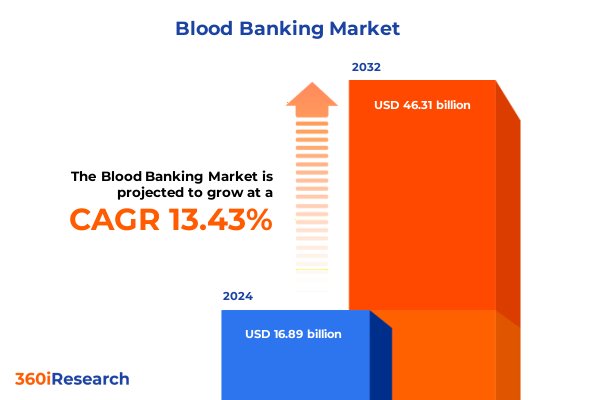

The Blood Banking Market size was estimated at USD 19.15 billion in 2025 and expected to reach USD 21.40 billion in 2026, at a CAGR of 13.44% to reach USD 46.31 billion by 2032.

Navigating the Modern Blood Banking Ecosystem Amidst Technological Advances and Evolving Healthcare Demands to Set the Stage for Informed Decision-Making

The contemporary blood banking environment has become increasingly complex as healthcare systems strive to balance the demands of patient safety, supply reliability, and technological advancement. Rising rates of chronic illness and an aging population have elevated the need for diverse blood products, requiring operators to adopt more sophisticated processing and storage techniques. Meanwhile, emerging threats-such as novel pathogens and supply chain disruptions-underscore the importance of resilient quality control frameworks. Against this backdrop, stakeholders from collection centers to clinical laboratories are embracing digital transformation and data-driven decision making to enhance traceability and streamline operations.

Transitioning from legacy manual workflows, many facilities are investing in integrated blood management platforms that facilitate real-time monitoring of inventory status, cold chain conditions, and donor records. At the same time, precision medicine initiatives are driving demand for specialized components like cryoprecipitate and pathogen-reduced products, increasing the complexity of production and distribution networks. Regulatory bodies have responded with updated guidelines and inspection protocols to uphold safety without stifling innovation, setting the stage for a dynamic interplay between public policy, technological capability, and market forces. This introduction establishes the foundational themes of innovation, operational resilience, and collaboration that permeate this report, equipping decision makers with a clear understanding of the current blood banking ecosystem.

Emerging Technological Innovations and Policy Developments Reshaping Blood Collection Processing Testing and Distribution Paradigms Across the Industry

Recent years have witnessed unprecedented shifts in how blood products are collected, tested, and distributed. Automation technologies ranging from robotic sample handlers to AI-driven donor eligibility algorithms are reshaping front-end operations, reducing human error and accelerating turnaround times. Concurrently, advancements in cold chain logistics-including IoT-enabled temperature tracking and modular storage solutions-have enhanced the reliability of sensitive components such as platelets and plasma during transit.

Policy changes have kept pace with technological strides, as regulatory agencies adopt risk-based inspection models and harmonized standards for pathogen reduction systems. The adoption of point-of-care blood grouping platforms is expanding diagnostic reach into remote care settings, enabling faster decision making in clinics and ambulatory surgical centers. In parallel, research laboratories are leveraging high-throughput screening techniques to explore novel therapies and transfusion protocols, further catalyzing development pipelines. These transformations are converging to redefine stakeholder expectations around quality, cost efficiency, and service level agreements, ultimately driving a more interconnected and responsive blood banking landscape.

Analyzing the Effects of New Tariff Policies on Blood Banking Equipment Consumables Materials and Cross Border Supply Chains in 2025

In 2025, the implementation of new import tariffs on medical equipment and consumables in the United States introduced significant considerations for blood banking operators and suppliers. Tariffs on critical apheresis machines and testing reagents have incrementally increased procurement costs, prompting providers to reassess vendor relationships and negotiate volume-based pricing agreements. At the same time, domestic manufacturers are exploring capacity expansions to capitalize on reshoring incentives, aiming to mitigate exposure to cross-border duties and improve supply chain predictability.

Healthcare networks and independent blood banks have responded by diversifying their sourcing strategies, blending domestic production with select tax-exempt imports under specialized tariff exclusion programs. This recalibration has led to pilot partnerships between technology providers and regional distributors, focusing on co-development agreements that align incentives around localized manufacturing. While higher input costs have necessitated incremental price adjustments in service contracts with hospitals and clinics, the industry as a whole is benefiting from reduced lead times and enhanced transparency in cost structures. These shifts underscore the nuanced interplay between fiscal policy and operational strategy shaping blood banking in the current regulatory climate.

Uncovering Critical Patterns Across Product Applications User Environments Testing Protocols Collection Methods and Donor Profiles Influencing Market Dynamics

A nuanced understanding of how diverse market segments interact is critical for stakeholders seeking to optimize their blood banking strategies. When examining the spectrum of product offerings, it becomes apparent that entities handling highly specialized components like cryoprecipitate and plasma require customized storage and inventory protocols distinct from those used for platelets, red blood cells, or whole blood. Such differentiation drives tailored investments in temperature-controlled units, automated mixers, and pathogen reduction systems suited to each product’s specific stability requirements.

Furthermore, the end uses of blood products in diagnostics, research, and transfusion create divergent demand patterns. Research institutions increasingly call for high-throughput screening assays for novel therapeutics, while transfusion services emphasize rapid compatibility testing and robust grouping platforms. Ambulatory surgical centers, centralized blood banks, and hospitals and clinics each maintain unique throughput volumes and regulatory compliance landscapes, influencing their purchasing priorities and service agreements. Threat detection protocols exemplify this, as blood grouping testing routines are supplemented by comprehensive infectious disease testing in higher-volume centers.

Collection methodology also plays a pivotal role, with apheresis procedures favored by specialty centers for precise component harvesting, while whole blood collection remains predominant in community drives due to logistical simplicity. Equally important is donor typology: voluntary altruistic donors underpin most routine supply channels, whereas family replacement and paid donors frequently support urgent or niche requirements. Each donor cohort demands specialized outreach, screening, and post-donation care pathways, shaping resource allocation across blood banking operations.

This comprehensive research report categorizes the Blood Banking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Type

- Collection Method

- Donor Type

- Application

- End User

Assessing the Divergent Blood Banking Trends Regulatory Frameworks and Infrastructure Strengths Across the Americas EMEA and Asia Pacific Regions

Regional characteristics exert profound influence over blood banking capabilities and strategic priorities. In the Americas, an established infrastructure of centralized blood centers and integrated healthcare networks supports advanced processing and distribution models. This region’s maturity enables swift adoption of digital donor management systems and cross-state coordination programs, enhancing inventory resilience while maintaining stringent safety standards.

Within Europe, the Middle East, and Africa, regulatory heterogeneity presents both challenges and opportunities. European nations often align with stringent EU guidelines, fostering robust quality assurance, whereas select Middle Eastern markets are investing heavily in state-of-the-art collection facilities to reduce reliance on imports. In parts of Africa, capacity gaps drive collaborative initiatives between public health agencies and private partners to expand screening for emerging pathogens, ensuring safer donor pools and bolstering regional self-sufficiency.

Asia-Pacific is characterized by rapid infrastructure expansion alongside evolving regulatory frameworks. Nations such as China and India are prioritizing domestic manufacturing of key consumables, while Australia and Japan lead in adopting next-generation diagnostic platforms. Strategic alliances between regional manufacturers and global technology leaders are accelerating the transfer of automation and cold chain expertise. Across these geographies, tailored approaches to training, donor mobilization, and data integration are critical for sustaining growth and meeting rising demand for versatile blood products.

This comprehensive research report examines key regions that drive the evolution of the Blood Banking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Innovators and Strategic Collaborators Shaping Blood Banking Through Advanced Technologies Partnerships and Service Offerings

Leading corporations and emerging innovators alike are driving progress through a combination of technological breakthroughs, partnership models, and service diversification. Terumo BCT continues to advance automated collection and processing solutions, focusing on expanding its apheresis platform footprint through collaborative agreements with regional distributors. Haemonetics has deepened its presence in the diagnostics space with integrated blood transfusion management software, aiming to streamline clinical workflows and regulatory reporting across hospital networks.

Meanwhile, Cerus Corporation has advanced pathogen reduction methods, targeting broader adoption of its photochemical treatment systems within high-volume blood centers. European-based Macopharma is strategically investing in plasma fractionation technologies and forging alliances to bolster its geographic reach. Grifols, with its established plasma collection network, has accelerated capacity expansions and research partnerships to support novel immunoglobulin therapies. On the specialized end, BioLife Solutions is enhancing bio-storage capabilities with advanced cryogenic systems optimized for long-term component preservation.

Collectively, these organizations exemplify the trend toward integration of hardware, software, and service offerings. Through joint development programs, strategic equity stakes, and value-based service models, key players are reshaping competitive dynamics and positioning themselves to meet the complex demands of modern blood banking.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Banking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Baxter International Inc.

- Beckman Coulter, Inc.

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Cardinal Health, Inc.

- Cerus Corporation

- F. Hoffmann-La Roche Ltd

- Fresenius Kabi AG

- Grifols S.A.

- Haemonetics Corporation

- ICU Medical, Inc.

- Immucor, Inc.

- Macopharma SA

- Nipro Corporation

- QuidelOrtho Corporation

- Sarstedt AG & Co. KG

- Siemens Healthineers AG

- Terumo BCT, Inc.

- Thermo Fisher Scientific Inc.

Strategic Measures for Market Participants to Enhance Operational Resilience Optimize Supply Chains and Drive Sustainable Growth in Blood Banking

Industry leaders should prioritize end-to-end process automation to mitigate error rates and enhance throughput in donor screening, collection, testing, and distribution. Investing in modular robotics and AI-augmented workflow orchestration can unlock efficiencies that drive down per-unit handling costs while elevating compliance with regulatory mandates. In parallel, strengthening relationships with multiple suppliers-balancing domestic manufacturing partners with selective imports-can insulate operations from tariff fluctuations and logistics bottlenecks.

Emphasizing data interoperability across clinical and operational systems will be critical for achieving real-time visibility into inventory levels, transfusion outcomes, and safety metrics. Organizations are encouraged to pursue secure, cloud-based platforms that facilitate cross-facility collaboration and predictive analytics for demand forecasting. Cultivating a robust pipeline of voluntary donors through targeted outreach campaigns and community partnerships will also help stabilize supply, reducing reliance on replacement and paid donor channels.

Finally, forging alliances with software developers, equipment manufacturers, and research institutions can accelerate iterative innovation in testing methodologies and pathogen inactivation. By adopting value-based contracting models, blood centers and end users alike can align incentives around outcomes rather than transaction volumes, fostering long-term sustainability and improved patient care across the evolving healthcare landscape.

Employing Rigorous Qualitative Quantitative and Secondary Research Techniques to Deliver Comprehensive and Reliable Blood Banking Market Insights

The insights presented in this report derive from a meticulously structured research framework encompassing both primary and secondary methodologies. Extensive interviews were conducted with blood center executives, laboratory directors, procurement officers, and clinical specialists to capture first-hand perspectives on operational challenges, technology adoption patterns, and evolving regulatory priorities. In parallel, data from public health agencies, regulatory filings, and industry consortia informed a comprehensive secondary research effort, ensuring alignment with current standards and published benchmarks.

Analysts applied quantitative techniques to assess equipment usage rates, testing volumes, and supply chain metrics, integrating these findings through rigorous data triangulation to validate key trends. Qualitative thematic analysis was used to contextualize the strategic rationales of leading companies, drawing out common success factors and potential pitfalls. Throughout the process, expert panels comprising regulatory specialists, technology developers, and clinical practitioners reviewed interim findings to enhance accuracy, relevance, and applicability. This layered approach ensures that the conclusions and recommendations delivered are both empirically grounded and forward-looking, equipping decision makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Banking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Banking Market, by Product Type

- Blood Banking Market, by Testing Type

- Blood Banking Market, by Collection Method

- Blood Banking Market, by Donor Type

- Blood Banking Market, by Application

- Blood Banking Market, by End User

- Blood Banking Market, by Region

- Blood Banking Market, by Group

- Blood Banking Market, by Country

- United States Blood Banking Market

- China Blood Banking Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications to Guide Decision Makers in Blood Banking Towards Future Growth and Innovation

In synthesizing the key themes of this report, it is clear that the future of blood banking will hinge on the successful integration of advanced technologies, resilient supply chain strategies, and nuanced market segmentation. Organizations that harness automation and digital platforms across collection, testing, and distribution will be best positioned to adapt to evolving safety standards and fluctuating demand. Moreover, understanding the divergent needs of diagnostics, research, and transfusion applications-as well as regional regulatory landscapes-enables more precise targeting of resources and service models.

Strategic collaborations among technology providers, service operators, and regulatory bodies will be instrumental in fostering innovation and driving broader adoption of next-generation solutions. By balancing domestic production capabilities with selective import strategies, stakeholders can navigate tariff environments and logistical complexities without compromising quality or cost efficiency. Ultimately, the stakeholders that align their operational roadmaps with the emerging trends identified here-embracing data-driven decision making, prioritizing voluntary donor recruitment, and pursuing value-based partnerships-will secure competitive advantage and deliver superior patient outcomes in a rapidly changing healthcare paradigm.

Partner with Ketan Rohom to Access In Depth Blood Banking Insights and Propel Your Organization’s Strategic Initiatives with Tailored Research Solutions

To secure the depth of insight and strategic clarity contained in this comprehensive report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing who brings extensive expertise in blood banking research and client engagement. By partnering with him, you will gain access to tailored analysis on product innovations, tariff impacts, regional dynamics, and actionable strategies designed to strengthen your organization’s competitive position. Whether you need further customization, executive briefings, or supplemental data sets, Ketan is prepared to align our research deliverables with your specific requirements. Don’t miss the opportunity to equip your leadership teams with the critical intelligence necessary to navigate an evolving blood banking environment with confidence and foresight. Contact Ketan today to purchase the full report and start transforming data into decisive action that drives sustainable growth and operational excellence

- How big is the Blood Banking Market?

- What is the Blood Banking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?