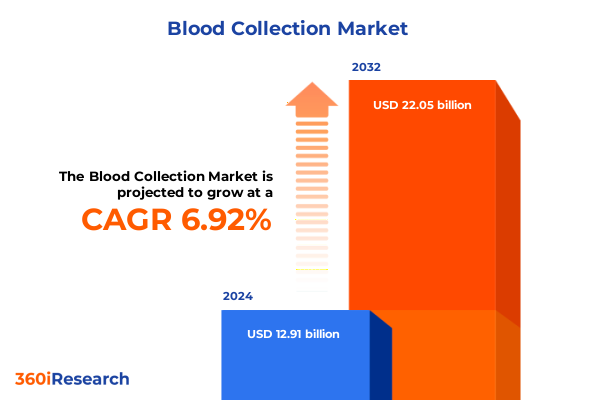

The Blood Collection Market size was estimated at USD 13.59 billion in 2025 and expected to reach USD 14.32 billion in 2026, at a CAGR of 7.15% to reach USD 22.05 billion by 2032.

Understanding the Blood Collection Landscape’s Emerging Drivers and Foundational Shifts Shaping Quality and Operational Excellence

The global blood collection landscape has undergone profound changes driven by escalating demand for accurate diagnostics and an intensified focus on patient safety. As healthcare systems worldwide seek to streamline workflows, blood collection processes have evolved from manual, time-consuming procedures to integrated, automated solutions that enhance throughput and minimize error. These shifts reflect a convergence of clinical necessity and technological innovation, as laboratories and care providers strive to deliver precise results with rapid turnaround times while mitigating risks associated with specimen handling and contamination.

Heightened regulatory oversight and strengthened safety mandates have positioned blood collection as a critical control point within the diagnostic value chain. Agencies have introduced stringent guidelines for device sterility, sharps management, and material biocompatibility, accelerating the adoption of safety needles and closed-system technologies that protect both healthcare workers and patients. At the same time, the aftermath of recent global health crises has laid bare vulnerabilities in supply networks, underscoring the need for robust sourcing strategies and domestic manufacturing capabilities to ensure uninterrupted access to vital consumables.

Against this backdrop, the market is witnessing a surge of investment in R&D and collaborative partnerships aimed at next-generation solutions. From smart vacuum tubes with traceable barcodes to ergonomic lancets engineered for minimal discomfort, the latest offerings demonstrate a clear shift toward patient-centric design and seamless data integration. As the industry charts the path forward, stakeholders must navigate a complex interplay of regulatory requirements, technological advances, and evolving end-user preferences to capture sustainable value and drive clinical excellence.

Revolutionizing Blood Collection Protocols through Integration of Advanced Safety Mechanisms and Digital Connectivity Enhancements

Technological innovation has radically transformed traditional blood collection workflows, pivoting the industry toward integrated platforms that reduce manual intervention and elevate data fidelity. Closed systems equipped with automated needle retraction and contamination safeguards are displacing open systems in high-volume environments, reinforcing safety standards and accelerating sample processing. Meanwhile, the integration of IoT-enabled devices is streamlining inventory management, offering real-time visibility into stock levels and enabling just-in-time replenishment across ambulatory care centers and diagnostic laboratories.

Concurrently, user demand has driven a dramatic uptick in safety needle adoption, with healthcare providers prioritizing devices that shield against needle-stick injuries. Manufacturers have responded with ergonomic designs that balance ease of use with superior patient comfort, underscored by single-handed activation mechanisms and low-pain lancet profiles. The emergence of high-performance plastic vacuum tubes, favored for their break-resistant properties, is reshaping procurement strategies previously dominated by glass counterparts, thereby mitigating shipping risks and regulatory hurdles associated with material fragility.

The home care segment has also emerged as a focal point for innovation, as remote monitoring and at-home diagnostics gain traction among chronically ill and elderly populations. Open systems tailored for layperson use are being reengineered with intuitive interfaces and color-coded components to minimize user error. This democratization of blood collection heralds new revenue streams and service models, prompting established players to forge partnerships with digital health providers and telemedicine platforms to deliver end-to-end virtual care solutions.

Evaluating the Far-Reaching Consequences of 2025 United States Tariff Revisions on Blood Collection Supply Chain Resilience

In early 2025, the introduction of revised United States tariffs on imported blood collection consumables introduced new cost pressures across the supply chain. Duties on essential items such as syringes, needles, and vacuum tube systems triggered a ripple effect, compelling procurement teams to reevaluate sourcing strategies and negotiate alternative supplier agreements. These adjustments underscored the fragility of lean inventory models and prompted enterprises to expand buffer stock levels, absorb elevated landed costs, and reassess global distribution footprints to mitigate tariff impacts.

Domestic manufacturers responded by scaling production capabilities and investing in advanced injection molding and glass-forming technologies to capture rising demand for locally produced vacuum tubes and accessories. In parallel, cross-sector alliances emerged, targeting supply diversification through co-development of components and shared logistical infrastructures. Although nearshoring initiatives reduced dependency on transpacific shipments, associated capital expenditures on tooling and quality certification slowed time to market and necessitated incremental capital deployment.

Despite these challenges, the realignment of tariff-induced cost structures has yielded unexpected benefits. Strengthened relationships between original equipment manufacturers and regional distributors have accelerated collaborative forecasting and risk-sharing models. Moreover, companies that proactively strategized around tariff shifts have achieved improved cost predictability and reinforced supply chain resilience, positioning themselves to navigate future policy fluctuations with greater agility.

Uncovering Critical Adoption Trends across Product Types Technologies End Users and Applications that Drive Market Differentiation

The blood collection market reveals distinct patterns when analyzed through the lens of product type, technology, end user, and application. Accessories and lancets, often perceived as ancillary, are powering operational efficiencies in high-throughput hospitals and research institutes by enabling standardized sample handling kits. In the syringes and needles segment, the bifurcation into needles and syringes illuminates divergent growth drivers: safety needles commanding premium adoption rates in ambulatory care centers, while standard needles maintain strong demand in regions with cost sensitivity. Further subsegmentation highlights that safety needles are increasingly preferred in hospital settings, reflecting regulatory imperatives to prevent occupational hazards, whereas glass and plastic vacuum tube system preferences are driven by trade-offs between material durability and cost effectiveness.

From a technology standpoint, closed systems are becoming the benchmark in clinical diagnostics laboratories, owing to their contamination control and integrated fluid management capabilities. Open systems retain relevance in home care environments, where simplicity and user familiarity are paramount. End users are charting unique trajectories: research institutes prioritize customization and minimal sample cross-contamination for biomarker discovery, whereas diagnostic laboratories focus on throughput and interoperability with laboratory information systems. Home care providers, on the other hand, are gravitating toward user-friendly kits that align with telehealth workflows.

Application segmentation further uncovers nuanced demands: blood banking operations require high-volume, consistent supply chains and robust cold-chain compliance, while clinical diagnostics emphasize sample integrity and traceability. The research segment, driven by the expansion of precision medicine and translational studies, is fostering demand for specialized collection systems that accommodate emerging assays and complex bioanalytical requirements.

This comprehensive research report categorizes the Blood Collection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Analyzing Regional Disparities and Harmonized Regulatory Frameworks Influencing Global Blood Collection Adoption Patterns

Regional dynamics in the blood collection arena vary significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific regions, reflecting diverse regulatory frameworks and healthcare infrastructure maturity. In the Americas, the United States leads with a strong emphasis on domestic production and compliance with FDA quality mandates, while Latin American nations are witnessing steady uptake driven by expanding diagnostic networks and increased public-private partnerships. Supply chain networks in this region are gradually shifting toward localized distribution hubs to reduce lead times and buffer against geopolitical disruptions.

Europe Middle East & Africa is characterized by harmonized regulations under the European Union’s In Vitro Diagnostic Regulation, which mandates rigorous performance evaluations and post-market surveillance. This regulatory rigor has catalyzed a preference for safety-certified devices and closed systems, particularly in Western Europe. Meanwhile, Middle Eastern markets are investing in advanced medical infrastructure to support burgeoning medical tourism, and African demand is propelled by international aid programs targeting blood safety and infectious disease screening.

The Asia-Pacific region presents a heterogeneous landscape, where mature markets like Japan and Australia favor cutting-edge innovations, including IoT-connected vacuum tube systems, while emerging economies in Southeast Asia and South Asia compete largely on cost and scalability. Rapid hospital network expansions in China and India are driving bulk procurement of syringes and needles, with plastic vacuum tubes gaining favor due to breakage concerns in long-distance logistics. Regional manufacturers are forging strategic alliances to co-develop products that meet both local affordability requirements and international quality benchmarks.

This comprehensive research report examines key regions that drive the evolution of the Blood Collection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Emerging Innovators and Collaborative Alliances Shaping the Future of Blood Collection Solutions

A cadre of leading companies is shaping the competitive landscape through an array of strategic initiatives and product innovations. Legacy medical device firms have leveraged their manufacturing scale to introduce next-generation safety needle portfolios complemented by closed-system vacuum tube technologies. These organizations are investing in fortified supply networks and modular automation platforms that cater to high-throughput laboratories and hospital procurement preferences.

In parallel, emerging players are carving niche positions by specializing in advanced polymer formulations for break-resistant blood collection tubes and ergonomic lancets optimized for home care applications. Partnerships with digital health providers have enabled the integration of sample tracking software and cloud-based analytics, enhancing traceability and operational transparency. Collaborative research agreements with academic institutions and contract research organizations have accelerated the development of specialized collection devices for novel biomarkers and point-of-care diagnostics.

Strategic mergers and acquisitions have also played a pivotal role in consolidating capabilities, as companies seek to broaden their geographic footprint and assemble end-to-end solution portfolios. Joint ventures focused on additive manufacturing and robotics underscore a collective push toward automated, high-precision blood collection systems. These alliances not only optimize production efficiencies but also align cross-functional expertise to address evolving clinical demands and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Collection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- CSL Limited

- Danaher Corporation

- Fresenius Kabi AG

- Greiner Bio-One International GmbH

- Grifols, S.A.

- Haemonetics Corporation

- ICU Medical, Inc.

- Kabe Labortechnik GmbH

- Maco Pharma International GmbH

- Medline Industries, Inc.

- Nipro Corporation

- QIAGEN N.V.

- Sarstedt AG & Co. KG

- Terumo Corporation

- Thermo Fisher Scientific Inc.

Actionable Strategies and Tactical Roadmaps for Leaders to Mitigate External Pressures and Enhance Market Penetration

To maintain competitive differentiation and navigate ongoing tariff pressures, industry leaders should prioritize strategic investments in local manufacturing capacity, ensuring proximity to key end-user markets and reducing exposure to import duties. By establishing flexible production lines capable of rapid tooling adjustments, organizations can adapt swiftly to shifting tariff policies while controlling per-unit costs. Concurrently, forging collaborative agreements with regional distributors and contract manufacturers can distribute risk and foster shared forecasting capabilities that stabilize inventory planning.

Embracing technology integration is essential; companies must develop comprehensive closed-system offerings that incorporate barcode tracking, RFID monitoring, and cloud-based analytics to deliver traceable, real-time insights across the supply chain. This digital transformation will not only improve operational efficiency but also satisfy regulatory demands for end-to-end sample integrity. Additionally, tailoring product portfolios to distinct end-user segments-such as high-throughput laboratories versus home care consumers-will enhance relevance and drive adoption, especially when accompanied by targeted training and customer support programs.

Finally, capitalizing on growth in emerging markets requires localized strategies that balance cost efficiency with quality assurance. Establishing regional R&D hubs and partnering with public health initiatives can facilitate product adaptations that resonate with local needs, enabling market entrants to differentiate through culturally informed value propositions. In doing so, companies will position themselves to capitalize on expanding diagnostic infrastructures and evolving application requirements worldwide.

Detailed Explanation of Research Processes Data Sources and Analytical Techniques Underpinning the Blood Collection Study

This study employs a comprehensive research framework combining primary and secondary data sources to ensure robustness and validity. Primary insights were gathered through in-depth interviews with procurement managers, laboratory directors, and clinical experts across major healthcare institutions. These qualitative perspectives were supplemented by a proprietary survey capturing end-user preferences and purchasing criteria for blood collection consumables and systems.

Secondary data was meticulously sourced from regulatory filings, government health agency reports, peer-reviewed journals, and industry association publications. Information on tariff policies and trade regulations was validated against official U.S. trade commission records and international trade databases. Vendor financial disclosures and press releases provided additional context on strategic partnerships, product launches, and corporate expansions.

Analytical methodologies included cross-verification of market trends through data triangulation, scenario analysis of tariff impact models, and segmentation-based frameworks that dissect product type, technology, end-user, and application dynamics. Regional analyses were conducted to capture regulatory disparities and infrastructure maturity levels. Finally, draft findings were subjected to expert review panels comprising industry veterans and academic researchers to refine insights and confirm practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Collection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Collection Market, by Product Type

- Blood Collection Market, by Technology

- Blood Collection Market, by Application

- Blood Collection Market, by End User

- Blood Collection Market, by Region

- Blood Collection Market, by Group

- Blood Collection Market, by Country

- United States Blood Collection Market

- China Blood Collection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Empower Stakeholders in Blood Collection Advancement

The collective insights underscore a rapidly evolving blood collection landscape shaped by safety enhancements, technological convergence, and shifting policy frameworks. Regulatory imperatives and heightened safety standards are accelerating the migration toward closed systems and safety needle adoption, while the rise of home care diagnostics is diversifying end-user requirements. Compounding these dynamics, new 2025 tariff regulations have prompted a reevaluation of sourcing strategies and emphasized the strategic value of domestic manufacturing capabilities.

Segmentation analysis reveals that distinct product types and technologies cater to nuanced clinical and operational demands, with research institutes driving specialized device adoption and hospitals prioritizing high-throughput solutions. Regional variances further highlight the need for tailored go-to-market approaches, as regulatory rigor and infrastructure readiness differ markedly between the Americas, Europe Middle East & Africa, and Asia-Pacific. Competitive landscapes continue to be reshaped through strategic alliances, M&A activity, and digital integration efforts that connect device performance with data analytics.

Taken together, these findings point to a market that rewards agility, innovation, and collaborative ecosystems. Stakeholders equipped to harmonize safety, efficiency, and regulatory compliance-while adapting to external pressures-are best positioned to unlock growth and deliver sustained value in the next phase of blood collection evolution.

Engage with Ketan Rohom Associate Director Sales & Marketing to Acquire the Definitive Blood Collection Market Research Report for Strategic Advantage

To secure comprehensive insights and empower data-driven decisions, reach out to Ketan Rohom, Associate Director, Sales & Marketing, for immediate access to the full blood collection market research report. This in-depth analysis is designed to guide strategic initiatives, optimize supply chain resilience, and capitalize on emerging opportunities. Engage now to harness evidence-based recommendations that will shape your competitive advantage and unlock long-term value.

- How big is the Blood Collection Market?

- What is the Blood Collection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?