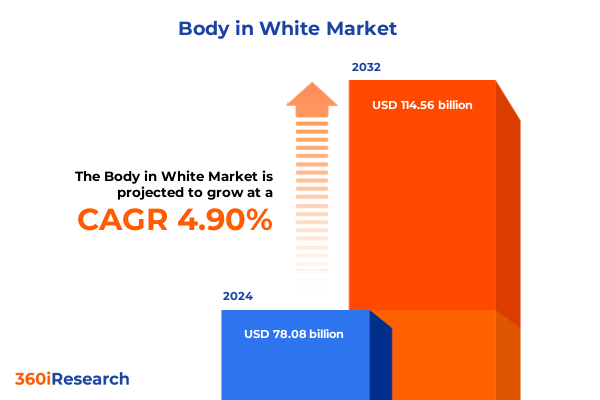

The Body in White Market size was estimated at USD 81.96 billion in 2025 and expected to reach USD 86.04 billion in 2026, at a CAGR of 4.90% to reach USD 114.56 billion by 2032.

Introducing Evolving Body in White Market Dynamics Shaping Next-Generation Automotive Structures While Balancing Sustainability and Lightweighting

The body in white segment has emerged as a cornerstone in automotive engineering, marking a critical phase where structural integrity, weight optimization, and manufacturability converge. As vehicles become electrified and more autonomous, the demands placed on the body in white have intensified, requiring a delicate balance between rigidity and lightness. Today’s manufacturers face the dual imperatives of meeting stringent safety standards and reducing overall mass to maximize range and efficiency for electric vehicles. Concurrently, consumer expectations around crashworthiness, tactile fit, and finish have elevated, underscoring the need for precision in joining and finishing techniques during the body in white stage.

Against this backdrop, technology enablers such as digital twins, additive manufacturing, and artificial intelligence–driven quality control are reshaping how the body in white is designed and produced. These innovations reduce time-to-market by enabling rapid prototyping and virtual validation of assembly processes. Meanwhile, heightened regulatory scrutiny on emissions and recyclability is driving OEMs and tier-one suppliers to adopt more sustainable materials and processes. This intersection of advanced materials science, digital manufacturing, and environmental stewardship sets the stage for a body in white market that is not only more efficient but also more adaptable to evolving automotive paradigms.

Identifying Transformative Shifts Redefining Body in White Strategies With Electrification, Digitalization, and Collaborative Lightweighting Innovations

Over the past several years, the body in white landscape has undergone fundamental shifts driven by convergence of electrification imperatives and digital transformation. The migration from traditional steel-centric structures to mixed-material architectures, featuring cast and wrought aluminum alongside advanced high-strength steels, has accelerated as OEMs strive to reduce platform weight without compromising occupant protection. This material diversification is complemented by a surge in advanced coating and sealing techniques, enabled by more precise robotic and laser-guided systems that ensure uniform corrosion protection across complex geometries.

At the same time, digitalization is permeating every stage of the body in white lifecycle, from simulation-led design exploration to sensor-integrated production lines that capture quality metrics in real time. These data-rich environments facilitate continuous process optimization and predictive maintenance, reducing downtime and scrap rates. Equally significant is the rise of open innovation networks, where OEMs, suppliers, and research institutions collaborate to co-develop novel joining methods such as friction stir welding and tailored blank technologies. In essence, these transformative shifts are not siloed but synergistic, propelling the entire body in white ecosystem toward greater agility, precision, and environmental responsibility.

Evaluating the Cumulative Impact of 2025 United States Steel and Aluminum Tariffs on Global Body in White Supply Chains and Material Strategies

The cumulative effects of United States steel and aluminum tariffs, instituted under Section 232 and other trade measures, continue to reverberate through the global body in white supply chain. While these tariffs initially aimed to bolster domestic production, they have also prompted automotive OEMs and their suppliers to rethink their sourcing strategies. Material costs have been subject to volatility as tariff schedules evolve, driving some manufacturers to pursue nearshoring opportunities in Mexico and Canada, where production costs remain competitive and trade access to the U.S. market is preserved under USMCA provisions.

Furthermore, the increased tariff burden has created a fertile environment for material substitution, particularly a shift from higher-cost imported steel to domestically produced advanced high-strength grades and alternative aluminum alloys. In response, U.S. suppliers have ramped up capacity expansions and invested in yield-enhancing process technologies to mitigate price increases. At the same time, global tier-one body in white integrators are adjusting their business models to absorb tariff fluctuations, leveraging hedging strategies and long-term supplier contracts. This recalibration underscores a broader industry trend toward supply chain resilience and flexible procurement frameworks capable of adapting swiftly to trade policy changes.

Uncovering Key Segmentation Insights Highlighting Material, Vehicle, and Production Process Dimensions in the Body in White Market Landscape

A nuanced understanding of market segmentation reveals how material, vehicle, and production process choices shape the body in white landscape.

On the material front, the interplay between aluminum and steel defines much of the development focus. Within the aluminum domain, manufacturers are leveraging both cast and wrought variants to optimize component geometry and weight distribution. Cast aluminum finds favor in complex structural nodes, while wrought aluminum is increasingly used for panels and subframes. In steel, advanced high-strength grades are deployed where crash energy must be managed, complemented by high-strength and mild steel for sections less critical to impact performance.

Vehicle type segmentation further influences body in white strategies, as commercial vehicles and passenger cars embody distinct performance and cost priorities. Commercial platforms prioritize load capacity and durability, often favoring robust steel-heavy architectures. Conversely, passenger cars, especially electrified models, demand aggressive weight reduction and stiffness-to-mass optimization to support extended driving range and dynamic handling.

Production process differentiation also informs cost, quality, and scalability considerations. Sealing and coating processes-spanning both e-coating and primer coating and extending to adhesive and mechanical sealing methods-ensure corrosion protection and airtight assembly. Stamping techniques, from cold stamping suited to high-volume flat panels to hot stamping for tailored hardening of critical sections, are matched to material selection. Welding practices, including arc, laser, and spot welding, are evaluated based on joint strength, cycle time, and integration with automation systems.

This comprehensive research report categorizes the Body in White market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Propulsion Type

- Manufacturing Process

- Body Construction Method

- Joining Technique

- Vehicle Type

- Sales Channel

Delivering Key Regional Insights Revealing Diverse Trends Across Americas, Europe Middle East & Africa, and Asia-Pacific Body in White Markets

In the Americas, automotive OEMs are intensifying investments in electrified platforms, prompting body in white suppliers to expand aluminum casting capabilities and adopt localized steel production. Mexico’s manufacturing corridors remain a strategic hub, offering cost efficiencies and seamless integration into North American supply chains under current trade frameworks. Meanwhile, the United States continues to see growth in domestic advanced high-strength steel capacity, driven by both government incentives and OEM preferences for enhanced safety performance.

Europe, the Middle East, and Africa exhibit a regulatory environment that heavily influences body in white development. Stringent emissions and recyclability standards in the European Union encourage the adoption of lightweighting measures and closed-loop material recovery systems. Tier-one integrators in the region are pioneering modular body in white platforms that can be reconfigured across vehicle segments, optimizing economies of scale. In the Middle East, emerging local assembly projects are creating new demand for regionally sourced components, while Africa’s nascent electric vehicle initiatives signal a long-term opportunity for body in white infrastructure.

The Asia-Pacific region, led by China and India, continues to be the epicenter of volume production. Chinese OEMs are rapidly expanding capacity for both aluminum subframes and advanced high-strength steel bodies, aligning with domestic content requirements and quality expectations. India’s automotive ecosystem is also evolving, with increased collaboration between government research agencies and private suppliers to develop cost-effective, locally adapted body in white solutions. Across Asia-Pacific, suppliers are leveraging digital quality assurance platforms and scalable manufacturing footprints to meet diverse regional demands.

This comprehensive research report examines key regions that drive the evolution of the Body in White market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Driving Innovation Collaboration and Strategic Positioning in the Global Body in White Ecosystem

Leading participants in the body in white sector are adopting differentiated strategies to maintain competitive advantage and capture emerging opportunities. Major global integrators are investing heavily in hybrid body architectures that combine aluminum castings with tailored blank high-strength steel panels. By integrating advanced forming technologies and digital inspection systems, they are able to deliver consistently high quality at reduced cycle times. Collaboration agreements between OEMs and material suppliers have also become more prevalent, facilitating co-development of proprietary alloys and optimized joining techniques.

Some suppliers are carving out niche capabilities, such as modular subframe assembly or laser-hybrid welding lines, to serve premium and electric vehicle segments. Partnerships with automation technology firms are accelerating the adoption of Industry 4.0 practices, including real-time defect detection and predictive maintenance. At the same time, new entrants focusing on circular economy principles are gaining traction by offering closed-loop recycling services and remanufacturing of body in white components. These diversified approaches demonstrate how leading actors are aligning technical proficiency, strategic alliances, and sustainability commitments to strengthen their market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Body in White market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- ArcelorMittal S.A.

- AutoForm Engineering GmbH

- Autokiniton Global Group LP

- Benteler International AG

- Bharat Forge Limited

- EDAG Engineering GmbH

- F-Tech Inc.

- GEDIA Automotive Group GmbH

- Gestamp Automoción, S.A.

- HBPO GmbH

- Honda Engineering North America, Inc.

- Hyundai Mobis Co., Ltd.

- JBM Auto Ltd.

- Magna International Inc.

- Martinrea International Inc.

- Metalsa S.A. de C.V.

- Multimatic Inc.

- Novelis Inc.

- Shiloh Industries, Inc.

- Tata AutoComp Systems Ltd.

- Tower International, Inc.

- Toyota Boshoku Corporation

Formulating Actionable Recommendations for Industry Leaders to Navigate Evolving Material Tariff Challenges and Accelerate Strategic Innovation in Body in White

To thrive amid the complexities of material price volatility and evolving regulations, industry leaders should prioritize establishing flexible supply networks that can pivot quickly between domestic and nearshore sourcing options. Investing in advanced materials research, particularly for next-generation aluminum-alloy formulations and coated steel grades, will provide a competitive edge in weight reduction without sacrificing durability. Equally important is deploying digital manufacturing platforms that integrate design for manufacturability with real-time quality analytics, enabling continuous process refinement and cost containment.

Forging deeper collaborative models with equipment OEMs and technology providers will accelerate the commercialization of innovative joining methods, such as friction stir welding and laser brazing. Furthermore, organizations should embed circularity considerations into product lifecycle planning, from material selection to end-of-life recycling initiatives. This holistic perspective not only meets increasing regulatory requirements but also resonates with stakeholders demanding environmentally responsible practices. By adopting these strategic imperatives, industry leaders can mitigate trade policy risks, drive operational excellence, and position themselves at the forefront of body in white innovation.

Outlining Rigorous Research Methodology Emphasizing Data Integration Interview Protocols and Triangulation Techniques in Body in White Market Analysis

This research synthesized extensive secondary data, including trade publications, patent filings, and regulatory filings, to establish a comprehensive baseline of material, process, and market dynamics. Primary research was conducted through structured interviews with key stakeholders across OEMs, tier-one integrators, and material suppliers. These interviews focused on validating emerging trends, technology adoption rates, and strategic imperatives impacting the body in white value chain.

Quantitative analysis incorporated supplier shipment data, trade flow statistics, and publicly available investment records to identify shifts in sourcing patterns and capacity expansions. Qualitative insights from expert roundtables were triangulated with survey feedback to ensure consensus on critical drivers. Advanced data modeling techniques, including scenario analysis, were employed to assess the implications of tariff adjustments and material substitutions. Quality assurance processes were integrated throughout the research lifecycle, encompassing peer reviews and cross-functional validation, to ensure accuracy, relevance, and actionable clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Body in White market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Body in White Market, by Material Type

- Body in White Market, by Propulsion Type

- Body in White Market, by Manufacturing Process

- Body in White Market, by Body Construction Method

- Body in White Market, by Joining Technique

- Body in White Market, by Vehicle Type

- Body in White Market, by Sales Channel

- Body in White Market, by Region

- Body in White Market, by Group

- Body in White Market, by Country

- United States Body in White Market

- China Body in White Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 7473 ]

Concluding Strategic Imperatives and Future Outlook Emphasizing Resilience Flexibility and Collaborative Efforts in the Body in White Industry

The body in white market stands at a pivotal juncture, where the integration of advanced materials, digital manufacturing, and resilient supply chain strategies will dictate competitive positioning through the next decade. Resilience against trade disruptions and material cost volatility has become a prerequisite for sustained operational excellence. Leaders equipped with deep segmentation insights, informed regional strategies, and a clear understanding of competitor capabilities are best positioned to capitalize on electrification and autonomy trends.

As the industry continues to evolve, flexibility in material sourcing, agility in process innovation, and a commitment to circular economy principles will define the most successful players. Collaboration across the value chain-from OEM design studios to coating specialists and welding equipment providers-will be instrumental in accelerating development cycles and achieving cost efficiencies. Ultimately, organizations that embrace a data-driven approach to both strategy formulation and execution will navigate uncertainties more effectively and secure long-term growth in the body in white ecosystem.

Driving Informed Decisions Secure Your Comprehensive Body in White Industry Insights by Connecting with Ketan Rohom to Acquire the Market Research Report

Don’t let uncertainty stall your strategic initiatives in the rapidly evolving body in white market. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain direct access to our comprehensive market research report. By engaging with Ketan, you’ll secure tailored insights that align with your organization’s priorities, ensuring you make informed decisions on material sourcing, supply chain optimization, and innovation investments. Contacting Ketan will also grant you the opportunity to discuss customized data packages and receive expert guidance on integrating our findings into your business roadmap. Act now to equip your leadership team with the authoritative analysis needed to outmaneuver competitors and capitalize on the transformative trends reshaping body in white manufacturing.

- How big is the Body in White Market?

- What is the Body in White Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?