthen Biosimilars Supply Chains, Accelerate Market Adoption, and Navigate Regulatory Complexities

To thrive amid evolving market conditions, industry leaders should prioritize diversification of supply chains by establishing regional manufacturing hubs and securing multiple API sources to mitigate tariff-related inflation and geopolitical risks. Pursuing interchangeable designations for key products can unlock pharmacy-level substitution opportunities, accelerating uptake and fostering prescriber confidence in biosimilar efficacy and safety profiles. Engaging in targeted strategic partnerships-whether through co-development, contract manufacturing, or distribution alliances-enables companies to share development costs, access new markets, and leverage complementary capabilities.

Organizations should also invest in real-world evidence generation platforms, integrating patient data and outcomes research to demonstrate long-term value to payers and healthcare systems. Proactive stakeholder education campaigns-spanning physicians, pharmacists, and patients-can demystify biosimilar science, address efficacy and immunogenicity concerns, and reinforce the economic benefits. Finally, advocating for policy frameworks that exempt critical biosimilar inputs from tariffs and promote streamlined regulatory pathways will help safeguard affordability and ensure sustainable industry growth.

Comprehensive Research Methodology Combining Primary Expert Engagement, Regulatory Analysis, and Robust Secondary Data to Ensure Report Accuracy and Reliability

This report’s insights are grounded in a rigorous, multi-layered research methodology designed to ensure accuracy, comprehensiveness, and objectivity. Primary research efforts included in-depth interviews and workshops with senior executives from leading biopharmaceutical companies, regulatory agency officials, healthcare providers, and patient advocacy groups. These engagements were complemented by a comprehensive extraction of regulatory filings, approval databases from agencies such as the FDA and EMA, and current tariff notifications impacting pharmaceutical trade flows.

Secondary research incorporated extensive reviews of peer-reviewed journals, white papers, industry association reports, and corporate press releases. Financial filings and investor presentations provided clarity on company strategies, pipeline composition, and capital investments. Data triangulation and iterative validation processes ensured robustness of findings, while periodic consultations with an expert advisory panel refined analytical frameworks and contextual interpretations. This blended approach guarantees that our conclusions reflect both high-level market dynamics and on-the-ground operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biosimilars market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biosimilars Market, by Product Type

- Biosimilars Market, by Therapeutic Area

- Biosimilars Market, by Route Of Administration

- Biosimilars Market, by Development Stage

- Biosimilars Market, by Manufacturing Technology

- Biosimilars Market, by End User

- Biosimilars Market, by Distribution Channel

- Biosimilars Market, by Region

- Biosimilars Market, by Group

- Biosimilars Market, by Country

- United States Biosimilars Market

- China Biosimilars Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Conclusion Synthesizing Insights on Emerging Biosimilars Trends, Evolving Market Forces, and Strategic Imperatives Guiding the Future of Biologic Therapies

In summary, the biosimilars sector stands at a pivotal juncture, propelled by clearer regulatory pathways, a growing pipeline of high-value candidates, and transformative innovations in manufacturing and formulation. At the same time, emerging tariff regimes introduce new cost pressures and supply chain complexities that demand strategic mitigation. Granular segmentation insights reveal that product type focus, indication-specific dynamics, administration modalities, and end-user preferences collectively shape adoption trajectories across diverse markets.

Regional nuances-from the Americas’ reimbursement-driven uptake to Europe’s mature regulatory ecosystem and Asia-Pacific’s manufacturing ascendancy-underscore the need for tailored market approaches. Leading companies are capitalizing on strategic alliances and internal capabilities to differentiate their offerings, while actionable recommendations highlight the importance of supply chain resilience, interchangeability, and evidence-driven stakeholder engagement. Together, these insights chart a clear path for organizations to navigate the evolving biosimilars landscape, optimize competitive positioning, and deliver enhanced patient access to affordable biologic therapies.

Take the Next Step Toward Enhanced Market Intelligence and Competitive Advantage by Engaging with Our Biosimilars Market Research Report Today

Engage directly with Ketan Rohom to explore how our in-depth market research on biosimilars can empower your organization with actionable intelligence. Discover detailed analyses on evolving regulatory landscapes, supply chain resilience strategies, and competitive positioning insights tailored to your strategic objectives. By securing this report, you gain exclusive access to expert-driven recommendations, comprehensive segmentation and regional breakdowns, and company profiles that will inform your decision-making and drive growth. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to discuss custom research solutions, licensing options, and to obtain your copy today.

- How big is the Biosimilars Market?

- What is the Biosimilars Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?