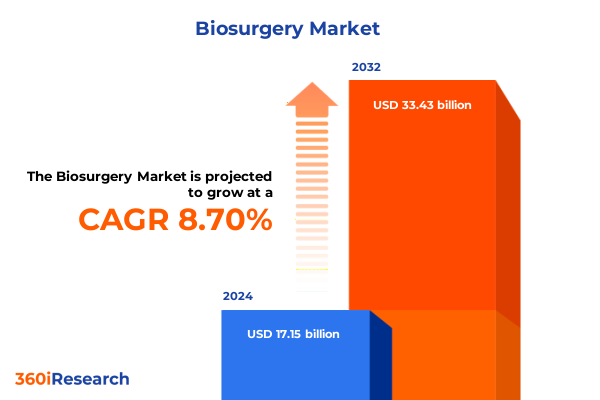

The Biosurgery Market size was estimated at USD 18.58 billion in 2025 and expected to reach USD 20.14 billion in 2026, at a CAGR of 8.75% to reach USD 33.43 billion by 2032.

Unveiling the Critical Role of Innovative Biosurgical Technologies in Revolutionizing Surgical Outcomes and Shaping the Future of Patient Care

The landscape of surgical care is experiencing a profound transformation driven by the imperative to enhance patient outcomes, minimize complications, and accelerate recovery. In recent years, biosurgical products have emerged at the forefront of this evolution, offering advanced hemostats, sealants, adhesives, and grafting materials that address complex clinical challenges. By integrating cutting-edge biomaterials science and innovative delivery mechanisms, these solutions have redefined standards of care across specialties ranging from cardiovascular and orthopedic surgery to minimally invasive procedures. As healthcare providers seek to balance clinical efficacy with cost efficiency, the strategic role of biosurgery has never been more critical.

This report’s executive summary distills the essential insights needed to navigate an increasingly competitive and regulated environment. It frames the competitive dynamics among key global players, highlights transformative technological advancements, and examines external factors reshaping the market’s trajectory. With patient-centered care models gaining momentum and healthcare systems under pressure to deliver value-based outcomes, biosurgical products are expected to play a pivotal role in driving procedural efficiencies and enhancing long-term healing. Through a deep dive into segment-specific drivers and constraints, this summary lays the groundwork for informed decision making and strategic investment in the years ahead.

Examining the Pivotal Technological Advances and Clinical Paradigm Shifts Transforming the Biosurgical Landscape Across Multiple Specialties

Rapid innovations in surgical practice and biomaterials research have catalyzed a wave of paradigm shifts in the biosurgery domain. Digital integration, propelled by advances in artificial intelligence and real-time imaging, now guides surgeons toward greater precision, enabling targeted hemostasis and tissue repair with minimal collateral damage. Simultaneously, the proliferation of robotic-assisted and bedside minimally invasive procedures has driven demand for next-generation sealants and adhesives that accommodate confined workspaces and offer rapid setting times. As a result, product development is rapidly migrating toward user-friendly formats compatible with both open and closed surgical platforms.

Concurrently, the convergence of biotechnology and materials engineering has given rise to multifunctional biosurgical solutions. Innovations such as hydrogel scaffolds that deliver antimicrobial agents, bioactive patches that stimulate angiogenesis, and composite matrices that combine mechanical support with resorption profiles are reshaping how clinicians approach wound closure and tissue regeneration. In parallel, personalized medicine initiatives are fostering patient-specific implants and custom-formulated sealants, reflecting a shift toward tailored surgical interventions. These transformative changes not only improve clinical efficacy but also set new benchmarks for postoperative recovery, positioning biosurgery as a key pillar in the future of surgical care.

Assessing the Comprehensive Consequences of 2025 United States Trade Measures on Biosurgical Supply Chains, Costs, and Innovation Trajectories

The introduction of new U.S. trade measures in 2025 has created a cumulative ripple effect throughout biosurgical supply chains and manufacturing costs. Tariffs on key inputs, including certain medical device components sourced from global suppliers, have introduced additional pricing pressures for both established corporations and emerging innovators. As import duties on steel and aluminum derivatives rose earlier in the year, many manufacturers faced elevated raw material costs for delivery systems and instrumentation, prompting a reevaluation of sourcing strategies and contract structures.

In response, industry leaders are accelerating efforts to diversify supply chains and nearshore production to mitigate tariff exposure. Domestic facility expansions and strategic partnerships with regional suppliers have gained traction as companies seek greater resilience against fluctuating trade policies. Moreover, the added cost pressures have tightened innovation timelines, as research and development teams prioritize materials that can be produced locally or qualify for tariff exemptions. Despite these headwinds, some manufacturers are leveraging the situation as an opportunity to invest in advanced automation and quality control, aiming to offset cost increases with improved operational efficiencies and product differentiation.

Deriving Strategic Perspectives from Multifaceted Product, Material, Resorbability, Application, and End User Segmentation Patterns in Biosurgery and Emerging Trends Revealed

A nuanced understanding of segmentation provides critical insight into where biosurgery products deliver maximum value and where opportunities for innovation remain ripe. When examining product type, hemostats, sealants and adhesives, and tissue grafts each display distinct clinical use cases and performance requirements, guiding investment in R&D and marketing efforts. Segmenting by material type reveals a competitive landscape in which collagen-based and fibrin-based solutions vie with gelatin formulations and fully synthetic alternatives, with each material class offering trade-offs between biocompatibility, handling characteristics, and cost efficiency.

Considering resorbability sheds further light on the market’s complexity: nonresorbable options continue to serve specific reconstructive needs, whereas resorbable variants, both fully and partially degradable, are gaining preference in procedures demanding temporary scaffolding and minimal long-term foreign material retention. Application segmentation underscores the varied demands within cardiovascular surgery (including bypass and valve repair), general surgery (such as hernia and wound repair), minimally invasive techniques spanning endoscopic and laparoscopic interventions, open surgery, and high-precision orthopedic procedures encompassing joint replacement and spinal fusion. Meanwhile, end-user differentiation highlights the importance of ambulatory surgery centers, hospitals, and specialty clinics, with dental and ophthalmology clinics emerging as niche growth nodes for targeted biosurgical solutions.

This comprehensive research report categorizes the Biosurgery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Resorbability

- Application

- End User

Uncovering Distinct Regional Dynamics Influencing Biosurgical Adoption and Market Maturation across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics play a defining role in the adoption and maturity of biosurgery innovations, shaped by healthcare infrastructure, reimbursement frameworks, and clinical practice patterns. In the Americas, established healthcare systems and robust capital investment have fostered early uptake of advanced hemostats and sealants, particularly in North America, where regulatory approvals and established clinical guidelines support rapid integration. Latin America presents both opportunities and challenges, as public health initiatives and growing surgical volumes encourage biosurgery adoption, yet budgetary constraints drive cost-sensitive procurement decisions.

Across Europe, the Middle East, and Africa, heterogeneous reimbursement landscapes and variable surgical volumes create a patchwork of adoption rates. Western European markets often lead in adopting minimally invasive biosurgical techniques underpinned by favorable reimbursement, whereas emerging markets in Eastern Europe and the Middle East are gradually expanding their capabilities through public-private partnerships and infrastructure investments. In Africa, access initiatives and global health programs are driving initial penetration of biosurgery essentials, with an emphasis on affordable and easy-to-store formulations. In the Asia-Pacific region, rapid healthcare spending growth, coupled with government initiatives to localize production, fuels demand for cost-effective biosurgical products, particularly in China, India, and Oceania, where clinical training programs increasingly emphasize advanced surgical modalities.

This comprehensive research report examines key regions that drive the evolution of the Biosurgery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovation Momentum of Leading Biosurgery Corporations Driving Disruption and Growth in Surgical Solutions

Competitive activity in the biosurgery domain is underscored by a blend of organic innovation, strategic partnerships, and targeted acquisitions. Leading organizations are advancing their product pipelines by investing in next-generation biomaterials that integrate antimicrobial functionality or growth-factor delivery. Concurrently, collaborations with academic research centers and contract development partners enable accelerated proof-of-concept studies and streamlined regulatory submissions.

Smaller specialized firms continue to challenge incumbents by focusing on niche applications, such as sprayable sealants for endoscopic procedures or rapid-setting adhesives for emergency wound management. Their agility in clinical trial execution and regulatory navigation allows them to bring differentiated products to market with greater speed. Established companies, in turn, leverage their global distribution networks and scale advantages to reinforce their positions, while selectively acquiring promising startups to bolster capabilities in areas like tissue engineering and immunomodulatory biomaterials.

In parallel, cross-industry alliances with digital health companies are emerging, as sensor-embedded delivery systems and data analytics platforms promise to deliver real-time insights on wound healing and device performance. This confluence of material science, clinical expertise, and digital innovation is generating a dynamic competitive landscape in which the ability to integrate multidisciplinary strengths becomes a key differentiator.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biosurgery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Medical Solutions Group plc

- Artivion, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- BioCer Entwicklungs‑GmbH

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Corza Medical GmbH

- CryoLife, Inc.

- CSL Limited

- Hemostasis, LLC

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Kuros Bioscience AG

- Medtronic plc

- Pfizer Inc.

- RTI Surgical, Inc.

- Samyang Holdings Corporation

- Sanofi SA

- Smith & Nephew plc

- Stryker Corporation

- Teleflex Incorporated

- Tissue Regenix Ltd

- Vivostat A/S

Implementing High-Impact, Actionable Strategies to Strengthen Biosurgical Supply Chains, Enhance Innovation Pipelines, and Elevate Patient Outcomes

Industry leaders seeking to secure long-term growth must embrace actionable strategies that bolster supply chain resilience, accelerate innovation cycles, and enhance patient-centric outcomes. First, fostering strategic partnerships with regional manufacturers or contract development organizations can mitigate tariff and sourcing risks, while ensuring consistent material quality. Investment in flexible production platforms and modular facility designs further enables rapid scaling as demand patterns shift.

Second, embedding digital capabilities into biosurgery solutions-whether through smart delivery systems, remote monitoring tools, or AI-driven procedural guidance-can create differentiated value propositions for clinicians and healthcare systems. Establishing cross-functional innovation teams that span R&D, regulatory, and clinical affairs will streamline development workflows and reinforce regulatory compliance.

Third, cultivating strong relationships with key opinion leaders and professional societies can accelerate adoption by driving evidence-based guidelines and generating real-world outcome data. By prioritizing health economics and outcomes research early in the product development lifecycle, organizations can proactively address reimbursement challenges and substantiate product value. Finally, aligning product portfolios to address underserved clinical segments, such as outpatient wound care and emerging specialty applications, will open new revenue streams while reinforcing market leadership.

Detailing the Rigorous Research Framework Encompassing Data Collection Techniques, Analytical Processes, and Validation Protocols Ensuring Report Integrity

This market analysis is built upon a structured research framework that integrates both primary and secondary data sources to ensure comprehensive coverage and analytical rigor. The secondary research phase involved systematic review of peer-reviewed journals, regulatory filings, patent databases, and clinical registry data to map technological developments, product approvals, and procedural adoption rates. In parallel, an extensive scan of industry white papers, trade association reports, and policy announcements provided context on external drivers such as trade measures, reimbursement evolutions, and healthcare infrastructure investments.

Primary research comprised in-depth interviews and surveys with a diverse panel of stakeholders, including surgeons, procurement directors, industry analysts, and supply chain experts. Qualitative insights from these discussions were triangulated against quantitative findings to validate segment definitions, elucidate emerging trends, and identify key decision criteria. Data synthesis employed a multi-step validation protocol that cross-checked findings across sources and leveraged expert workshops to resolve discrepancies.

Analytical processes included segmentation modeling, competitive benchmarking, and scenario analysis, each underpinned by clearly defined assumptions and boundaries. Rigorous quality assurance measures, including peer review and consistency checks, underpin the integrity of the final insights and ensure actionable relevance for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biosurgery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biosurgery Market, by Product Type

- Biosurgery Market, by Material Type

- Biosurgery Market, by Resorbability

- Biosurgery Market, by Application

- Biosurgery Market, by End User

- Biosurgery Market, by Region

- Biosurgery Market, by Group

- Biosurgery Market, by Country

- United States Biosurgery Market

- China Biosurgery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives to Navigate Future Challenges and Unleash the Full Potential of Biosurgical Innovations

The evolving biosurgery landscape presents a compelling convergence of innovation, clinical demand, and strategic opportunity. Key findings underscore the accelerating shift toward minimally invasive platforms, the rise of multifunctional biomaterials, and the imperative to navigate trade and regulatory complexities with agility. By synthesizing segmentation views-from product formats and material classes to resorbability profiles and end-user settings-decision makers gain a holistic understanding of where investment and R&D efforts can yield the greatest impact.

As regional dynamics continue to shape adoption patterns, organizations must calibrate their market entry and expansion strategies to local reimbursement models, infrastructure maturity, and clinical practice guidelines. Competitive imperatives demand a balance between scalable manufacturing capabilities and the flexibility to address niche applications and emerging specialty care settings. Above all, forging seamless partnerships across the value chain-from material suppliers to healthcare providers-will determine the pace at which biosurgical innovations translate into tangible clinical benefits.

Looking ahead, the ability to integrate digital intelligence, real-world outcomes data, and patient-centered design will define the next frontier of biosurgery excellence. By embracing strategic recommendations and leveraging robust market insights, stakeholders can navigate uncertainties, capitalize on growth opportunities, and contribute to the sustained advancement of surgical care.

Engage with Ketan Rohom to Secure Exclusive Biosurgery Market Insights and Propel Your Organization’s Strategic Decision Making Forward Today

Engaging with Ketan Rohom unlocks a strategic partnership that translates deep biosurgery market intelligence into transformative growth initiatives tailored to your organization’s needs. By collaborating directly with an industry expert, decision makers gain early access to nuanced insights on evolving product innovations, regulatory shifts, and competitive dynamics. This exclusive dialogue ensures that your leadership team can swiftly adapt to emerging trends, refine investment priorities, and anticipate market disruptions before they occur. Whether you seek to optimize your product portfolio, expand into new clinical applications, or strengthen supply chain resilience, personalized guidance from an experienced associate director will accelerate your strategic roadmap.

Initiating a conversation with Ketan Rohom bridges the gap between high-level market data and actionable strategies that drive sustained performance. His expertise in sales and marketing offers practical recommendations on positioning differentiated biosurgical solutions, navigating complex reimbursement landscapes, and fostering key partnerships across healthcare ecosystems. Embrace this opportunity to elevate your market approach, reinforce competitive advantages, and achieve measurable impact. Connect today to secure your access to the full market research report and embark on a customized journey toward accelerated innovation and growth.

- How big is the Biosurgery Market?

- What is the Biosurgery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?