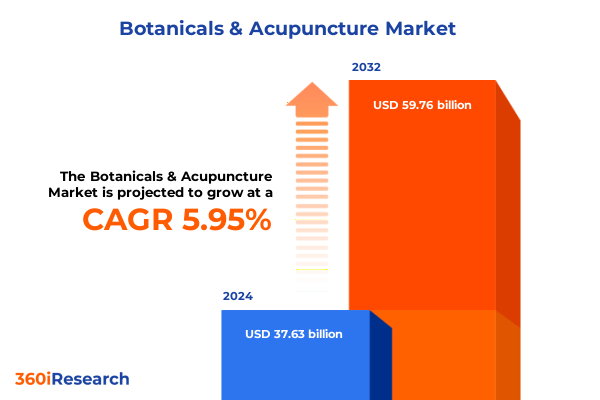

The Botanicals & Acupuncture Market size was estimated at USD 39.85 billion in 2025 and expected to reach USD 42.21 billion in 2026, at a CAGR of 5.95% to reach USD 59.76 billion by 2032.

Exploring the Convergence of Time-Honored Botanical Traditions and Holistic Acupuncture Practices Shaping Modern Integrative Healthcare Paradigms

The enduring heritage of botanical remedies and acupuncture practices has evolved into a cornerstone of modern integrative health paradigms, driven by an expanding appreciation for natural therapies that address mind, body, and spirit. As consumers increasingly prioritize preventive care over reactive treatment, demand for solutions rooted in centuries-old traditions has surged, reshaping the broader healthcare ecosystem. In parallel, scientific validation of herbal extracts and needling techniques has bolstered confidence among both practitioners and patients, fostering a renewed willingness to explore complementary modalities alongside conventional medicine.

Amidst this convergence of ancient wisdom and contemporary health imperatives, the market landscape is being redefined by a synthesis of wellness, personalization, and evidence-based practice. Regulatory bodies around the globe are updating frameworks to accommodate botanical ingredients and licensure for acupuncture professionals, reflecting a shifting consensus that integrative approaches warrant formal recognition. Consequently, organizations operating at the intersection of these disciplines now face the imperative to align their offerings with emerging clinical standards, while positioning themselves to capitalize on the momentum of holistic healthcare adoption.

Unveiling the Rapid Shifts in Consumer Demand Technological Integration and Regulatory Evolution Altering the Botanicals and Acupuncture Ecosystem

Over the past few years, transformational forces have upended the conventional boundaries that once separated botanical nutraceuticals from acupuncture services, giving rise to a hybridized ecosystem. Consumer behaviors have shifted towards greater self-education, propelled by digital channels that provide unprecedented access to research, peer communities, and telehealth consultations. This has empowered individuals to curate personalized wellness regimens, blending dietary supplements, essential oils, and needling protocols in ways that reflect unique health profiles and lifestyle aspirations.

Concomitantly, technological integrations such as mobile health platforms, remote monitoring devices, and data analytics have enhanced treatment efficacy and patient engagement. Acupuncturists and herbalists are now collaborating with software developers to deliver guided regimens and real-time feedback, thereby enriching the therapeutic experience. At the same time, regulators are reexamining ingredient safety standards and professional accreditation models, introducing more stringent requirements to ensure quality and consistency. Taken together, these dynamics underscore a market in flux, where agility and innovation are paramount.

Assessing the Impact of 2025 United States Tariff Measures on Supply Chain Costs Innovation and Availability of Botanicals and Acupuncture Practices

The implementation of new United States tariff measures in early 2025 has reverberated across the botanicals and acupuncture supply chain, with import duties affecting key raw materials such as ginseng roots, medicinal herbs, and acupuncture needles sourced from major overseas producers. These heightened costs have prompted suppliers to reassess sourcing strategies, leading many to explore domestic cultivation programs and contract farming partnerships to mitigate price pressures. By developing localized herb farms and expanding traceability initiatives, stakeholders aim to preserve margin structures and maintain competitive pricing for end users.

At the same time, the tariff environment has accelerated innovation in alternative species and synthetic analogues to reduce dependence on vulnerable supply corridors. Manufacturers are investing in research and development to standardize extracts derived from lesser-known botanicals, while equipment suppliers are exploring novel materials for needle production. Although these adaptations require time and capital, the resulting diversification has begun to foster greater resilience. For practitioners and patients, access to a broader array of formulations and tools reflects both a response to tariff-driven disruption and an opportunity to advance therapeutic options.

Revealing Critical Insights from Product Form Treatment Modalities and End-User Segmentation Unveiling Diverse Dynamics in Botanicals and Acupuncture Markets

An analysis of market segmentation reveals a multifaceted tapestry of demand drivers and practitioner preferences. Within dietary supplements, essential oils, herbal extracts, herbal powders, and tinctures, product categories demonstrate divergent trajectories: while capsules and tablets continue to dominate convenience-focused channels, liquid formats and powdered preparations are carving out niches among consumers seeking rapid absorption or customizable dosing. This fluid interplay between form factors is further complicated by treatment context, where home care settings emphasize shelf-stable solutions, inpatient environments demand precisely standardized extracts, and outpatient clinics prioritize ease of administration.

Treatment areas such as fertility enhancement, pain management, and stress relief are shaping modality selection and product design, influencing whether group practices, hospital-based facilities, or individual practitioners serve as primary delivery points. Distribution channels underscore this complexity, as direct sales and hospital stores coexist alongside specialty retailers, while online touchpoints including company websites and e-commerce marketplaces gain ascendancy. Clinics and hospitals represent core end users, yet pharmacies are emerging as critical access points for both over-the-counter herbal supplements and acupuncture aftercare supplies. Finally, applications spanning cosmetics, nutraceuticals, personal care, and pharmaceuticals reflect the versatility of botanicals, bridging consumer wellness and clinical therapy with regulatory frameworks that vary by jurisdiction.

This comprehensive research report categorizes the Botanicals & Acupuncture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Form

- Treatment Type

- Treatment Area

- Practice Type

- Distribution Channel

- End User

- Application

Elucidating Regional Nuances in the Americas Europe Middle East Africa and Asia-Pacific Revealing Geographical Drivers of Botanicals and Acupuncture Trends

Regional dynamics illuminate how cultural heritage, regulatory architecture, and consumer sophistication shape adoption patterns. In the Americas, a burgeoning wellness culture and digital fluency have catalyzed growth in online supplementation and tele-acupuncture consultations, leading to robust demand for personalized regimes. North American markets, in particular, display high receptivity to functional cosmetics and nutraceuticals containing botanical actives, reflecting a preference for scientifically validated natural solutions.

Europe, the Middle East, and Africa each present distinct contours: pan-European regulation seeks harmonization of herbal monographs, fostering cross-border trade, while Middle Eastern markets gradually embrace traditional acupuncture services through the lens of integrative hospitals. In Africa, increasing urbanization and the expansion of specialty pharmacies are driving initial uptake of powdered and liquid herbal formulations. Meanwhile, Asia-Pacific retains its status as the ancestral heartland of these therapies, where government support and long-standing practitioner networks underpin sophisticated R&D in both phytochemistry and needle innovation, ensuring the region remains pivotal to global supply and thought leadership.

This comprehensive research report examines key regions that drive the evolution of the Botanicals & Acupuncture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Collaborations and Innovations from Leading Companies Shaping the Future of Botanicals and Acupuncture Solutions

Leading organizations are demonstrating strategic agility by forging collaborations that span research institutions, clinical centers, and technology firms. Botanical ingredient suppliers are entering joint ventures to scale cultivation of endangered plant species, while acupuncture device manufacturers are investing in digital sensor integration to monitor treatment efficacy in real time. At the same time, integrative health clinics are piloting membership-based models that bundle herbal consultations and needling sessions, driving deeper patient loyalty and recurring revenue.

Innovation hubs have emerged within both established multinationals and nimble start-ups, with the former leveraging global distribution networks to introduce novel tinctures and precision-engineered needle systems, and the latter focusing on direct-to-consumer personalization platforms. Strategic acquisitions have enabled select players to broaden their portfolios, incorporating advanced extraction technologies alongside proprietary formulation patents. Collectively, these initiatives reflect a competitive landscape defined by convergence-where botanical science, digital health, and traditional medicine intersect to create differentiated value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Botanicals & Acupuncture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3B Scientific GmbH

- Arkopharma Laboratories S.A.

- Baidyanath Group

- Bionorica SE

- Bio‑Botanica, Inc.

- Blackmores Limited

- Brihans Natural Products Ltd.

- Buchang Pharmaceuticals

- Dabur India Ltd.

- Dongbang Acupuncture Inc.

- Dr. Willmar Schwabe GmbH & Co. KG

- Herbalife Nutrition Ltd.

- Himalaya Global Holdings Ltd.

- Kwangdong Pharmaceutical Co., Ltd.

- Nature’s Sunshine Products, Inc.

- Nature’s Way Products, LLC

- Patanjali Ayurved Limited

- SEIRIN Corporation

- Suzhou Medical Appliance Factory Co., Ltd.

- Tasly Holding Group Co., Ltd.

- Tong Ren Tang

- Tsumura & Co.

- Weleda AG

- Wuxi Jiajian Medical Instruments Co., Ltd.

- Yunnan Baiyao Group Co., Ltd.

Providing Actionable Recommendations to Industry Leaders on Harnessing Innovation Adapting to Regulatory Shifts and Growth in Botanicals and Acupuncture

To thrive amid ongoing turbulence, industry leaders should prioritize investment in digital infrastructure that supports telehealth, remote monitoring, and e-commerce integration. By leveraging data analytics and artificial intelligence, organizations can tailor botanical-acupuncture regimens to individual patient profiles, thereby enhancing outcomes and patient retention. Simultaneously, supply chain resilience must be fortified through diversification of raw material sources and development of strategic partnerships with domestic cultivators to navigate tariff fluctuations and geopolitical uncertainties.

Regulatory engagement represents another critical domain: proactive collaboration with policymakers and standards bodies can help shape guidelines that recognize both safety and efficacy of integrative therapies. Companies should accelerate clinical validation through targeted studies that underscore mechanisms of action, while also expanding education programs for practitioners to ensure consistent application of best practices. Ultimately, a holistic approach-encompassing innovation, regulatory alignment, and patient-centric service models-will enable organizations to capture emerging opportunities and establish leadership within the botanicals and acupuncture landscape.

Outlining the Rigorous Research Methodology with Qualitative Interviews Quantitative Surveys and Integrative Data Analysis in Botanicals and Acupuncture Studies

Our research methodology blends qualitative and quantitative approaches to deliver a nuanced understanding of the botanicals and acupuncture sector. Primary fieldwork included in-depth interviews with seasoned practitioners, botanists, regulatory authorities, and consumer focus groups, providing firsthand perspectives on treatment efficacy, sourcing challenges, and user preferences. Complementing this, a structured survey of industry executives captured strategic priorities and investment intentions across diverse market segments.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory filings, clinical trial repositories, and public company disclosures, ensuring that our analysis reflects both the scientific foundations and commercial realities of the field. Advanced analytical techniques were applied to cross-validate findings, including thematic coding to identify emerging patterns and cross-referencing supply chain data to assess structural vulnerabilities. This rigorous process underpins the actionable insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Botanicals & Acupuncture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Botanicals & Acupuncture Market, by Product Category

- Botanicals & Acupuncture Market, by Form

- Botanicals & Acupuncture Market, by Treatment Type

- Botanicals & Acupuncture Market, by Treatment Area

- Botanicals & Acupuncture Market, by Practice Type

- Botanicals & Acupuncture Market, by Distribution Channel

- Botanicals & Acupuncture Market, by End User

- Botanicals & Acupuncture Market, by Application

- Botanicals & Acupuncture Market, by Region

- Botanicals & Acupuncture Market, by Group

- Botanicals & Acupuncture Market, by Country

- United States Botanicals & Acupuncture Market

- China Botanicals & Acupuncture Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights from Market Dynamics Technological Advancements and Regulatory Trends to Chart a Promising Future for Botanicals and Acupuncture

In synthesizing these insights, a clear narrative emerges: the botanicals and acupuncture market is characterized by dynamic interplay between tradition and innovation, consumer empowerment and clinical rigor, global supply chains and localized sourcing. Technological advancements-ranging from digital platforms to precision extraction methods-are enhancing both practitioner capabilities and patient experiences, while shifting regulatory frameworks signal a maturation of the integrative health domain.

Looking ahead, organizations that master the convergence of evidence-based botanical science with digital-enabled acupuncture services will be best positioned to lead. By balancing the preservation of time-tested practices with relentless pursuit of quality, safety, and accessibility, the industry can unlock new avenues for growth and patient well-being. Ultimately, the evolution of this space will depend on the capacity of stakeholders to innovate collaboratively and adapt proactively to an ever-changing landscape.

Encouraging Industry Stakeholders to Contact Ketan Rohom Associate Director of Sales and Marketing to Secure Access to the Botanicals and Acupuncture Market Report

For those seeking to harness the strategic insights contained in this comprehensive examination of botanicals and acupuncture, direct engagement with Ketan Rohom, Associate Director of Sales and Marketing, offers the most streamlined path to obtain the full report. Through a personalized consultation you can secure access to in-depth analysis and bespoke intelligence tailored to support your organization’s specific objectives and market positioning. Reach out today to explore exclusive licensing options and ensure your decision-making is underpinned by the most current and authoritative research available.

- How big is the Botanicals & Acupuncture Market?

- What is the Botanicals & Acupuncture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?