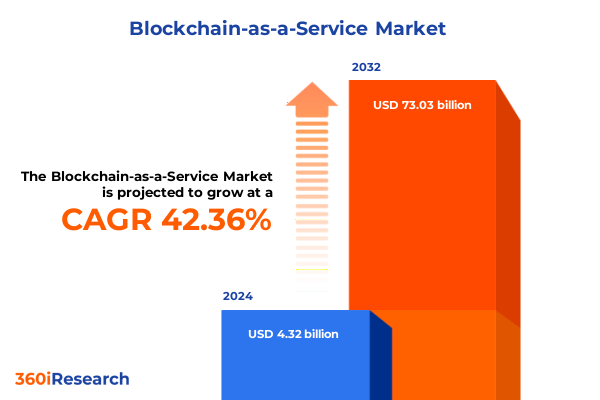

The Blockchain-as-a-Service Market size was estimated at USD 6.13 billion in 2025 and expected to reach USD 8.68 billion in 2026, at a CAGR of 42.46% to reach USD 73.03 billion by 2032.

Charting the Evolution and Imperatives of Blockchain-as-a-Service Platforms in Revolutionizing Enterprise Operations through Cross-Industry Collaboration

Blockchain-as-a-Service (BaaS) has emerged as a pivotal enabler for organizations seeking to harness the potential of distributed ledger technologies without the burdens of building and maintaining the underlying infrastructure. By abstracting the complexities of nodes, consensus mechanisms, and network governance, BaaS platforms empower enterprises to concentrate on developing transformative applications and business models. This report delves into the multifaceted dimensions of BaaS, examining how its evolution has coincided with broader trends in cloud computing, cybersecurity, and cross-industry collaboration.

In recent years, BaaS offerings have transcended mere pilot programs to become integral components of enterprise digital strategies. Leading cloud providers and specialized technology firms have partnered with industry consortia to establish interoperable standards, fostering robust networks that span financial services, supply chain, and public sector use cases. As BaaS solutions mature, they are addressing critical concerns such as data privacy, regulatory compliance, and integration with emerging technologies like artificial intelligence and the Internet of Things. Transitioning from proof-of-concept stages to large-scale production deployments, organizations are unlocking new avenues for efficiency, transparency, and competitive differentiation through BaaS.

Identifying the Pivotal Transformative Shifts Redefining Blockchain-as-a-Service Solutions and Driving Future Enterprise Adoption Patterns

The landscape of Blockchain-as-a-Service is undergoing transformative shifts that are redefining both its technical foundations and its strategic value to enterprises. One of the most significant developments is the integration of advanced analytics and AI-driven smart contracts, enabling automated decision-making and real-time compliance monitoring. This convergence of AI and distributed ledgers is unlocking novel use cases in predictive asset management and dynamic pricing models.

Interoperability has also moved to the forefront, as industry stakeholders coalesce around open standards and cross-chain protocols. By facilitating seamless data exchange between disparate ledgers, these standards are accelerating blockchain adoption across complex ecosystems such as global trade finance and multi-party supply chains. At the same time, regulatory frameworks are evolving, with major jurisdictions clarifying guidelines for tokenized securities and digital identity solutions. This regulatory maturation is instilling confidence in enterprise adopters and catalyzing investments in blockchain infrastructure.

Moreover, the shift toward decentralized identity management and green blockchain initiatives is reshaping governance models and sustainability benchmarks. Organizations are prioritizing energy-efficient consensus algorithms and carbon footprint tracking within BaaS offerings, aligning their deployments with corporate responsibility goals. These convergent trends are setting the stage for the next phase of BaaS innovation, where scalability, security, and sustainable design drive strategic differentiation.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Blockchain-as-a-Service Infrastructure, Cost Structures, and Adoption Dynamics

In early 2025, the United States introduced a series of tariff measures targeting high-performance computing hardware, which form the backbone of many Blockchain-as-a-Service infrastructures. These tariffs, applied principally to imported servers and specialized accelerators, have driven an uptick in hardware acquisition costs for BaaS providers operating within U.S. borders. With these increased input prices, providers are reassessing supply chain strategies and reconfiguring their global sourcing models to mitigate cost pressures.

As a result, BaaS firms have accelerated investments in edge computing and containerized blockchain nodes deployed closer to end-user environments, thus reducing dependency on tariff-affected imported hardware. Concurrently, providers are deepening partnerships with domestic hardware manufacturers to secure preferential procurement agreements and guarantee capacity for validator nodes. These strategic realignments are reshaping total cost curves and forcing a reevaluation of service-level agreements for enterprise clients.

The cumulative impact of these tariff policies extends beyond direct cost considerations. Increased hardware expenses have prompted BaaS vendors to innovate around resource-efficient consensus algorithms and adopt serverless blockchain execution models. By minimizing resource footprints, providers can partly offset tariff-induced cost increases. In turn, enterprises exploring BaaS adoption are emphasizing proof-of-concept projects that demonstrate performance and cost resilience under the new tariff regime.

Uncovering Strategic Insights across Component Organization Size Deployment Model Application and End User Industry Segmentation for Blockchain-as-a-Service

An in-depth examination of market segmentation uncovers critical insights into how diverse dimensions influence BaaS adoption trajectories. Component-level analysis reveals that platform offerings-comprising hosted blockchain networks and development kits-are converging with services spanning consulting, systems integration, and support and maintenance to form end-to-end solution stacks tailored for both technical and business audiences. This integration of platform capabilities with bespoke professional services is empowering organizations to navigate complex implementations with expert guidance.

Assessment by organization size demonstrates that large enterprises are leveraging BaaS for enterprise-wide ledger networks, embedding blockchain into core processes such as cross-border settlements and digital identity management. Conversely, small and medium enterprises are adopting turnkey BaaS services to streamline payment processing and contract automation, enabling rapid deployment with minimal up-front investment. This bifurcation in use-case scale reflects the adaptability of BaaS solutions to organizations at different maturity levels.

Deployment model distinctions further shape strategic choices, as hybrid cloud environments offer a balanced approach for enterprises requiring both on-premises control and cloud scalability. Private cloud deployments appeal to highly regulated industries, while public cloud offerings facilitate broader accessibility and rapid onboarding. Across application segments-ranging from contract management and cross-border payments to digital identity, payment processing, and supply chain management-BaaS is demonstrating its versatility. End-user industry analysis highlights that banking, government, healthcare, information technology and telecom, and retail and e-commerce sectors are at the vanguard of adoption, each prioritizing use cases aligned with their operational imperatives.

This comprehensive research report categorizes the Blockchain-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Model

- Application

- End User Industry

Discerning the Growth Drivers and Adoption Patterns of Blockchain-as-a-Service Solutions across the Americas Europe Middle East & Africa and Asia-Pacific

Regional insights reveal how geographic dynamics influence BaaS adoption patterns and strategic priorities. In the Americas, leading enterprises are pioneering blockchain-based payment rails and supply chain provenance projects, leveraging a mature cloud ecosystem and established regulatory clarity to accelerate proof-of-concept to production timelines. These deployments frequently emphasize interoperability with existing financial infrastructure and integration with fintech innovation hubs.

In Europe, the Middle East & Africa region, regulatory harmonization efforts are advancing across the EU and select Middle Eastern jurisdictions, fostering cross-border digital identity initiatives and tokenization pilots within the public sector. Economic diversification strategies in the Gulf Cooperation Council are driving government-led blockchain networks for citizen services, while South Africa is spearheading banking consortiums that leverage shared ledgers for real-time settlements.

Across Asia-Pacific, a heterogeneous landscape emerges. Leading markets like Singapore and Australia are rapidly scaling blockchain platforms for trade finance and digital asset exchanges, supported by supportive regulatory sandboxes. Meanwhile, emerging economies are exploring blockchain in supply chain and healthcare contexts to improve transparency and data integrity. These regional variations underscore the importance of localized strategies and the need for BaaS providers to tailor offerings to diverse regulatory, economic, and technological environments.

This comprehensive research report examines key regions that drive the evolution of the Blockchain-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning Innovations and Competitive Differentiators of Leading Blockchain-as-a-Service Providers Shaping Future Industry Dynamics

The competitive field of Blockchain-as-a-Service is defined by a diverse set of providers, each leveraging unique strengths to capture enterprise attention. Global cloud giants are embedding blockchain templates and toolkits directly into their broader platform ecosystems, allowing customers to provision networks through familiar interfaces and benefit from integrated security services. Simultaneously, specialized blockchain players are differentiating through advanced protocol innovations, such as zero-knowledge proofs, tokenization modules, and modular consensus frameworks.

Partnerships and acquisitions are accelerating innovation cycles, with providers collaborating across technology domains to enhance user experience and interoperability. Some firms are defining new industry consortiums that standardize APIs, while others are developing turnkey accelerators for specific use cases like digital identity verification or cross-border trade. Differentiation also emerges in service-level offerings, as leading BaaS companies introduce outcome-based service warranties and customizable SLA metrics to align with enterprise performance expectations.

Furthermore, strategic roadmaps emphasize open-source contributions and community governance. By fostering developer ecosystems around shared codebases, providers can accelerate feature development and mitigate vendor lock-in concerns. This dynamic competitive environment underscores the imperative for enterprises to evaluate BaaS vendors not only on current capabilities but on their capacity for sustained innovation and ecosystem stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blockchain-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alibaba Group Holding Limited

- Altoros Inc.

- Amazon Web Services, Inc.

- Appinventiv Technologies Pvt. Ltd.

- Axoni, Inc.

- Baidu, Inc.

- Blockstream Corporation

- Bloq, Inc.

- Chainlink Labs

- ConsenSys Software Inc.

- Google LLC

- Huawei Investment & Holding Co., Ltd.

- Innominds Software

- International Business Machines Corporation

- LeewayHertz

- Microsoft Corporation

- Oracle Corporation

- Paystand, Inc.

- SAP SE

- StarkWare Industries Ltd.

- Tencent Holdings Limited

- Webisoft Technologies

Actionable Recommendations for Industry Leaders to Harness Blockchain-as-a-Service Capabilities Optimize Implementation and Drive Competitive Advantage

Industry leaders seeking to capture the strategic benefits of BaaS should first establish clear governance frameworks that define ownership models, performance benchmarks, and risk controls. By articulating governance principles upfront, organizations can ensure alignment between technical implementation teams and business stakeholders. Next, enterprises should adopt an iterative deployment approach, starting with focused pilot programs in high-impact areas such as contract management or payment processing, then progressively expanding network scope as use-case maturity grows.

To achieve optimal results, leaders are advised to cultivate cross-functional talent pools that bridge blockchain development expertise with domain-specific knowledge in finance, supply chain, or identity management. Investing in targeted training and certification programs will accelerate internal competency building and reduce dependence on external consultants. In parallel, selecting a deployment model that balances operational control with scalability-whether public, private, or hybrid-will enable tailored risk management and data sovereignty strategies.

Finally, forging strategic alliances with technology partners and industry consortia is crucial. These partnerships can provide access to standardized tools, regulatory insights, and shared infrastructure, reducing time-to-value and fostering collective innovation. By following these actionable recommendations, enterprises can navigate the complexity of BaaS adoption and secure a differentiated market position.

Detailing the Research Methodology Employed to Analyze Blockchain-as-a-Service Markets Including Data Collection Analysis Framework and Validation Protocols

Our analysis combines primary and secondary research methodologies to ensure a robust and unbiased perspective on the BaaS landscape. Primary data was collected through in-depth interviews with C-level executives, blockchain architects, and procurement specialists across key industries. These interviews provided firsthand insights into deployment challenges, use-case prioritization, and future roadmap considerations.

Supplementing this, secondary research encompassed a comprehensive review of technical white papers, regulatory filings, industry consortium guidelines, and academic publications to contextualize emerging standards and governance frameworks. Data triangulation was conducted by cross-referencing provider announcements, technology benchmarks, and case study outcomes. A multi-tiered validation protocol was employed, involving expert advisory panels and peer reviews to confirm the accuracy and relevance of findings.

Analytical frameworks such as SWOT and PESTEL were applied to evaluate vendor capabilities, regulatory environments, and market drivers. This structured approach ensures that conclusions and recommendations are grounded in empirical evidence and reflect the operational realities faced by enterprises deploying BaaS solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blockchain-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blockchain-as-a-Service Market, by Component

- Blockchain-as-a-Service Market, by Organization Size

- Blockchain-as-a-Service Market, by Deployment Model

- Blockchain-as-a-Service Market, by Application

- Blockchain-as-a-Service Market, by End User Industry

- Blockchain-as-a-Service Market, by Region

- Blockchain-as-a-Service Market, by Group

- Blockchain-as-a-Service Market, by Country

- United States Blockchain-as-a-Service Market

- China Blockchain-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights and Forward-looking Perspectives on Blockchain-as-a-Service Evolution to Guide Strategic Decision-making and Enterprise Investments

This executive summary has synthesized the current state and future trajectory of Blockchain-as-a-Service, highlighting the crucial technological shifts, tariff-induced cost dynamics, and the strategic insights derived from segmentation and regional adoption patterns. By examining both global cloud providers and niche blockchain specialists, we have identified the competitive differentiators and innovation pathways that define the BaaS ecosystem.

Enterprises now face a strategic inflection point: embracing BaaS can unlock new efficiencies in contract automation, cross-border transactions, and decentralized identity management, yet success hinges on clear governance, talent enablement, and judicious selection of deployment models. The evolving regulatory landscape and sustainability imperatives further underscore the need for adaptable strategies and continuous innovation.

Looking ahead, organizations that proactively engage with these insights and cultivate collaborative partnerships will secure a sustainable advantage, positioning themselves as leaders in the next era of digital services.

Engage with Ketan Rohom Associate Director Sales & Marketing to Discover the Blockchain-as-a-Service Market Research Report That Delivers a Strategic Advantage

To access the comprehensive market research report that will equip your organization with unparalleled strategic insights and a clear roadmap for Blockchain-as-a-Service adoption, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in aligning cutting-edge technology research with enterprise objectives ensures you will receive a tailored consultation that addresses your unique challenges and objectives. By engaging with Ketan, you gain early access to executive briefings, customized data dashboards, and priority support for implementation guidance. Secure your competitive edge today by exploring how this in-depth report will accelerate your strategic planning and drive measurable outcomes in your Blockchain-as-a-Service initiatives.

- How big is the Blockchain-as-a-Service Market?

- What is the Blockchain-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?