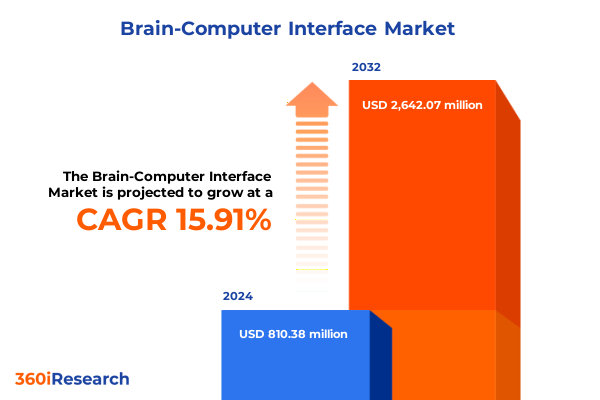

The Brain-Computer Interface Market size was estimated at USD 931.21 million in 2025 and expected to reach USD 1,073.59 million in 2026, at a CAGR of 16.06% to reach USD 2,642.07 million by 2032.

Unveiling the Paradigm Shift Where Brain-Computer Interfaces Forge New Pathways for Human Cognitive Augmentation and Interaction

Brain-computer interfaces represent a frontier where human cognition and digital systems converge, enabling direct neural communication for unprecedented levels of control, insight, and augmentation. This introduction traces the evolution of the field from rudimentary signal acquisition experiments to sophisticated platforms capable of translating thought into action. By contextualizing the technological breakthroughs, regulatory shifts, and growing interdisciplinary collaborations, we lay the groundwork for a deeper understanding of the market’s trajectory.

In recent years, advances in sensor miniaturization, machine learning algorithms for signal decoding, and improvements in user comfort have accelerated adoption across medical, defense, and consumer sectors. Early prosthetic applications have paved the way for therapeutic neurofeedback, while pilot programs in gaming and smart environments hint at mass-market potential. This executive summary distills the most compelling insights across transformative shifts, tariff impacts, segmentation dynamics, regional variations, and competitive landscapes, guiding decision-makers toward informed strategies.

Exploring the Fundamental Disruptions Reshaping the Brain-Computer Interface Ecosystem Across Technologies and Applications

The landscape of brain-computer interfaces is undergoing several transformative shifts that redefine its potential impact. First, the integration of artificial intelligence and advanced signal processing has dramatically improved the precision and accuracy of neural decoding, enabling more seamless interactions. Second, partnerships between academic research centers and industry leaders are fostering rapid innovation cycles, accelerating the time it takes to move from laboratory prototypes to clinically validated solutions.

Simultaneously, regulatory frameworks are adapting to the unique challenges posed by direct neural interfaces, balancing patient safety with the need for accelerated approvals. Private and public funding models are evolving in response, with an increasing number of governments recognizing the strategic importance of neurotechnology for national health and defense priorities. As a result, the market is poised for a shift from niche therapeutic applications to broader deployments in gaming, smart environments, and human performance enhancement.

Analyzing the Ripple Effects of 2025 United States Tariffs on Brain-Computer Interface Supply Chains and Global Trade Dynamics

In 2025, the United States implemented revised tariff policies targeting imported components critical to brain-computer interface manufacturing, including precision electrodes, amplifiers, and specialized semiconductors. These measures were intended to bolster domestic production but have also introduced cost pressures along the supply chain. Manufacturers reliant on overseas suppliers face increased duties, which in turn impact profit margins and end-user pricing for medical and consumer products.

However, these same policies have stimulated investments in domestic research and advanced manufacturing capabilities, with several component suppliers expanding facilities and forging partnerships with semiconductor fabricators in North America. While near-term adjustments are needed to navigate higher input costs, the long-run effect may strengthen local ecosystems. Companies able to diversify sourcing strategies and negotiate volume agreements stand to mitigate tariff impacts and maintain competitive positioning.

Revealing Comprehensive Segmentation Perspectives That Illuminate Component Types Technologies Interfaces and Applications Driving Market Differentiation

An in-depth examination of market segmentation reveals critical insights across components, interface types, technologies, and applications. Hardware delivers the physical nexus between neuron and machine, ranging from headsets and mounting assemblies to sensors, electrodes, amplifiers, and signal processors, each requiring distinct design considerations for comfort, signal fidelity, and manufacturability. Service offerings encompass consulting, installation, integration, maintenance, support, training, and education, which collectively facilitate seamless deployment and user adoption. Software segments, including applications, data visualization, machine learning algorithms, and signal processing modules, provide the intelligence that transforms raw neural data into actionable feedback and control commands.

Interface classifications further delineate the market by invasiveness: fully invasive implants, non-invasive external devices, and partially invasive solutions that leverage subcutaneous electrodes. Complementing these categories, the underlying neuroimaging and neuromonitoring technologies such as electrocorticography, electroencephalography, functional MRI, near-infrared spectroscopy, implanted microelectrodes, and magnetoencephalography determine spatial resolution, temporal precision, and clinical applicability. Finally, applications span communication enhancements, learning and training simulators, gaming and entertainment integration, diagnostic and therapeutic healthcare interventions, military situational awareness, unmanned systems control, and smart home automation and security, each presenting unique performance requirements and market dynamics.

This comprehensive research report categorizes the Brain-Computer Interface market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type of Interface

- Technology

- Application

Decoding Regional Variations That Shape Brain-Computer Interface Adoption Patterns Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional market dynamics reflect distinct adoption drivers and challenges across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, robust healthcare reimbursement systems and defense contracts have fueled clinical and military implementations, while leading technology hubs in North America accelerate commercial product development. Latin America, with growing telemedicine initiatives, presents emerging opportunities for remote neurodiagnostics and rehabilitation services.

Europe, the Middle East, and Africa showcase a mosaic of regulatory landscapes and funding priorities. Western European nations benefit from established regulatory pathways and research consortia focused on neurodegenerative disease diagnosis and therapy, whereas Gulf states are channeling sovereign wealth into advanced defense applications. Across sub-Saharan Africa, nascent telehealth platforms hint at long-term growth potential once infrastructure gaps narrow. In Asia-Pacific, a combination of large consumer electronics manufacturers, active government R&D funding, and expanding academic-industry collaborations has positioned the region as both a production powerhouse and a testing ground for novel user-focused devices.

This comprehensive research report examines key regions that drive the evolution of the Brain-Computer Interface market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovations from Leading Players Pioneering Brain-Computer Interface Breakthroughs and Collaborations

The competitive landscape features a diverse mix of specialized startups, established medical device companies, and technology giants. Some pioneers focus on implantable microelectrode arrays and intracortical signal acquisition, pursuing high-resolution interventions in therapeutic and prosthetic use cases. Others emphasize non-invasive EEG headsets aimed at consumer wellness, gaming, and workplace productivity. Strategic partnerships and collaborations between hardware innovators and software developers have emerged as a dominant theme, enabling joint development of end-to-end solutions.

Key players have expanded their footprints through licensing deals with academic institutions, joint ventures with contract manufacturers, and strategic equity investments by venture capital and corporate funds. Mergers and acquisitions activity remains elevated as leading firms seek to integrate complementary technologies, accelerate regulatory approvals, and enhance global distribution networks. Meanwhile, companies at the intersection of artificial intelligence and neurotechnology leverage proprietary machine learning models to optimize signal decoding across diverse application scenarios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brain-Computer Interface market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Brain Monitoring, Inc.

- ANT Neuro B.V.

- Brain Products GmbH

- BrainCo Inc

- Cadwell Industries, Inc.

- Cerora Incorporation

- Compumedics Neuroscan

- Cortech Solutions, Inc.

- Emotiv Incorporation

- InteraXon Inc.

- Kernel by HI, LLC

- Medtronic PLC

- Neuralink

- Neuroelectrics

- NeuroSky, Inc.

- NIRx Medical Technologies, LLC.

- OpenBCI, Inc.

- Ripple LLC

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Brain-Computer Interface Opportunities and Mitigate Key Market Risks

To capitalize on emerging opportunities and navigate complex challenges, industry leaders must adopt a multifaceted strategic approach. First, elevating investments in sensor miniaturization and advanced materials will improve device ergonomics and signal quality, enhancing user acceptance across healthcare and consumer segments. Second, establishing diversified supply chains through regional partnerships and strategic inventory management will reduce vulnerability to tariff disruptions and geopolitical volatility.

Engaging proactively with regulatory agencies and participating in the development of industry standards will streamline approval pathways and foster trust among clinicians, end users, and payers. Collaborative pilot programs with healthcare providers and defense organizations can demonstrate real-world efficacy and inform iterative product enhancements. Lastly, fortifying data privacy and cybersecurity protocols will safeguard sensitive neural information, assuring stakeholders of ethical and secure deployments.

Outlining the Rigorous Mixed Methodology Employed to Deliver Comprehensive Insights into Brain-Computer Interface Market Trends

Our research methodology integrates quantitative and qualitative techniques to ensure robust, multidimensional insights. Secondary research encompassed analysis of scientific publications, patent filings, regulatory databases, and market intelligence reports from academic, government, and industry sources. We complemented this with primary research through in-depth interviews with neuroscientists, biomedical engineers, clinical practitioners, regulatory experts, supply chain executives, and end users, capturing a comprehensive view of market conditions and unmet needs.

Data triangulation was achieved by cross-validating findings from secondary and primary sources, while iterative workshops with internal subject-matter experts refined our interpretations and framed actionable takeaways. The result is a structured, transparent process that balances breadth of data with depth of expert knowledge, delivering insights that are both evidence-based and contextually relevant for stakeholders seeking to navigate the evolving brain-computer interface landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brain-Computer Interface market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brain-Computer Interface Market, by Component

- Brain-Computer Interface Market, by Type of Interface

- Brain-Computer Interface Market, by Technology

- Brain-Computer Interface Market, by Application

- Brain-Computer Interface Market, by Region

- Brain-Computer Interface Market, by Group

- Brain-Computer Interface Market, by Country

- United States Brain-Computer Interface Market

- China Brain-Computer Interface Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Core Insights to Illuminate the Future Trajectory of Brain-Computer Interfaces and Inform Strategic Decision Making

As the convergence of neuroscience, engineering, and artificial intelligence reaches new heights, brain-computer interfaces are poised to redefine human-machine interaction across numerous domains. The insights presented in this summary underscore how technological maturation, strategic regional initiatives, and adaptive regulatory environments are collectively shaping market trajectories. Tariff-driven cost pressures catalyze domestic ecosystem development, while segmentation nuances highlight areas of high growth potential and specialization.

Regional variations inform tailored approaches to market entry and expansion, whereas competitive dynamics emphasize the importance of strategic partnerships and integrated solution development. By assimilating these core findings and aligning them with organizational strengths and objectives, decision-makers can chart a path toward sustainable innovation and competitive advantage in this transformative field.

Discover How Partnering with Ketan Rohom Can Unlock Actionable Intelligence and Drive Innovation Through Tailored Brain-Computer Interface Research

Embarking on an exploration of brain-computer interfaces demands authoritative insights and tailored support. To equip your organization with the intelligence necessary for strategic decision making, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in translating complex research findings into actionable business solutions will ensure you unlock the full potential of the report. Engage today to secure comprehensive guidance and begin leveraging the opportunities uncovered by our detailed analysis.

- How big is the Brain-Computer Interface Market?

- What is the Brain-Computer Interface Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?