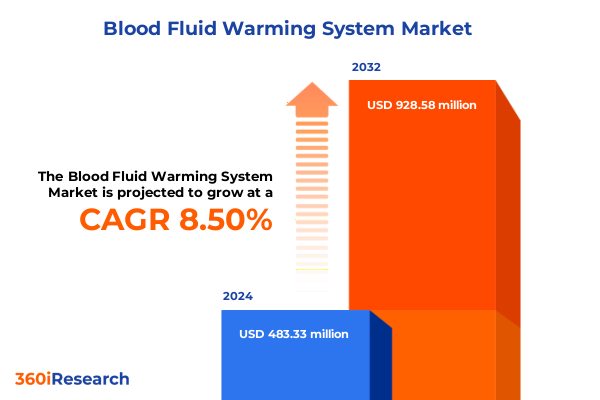

The Blood Fluid Warming System Market size was estimated at USD 524.93 million in 2025 and expected to reach USD 575.33 million in 2026, at a CAGR of 8.48% to reach USD 928.57 million by 2032.

Opening the landscape of blood fluid warming systems by exploring foundational clinical drivers, technological evolution, and patient safety imperatives

The clinical management of patient body temperature during fluid administration has emerged as a critical component of perioperative and emergency care. Blood fluid warming systems have evolved from rudimentary warming blankets to sophisticated inline devices capable of precisely controlling infusion temperatures in real time. This introduction explores the foundational clinical drivers that have propelled adoption, underscoring the imperative to maintain normothermia, reduce infection risk, and improve patient outcomes across diverse care settings.

As demand for minimally invasive procedures has grown, practitioners have sought solutions that balance efficacy with ease of integration into existing workflows. Recent advancements in device ergonomics and automation have facilitated seamless adoption by multidisciplinary teams. The convergence of user-centric design and technological innovation sets the stage for more personalized warming strategies, minimizing intraoperative hypothermia and its associated complications.

In parallel, economic considerations have influenced procurement strategies, prompting facilities to weigh device efficiency against capital and operating expenses. Stakeholders now evaluate total cost of ownership in the context of regulatory compliance and reimbursement pathways, reinforcing the strategic importance of optimized warming technologies.

Looking ahead, the ability to tailor warming protocols to individual patient profiles will become increasingly important. Continuous improvement in temperature monitoring algorithms and integration with electronic health record systems promises to drive further gains in safety and efficiency. This introduction establishes the clinical context and highlights the evolving priorities that shape the landscape of blood fluid warming solutions.

Highlighting transformative shifts in clinical practices, regulatory frameworks, and technology breakthroughs reshaping blood fluid warming system performance

Healthcare delivery paradigms have shifted dramatically in recent years, prompting a reevaluation of how warming systems integrate with dynamic care pathways. Surgeons and anesthesiologists now demand precision across the entire spectrum of fluid management, while regulatory authorities have imposed more stringent guidelines on temperature control to safeguard patient safety. Consequently, device manufacturers have redirected development efforts toward solutions that seamlessly align with these heightened expectations.

Moreover, regulatory frameworks issued by entities such as the U.S. Food and Drug Administration and analogous agencies internationally have introduced new standards for device qualification and performance validation. These frameworks place greater emphasis on real-world evidence, driving investments in clinical trials and post-market surveillance. As a result, stakeholders must now navigate complex approval pathways while concurrently demonstrating tangible clinical benefits, fostering a more evidence-driven innovation cycle.

Technological breakthroughs have further accelerated market evolution. Integration of advanced sensor arrays and predictive analytics into warming cabinets and inline units enables adaptive temperature regulation in response to patient-specific variables. These capabilities enhance treatment precision and reduce the risk of thermal injury or infusion-related complications. In turn, healthcare providers can streamline workflows, consolidate monitoring tasks, and achieve greater confidence in procedural outcomes.

In addition, partnerships between technology firms and clinical research institutions have spurred iterative enhancements, fostering a collaborative ecosystem of continuous improvement. As these alliances deepen, the pace of innovation is set to accelerate, reshaping the competitive landscape and establishing new benchmarks for device performance and patient-centered care.

Assessing the cumulative impact of newly enacted United States tariffs on blood fluid warming system components and supply chains throughout 2025

The implementation of targeted U.S. tariffs on medical device components during 2025 has introduced new challenges for manufacturers and distributors alike. Import duties applied to specialized tubing, resistive wire elements, and modular heating units have elevated input costs, sparking strategic reassessments of global procurement models. In response, several suppliers have explored options ranging from localizing component manufacturing to renegotiating vendor contracts, seeking to preserve margin profiles while maintaining uninterrupted service delivery.

These tariff-driven cost pressures have illustrated the delicate interplay between trade policy and clinical operations. Hospitals and ambulatory facilities, faced with potential cost pass-through to purchasing budgets, are evaluating their inventory management methodologies and exploring consignment models to mitigate immediate financial impact. Concurrently, some regional distributors have shifted emphasis toward domestic assembly capabilities, accelerating nearshoring initiatives that promise reduced lead times and enhanced supply chain resilience against future tariff fluctuations.

Meanwhile, the broader supply ecosystem has witnessed a diversification of sourcing strategies. Suppliers are forging strategic alliances with regional partners to establish alternative supply corridors. This realignment not only alleviates the risk of punitive tariffs but also cultivates redundancy within the logistics network, enabling more agile responses to geopolitical developments. In turn, care providers benefit from improved availability of critical warming devices and consumables.

Looking forward, the cumulative influence of these tariffs will likely shape competitive positioning and market entry strategies. Organizations that proactively recalibrate their manufacturing footprints, optimize inventory practices, and fortify supplier relationships stand to navigate the evolving policy landscape more effectively, thereby safeguarding continuity of care and fostering sustainable growth.

Unveiling segmentation insights highlighting opportunities within product offerings, technological platforms, clinical care pathways, and end user settings

An in-depth examination of market segmentation reveals diverse pathways through which providers and manufacturers can capitalize on evolving clinical demands. Analysis by product category highlights the role of Accessories that support warming units, the significance of Consumables that deliver single-use sterile interfaces, and the paramount importance of Systems themselves. Within this latter category, both standalone Fluid Warming Cabinets designed for batch preparation and Inline Fluid Warmers engineered for point-of-care integration command significant attention due to their distinct clinical applications and workflow alignments.

Transitioning to an evaluation based on technological platforms, Dry Heat devices offer simplicity and reduced maintenance requirements, whereas Water Bath solutions provide consistent thermal exchange at the expense of additional fluid management protocols. Of particular note, Resistive Wire technologies have emerged as a hybrid offering, with Single Wire configurations providing uniform heat distribution and Dual Wire systems delivering enhanced safety redundancies and rapid thermal response. Manufacturers continue to invest in optimizing these modalities, driving incremental improvements in energy efficiency and user interface design.

Application-focused segmentation underscores the critical role of these systems across three primary care environments. In Critical Care settings, precision temperature control mitigates complications for vulnerable patient populations. During Emergency interventions, rapid ramp-up times and compact form factors become essential to address acute hypothermia risks. Within Intraoperative suites, seamless integration with surgical workflows and centralized monitoring platforms ensures that multidisciplinary teams maintain uninterrupted oversight of infusion temperatures.

Finally, end user dynamics shape adoption patterns, with Ambulatory Surgical Centers seeking cost-effective and mobile solutions, Hospitals demanding enterprise-grade performance and interoperability, and Specialty Clinics prioritizing device versatility and ease of use. These differentiated needs guide product development roadmaps and marketing strategies, enabling stakeholders to tailor offerings to specific care delivery environments.

This comprehensive research report categorizes the Blood Fluid Warming System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Providing key regional insights into market dynamics across the Americas, Europe, Middle East and Africa, and Asia-Pacific healthcare ecosystems

A regional perspective illuminates the nuanced interplay between healthcare infrastructure maturity and adoption of warming system technologies. In the Americas, advanced healthcare networks in the United States and Canada drive demand for integrated warming cabinets and next-generation inline devices. Established reimbursement frameworks and rigorous quality standards fuel investment in devices that offer comprehensive monitoring features and remote connectivity, enabling care teams to proactively manage patient thermal status across perioperative and critical care pathways.

In Europe, Middle East and Africa, market dynamics are shaped by diverse regulatory environments and a mosaic of public and private healthcare funding models. Western European nations prioritize stringent device certifications and robust clinical validation, while emerging economies in Eastern Europe, the Middle East, and Africa focus on cost containment and scalable solutions. As a result, manufacturers often adopt dual branding strategies, offering premium systems alongside more cost-effective variants to accommodate heterogeneous purchasing criteria and varied resource availability.

The Asia-Pacific region exhibits significant project-based growth, driven by increasing healthcare infrastructure investments and rising surgical volumes in countries such as China and India. Government-led initiatives aimed at expanding surgical capacity and improving perioperative safety have catalyzed procurement of larger warming cabinets in tertiary care centers. Simultaneously, the proliferation of specialty clinics in urban areas has spurred demand for compact inline warmers that facilitate efficient patient turnover and reduce the risk of procedure-related hypothermia.

Across all regions, localized support networks and training programs play a pivotal role in technology adoption. Manufacturers that establish robust service capabilities and tailored educational resources not only enhance device uptime but also cultivate deeper customer relationships, thereby reinforcing market penetration and long-term loyalty across geographically diverse healthcare ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Blood Fluid Warming System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining competitive and collaborative strategies among leading companies driving innovation and expansion within the blood fluid warming system domain

The competitive landscape of blood fluid warming systems is marked by a blend of established medical device leaders and innovative specialized firms. Industry incumbents have leveraged extensive global networks to distribute comprehensive warming solutions with integrated monitoring modules and customizable software interfaces. At the same time, agile technology developers concentrate on modular architectures, rapid prototyping, and user-driven refinements, prompting larger organizations to pursue targeted acquisitions and strategic investments in order to maintain leadership positions.

Recent activity underscores a trend toward collaboration and consolidation. Leading firms have formed partnerships with software developers and sensor manufacturers to enrich their offerings with smart analytics, enabling predictive maintenance and remote diagnostics. In parallel, select players have engaged in joint ventures that combine distribution expertise with localized manufacturing capabilities, thereby accelerating time-to-market and optimizing cost structures. These alliances reflect a broader migration from purely hardware-centric models toward end-to-end service platforms.

Moreover, mid-size companies continue to differentiate through specialized application focus. By tailoring fluid warming cabinets for trauma centers and designing inline warmers for interventional radiology, these organizations carve out niche segments that align with specific clinical workflows. This targeted approach has yielded opportunities for premium pricing and deeper integration with clinical protocols, prompting larger rivals to replicate similar strategies or pursue licensing agreements.

In summary, market dynamics are influenced by a combination of scale-driven distribution, technology-led partnerships, and application-specific innovation. Firms that strike the optimal balance between these dimensions, while demonstrating regulatory compliance and clinical efficacy, stand to capture leadership positions and sustain competitive advantage in a rapidly evolving environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Fluid Warming System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acemedical Co., Ltd

- ALC TahatAksi

- ANANDIC MEDICAL SYSTEMS AG

- Barkey GmbH & Co. KG

- Baxter International Inc.

- Belmont Medical Technologies

- Biegler GmbH

- Bio-x

- Braile Biomédica

- EMIT Corporation

- Estill Medical Technologies, Inc.

- GE Healthcare

- Haier Biomedical

- ICU Medical, Inc.

- Keewell Medical Technology Co. Ltd.

- Life Warmer

- MedLume Scientific Co., Ltd.

- MEQU A/S

- Player Name

- Sino Medical-Device Technology Co., Ltd.

- Smisson-Cartledge Biomedical

- Stryker Corporation

- The Surgical Company

- Thermo Fisher Scientific Inc.

- WEG Surgical Solutions LLC

Delivering recommendations enabling industry leaders to optimize strategic investments, navigate regulatory complexities, and foster technology integration

Industry leaders must embrace strategic partnerships with component suppliers and technology integrators to navigate the increasingly complex regulatory and trade environments. Establishing collaborative agreements that secure preferential access to critical raw materials and heating elements can mitigate the cost impacts of fluctuating tariffs. Furthermore, co-development arrangements with software providers can unlock advanced analytics capabilities, enabling predictive temperature control and enhanced patient safety.

In the face of evolving clinical expectations, manufacturers should invest in modular design frameworks that simplify device customization and facilitate rapid configuration for diverse care settings. By adopting agile development methodologies and iterative design sprints, organizations can accelerate product enhancements and incorporate user feedback in real time. This approach not only improves time-to-market but also strengthens alignment with end user requirements, bolstering customer satisfaction and retention.

Additionally, implementing robust supply chain risk management practices is essential. Organizations should diversify sourcing strategies across regional suppliers, verify alternative logistics corridors, and maintain buffer inventories of critical consumables. Coupling these measures with digital supply chain visibility tools will enhance responsiveness to policy shifts and geopolitical developments. Collectively, these recommendations provide a roadmap for decision-makers seeking to optimize operational resilience, foster innovation, and maintain leadership in the blood fluid warming system arena.

Describing a rigorous research methodology that combines comprehensive secondary data analysis with primary interviews to ensure analytical integrity

This analysis employs a structured methodology integrating both secondary and primary research techniques to ensure comprehensive coverage and analytical rigor. Initial data collection drew upon peer-reviewed journals, regulatory filings, and white papers published by professional societies to establish a foundational understanding of device classifications, clinical guidelines, and technology trends. Market participants, competitive benchmarks, and policy developments were further mapped through systematic reviews of product literature and patent databases.

Subsequently, the study engaged with a series of in-depth interviews involving key opinion leaders, including clinicians, biomedical engineers, and procurement managers across diverse healthcare settings. These discussions provided qualitative insights into clinical preferences, device performance attributes, and operational constraints. To validate these findings, quantitative data points were triangulated against distribution metrics and vendor-reported sales information, ensuring consistency between projected demand drivers and real-world adoption patterns.

Throughout the process, strict protocols governed data integrity, encompassing source verification, cross-referencing, and quality control audits. The methodology remains transparent and reproducible, offering stakeholders clear visibility into research assumptions, segmentation criteria, and analytical frameworks. This rigorous approach underpins the credibility and actionable value of the insights presented within this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Fluid Warming System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Fluid Warming System Market, by Product

- Blood Fluid Warming System Market, by Technology

- Blood Fluid Warming System Market, by Application

- Blood Fluid Warming System Market, by End User

- Blood Fluid Warming System Market, by Region

- Blood Fluid Warming System Market, by Group

- Blood Fluid Warming System Market, by Country

- United States Blood Fluid Warming System Market

- China Blood Fluid Warming System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding reflections on the evolving blood fluid warming system landscape underscoring clinical benefits, technology progress, and strategic imperatives

The dynamic landscape of blood fluid warming systems underscores the intersection of clinical necessity, technological advancement, and regulatory evolution. As practitioners prioritize normothermia management to reduce surgical complications, device manufacturers respond with ever more sophisticated warming solutions that integrate intelligent monitoring and streamlined user interfaces. The resulting synergy between clinical demand and engineering innovation drives progressive enhancements in patient care.

Furthermore, the interplay of trade policy, segmentation dynamics, and regional adoption patterns highlights the complexity of market development. Organizations that align their strategic roadmaps with localized regulatory requirements, diversify sourcing approaches, and target specific clinical applications will be best positioned to lead. In this context, the most successful stakeholders are those that adopt a holistic perspective, integrating insights across product categories, technology modalities, and end user environments to achieve sustained differentiation.

Encouraging engagement with an exclusive opportunity to purchase the comprehensive blood fluid warming system market research report through consultation

We invite healthcare executives and procurement professionals to engage in a personalized consultation to explore the full depth of insights contained in this comprehensive study. For tailored discussions on how these findings apply to your organization, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will facilitate access to the detailed report.

Securing this market research report will empower decision-makers with actionable intelligence on clinical trends, technology developments, and strategic imperatives. Contact Ketan Rohom to obtain your copy and gain a competitive advantage in the evolving landscape of blood fluid warming systems.

- How big is the Blood Fluid Warming System Market?

- What is the Blood Fluid Warming System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?