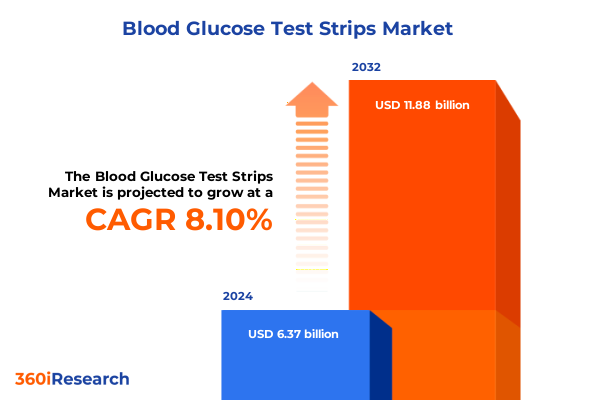

The Blood Glucose Test Strips Market size was estimated at USD 6.83 billion in 2025 and expected to reach USD 7.32 billion in 2026, at a CAGR of 8.23% to reach USD 11.88 billion by 2032.

Revealing the Critical Role of Blood Glucose Test Strips in Evolving Diabetes Care and Market Dynamics for Enhanced Patient Outcomes

The prevalence of diabetes has risen sharply, underscoring the critical importance of reliable blood glucose test strips in both diagnostic and therapeutic contexts. In the United States alone, more than 38 million individuals live with diagnosed diabetes, with an age-adjusted prevalence climbing from 9.7% in 1999–2000 to 14.3% between August 2021 and August 2023, intensifying the demand for accessible and accurate monitoring solutions. Global health dynamics further exacerbate this demand, as recent analyses estimate that over 588 million people worldwide are currently managing diabetes, fueling a pressing need for innovations that enhance patient adherence and outcomes.

Against this backdrop, blood glucose test strips have evolved from simple chemical assays to sophisticated platforms integrating advanced enzyme chemistries, digital connectivity, and predictive algorithms. This executive summary synthesizes the latest market drivers, regulatory influences, competitive strategies, and emerging technological paradigms that collectively shape the blood glucose test strip landscape. By distilling critical insights from primary interviews, industry publications, and regulatory reports, this document offers decision-makers a concise yet comprehensive introduction to the forces driving change in this essential segment of diabetes care.

Exploring the Groundbreaking Paradigm Shifts Reshaping Blood Glucose Test Strip Innovations and Adoption Across Global Healthcare Ecosystems

The blood glucose test strip market is experiencing a paradigm shift driven by converging technological innovations and evolving care models. Continuous glucose monitoring (CGM) technologies, once confined to specialized devices, are now being integrated with traditional test strip platforms to offer hybrid monitoring capabilities that address intermittent and real-time needs simultaneously. This hybridization enhances the flexibility of self-monitoring regimens, enabling patients to optimize therapy adjustments with greater precision and confidence.

Concurrently, artificial intelligence and machine learning algorithms are being woven into glucose monitoring ecosystems, empowering predictive analytics that forecast glycemic excursions before they occur. Collaborations between leading diagnostics firms and technology partners have yielded AI-enabled solutions that fuse sensor data with user behavior, delivering actionable insights to preempt hypoglycemia and hyperglycemia and to inform personalized lifestyle interventions.

Telemedicine adoption and remote patient monitoring frameworks are also reshaping the supply-and-demand equation for test strips, as virtual care providers increasingly prescribe and dispense supplies through digital channels. This digital-first approach not only streamlines patient access but also feeds anonymized usage data back into clinical decision support systems, closing the feedback loop for continuous improvement. Taken together, these transformative shifts are accelerating the adoption of smarter, more interconnected test strip solutions within an ecosystem that values predictive accuracy and seamless patient engagement.

Analyzing the Cumulative Ramifications of 2025 United States Trade Policies on the Blood Glucose Test Strip Supply Chain and Stakeholder Economics

U.S. trade policies implemented under Section 301 have progressively raised tariffs on diagnostic and medical device imports, including components integral to blood glucose test strip manufacturing. Recent tariff increases, effective January 1, 2025, have compounded the cost bases for primary manufacturers that rely on cross-border supply chains, particularly those sourcing reagents, electrode substrates, and assembly services from China and other Asia-Pacific markets.

Financial disclosures from industry leaders highlight the tangible impact of these policy changes. A leading diabetes care company reported that new tariffs could impose a few hundred million dollars in additional costs during the second half of 2025, an expense anticipated to become a persistent margin pressure point in the absence of exemptions. Providers and distributors, in turn, face the challenge of balancing cost recovery with patient affordability, often navigating complex reimbursement frameworks to maintain access.

In response to these headwinds, market participants are diversifying manufacturing footprints, exploring nearshoring options, and engaging with U.S. trade authorities to secure exclusions for medical diagnostics. Despite these efforts, the cumulative effect has been a recalibration of procurement strategies, heightened inventory buffer mandates, and renewed emphasis on lean operational models designed to withstand tariff volatility and safeguard consistent patient supply.

Unlocking Deep Segmentation Insights to Guide Strategic Decisions in the Blood Glucose Test Strip Market Across Technology and Distribution Channels

Enzyme technology remains the foundational chemistry driving blood glucose test strip accuracy and reliability. Manufacturers continue to refine formulations based on glucose dehydrogenase and glucose oxidase, optimizing for parameters such as reagent stability, interference resistance, and linearity. Within glucose dehydrogenase platforms, subtypes leveraging FAD, NAD, and PQQ cofactors deliver nuanced performance profiles that cater to diverse clinical environments, from high-volume professional settings to patient self-monitoring at home.

Product type segmentation distinguishes between professional-use and self-monitoring strips, each calibrated to distinct performance requirements. Professional strips prioritize throughput, stringent quality controls, and compatibility with point-of-care analyzers, while self-monitoring strips emphasize user convenience, intuitive meter interfaces, and minimal blood sample volumes. End-user dynamics further inform design considerations, with clinics and diagnostic centers demanding robust batch testing protocols, and home care and hospital channels requiring seamless integration with electronic health records and nurse-managed workflows.

Distribution channels bridge the gap between manufacturing excellence and end-user accessibility. Traditional offline networks, encompassing department stores, direct-sales models, and specialty medical outlets, coexist alongside burgeoning online platforms that incorporate company websites and major e-commerce marketplaces. These dual pathways offer differentiated consumer experiences; offline channels benefit from professional guidance, whereas online channels deliver on-demand replenishment and subscription services that enhance adherence.

This comprehensive research report categorizes the Blood Glucose Test Strips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Enzyme Technology

- Distribution Channel

- End User

Illuminating Regional Market Dynamics and Growth Drivers Shaping Blood Glucose Test Strip Adoption Across the Americas, EMEA and Asia-Pacific Territories

Regional market dynamics exhibit pronounced variation in adoption patterns and growth drivers. In the Americas, strong payer systems and established reimbursement policies reinforce high per-capita consumption of test strips, driven by mature self-monitoring practices and proactive screening programs. Leading industry players are expanding U.S.-based manufacturing capacity to secure stable supply, while innovative distribution models, such as direct-to-consumer e-commerce channels, cater to patient preferences for convenience and transparency.

Within Europe, the Middle East, and Africa, regulatory frameworks and health care infrastructure diversity yield a mosaic of market conditions. Western Europe’s stringent quality standards and established tender systems contrast with emerging markets in Eastern Europe and the Middle East, where growing diabetes prevalence underscores unmet needs for affordable self-monitoring solutions. African markets, though nascent, present opportunities for low-cost, robust strips tailored to resource-constrained settings.

The Asia-Pacific region is characterized by rapid urbanization, escalating diabetes incidence, and government-led initiatives to enhance chronic disease management. Local manufacturing hubs in China, India, and Southeast Asia are scaling production to meet both domestic and export demand. Additionally, digital health initiatives, such as mobile diabetes management apps, are fostering integrated ecosystems that seamlessly connect test strip usage with telemedicine platforms and national health information exchanges.

This comprehensive research report examines key regions that drive the evolution of the Blood Glucose Test Strips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Pioneering Strategic Initiatives That Drive Innovation and Competitive Differentiation in the Blood Glucose Test Strip Sector

The competitive landscape is anchored by established diagnostics and consumer health companies that blend product innovation with global distribution prowess. One leading organization cemented its position through the introduction of an AI-enabled predictive continuous glucose monitoring app, developed in partnership with a major technology firm, that delivers real-time insights and advanced hypoglycemia forecasting capabilities. Simultaneously, this company announced a substantial investment at its Indianapolis manufacturing site to expand continuous glucose monitor production and to fortify North American supply resilience.

A key competitor reported robust growth in its diabetes portfolio, with continuous glucose monitor sales surging by over 18% in early 2025, despite the headwinds of new tariff costs estimated in the hundreds of millions of dollars. This firm’s strategic response involved optimizing manufacturing footprints, advancing proprietary enzyme chemistries, and reinforcing digital prescription fulfillment through both direct sales and e-commerce platforms.

Meanwhile, a long-standing market participant in blood glucose monitoring has restructured its balance sheet to strengthen financial flexibility and to invest in future-focused growth areas, including the expansion of online storefronts to ensure the authenticity and accessibility of its testing supplies. This organization’s portfolio refresh incorporates meters with integrated color-coded feedback, mobile app connectivity, and subscription-based strip delivery, underscoring a customer-centric approach to product differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blood Glucose Test Strips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON Laboratories, Inc.

- AgaMatrix, Inc.

- Arkray, Inc.

- Ascensia Diabetes Care Holdings AG

- Bionime Corporation

- F. Hoffmann-La Roche Ltd.

- i-SENS, Inc.

- LifeScan, LLC

- Nipro Diagnostics, Inc.

- Nova Biomedical Corporation

- Omron Healthcare Co. Ltd.

- Rossmax International Ltd.

- SD Biosensor, Inc.

- Sinocare Inc.

- TaiDoc Technology Corporation

- Trividia Health, Inc.

- Ypsomed AG

Delivering Actionable Recommendations to Navigate Supply Chain Challenges and Accelerate Innovation in the Evolving Blood Glucose Test Strip Ecosystem

Stakeholders should prioritize diversification of manufacturing and supply chain networks to mitigate the impact of tariff fluctuations and geopolitical uncertainties. By establishing regional production hubs and leveraging free-trade zones for critical component assembly, industry leaders can optimize cost structures and ensure uninterrupted supply. Collaborative engagements with trade authorities to secure exemptions for essential medical diagnostics remain vital.

Investing in advanced enzyme chemistries and microfluidic strip technologies can elevate analytical performance and expand applications beyond traditional glucose monitoring, unlocking adjacent revenue streams in biomarkers and point-of-care diagnostics. Concurrently, forging cross-industry partnerships with software developers and telehealth providers will accelerate the integration of test strip data into comprehensive digital health platforms that support continuous patient monitoring and remote care.

To capture emerging market opportunities, tailored distribution strategies should balance offline professional networks with scalable online subscription models. Enhancing patient adherence through automated replenishment services, bundled device-strip offerings, and outcome-driven reimbursement agreements will not only boost customer retention but also reinforce value propositions for payers and providers.

Detailing a Robust Research Methodology Underpinning the Comprehensive Analysis of Technological and Market Trends in Blood Glucose Test Strips

This report synthesizes findings from a multi-phase research methodology designed to ensure comprehensive market intelligence. The initial stage involved an extensive review of peer-reviewed journals, regulatory filings, and industry press releases to identify macroeconomic drivers and technological trajectories. Primary research was conducted through in-depth interviews with key opinion leaders, including endocrinologists, procurement specialists, and device engineers, to validate emerging trends and to capture firsthand stakeholder perspectives.

Quantitative data was collected from a proprietary database of patent filings, clinical trial registries, and trade commission records to track innovations and tariff developments. Qualitative insights were triangulated against publicly available financial disclosures and government trade documents to ensure accuracy and to contextualize strategic responses. The resulting analysis underwent rigorous peer review by industry experts to affirm the reliability and relevance of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blood Glucose Test Strips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blood Glucose Test Strips Market, by Product Type

- Blood Glucose Test Strips Market, by Enzyme Technology

- Blood Glucose Test Strips Market, by Distribution Channel

- Blood Glucose Test Strips Market, by End User

- Blood Glucose Test Strips Market, by Region

- Blood Glucose Test Strips Market, by Group

- Blood Glucose Test Strips Market, by Country

- United States Blood Glucose Test Strips Market

- China Blood Glucose Test Strips Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Drawing Conclusive Perspectives on Market Imperatives and Strategic Opportunities Amidst Rapid Evolution in the Blood Glucose Test Strip Industry Landscape

As diabetes care continues its trajectory toward personalized, technology-driven management, blood glucose test strips remain integral to the continuum of monitoring solutions. The convergence of advanced enzyme chemistries, AI-enabled analytics, and digital health integration delineates a future where test strips serve as gateways to predictive, proactive care. Trade policy uncertainties and supply chain complexities underscore the necessity for agile manufacturing strategies and dynamic distribution models.

Regional diversification, strategic partnerships, and sustained investment in R&D will define market leaders, while patient-centric innovations and outcome-oriented reimbursement frameworks will shape adoption curves. By harnessing the insights and recommendations detailed in this summary, decision-makers can navigate the evolving landscape with clarity and confidence, positioning their organizations at the forefront of diabetes monitoring excellence.

Seize Exclusive Insights and Book Your In-Depth Blood Glucose Test Strip Market Research Report Today Through Ketan Rohom’s Expert Guidance

Embark on a path to strategic advantage by securing comprehensive market intelligence on blood glucose test strips. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to explore customized research insights that align with your business objectives and operational priorities. By leveraging our detailed analyses and expert recommendations, you can unlock untapped opportunities, mitigate risks associated with tariff fluctuations and supply chain disruptions, and stay ahead of technological advancements transforming diabetes care. Take the first step toward informed decision-making and market leadership by connecting with Ketan Rohom today to purchase the definitive market research report and drive sustainable growth in the dynamic blood glucose test strip sector.

- How big is the Blood Glucose Test Strips Market?

- What is the Blood Glucose Test Strips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?