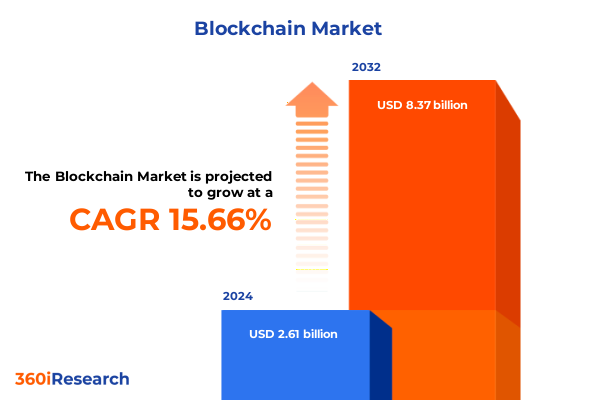

The Blockchain Market size was estimated at USD 2.97 billion in 2025 and expected to reach USD 3.40 billion in 2026, at a CAGR of 15.94% to reach USD 8.37 billion by 2032.

Unveiling the Strategic Significance of Blockchain Infrastructure for Driving Cross-Industry Innovation and Operational Excellence in the Digital Era

Blockchain technology has emerged as a foundational pillar of digital transformation, redefining trust and transparency across industries. Its cryptographic underpinnings ensure that transactions are immutable and verifiable, enabling organizations to streamline processes and eradicate inefficiencies inherited from legacy systems. As enterprises pursue competitive differentiation, blockchain offers a pathway to innovate operational models in areas ranging from supply chain provenance to cross-border payments.

In this executive summary, we examine the latest developments shaping the blockchain landscape and analyze critical factors influencing adoption. By synthesizing insights on regulatory shifts, tariff impacts, market segmentation, regional dynamics, and key players, we provide a robust framework for decision-makers to navigate complexity. The overview begins with a exploration of transformative trends and the far-reaching implications of recent policy changes, followed by an in-depth look at segmentation and regional nuances. We then highlight major industry participants and conclude with strategic recommendations and research methodology. The goal is to equip stakeholders with a clear, actionable understanding of the blockchain ecosystem as it stands in 2025 and to illuminate pathways for sustainable growth and innovation.

Navigating the Evolving Blockchain Ecosystem Shaped by Decentralized Finance Interoperability and Regulatory Advances Worldwide

The blockchain landscape has evolved significantly beyond its initial focus on cryptocurrency applications. Interoperability between disparate ledger platforms has become a defining trend, enabling data to flow seamlessly across networks. This shift is driven by the advent of cross-chain protocols and standardized APIs that bridge public and private environments. Meanwhile, decentralized finance has matured into a multi-trillion-dollar opportunity, ushering in novel financial instruments, on-chain lending pools, and tokenized assets that challenge traditional banking paradigms.

Concurrently, central banks around the world are piloting or launching digital currencies, reflecting a broader recognition of blockchain’s potential to enhance monetary policy and financial inclusion. Enterprises in sectors such as healthcare, energy, and real estate are forging consortiums to co-develop permissioned networks, accelerating use cases from digital identity verification to supply chain traceability. Equally important, enhanced focus on sustainability has led to low-energy consensus mechanisms, addressing prior environmental concerns and paving the way for broader acceptance. These transformative shifts illustrate how blockchain is transitioning from niche deployments to a core strategic technology for 21st century businesses.

Assessing the Ripple Effects of 2025 United States Trade Tariffs on Blockchain Supply Chains and Cryptocurrency Mining Ecosystems

In 2025, United States trade policy introduced targeted tariffs that have reverberated through the blockchain supply chain. Tariffs on specialized semiconductor equipment and high-performance mining rigs sourced from key manufacturing hubs have elevated capital expenditures for mining operations, prompting a re-evaluation of geographic footprints. As mining profitability margins tightened, miners have increasingly turned to regions with lower electricity costs and favorable regulatory structures to maintain competitiveness.

Beyond hardware costs, the ripple effects extend to software development and consulting services, as increased input prices and logistical complexities have influenced project timelines and budgets. Consequently, service providers have adapted pricing models and sought alternative suppliers to mitigate cost pressures. At the same time, these tariffs have catalyzed discussions around domestic manufacturing incentives and strategic stockpiling of critical components. In aggregate, the cumulative impact underscores the intricate dependencies within the blockchain ecosystem and highlights the importance of resilient supply chain strategies amid shifting trade dynamics.

Integrating Multi-Dimensional Market Segmentation Insights to Illuminate the Diverse Blockchain Adoption Scenarios Across Stakeholder Profiles

Understanding how blockchain adoption unfolds requires a granular examination of market segments that reflect diverse stakeholder needs. The distinction between software and services underscores this dynamic, wherein end users may prioritize turnkey managed services for rapid deployment and assurance, while professional services cater to bespoke integration and advisory mandates. Organization size further delineates decision-making processes and resource allocation, as large enterprises typically invest in enterprise-grade platforms with comprehensive governance frameworks, whereas small and medium enterprises gravitate toward modular solutions that offer scalability and cost efficiency.

Deployment mode is another axis of differentiation, with cloud environments enabling flexible, on-demand access and reduced infrastructure overhead, while on-premises installations address stringent security or data sovereignty requirements. At the application level, blockchain’s versatility manifests across digital identity systems that cement user trust, exchanges that facilitate token liquidity, payment rails that optimize cross-border settlement, programmable smart contracts automating agreements, and supply chain management solutions ensuring traceability. Finally, end-use industries such as banking and financial services leverage blockchain to streamline clearing and custody, energy and utilities pursue peer-to-peer trading, government agencies explore transparent record-keeping, healthcare entities safeguard patient data integrity, and sectors ranging from manufacturing to travel harness provenance, loyalty, and logistics optimizations.

This comprehensive research report categorizes the Blockchain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Organization Size

- Deployment Mode

- Application

- End-use

Highlighting Regional Dynamics and Strategic Imperatives Shaping Blockchain Ecosystem Growth in the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping blockchain adoption trajectories as local policies and market maturities vary widely. In the Americas, the United States and Canada have cemented themselves as innovation hubs, driven by a confluence of regulatory clarity, venture capital investment, and enterprise-led proofs of concept in financial services and supply chain sectors. Latin American markets are rapidly embracing digital asset remittances as a hedge against currency volatility, while regulatory sands are gradually shifting toward accommodating token offerings.

Across Europe, the Middle East, and Africa, legislative frameworks such as MiCA are providing a blueprint for harmonized digital asset regulation, fostering institutional confidence. Simultaneously, public sector initiatives in the UAE and Saudi Arabia are elevating blockchain credentials through strategic economic diversification programs. In Africa, decentralized identity projects are gaining traction to address documentation gaps and expand financial inclusion. The Asia-Pacific region exhibits a blend of state-driven and private-led efforts, with China accelerating its digital yuan rollout, India exploring regulatory sandboxes for tokenized securities, and Southeast Asian nations prioritizing cross-border trade facilitation through blockchain corridors. Collectively, these regional dynamics highlight the necessity for tailored strategies that align with local market conditions and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Blockchain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Blockchain Innovators and Strategic Partnerships Driving Technological Advances and Market Expansion Globally

The competitive landscape of blockchain technology is characterized by alliances between established technology providers and emerging specialists. Major cloud incumbents have introduced blockchain-as-a-service offerings, leveraging global infrastructure to support rapid proof-of-concept deployments. At the same time, pure-play platform vendors continue to differentiate themselves through domain-specific applications and open-source contributions that drive community adoption. Collaborative consortia have become a hallmark of enterprise activity, with cross-industry groups co-authoring interoperability protocols and governance models to reduce integration complexity.

Blockchain analytics and security firms have also risen in prominence, offering real-time transaction monitoring and forensic tools to ensure compliance and risk mitigation. Furthermore, digital asset exchanges and custodial services are expanding institutional-grade solutions to meet growing demands for secure trading environments. Partnerships between financial institutions and both technology providers and niche blockchain developers underscore a trend toward ecosystem-centric growth strategies, as organizations seek to combine domain expertise with technical prowess to accelerate time-to-market and foster sustainable adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alibaba Group Holding Limited

- Altoros Labs LLC

- Amazon.com, Inc.

- Avalanche Inc.

- Bitfury Group Limited

- BlockSec

- Blockstream Corporation Inc.

- Capgemini SE

- Chainalysis Inc.

- CipherTrace

- Consensys Software Inc.

- Deloitte Touche Tohmatsu Limited

- Elliptic Enterprises Limited

- Ernst & Young Global Limited

- Fireblocks Inc.

- FortKnoxster A/S

- HCL Technologies Limited

- Huawei Technologies Co., Ltd.

- Hyperchain Technology Co., Ltd.

- Infineon Technologies AG

- Infosys Limited

- International Business Machines Corporation

- JPMorgan Chase & Co

- KPMG International Limited

- Mastercard Incorporated

- Microsoft Corporation

- OceanEx Ltd.

- Oracle Corporation

- PricewaterhouseCoopers International Limited

- R3 LLC

- SAP SE

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Tencent Holdings Limited

- Thales S.A.

- Wipro Limited

Actionable Strategic Roadmap for Industry Leaders to Harness Blockchain Technology for Competitive Advantage and Sustainable Growth

To capitalize on blockchain’s potential, industry leaders must adopt a strategic roadmap that balances innovation with prudent risk management. First, defining clear business objectives is essential; organizations should align blockchain initiatives with quantifiable performance indicators, whether enhancing operational transparency or enabling new revenue streams. Next, forging ecosystem partnerships can accelerate capability building; collaborating with technology vendors, academic institutions, and regulatory bodies fosters an environment conducive to experimentation and standards development.

Moreover, leaders should prioritize modular architectures and open protocols to maximize interoperability and avoid vendor lock-in. Embedding security and compliance requirements from the outset reduces downstream remediation costs and ensures adherence to evolving regulations. Investing in talent through targeted training programs will bridge skill gaps and empower cross-functional teams to drive adoption. Finally, embracing iterative pilot frameworks allows for rapid feedback loops, facilitating course corrections and scaling successful use cases. This pragmatic approach ensures that blockchain deployments deliver tangible value while maintaining flexibility to adapt to future technological and regulatory developments.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Triangulation and Rigorous Validation for Robust Insights

Our research methodology integrates rigorous primary and secondary approaches to deliver robust insights. Primary data collection consisted of in-depth interviews with C-level executives and blockchain practitioners across diverse industries, supplemented by a structured survey capturing qualitative perspectives on adoption drivers and challenges. These interactions provided a nuanced understanding of organizational priorities and technology roadmaps.

Secondary research encompassed an exhaustive review of public filings, whitepapers, regulatory documents, and academic publications to contextualize market dynamics and benchmark best practices. Triangulation of data from multiple sources enabled validation of emerging trends and identification of potential inconsistencies. Quantitative and qualitative findings were then synthesized through a multi-stage review process involving subject-matter experts and editorial oversight, ensuring accuracy and coherence. This comprehensive methodology underpins the credibility of our analysis and supports informed decision-making for stakeholders navigating the blockchain ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain Market, by Offering

- Blockchain Market, by Organization Size

- Blockchain Market, by Deployment Mode

- Blockchain Market, by Application

- Blockchain Market, by End-use

- Blockchain Market, by Region

- Blockchain Market, by Group

- Blockchain Market, by Country

- United States Blockchain Market

- China Blockchain Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Forward-Looking Perspectives on Blockchain Evolution to Guide Decision-Makers in Complex Digital Landscapes

The blockchain ecosystem in 2025 stands at a critical inflection point, characterized by maturing technologies, evolving regulatory frameworks, and shifting geopolitical factors. Core findings underscore the importance of interoperability, sustainable consensus mechanisms, and targeted use case development to drive mainstream adoption. Trade policy developments, such as recent tariffs, highlight the need for resilient supply chain strategies and diversified sourcing.

Regional analyses reveal that successful market entry requires alignment with local regulatory statutes and cultural nuances, while segmentation insights reinforce that deployment choices must reflect organizational scale, technical capabilities, and industry-specific requirements. Leading companies are forging strategic alliances and investing in domain expertise to differentiate their offerings, and actionable recommendations provide a pathway for industry leaders to translate insights into value. In aggregate, the landscape is ripe with opportunity for those who can navigate complexity, adapt quickly to regulatory shifts, and foster collaborative ecosystems. Armed with this knowledge, decision-makers are well positioned to capitalize on blockchain’s transformative promise.

Empowering Your Organization with Tailored Blockchain Market Intelligence Through Consultation and Partnership with Associate Director of Sales Marketing

To explore how bespoke blockchain intelligence can drive your strategic vision, connect with Ketan Rohom Associate Director of Sales & Marketing at our firm to discuss tailored insights and partnership opportunities. Ketan brings deep industry experience and can guide your organization through a consultative process designed to align research findings with your specific objectives. By engaging directly, you will receive a customized briefing highlighting the most relevant trends, competitive landscapes, and actionable strategies to maximize the value of blockchain initiatives. Reach out to arrange a discovery call or personalized presentation that will equip your leadership team with the clarity and confidence needed to accelerate adoption. Secure your competitive edge by leveraging expert analysis and market intelligence designed to support decision-making at every stage of your blockchain journey. Begin the conversation today to harness the transformative power of distributed ledger technologies for sustainable growth and innovation.

- How big is the Blockchain Market?

- What is the Blockchain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?